Having started December 2014 seeing something really weird for new home prices in October 2014, we anticipated that the record prices that were initially recorded for the month would be revised considerably downward.

And so they were! The median new home sale price for October 2014 was revised downward by nearly 5%, from $305,000 to $290,100, while the average new home sale price was revised downward by 6.5%, from $401,100 to $375,200.

These figures will continue to be revised over the next two months as the U.S. Census Bureau accumulates more sales data for the month.

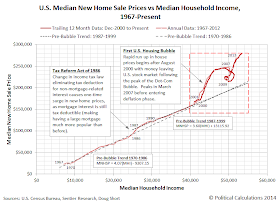

Meanwhile, we find that the overall trend for median new home sale prices has continued to increase in 2014, doing so at an average pace of $9.77 for every $1 that median household income increases.

This pace of growth is anywhere from 2-3 times the typical pace that was seen in the period from 1967 through 1999, or in the initial post-housing bubble crash recovery period from January 2011 through June 2012.

It is also considerably less than the rate of increase that was recorded during the primary inflation phases of the first and second U.S. housing bubbles, where median new home sale prices were rising at a rate of $21 to $25 for each $1 that median household income was increasing during those periods.

Our second chart below shows the longer term picture for the escalation of median new home sale prices in the U.S. since 1967.

We think that the big thing to watch for in 2015 is the re-emergence of the affordable home portion of the new home market. Since investors sparked the second U.S. housing bubble in July 2012, new home prices have largely escalated as U.S. home builders deliberately neglected this portion of the housing market, focusing instead on building premium homes, which they then attempt to sell for premium prices.

But that is a thin portion of the market that is getting thinner. Builders who have already begun adopting a strategy of building more affordable homes are being rewarded with higher volumes of sales.

“The mood of the industry heading into next year is extremely cautious,” said John Burns, CEO of his namesake firm based in Irvine, Calif. “Nothing has happened to cause sales to slow this much. But prices rose so fast in 2013, so that’s probably the primary culprit....”

This year has shaped up to be a giant stall for the new-home market, as sales through the first 10 months mustered only a 1% increase from the same period a year ago....

Some builders, however, are seeing signs of more activity from buyers. While many national builders reported lackluster results for their recent quarters, D.R. Horton Inc. posted a 38% gain by focusing on lower-priced homes and using more sales incentives to coax buyers into deals.

Paradoxically then, we would see business improve for new home builders as the median and average prices of the homes they build fall as they change up their sales mix to be more affordable for new home buyers.

References

Sentier Research. Household Income Trends: July 2014. [PDF Document]. Accessed 23 December 2014. [Note: We have converted all the older inflation-adjusted values presented in this source to be in terms of their original, nominal values (a.k.a. "current U.S. dollars") for use in our charts, which means that we have a true apples-to-apples basis for pairing this data with the median new home sale price data reported by the U.S. Census Bureau.]

U.S. Census Bureau. Median and Average Sales Prices of New Homes Sold in the United States. [Excel Spreadsheet]. Accessed 23 December 2014.

Previously on Political Calculations

We were among the first to declare that a second housing bubble was forming in the U.S. economy, and we were the first to back it up with an objective framework of analysis and data. Our ongoing analysis is chronicled below....

- The U.S. Housing Bubble Is Back - we apply our groundbreaking analytical methods to determine that a new housing bubble has begun to inflate in the U.S. economy.

- Fuel, Oxidizer and a Spark - Part 1 - we revisit the origins of the first U.S. housing bubble and identify the factors that ignited it.

- Fuel, Oxidizer and a Spark - Part 2 - we explain why housing prices rose so much more in just four states than they did elsewhere, and point our finger at the Fed's below-market interest rate policy as the primary source of fuel for the bubble.

- Fuel, Oxidizer and a Spark - Part 3 - we examine the factors that kept the first U.S. housing bubble going, even after the Fed finally acted to stop throwing so much fuel on the fire.

- Confirming the Second U.S. Housing Bubble - using revised data, we confirm that there is no apparent new-year slowdown in the inflation phase of the new U.S. housing bubble.

- As the Housing Bubble Inflates: Month 9 - we use hard data to refute the housing bubble deniers!

- As the Housing Bubble Inflates: Month 10 - we note the fourth consecutive record for median new home sale prices and discuss the spark that set off the second U.S. housing bubble.

- Setting the Baseline for a Better Housing Affordability Index - how affordable is your home when compared with every other American homeowner? We create a new index to answer that question for any household income level.

- As the Second U.S. Housing Bubble Inflates: Rapidly Escalating Prices - each revision of median new home sale prices indicates the second U.S. housing bubble is growing even faster than the first!

- The Sales Mix of the New Housing Bubble - we find that just like in the first U.S. housing bubble, the sales mix of new homes in the second U.S. housing bubble is being distorted in a very similar way.

- The First Anniversary of the Second U.S. Housing Bubble - we mark the first birthday of the second U.S. housing bubble.

- Is the Second U.S. Housing Bubble Beginning to Peak? - We note a deceleration in the upward trajectory of median new home sale prices and identify the primary cause. Along the way, we find that bubbles can only exist if the Fed wants them to exist!

- U.S. New Home Sale Prices Stalling Out

- Breathing New Life Into the Second U.S. Housing Bubble - After stalling out through September 2013, we find that U.S. housing prices began to rise again with lower mortgage rates following the Fed's decision to delay tapering its purchases of U.S. Treasuries and Mortgage-Backed Securities in September 2013.

- Slowing Inflation for the Second U.S. Housing Bubble - looking at the data through December 2013, we find that while the second housing bubble has resumed inflating, it would also seem to be inflating at a decelerating rate.

- U.S. New Home Sale Prices at the Mercy of Mortgage Rates - we note the increased sensitivity of the growth rate of new home sale prices with respect to mortgage interest rates.

- Revisualizing the Second U.S. Housing Bubble - we often get requests to present our charts showing the relationship between median new home sale prices and median household income using inflation-adjusted data, so we did. From our perspective, there is no real value in presenting our data this way because we're tracking new home sale prices against median household income, so both axes on our chart are being adjusted for inflation. Adjusting data to account for the effects of inflation is really only worthwhile if you're tracking data against time.

- Real Estate Prices Begin to Contract - we note the appearance of the first month-over-month decline in the trailing twelve month average of median new home sale prices since the second U.S. housing bubble began to inflate.

- U.S. Real Estate's State of Malaise - media reports begin to catch up to our assessment that all is not well with the state of the U.S. housing market.

- What's Driving the U.S. Housing Market? - we point to the role of the skewed sales mix of new homes to explain why prices are rising at the same time the number of sales fell sharply in March 2014. A lot of so-called "housing analysts" would not appear to be aware that such a distorted sales mix is a characteristic of a bubble being present in a real estate market, but then, they're also not very aware of any kind of relationship between household income and new home sale prices.

- New Home Sale Prices Fall for Second Time in 2014 - For the second time, new home sale prices dipped in preliminary month-over-month data.

- London's Bipolar Housing Market - we extend our analysis to cover London's housing market.

- A New Trend Shaping Up for U.S. Housing Prices? - we consider whether the U.S. housing market is getting on a stable growth track in 2014.

- The Escalation of New Home Sale Prices - If there is a stable trend forming in the U.S. housing market, we define what it may be.

- Temporal Trends in U.S. Housing - we analyze median new home sale prices as if they are a function of time. (They're not, but we did anyway!)

- Decelerating Growth for New Home Sale Prices - we find evidence that not all is well for the new home construction industry in the U.S.

- The State of the U.S. New Home Market - we do something novel and calculate the market cap of the U.S. new home market to determine whether its growing or stalling out.

- Did U.S. New Home Sale Prices Fall in September 2014? - after steadily rising for several months, we find that the market unexpectedly dipped in September 2014.

- Something Weird in the U.S. New Home Market - we note that the preliminary sale prices for October 2014 were abnormally high and predict they will be revised downward. They were when the data for November was released!

- Declining Affordability in the Sales Mix of New Homes - we find that the pursuit of the high end home market by U.S. builders is choking out affordability from the new home market.