For some crazy reason, we thought it might be fun to take a look at the recent history of cigarette taxes in Hawaii and do some back-of-the-envelope analysis.

For some crazy reason, we thought it might be fun to take a look at the recent history of cigarette taxes in Hawaii and do some back-of-the-envelope analysis.

Why, you ask? Well, unlike other states, when Hawaii raises its cigarette taxes, neither Hawaiian smokers nor smugglers can just hop in their cars and go across state lines to where they might find cheaper cigarettes to buy legally and sneak back into the state. Surrounded by thousands of miles of ocean, it takes a lot more effort to make bootlegging cigarettes a profitable enterprise in Hawaii!

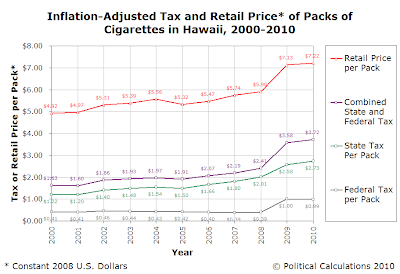

What we see is that the average retail price of a pack of cigarettes in Hawaii has increased from $4.05 in 2000 to $7.39 in 2010. By and large, what we observe is that the price of cigarettes largely changes in conjunction with increases in the state and federal excise taxes on tobacco, as these have increased from a combined level of $1.34 per pack in 2000 to $3.81 per pack in 2010.

Looking at this chart, we see that the change in the average price of a pack of cigarettes in Hawaii has grown from $4.92 in 2000 to $7.22 in 2010 in terms of constant 2008 U.S. dollars, a 46.7% increase. Combined state and federal taxes meanwhile grew from an inflation-adjusted level of $1.63 in 2000 to $3.72 in 2010, a 128% increase.

Looking at the difference between these figures, the average retail price grew by an inflation-adjusted $2.30 per pack, while taxes increased by $2.09 per pack, indicating that the increases in the amount of state and federal excise taxes on tobacco are responsible for 90.9% of the increase in the price of a pack of cigarettes in Hawaii.

With 2001 marking the last year that the federal and state excise tax combined at the low level of $1.34 per pack (in nominal terms) and 2009 marking the most recent year for which we have Hawaii's tobacco tax collection data, we estimated the equivalent quantity of packs of cigarettes sold in Hawaii by dividing each year's total tax collections by the state's cigarette tax per pack. We've presented those results in the chart on the left.

What we see is that at first, as taxes rose, in Hawaii, so did the number of packs of cigarettes purchased legally. Since this occurred in the years from 2001 through 2005, we believe this result indicates that the relatively low level of tax increases in these years, combined with a growing economy providing increasing incomes, allowed smokers to purchase an increased number of packs of cigarettes through this period.

But beginning in 2005, higher taxes made packs of cigarettes relatively more expensive for Hawaiian smokers, who reacted by cutting back on their consumption.

That continued until the transition from 2008 to 2009, when both Hawaii and the U.S. government sharply increased their excise taxes on tobacco products. These higher taxes, combined with the income-reducing outcomes of the U.S. recession which began in December 2007, combined to dramatically lower the amount of packs of cigarettes consumed in Hawaii.

More interesting to us though is that the magnitude of the increase of inflation-adjusted cigarette pack prices from 2008 to 2009 very nearly matches the magnitude of the drop in the quantity of packs of cigarettes that were legally purchased in Hawaii between these years. The percentage increase in inflation-adjusted retail cigarette pack prices was 20.8%, while the percentage decline in the number of cigarette packs sold was 20.9%.

This latter observation suggests that the tipping point in cigarette taxes may have been reached in Hawaii. By that, we mean that each percentage increase in the inflation-adjusted price of cigarettes above their 2009 level will result in a greater percentage decline in the quantity of cigarettes sold.

That result suggests then that both Hawaii and the federal government have little to gain in terms of their tax collections from Hawaiian smokers by increasing cigarette taxes at a rate faster than inflation. Which means that if these governments are counting on having higher taxes on tobacco products for funding their spending programs, they can instead count on being out of luck.

What we see is that Hawaiian tobacco consumers are pulling ahead their purchases of tobacco in advance of cigarette tax increases. We see this rather dramatically in 2005, the last year in which no cigarette tax increase took place in Hawaii that coincides with a strongly growing state economy, and again in 2008, where even though the economy had entered into recession, Hawaiian smokers acted to beat the tax increases that were certain to be coming in 2009.

Which means that where the tax collections that state officials were counting on to cover their spending in 2006 and 2009 likely fell far short of what they expected. That's quite a lot of deadweight loss if you think about it, with more guaranteed to occur when they try to increase taxes again to cover their unexpected deficits. And with taxes already set so high, they just won't be able to get the taxes out of Hawaii's smokers that they're hoping to get!

Labels: taxes

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.