New home prices are trending downward. They're falling, but they are falling very slowly.

But because mortgage rates have been rising, they've become fully unaffordable for the typical American household. The average 30-year conventional fixed-rate mortgage now has an interest rate approaching 8%. Mortgage rates have doubled since 2019.

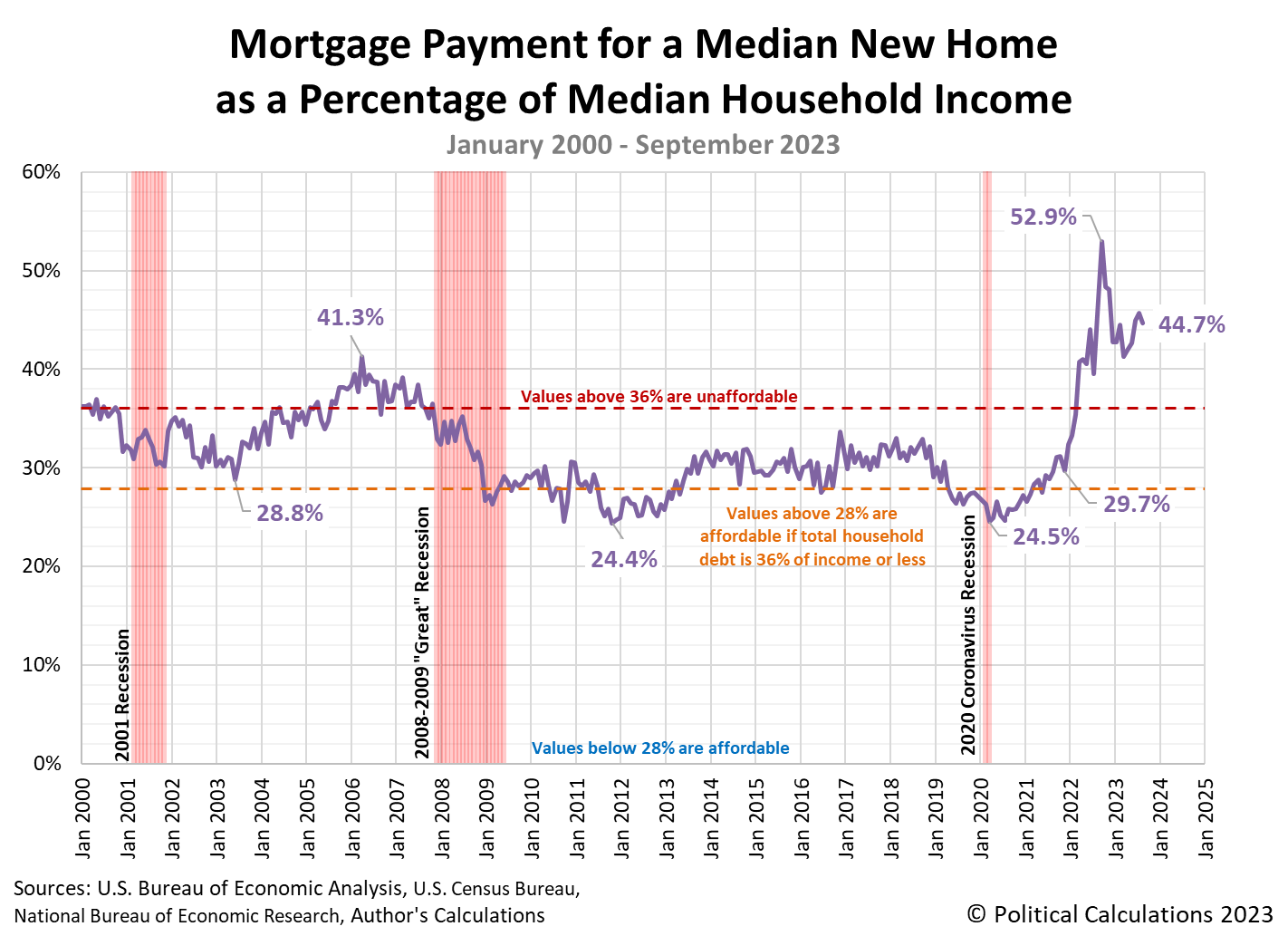

What does doubling the average mortgage rate do to the affordability of new homes? The following chart confirms the relative affordability of a new home well remains well elevated above the maximum income threshold lenders set when considering whether they'll loan money to prospective homeowners seeking to take out a mortgage for the median new home being sold in the U.S. in September 2023:

Many economists believe high mortgage rates are behind the shortage of existing homes in the U.S., which is pushing homebuyers into to the market for new homes. They believe that increased demand is keeping prices from falling more quickly:

Many economists believe that the lock-in effect is what is keeping home sales depressed, while also keeping home prices high.

Low inventory is “a major factor keeping prices from falling as much as they normally would in an economic slowdown,” Jeffrey Roach, chief economist at LPL Financial, told MarketWatch recently.

The National Association of Realtors has said it expects existing-home sales to fall 17.5% in 2023 to a pace of 4.15 million, which would be the slowest pace since 2008.

Due to low inventory, the median home price will increase by 0.1% in 2023, the NAR said, to $386,700.

“An unintended consequence of so many who refinanced to historically low rates is [that] many have golden handcuffs, keeping them in their homes with no expectations to move,” Roach said.

“Inventory of existing homes will stay low for this reason,” he added.

Until something changes to either increase the supply of existing homes for sale or to cause mortgage rates to fall, new homes will remain unaffordable for the typical American household.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 October 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 October 2023.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 3 November 2023. Note: Starting from December 2022, the estimated monthly mortgage rate is taken as the average of weekly 30-year conventional mortgage rates recorded during the month.

Image credit: Gold house keys photo by Maria Ziegler on Unsplash.

Labels: personal finance, real estate

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.