The first quarter of 2022 has come to a close, with the U.S. stock market's dividend-paying companies turning in a very strong performance. At the same time, there are signs of increasing distress in some quarters of the market, though that distress remains well below the threshold indicating recessionary conditions are present in the U.S. economy.

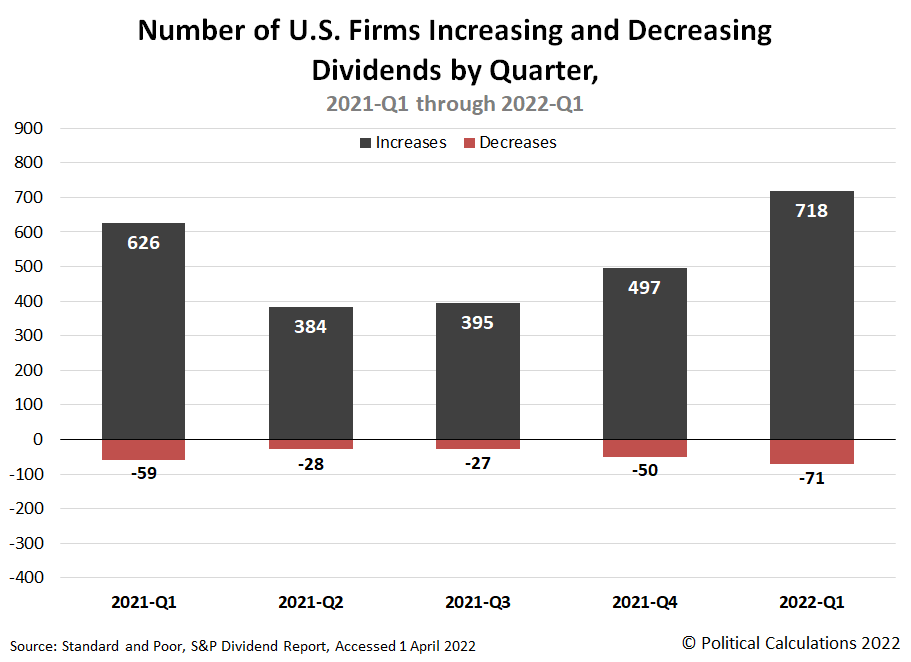

The following chart visualizes the count of U.S. firms either increasing or decreasing their dividends in each quarter from the first quarter of 2021 (2021-Q1) through the just completed first quarter of 2022 (2022-Q1).

During 2022-Q1, 718 publicly traded dividend paying firms announced they would increase their dividend payouts to their shareholding owners, which is both 92 more than 2021-Q1's total of 626 and the most since 2018-Q1's 807. At the same time, the number of companies announcing dividend cuts crept up for the second quarter in a row, rising to 71, which is greater than the number of companies cutting dividends in the first quarter of the previous year, the most since the Coronavirus Recession bottomed in the second quarter of 2020.

Looking just at March 2022, we find the both the month's totals for dividend rises and reductions are rising, as shown in our second chart, which visualizes these numbers going back to January 2004:

Let's get under the hood with March 2022's metadata, which records the number of dividend declarations, special dividends, increases, decreases, and omissions, along with their month-over-month and year-over-year comparisons:

- A total of 4,438 U.S. firms declared dividends in March 2022, a decrease of 218 from February 2022's recorded value but 1,259 more than did in March 2021.

- 72 firms announced they would pay a special (or extra) dividend to their shareholders in March 2022, 12 less than did in February 2022 but 7 more than did in March 2021.

- There were 158 firms that declared they would increase their dividends in March 2022. That's 208 fewer than did in February 2022, but just 8 fewer than did in March 2021. The U.S. stock market has a seasonal pattern where March's number of dividend increases is significantly lower than both January and February's totals, so this outcome is keeping with that factor.

- On the negative side, 29 publicly traded companies announced they would reduce their dividends in March 2022, which is 4 more than did in February 2022 and 6 more than did in back in March 2021. March 2022's total is more than any month since January 2021's count of 32 dividend cut announcements.

- No U.S. firms omitted paying their dividends in March 2022, continuing the trend established after June 2021. For a year over year comparison, that's one less than March 2021's total number of firms that suspended paying their dividends.

Because we're seeing a rising number of dividend cuts, we've pulled a sample of 25 firms whose dividend cut announcements we tracked during the first quarter of 2022 to get a sense of which industrial sectors are coming under earnings pressure. Here's the list:

- Compass Diversified Holdings (NYSE: CODI)

- Orchid Island Capital (REIT-Mortgage) (NYSE: ORC)

- Cross Timbers Royalty Trust (NYSE: CRT)

- Mesa Royalty Trust (NYSE: MTR)

- KKR (NYSE: KKR)

- AT&T (NYSE: T)

- Sabine Royalty Trust (NYSE: SBR)

- Exelon (NASDAQ: EXC)

- Apollo Global Management (NYSE: APO)

- Falcon Minerals (NASDAQ: FLMN)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Cross Timbers Royalty Trust (NYSE: CRT)

- PPL (NYSE: PPL)

- Permian Basin Royalty Trust (NYSE: PBT)

- Mesa Royalty Trust (NYSE: MTR)

- James River (NASDAQ: JRVR)

- Gouverneur Bancorp (OTC: GOVB)

- Bridge Investment Group Holdings (NASDAQ: BRDG)

- Luby's (NYSE: LUB)

- Lument Finance Trust (REIT-Mortgage) (NASDAQ: LFT)

- Orchid Island Capital (REIT-Mortgage) (NYSE: ORC)

- Permianville Royalty Trust (NYSE: PVL)

- Permian Basin Royalty Trust (NYSE: PBT)

- Cross Timbers Royalty Trust (NYSE: CRT)

- Mesa Royalty Trust (NYSE: MTR)

- Western Asset Mortgage Capital (REIT-Mortgage) (NYSE: WMC)

In the sample, which represents just 35% of 2022-Q1's total number of reported dividend reductions, we find 11 firms from the oil and gas sector, mainly royalty trusts that pay variable dividends on a monthly basis, which is why some appear on the list twice. While these firms' revenues benefit from the rising global price for oil, they also face rising costs for capital expenditures from constrained supply chains, pinching their margins. The next biggest category for dividend cutters are the four Real Estate Investment Trusts (REITs) in the sample, which is heavily represented by mortgage REITs. These firms are negatively impacted by rising interest rates, where we anticipate seeing more firms from this category in the months ahead.

The biggest dividend cut in the sample is for AT&T (NYSE: T) that is related to the telecom's sale of its WarnerMedia unit to Discovery (NASDAQ: DISCB), which does not pay a dividend. Standard & Poor reports the change in corporate ownership reduced the S&P 500's quarterly dividend for 2022-Q1 by $0.82 per share.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 1 April 2022.

Standard and Poor. S&P Indicated Rate Change. [Excel Spreadsheet]. Accessed 1 April 2022.

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.