New home sales in the U.S. were surprisingly muted in August 2024 after rising sharply in July after mortgage rates dropped below seven percent.

That's surprising because 30-year conventional fixed rate mortgages continued falling in August to average 6.5% during the month. Yet, new home sales were down for the month. The initial estimate puts the number of sales in August 2024 at an annualized figure of 716,000 new homes sold, which is 4.7% less than July 2024's revised estimate of 751,000 new home sales.

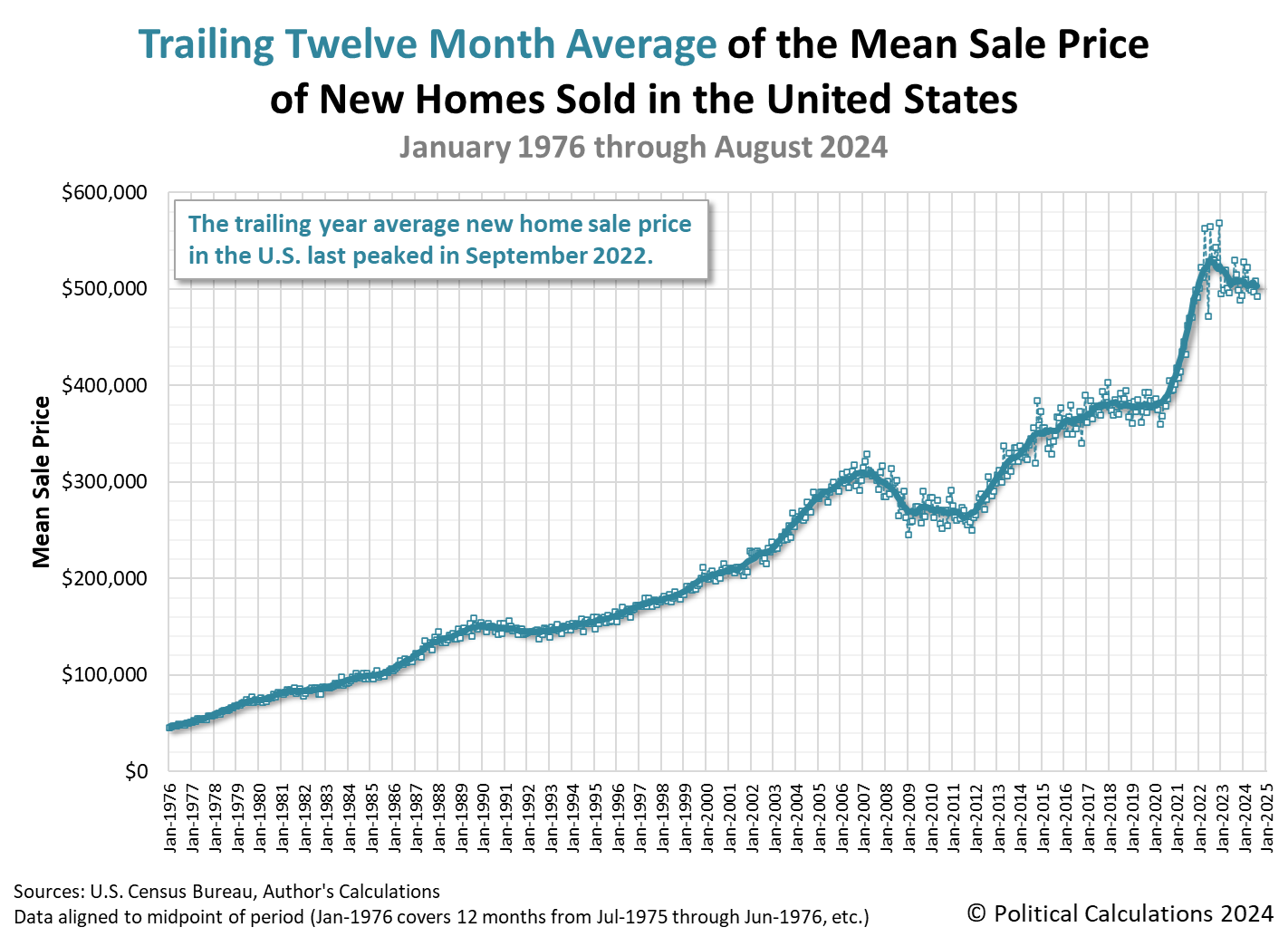

Those lower sales totals are also surprising because new home prices dipped in August 2024. The initial estimate of the average price of a new home sold was $492,700, down from July's revised estimate of $508,200, which itself was down from the initial estimate of $514,800 for the month. The first estimate of the median new home sale price was $420,600, a decrease from July 2024's revised figure of $429,000, which was just $900 less than July's initial estimate.

The three following charts track the trends for the U.S. new home market capitalization, the number of new home sales, and their sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through August 2024.

At $31.06 billion, August 2024's initial estimate is higher than July 2024's revised figure. July 2024's initial estimated trailing twelve month average new home market cap of had been $31.30 billion, which has fallen to $31.01 billion following the downward revisions.

Those decreased estimates in light of August 2024's falling mortgage rates and new home sale prices raise the question of just how strong the U.S. new home market is. The speculation being advanced in the media is that new home buyers held off buying until the Federal Reserve lowered the Federal Funds Rate in mid-September 2024 to get even lower mortgage rates. Here's an example of that thinking from the National Association of Home Builders:

Expectations of the Federal Reserve beginning the first in a series of rate reductions kept potential home buyers in a holding pattern in August....

The problem with this thinking is that if buyers were doing that, the logic of waiting until mortgage rates might decrease would have held in July 2024 when interest rates were even higher. Why would homebuyers rush to sign a contract to buy a new house in July when they could get a much cheaper mortgage payment for by waiting until August or later?

Meanwhile, a lot of Americans who already own homes acted to take advantage of falling mortgage rates in August 2024 to refinance their mortgages. Since rates are falling and are expected to continue falling, why wouldn't the buyers of new homes buy at higher rates with a plan to refinance later after they've dropped more?

At least then, they wouldn't be homeless and sitting outside the new home they want to buy while waiting for mortgage rates to fall.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 September 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 September 2024.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of people waiting for mortgage rates to fall before buying a new home".

Labels: market cap, real estate

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.