This past weekend, we received an e-mail pointing to this video of the Financial Times' John Authers, who points to Intrade's recession market, stock prices and manufacturing exports as signs that the risk of recession taking place in the United States this year is fading. Meanwhile, on Monday, U.S. Federal Reserve Chairman Ben Bernanke offered a similar assessment that a substantial downturn is now highly unlikely, so we thought we'd take a moment to add our own short view to the FT's and the Fed Chairman's.

Why not? Our view on these things is at least as good as these guys!

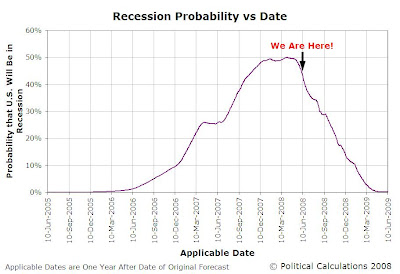

Our primary measure of recession risk currently shows that the odds that the U.S. would be in recession at this point in time is now dropping rapidly from its peak on 4 April 2008 of 50%:

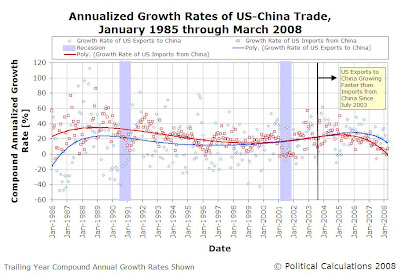

Looking at trade, our primary indicator is the rate of growth of imports and exports between the U.S. and China. Here, the evidence is less clear, as the rate of growth of the value of what the U.S. imports from China surged for April 2008:

This increase in Chinese exports to the U.S. contradicts a recession if our hypothesis that a slowing economy would demand less of the things China produces (consumer electronics, toys, clothing, etc.) is correct, but that doesn't rule it out the possibility of recession either. Here, we'll need more data points in the months ahead to confirm if either a recession or a recovery from an economic slowdown is the dominant trend in the U.S.

Finally, there's the matter of the stock market. Here, the order that we see emerging following January 2008's disruptive event is not indicative of a recession, but that insight deserves its own post, which we'll tackle in the very near future.

Labels: recession forecast, trade

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.