Here at Political Calculations, we're perhaps best known for the tools we've developed to solve problems related to investing, personal finance, health matters, business, politics, finance, economics and of course, awkward situations. But more than that, we're connoisseurs of online tools. We seek out and review the tools at other sites, looking to identify the best (what we would award our top honor, the Gold Standard) among the good (which earn our Silver Standard) and the outright awful (an online tool that actually "Makes You Stupider").

Here at Political Calculations, we're perhaps best known for the tools we've developed to solve problems related to investing, personal finance, health matters, business, politics, finance, economics and of course, awkward situations. But more than that, we're connoisseurs of online tools. We seek out and review the tools at other sites, looking to identify the best (what we would award our top honor, the Gold Standard) among the good (which earn our Silver Standard) and the outright awful (an online tool that actually "Makes You Stupider").

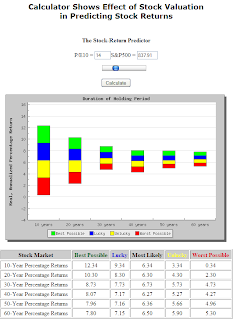

Today, we're going to feature a tool that satisfies our Silver Standard, which was developed by Rob Bennett of PassionSaving.com with John Walter Russell of Early-Retirement-Planning-Insights.com, The Stock-Return Predictor.

About the Tool

The Stock-Return Predictor is based on historical stock return data for the S&P 500, using John Walter Russell's regression analysis of data that considers the impact of stock valuations upon their long-term return. Stock valuations for this tool are based on a variation of the traditional Price Earnings Ratio (P/E Ratio) that was developed by John Campbell and Robert Shiller, in which earnings data over a 10-year period is adjusted for inflation and averaged over that time. This is more accurately called the P/E10 ratio.

Who Is the Tool Aimed At?

The tool is intended for users who might be considering making a new investment in the stock market, or who are perhaps reconsidering how they are allocating the various parts of their investment portfolio. The tool only considers stock market data, so it's actually more designed to provide information to the user on the potential outcomes they might have for the stock market portion of their portfolio.

Using the Tool

In that respect, this tool is very similar to our "Lemony Snicket" tools, which considers the absolute best, absolute worst and absolutely average investing scenarios based on our own analysis of the performance of the S&P 500 over the index' entire history.

What makes Rob's tool different is that it incorporates the effects of the market's valuation as measured by the P/E10 ratio. Here, it accounts for the most likely outcomes for an investment that is made when this valuation is high (greaater than 20, for example) or low (in single digits). It then graphically depicts the range of recorded returns graphically for certain periods of time, beginning with a 10-year return and increasing in 10-year increments to reach 60 years.

For making an investment decision, a user would enter the most recent P/E10 ratio and find the corresponding historical rates of return. Based on those results, a user could recognize their potential level of risk in making a long-term investment, and adjust the amount of their stock market investment accordingly.

Design and User Interface

Perhaps the biggest complaints we have regarding the tool fall into the design category. The tool has very much of a 1990's vibe going on in its design, with its use of primary web-safe colors and HTML tables, which give it a very dated look.

Those complaints out of the way, we really like the slider control as a way of quickly changing the input values for the tool. Better still, we can override the slider and directly enter a value for the P/E10 ratio.

Not so great, but less important, is that we cannot enter a value for the S&P 500 index to reverse calculate a corresponding P/E10 ratio. This however is not a problem of the tool, so much as it's a problem of where the S&P 500 index value text field is placed. Located above the "Calculate" button, we would anticipate that this would be an input text field. The easiest way to resolve this potential confusion for users would be to relocate it so that it appears below the button.

Finally, we believe the user interface could be improved by providing more information about how to use the tool above the user interface. Presently, this information is located well below the tool interface, which makes for a lot of up-and-down scrolling to really understand the results the tool provides.

Conclusion

While not cutting-edge where stock market theory is concerned (that's our bailiwick!), The Stock-Return Predictor will provide a reasonably good rule-of-thumb for informing a potential user's stock market investing decisions. The tool provides a neat approach for delivering high quality information to the tool's intended audience. What's more, we really like the valuation-based approach since this helps communicate some of the risk that an investor may be taking on when making a new investment.

The user-interface could use some serious refreshing, but overall, we find this tool satisfies our requirements for earning our Silver Standard. It's informative, it's based on solid data and it provides useful results.

Update (12 February 2009): Via e-mail, Rob Bennett clarifies that John Walter Russell's role in developing the tool went beyond the regression analysis forms the basis on which the tool works! We've modified the review above accordingly to recognize his role in jointly creating the Stock Market Predictor tool.

Labels: review

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.