We're going to play a little bit of catch up today, starting from the last time in 2015 that we discussed where the S&P 500 was going to head next.

On that day, we added an update to our original post to note where the market closed:

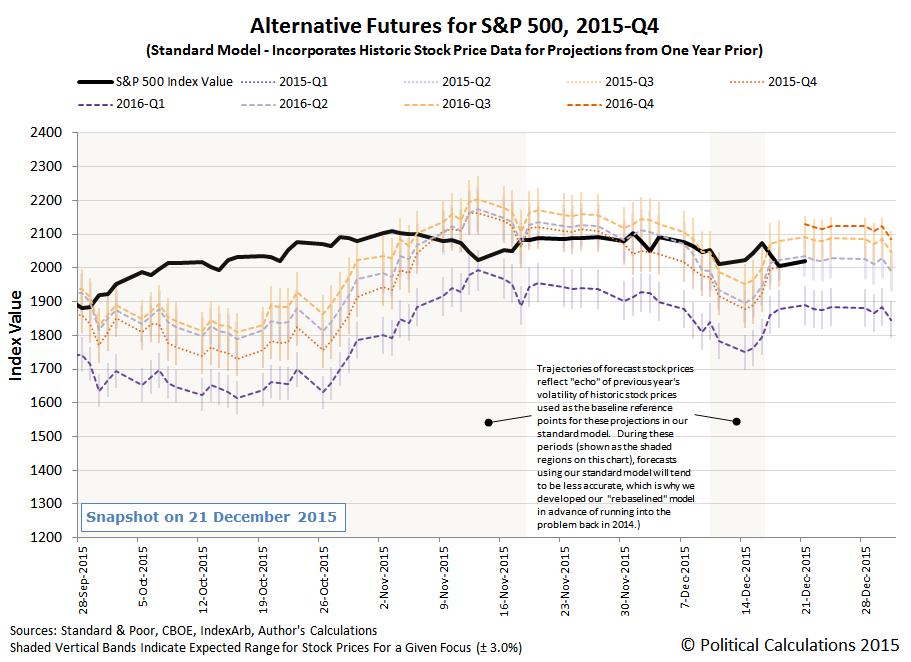

Update 21 December 2015, 6:38 PM EST: Here are the current expectations for the S&P 500's quarterly dividends per share for 2016, as determined from today's recorded values for the CBOE's dividend futures contracts for the S&P 500:

2016-Q1: $11.40 | 2016-Q2: $11.45 | 2016-Q3: $11.64 | 2016-Q4: $11.77

Meanwhile, here's the updated version of our alternative futures forecast chart through the close of trading on 21 December 2015:

Still focused on 2016-Q2. At least, until that changes....

We're now going to roll our chart to the left, to capture all the time from when the dividend futures contracts for 2015-Q4 expired on the third Friday of December 2015 through the end of the first quarter of 2016.

In between then and last Friday (8 January 2016), here's what really drove U.S. stock prices:

- 21 December 2015: U.S. investors focused on 2016-Q2 in setting stock prices.

- 23 December 2015: The third estimate of U.S. GDP in the third quarter of 2015 is released. The less than stellar growth that occurred going into what is widely believed to be an even slower fourth quarter leads investors to speculate that the U.S. Federal Reserve will push back the date it will next implement a short term interest rate hike. In our chart above, we see that as investors shifting their focus from 2016-Q2 to 2016-Q3. This shift in focus leads to an increase in stock prices, as the change in the year over year rate of growth of dividends in 2016-Q3 is expected to be stronger than in 2016-Q2.

- 23 December 2015 - 31 December 2015: Investors sustain their forward-looking focus on 2016-Q3, as no other news is sufficient to prompt investors to focus on other periods of time through the end of the year.

- 4 January 2015: The first day of trading in 2016 coincides with a large selloff of stocks in China, as that nation relaxes the restrictions it had imposed on selling during 2015, believing its new stock market "circuit breakers", which would halt trading if stock prices fell at least 7% during a trading day, would work. They were tested almost immediately. In the U.S., the noise from China combined with news that both manufacturing and construction slumped during 2015-Q4 to lead investors to speculate that the Fed's next rate hike might be pushed back even further, from the 2016-Q3 they were speculating it would at the end of 2015 to 2016-Q4 instead. Stock prices rise once again as the year over year rate of growth of dividends in 2016-Q4 is expected to be even stronger than in 2016-Q3.

What we just described above hopefully explains why bad economic news can produce the seemingly paradoxical result of rising stock prices. The trajectory that stock prices follow depends not just on where they just were, but also upon how far forward in time investors are focusing as they make their current day investment decisions.

But that only brings us up to the beginning of the past week. Let's resume our day-by-day play-by-play:

- 5 January 2016: U.S. GDP growth estimates for the last quarter of 2015 weaken further, suggesting that the economic headwinds for 2016 are stronger than previously anticipated. Stock prices remain consistent with investors focusing on 2016-Q4, which is consistent with the speculation that the Fed will hold off hiking interest rates again until that quarter in the face of the declining economic expectations.

- 6 January 2015: The minutes of the Federal Open Market Committee's December 2015 meeting are released, showing that the Fed is both concerned by low inflation and strongly committed to hiking interest rates several times during 2016. U.S. stock prices begin falling as investors shift their focus back to 2016-Q3 in reaction to the statements of Fed officials.

- 7 January 2016: The carnage in the stock market continues as investors continue to align their expectations for the next Fed rate hike, pulling back to focus upon 2016-Q2 as the quarter when the next rate hikes will take effect. Coincidentally, more noise emanates from China regarding the health of its economy.

- 8 January 2016: News from the December 2015 employment situation report that wage growth in the U.S. is accelerating combined with statements by San Francisco Fed President John Williams and Richmond Fed President Jeffrey Lacker combine to lead investors to split their focus between 2016-Q2 and 2016-Q1, as they begin speculate that the Fed may act to hike short term interest rates in the U.S. before the end of the first quarter of 2016.

Given all the news from China, many might be surprised that we don't consider it to have been much of a major influence over what has been happening in U.S. markets. Looking at what's happened during the past week however, we do see a repeating theme from August 2015.

Back then, the massive selloff that took place in China's markets came in response to Chinese authorities relaxing some of the restrictions they had placed on selling stocks earlier in the year.

In January 2016, after setting up their market's new circuit breakers, Chinese authorities once again relaxed their other restrictions on selling activity, believing they would be sufficient to arrest downward pressure on Chinese stock prices. Days after taking effect, the circuit breakers are being dumped as restrictions on selling stocks are now being reimposed.

Meanwhile, the same factors that initially drove such widespread selling activity are still present in China, with the pressure for selling growing because that activity has been forcefully constrained without the sufficient improvement in China's economic situation that would be needed to allow that pressure to be relaxed naturally as yet.

Speaking of which, Zero Hedge reports that Goldman Sachs is estimating that China's leaders have spent 1.8 trillion yuan to prop up Chinese stock prices by buying up the shares of Chinese firms. Funny - if they had only underwritten the dividend payments of the Chinese firms instead, decoupling them from their earnings, they could have both been more successful in propping up prices and spent quite a lot less, as that action would have relaxed a good portion of the pressure upon Chinese investors to sell.

As for what's happening in U.S. markets, the best way to describe what's happening there is that investors have been engaged in a speculative dispute with the Fed over the number of rate hikes in 2016, with investors saying fewer and the Fed saying more. Recent falling stock prices are consistent with investors shifting their forward-looking focus from 2016-Q3 to 2016-Q2 (mostly) as the likely timing for the Fed's next rate hike. The activity in China's markets is mostly coincidental to what's really been driving U.S. markets.

The big question of course is whether the Fed really wants to fully convince the market that they're solidly committed to boosting interest rates again during 2016-Q1. If they do, watch out below....

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.