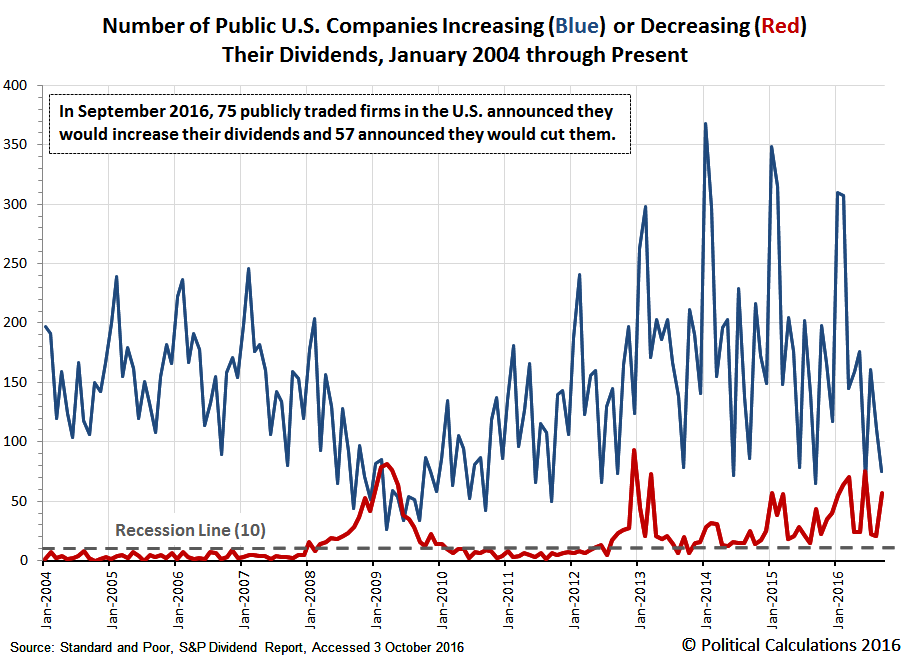

The number of publicly traded U.S. companies that announce either increase or decrease their dividends each month is perhaps the simplest indicator of the relative health of the private sector of the U.S. economy.

For instance, if we count an increasing number of firms that announce they will increase their cash dividend payments to their shareholders compared to previous months, we can take that as a sign of expansion. Conversely, if we count an increasing number of firms that cut their dividend payments to investors, we can take that as an indication that there are recessionary conditions present in the economy. And if we pay attention to which kinds of firms announce either, we can get a sense of where the strengths and weaknesses may be in the U.S. economy.

Let's start by considering the total number of firms that declared they will either increase or reduce their cash dividend payments to their shareholders.

September 2016 sent something of a mixed message in that it saw both an increase in the total number of U.S. firms that announced they were increasing their dividends (75) and also in the total number of publicly-traded companies that decreased their dividends (57) compared to recent months. Looking back over the entire third quarter, we count 346 dividend increasing firms and 100 dividend cutting ones.

Looking closer at a sampling of the number of firms that announced dividend increases in the month of September 2016 (75), and comparing it to the year ago month of September 2015 (65), we find that firms in three industries made the difference in the apparent year over year improvement for the month: small banks, food-related industries and utilities. And perhaps the most surprising thing is that the improvement from the year ago period took place in just the last week of September 2016.

Next, let's zoom in on the number of firms that announced they would cut their dividends.

The most disturbing thing here is that we're still seeing what looks like an upward trend in the number of U.S. firms that are announcing dividend cuts, where the number of such firms is consistently falling in the ranges that indicate either that recessionary conditions are present or that some degree of economic contraction is occurring within the U.S. economy.

As for where that distress is to be found, we identified the following kinds and numbers of firms in our sampling over the entire quarter of 2016-Q3.

Compared to a year ago, we find that the oil and gas production sector of the U.S. economy is still the most negatively affected industry, but also that the level of relative distress in the U.S. economy has spread to a number of other industries, which now outnumber the dividend cutting oil and gas industry firms.

Notes

We only started paying closer attention to dividend increasing firms in September 2016, which is why we only looked at that month in this analysis. Meanwhile, we've been keeping track of dividend cutting firms for a much longer period of time, which is why we're able to present much more data in that category.

Data Sources

Standard & Poor. Monthly Dividend Action Report. [Excel Spreadsheet]. Accessed 3 October 2016.

Seeking Alpha Market Currents Dividend News. [Online Database]. Accessed 3 October 2016.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed 3 October 2016.

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.