Dividends by the Numbers is one of our most popular series. Each month, we discuss the U.S. stock market's metadata for the number of dividends that were declared, visualizing how many U.S. publicly-traded companies either increased or decreased their dividends, and report how many firms omitted paying dividends or resumed paying them and also the number of companies that announced they would pay an extra, or "special", dividend to their shareholding owners.

In doing that, we're following in the footsteps of legendary financial writer Bertie Forbes, who pioneered this kind of reporting in 1922. B.C. Forbes, a Scottish immigrant who founded the business and finance magazine that still bears his name today after becoming a U.S. citizen in 1917, was one of the earliest market observers to realize this data was telling an incredible story as the roaring twenties boom was getting underway. Within a year, he was incorporating the dividend metadata from several hundred stocks he regularly followed into his syndicated columns.

The 1920s was also when the Standard Statistics Company, the "Standard" in today's Standard and Poor, launched its market analytics business. The firm had its big breakthrough on 2 January 1929, when the Associated Press adopted its 90-stock composite index for its reporting on the U.S. stock market. The market capitalization weighted index is the direct precursor to the S&P 500, and the AP's decision played a large role in establishing the new index as widely reported market metric.

But that wasn't all the information that Standard Statistics compiled for the AP. They also compiled monthly dividend metadata as B.C. Forbes was doing, but for the entire U.S. stock market, which in that era consisted of more than 3,100 individual stocks.

1929 is a remarkable year because it also marks the beginning of the Great Depression and the stock market crashes that signaled it was getting underway. The U.S. stock market's dividend metadata soon proved to be a vital indicator, particularly the number of dividend reductions that were announced each month. In the worst years of the depression, the reports changed to be presented on a weekly basis because the number of cuts had become so large.

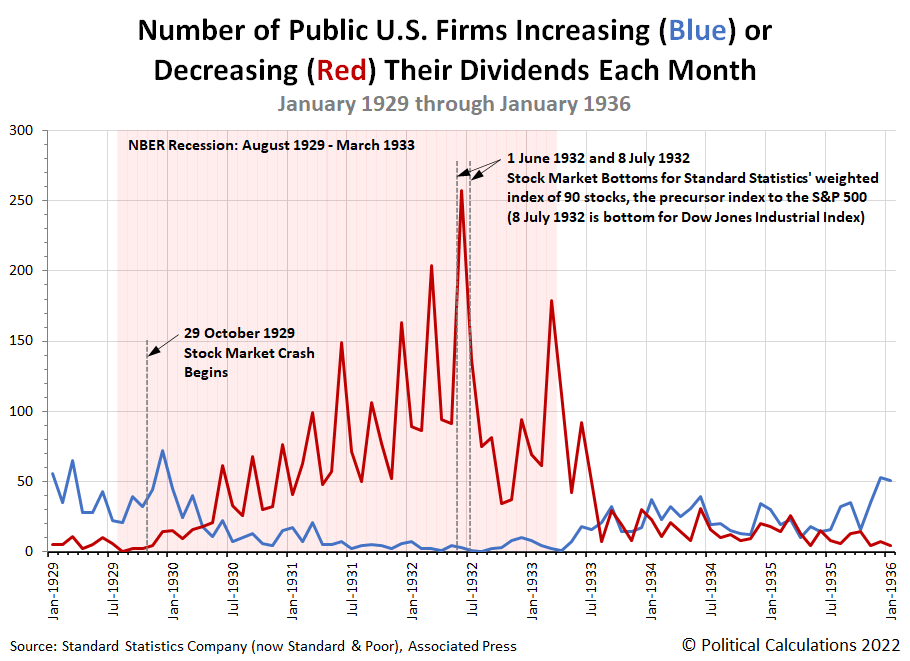

We've reconstructed the data series for the number of dividend increases and reductions being announced each month from that era's contemporary news reporting. If you want to know what an economic disaster really looks like, here's the picture:

We selected this period to show the full cycle of dividend rises and reductions as started from their pre-Depression levels, to exploding in economic crisis, to once again resuming their pre-Depression levels.

We've also shown the period the National Bureau of Economic Research indicates the U.S. economy cycle went into and stayed in contraction after having peaked in August 1929. Note that the number of dividend cuts begins to rise above its pre-Depression levels some three-to-six months after the Depression started. After a year, there's a regular spike every three months as U.S. companies reported their earnings and as increasingly become the case, their dividend cuts. Those cuts kept getting worst until June 1932, when the number of dividend cuts peaked. That peak coincides with the market bottom for Standard Statistics' 90-stock composite index during the Great Depression.

Afterward, the number of dividend cuts reported each month began to fall as economic conditions improved. After the NBER-recession ended in March 1933, it took another three-to-six months for the number of dividend cuts to drop back to what we'll call "near pre-Depression levels". At the same time the number of dividend increases began to rise off the floor, also signaling the improvement taking place in the economy. But then it took another four years before dividend increases and decreases consistently tracked their pre-Depression levels.

After January 1936, reporting on dividend metadata became more sparse and eventually disappeared from regular news coverage. In the era since, it hasn't been a regular feature, even though its still reported each month by Standard Statistics successor firm, Standard and Poor. Only now, that metadata is included as part of a wider ranging report featuring much more market performance data, so it doesn't stand out the way it did when it was widely recognized as a vital market measure during the most critical period the U.S. economy has experienced.

At least, until several years ago, when we unknowingly followed in Bertie Forbes footsteps and brought it back to life as the main feature of a regular column. We only learned about Forbes' role in originating this kind of analysis because we went looking for historic metadata for dividends during the Great Depression and kept running into his syndicated columns as we reconstructed the data!

Labels: data visualization, dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.