The S&P 500 (Index: SPX) was headed for a losing week, but got good news in the form of slowing U.S. job growth numbers late last week. While not necessarily as good for Americans, the news increased the likelihood the Fed will react to boost the U.S. economy by cutting interest rates more than once in 2024.

That prospect provided enough momentum for the S&P 500's to record its second up-week of the second quarter of 2024. The index ended the trading week at 5,127.79, up over 0.5% from where it closed the preceding week.

The CME Group's FedWatch Tool continued holding steady in anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3) for the third week in a row. However, the tool now projects the Fed will start a series of 0.25% rate cuts on that date that will continue well into 2025 at 12 week intervals.

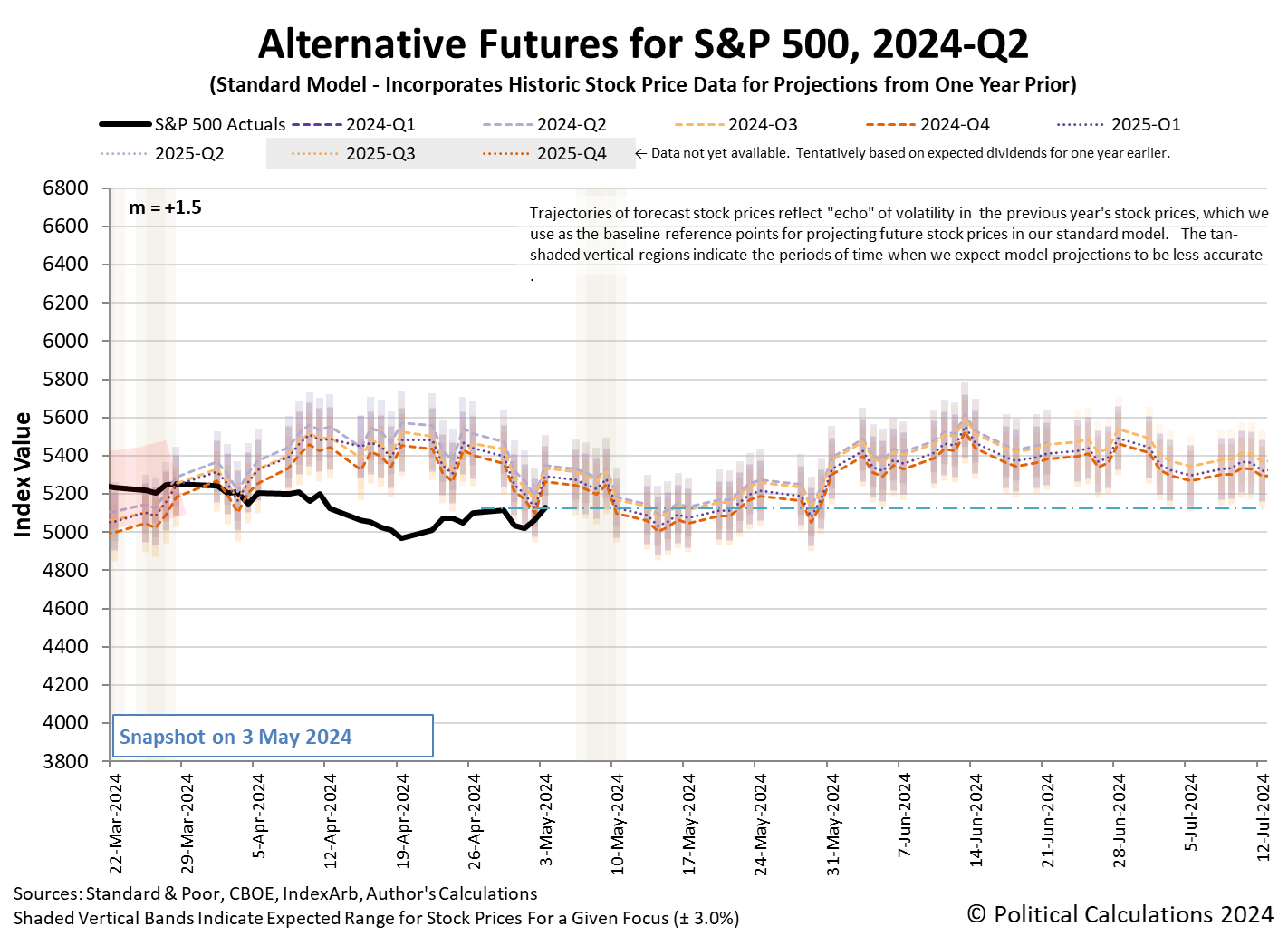

The trajectory of the S&P 500 remained consistent with investors focusing on 2024-Q3 in setting current day stock prices. Moreover, the trajectory of the index looks set to rejoin the dividend futures-based model's projections associated with this future quarter in the next two weeks.

The deviation between the model's trajectories and the actual trajectory of the index is attributed to how the projections are generated. Because its projections are "locked-in" once it gets within a 30-day window of the present, if something unexpected happens to prompt investors to alter their outlook for the future within that period, it results in a short-term deviation between the model's projections and the S&P 500's trajectory. At least, until the trajectory gets outside the "locked-in" window of when the unexpected event began.

In a little over a week, the actual trajectory of the S&P 500 appears set to rejoin the model's projections that incorporate the information investors absorbed a little over 30 days earlier when an unexpected resurgence of inflation prompted them to push back their expectations for when rate cuts would start in the U.S.

Speaking of absorbing information, here's our summary of the market-moving headlines of the trading week ending on Friday, 3 May 2024.

- Monday, 29 April 2024

-

- Signs and portents for the U.S. economy:

- Oil dips on Israel-Hamas peace talks, slim near-term US rate cut hopes

- US regulators seize troubled lender Republic First, sell it to Fulton Bank

- Fed minions thinking about when, whether to cut interest rates in 2024:

- Bigger trouble, stimulus developing in China:

- China's Big Five lenders see margins shrink in the first quarter

- China industrial profits fall in March, stir doubts about economic recovery

- Chinese property shares rally on stimulus hopes

- BOJ minions start propping up yen:

- ECB minions excited Eurozone inflation is slowing:

- Central Europe's rate-setters have pause for thought

- ECB's Knot: increasingly confident about disinflation

- Nasdaq, S&P, Dow ended higher in a choppy session as investors shift attention to the Fed

- Tuesday, 30 April 2024

-

- Signs and portents for the U.S. economy:

- US labor costs increase more than expected in first quarter

- Oil falls to 7-week low on surprise US storage build, Middle East hopes

- Fed minions thinking about what to do with their balance sheet:

- Bigger trouble, stimulus developing in China:

- China's factory, services activity growth slows in April

- China to step up support for economy, flexibly use policy tools, Politburo says

- BOJ minions happy with data they like:

- Bank of Japan upbeat on consumption, service price outlook

- Japan March factory output rises as vehicle production recovers

- Growth signs in the Eurozone, ECB minions looking forward to rate cuts:

- Euro zone grows more than expected in Q1 after recession

- Euro zone inflation steady in April, reinforcing ECB rate cut case

- Nasdaq slides ~2%, Dow and S&P shed over 1% each as Wall Street ends April in the red

- Wednesday, 1 May 2024

-

- Signs and portents for the U.S. economy:

- Oil prices rebound after closing at seven-week low

- US job openings slide to three-year low as demand for labor gradually eases

- Fed leaves rates unchanged, flags 'lack of further progress' on inflation

- Fed's Powell says looming US election will not sway rate decisions

- FOMC holds rates in place and will slow balance sheet drawdown

- More Fed officials ready to say goodbye to low-rate world

- BOJ minions intervenes to support falling yen:

- ECB minions push back date Eurozone inflation will hit its target:

- Nasdaq, S&P, Dow's Fed-sparked gains cool off, but bonds rise as Powell says hike unlikely

- Thursday, 2 May 2024

-

- Signs and portents for the U.S. economy:

- Weak US productivity could threaten Fed's 'soft landing' hopes

- US high yield spreads still tight despite pick-up in distress

- BOJ minions get desired result after propping up Japan's yen:

- Bigger trouble developing in Eurozone as ECB minions get reason to cut interest rates:

- Euro zone factory activity takes turn for the worse in April, PMI survey shows

- ECB's Stournaras sees just three rate cuts in 2024 on strong growth

- ECB should accumulate data between rate cuts, chief economist says

- Nasdaq, S&P snap two-day losing streak while Dow also advances ahead of Apple results

- Friday, 3 May 2024

-

- Signs and portents for the U.S. economy:

- Oil settles down on US jobs data, steepest weekly loss in 3 months

- US job gains fewest in six months as labor market cools

- US service sector contracts in April; price pressures reaccelerate

- Fed minions thinking about what their inflation target should be, might try being clearer about what their dot plot rate forecast means:

- NY Fed’s John Williams says 2% inflation target is ‘critical’ for monetary policy

- Fed's Goolsbee: US rate-path 'dot plot' needs more context

- Fed's Bowman supports current policy stance but still sees inflation risks

- Dovish Fed, 'Goldilocks' jobs report helps S&P 500 notch back-to-back weekly gains

The Atlanta Fed's GDPNow tool is forecasting an annualized real GDP growth rate of 3.3%, down from its initial forecast of +3.9% growth in the previous week.

Image credit: Microsoft Bing Image Creator. Prompt: "An editorial cartoon of a Wall Street bull sitting up after having received CPR from a paramedic wearing a name badge that says 'RATE CUTS'".

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.