After all the fireworks of volatility over the last several weeks, the second week of trading in September 2019 saw precious little for the S&P 500 (Index: SPX), which closed up for the entire week by less than 1% from the previous week's close.

All the action during the week was fully consistent with investors being closely focused on 2020-Q1 in setting current day stock prices, as suggested by our alternate futures spaghetti chart.

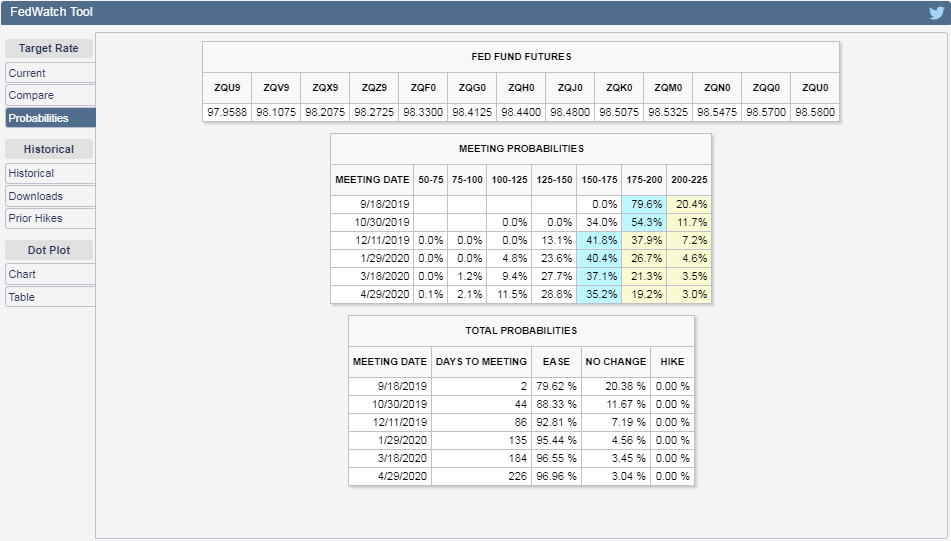

The reason for that was an outbreak of relatively good news, which has reduced the odds of future Fed rate cuts in upcoming months. As of the close of trading on Friday, 13 September 2019, the CME Group's FedWatch Tool is projecting quarter point rate cuts at the conclusion of the Fed's upcoming meetings this week, and again in December 2019. But whether there will be another in 2020-Q1 has become an open question, which is why investors would continue to be focusing on that particular distant future quarter:

We said there was an outbreak of good news, and we meant it! Here are the headlines that caught our attention during the less-than-volatile week that was:

- Monday, 9 September 2019

- Oil gets boost as new Saudi minister commits to output cuts

- Bigger stimulus developing

in Chinaall over: - China to further support private firms, boost manufacturing - state media

- China's August new loans seen up slightly, more easing expected: Reuters poll

- Time for shock and awe: Five questions for the ECB

- Wall Street ends flat amid rate hopes, tech declines

- Tuesday, 10 September 2019

- Oil falls on possibility of Iran exports resuming after Trump fires hard-line adviser

- Bigger trouble developing

in Chinaall over: - China August factory deflation deepens, prices fall most in three years; pork prices soar

- Australia business conditions deteriorate again in August: survey

- Exclusive: Waning confidence over global recovery may nudge BOJ closer to easing - sources

- Inverted yield curves 'not a vote of confidence': BoE's Carney

- Wall Street mixed as investors flee growth for value

- Wednesday, 11 September 2019

- Oil prices slide 2% after report Trump weighed easing Iran sanctions

- Bigger trouble developing

in Chinaall over: - China's auto sales face more bumps ahead, industry body warns, after latest slump

- German institutes see recession, cut growth forecasts for 2019, 2020

- Bigger stimulus developing

in Chinaall over: - China bank loans up in August, more stimulus expected

- Chile could cut rates but sub-zero, QE talk premature: central bank governor

- Trump reverses course, seeks negative rates from Fed 'boneheads'

- Trade hopes buoy Wall Street as China extends olive branch

- Thursday, 12 September 2019

- Oil prices fall 1% on U.S.-China trade doubts, OPEC+ talks

- Bigger trouble developing all over:

- Bigger stimulus developing all over:

- ECB cuts key rate, to restart bond purchases

- Draghi ties Lagarde's hands with promise of indefinite stimulus

- Draghi's parting shot leaves next ECB boss with existential dilemma

- Explainer: How does negative interest rates policy work?

- Denmark's central bank cuts key interest rate to historic low

- BOJ considering ways to deepen negative rates at minimal cost: sources

- Chinese and U.S. officials will meet next week to discuss trade: Xinhua

- Exclusive: Ahead of trade talks, China makes biggest U.S. soybean purchases since June - traders

- China to exempt U.S. pork, soybeans from additional tariffs: Xinhua

- Trump: would consider interim trade deal with China

- Wall Street ends higher on trade, ECB stimulus hopes

- Friday, 13 September 2019

Elsewhere, Barry Ritholtz listed six positives and six negatives he found in the week's economics and market-related news over at the Big Picture.

Given overseas events, we're afraid the upcoming week will be quite different.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.