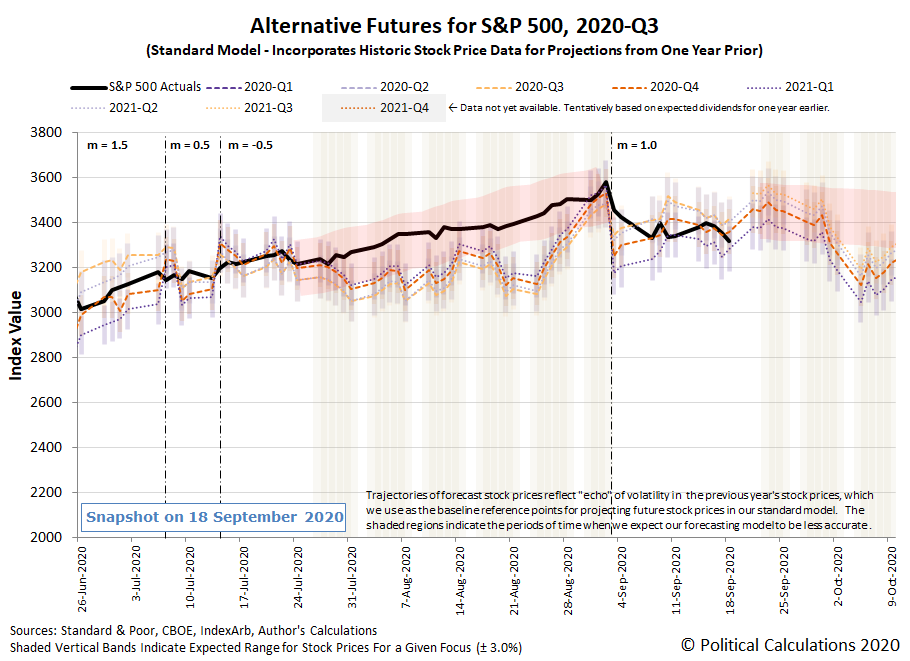

The dividend futures-based model we use to project the future for the S&P 500 (Index: SPX) presents some unique challenges from time to time.

In 2020, one of those challenges has been coping with changes in the model's amplification factor (m) which, after more than a decade of holding a virtually constant value, suddenly became a variable. Add to that a bubble in stock prices inflated by a Japanese investment bank, and we've had our hands full in keeping up with the changes that have driven stock prices.

The unwinding of the one-sided trades launched by the Japanese investment bank's "NASDAQ whale" combined with statements by Federal Reserve officials on Wednesday and Thursday in the past week however provided us with an opportunity to calibrate the model and empirically determine the amplification factor. Assuming investors are continuing to focus on 2020-Q4 in setting current day stock prices, it seems to have settled at a positive value of 1.0.

That's less than the value of 1.5 that held in the period prior to the NASDAQ whale's influence, where the reduction from this level is consistent with the Fed adopting a more expansionary monetary policy. Since nobody outside of Japan's SoftBank had visibility on its role in the summer stock price rally, we had previously attributed the runup in the S&P 500 to investors responding the Fed's signaling its increasing willingness to adopt a more 'dovish' policy. Now that the NASDAQ whale is out of the picture, so to speak, we can now better quantify the contribution of the Fed's signaled policy change to the summer rally, where it would appear to account for 25% of the change in the amplification factor.

This past week is when that signal was set more definitively, although as you'll see in the headlines we plucked from the week's major market-moving newstream, the Fed is still really shaky on what that new policy means.

- Monday, 14 September 2020

- Daily signs and portents for the U.S. economy:

- Oil edges lower, shrugging off Gulf of Mexico shut-ins

- Mnuchin says he will continue to work on COVID-19 deal: CNBC

- Economic rebound taking shape in Eurozone, but ECB minion sees disinflation developing in Eurozone:

- German economic recovery to continue in second-half, third-quarter to show strong growth: ministry

- ECB's Makhlouf sees continued fall in prices during pandemic

- Wall Street closes broadly higher on deal news, vaccine hopes

- Tuesday, 15 September 2020

- Daily signs and portents for the U.S. economy:

- Oil gains as hurricane shuts U.S. output, stockpiles fall

- Bipartisan U.S. lawmakers to unveil $1.5 trln COVID-19 aid bill

- White House open to 'Problem Solvers' compromise in coronavirus aid fight

- Leading U.S. House Democrats say coronavirus relief plan from moderates 'falls short'

- U.S. median income hit record in 2019, Census data shows

- U.S. manufacturing production increases in August

- Bigger stimulus still rolling out in China:

- ECB minions having second thoughts on policies:

- S&P 500 ends higher on growing hopes Fed will stay accommodative

- Wednesday, 16 September 2020

- Daily signs and portents for the U.S. economy:

- Oil up more than 4% as U.S. stockpiles fall, hurricane hits output

- Fading fiscal stimulus restraining U.S. consumer spending

- Fed minions say no rate hikes:

- Fed touts economic recovery, vows to keep interest rates low

- Fed defends 'pedal to the metal' policy and is not fearful of asset bubbles ahead

- Fed vows to keep interest rates near zero until inflation rises

- ECB minions argue negative, low interest rates are bad:

- 'Don't do it': studies flash sub-zero rate warnings to central banks

- ECB's Holzmann says low rates harmful in long term

- Bigger trouble developing in China:

- Surprising news:

- S&P 500 ends down after late reversal despite Fed's low-rate stance

- Thursday, 17 September 2020

- Daily signs and portents for the U.S. economy:

- Oil rises 2%, reverses loses as OPEC+ addresses market weakness

- U.S. labor market recovery stalling; housing market presses ahead

- Bigger trouble developing in Eurozone:

- Resurging coronavirus biggest threat to euro zone economy: economists

- Euro zone August price fall confirmed, core inflation slows

- Fed minion seeks to lower expectations, ECB minions want to devalue Euro and bail out banks:

- Fed's Powell sees a long road to 'maximum employment'

- ECB's de Guindos says exchange rate is fundamental for inflation

- Euro zone banks get 73 billion euro ECB relief to withstand pandemic

- Wall Street falls as tech sells off again, jobless claims still high

- Friday, 18 September 2020

- Daily signs and portents for the U.S. economy:

- Oil flat as Libya developments counter OPEC+ boost

- U.S. details up to $14 billion in new aid for farmers

- Fed says household finances improving, but low-income ones face tougher road

- Fed minions don't understand their new policy, worry about inflation, admit pandemic aid aimed at bailing out banks, looking to bail out Main Street and fix effects of decades-old racist policies:

- Fed officials tussle over practical meaning of new inflation policy

- What are the Fed's new hurdles for rate hikes? Only the Fed knows

- Bostic: Inflation up to 2.3% 'would be fine' as long as it is stable

- Fed's Kashkari wanted stronger commitment to delay rate hikes

- Bullard: Loose central banks, big deficits could produce inflation

- Fed's Kashkari says pandemic aid was also 'banking bailout'

- Fed, regulators take step to encourage more Main Street loans

- Bostic: 'Fundamental' effort needed to address racial wealth, economic gaps

- ECB minion wants more stimulus:

- Wall Street posts third week of declines as tech slide drags on

Meanwhile, Barry Ritholtz succinctly summarized each of the positives and negatives he found in the past week's economics and markets news.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.