It's not often we get to take on a mystery that perplexes professional investors, but as fortune would have it, here we are!

Let's turn to a Reuters analysis that appeared on 30 March 2022 to get a description of what's got Wall Street's money mavens all hot and bothered about what they don't know.

As a stunning rebound in U.S. stocks charges on, investors are questioning how long the surge can continue in the face of a hawkish Federal Reserve, warnings of recession from the bond market and geopolitical uncertainty.

The S&P 500 is up 11% since March 8, its biggest 15-day percentage gain since June 2020, led by many of the high-growth stocks that have been pummeled for much of the year. The benchmark index has cut its year-to-date losses to 2.8%, after it earlier swooned by as much as 12.5%.

The move has come despite a broad range of concerns that rocked equities earlier this quarter, among them the war in Ukraine, surging inflation and a sharp rise in Treasury yields fueled by tightening monetary policy from the Fed.

Stocks shrugged off the latest ominous sign from the bond market on Tuesday. The S&P 500 closed up 1.2% even as the widely tracked U.S. 2-year/10-year Treasury yield curve inverted for the first time since September 2019, a phenomenon that has reliably predicted past recessions.

"It's been mystifying," said Jack Ablin, chief investment officer at Cresset Capital Management. "I think that the bond market is sober and the equity market is quixotic."

Is it now?

Perhaps not so much if you know how the math behind stock prices works. Let's see if we can't boil this down simply.

First, the stock market and the bond market are not the same. While both certainly reflect the random onset of new information that investors continually absorb, they do not work the same. Because they don't, they can produce very different outcomes even when they absorb the same information. Both markets have been absorbing the expectations that investors are developing for what the U.S. Federal Reserve will do with the short term interest rate it controls as it copes with President Biden's persistent inflation. Investors in both markets are gearing up for the Fed to step up the size of the rate hikes it will implement at roughly six week intervals throughout 2022.

For the bond market, that directly affects the yields that are the ultimate output of the bond market. They see the escalation path for the future and that's pretty much it as far as it affects how they go about making their current day investment decisions.

But stock prices work differently than bond yields. Stock prices are driven by growth expectations for their underlying dividends per share, which are similar to and yet are not bond yields. Stock market investors making their current day investment decisions expect to realize different levels of growth in dividends at different points of time in the future.

For them, the timing of each of the Fed's upcoming interest rate hikes matters just as much as their size. During the first quarter of 2022, they were mainly focused on what the Fed would be doing in 2022-Q2. Mainly because they've gone from simply wondering how many quarter point rate hikes there would be during the quarter to nearly fully accepting they'll see the Fed announce two half point rate hikes before the end of June 2022.

That addressed their expectations for 2022-Q2, but not 2022-Q3, which is where their forward-looking focus has shifted. That shift sparked the rally through what we've been reporting as the second Lévy flight event of 2022. Stock prices have risen because the expections for the change in the growth rate of dividends for the S&P 500 (Index: SPX) is much more positive than it is for 2022-Q2.

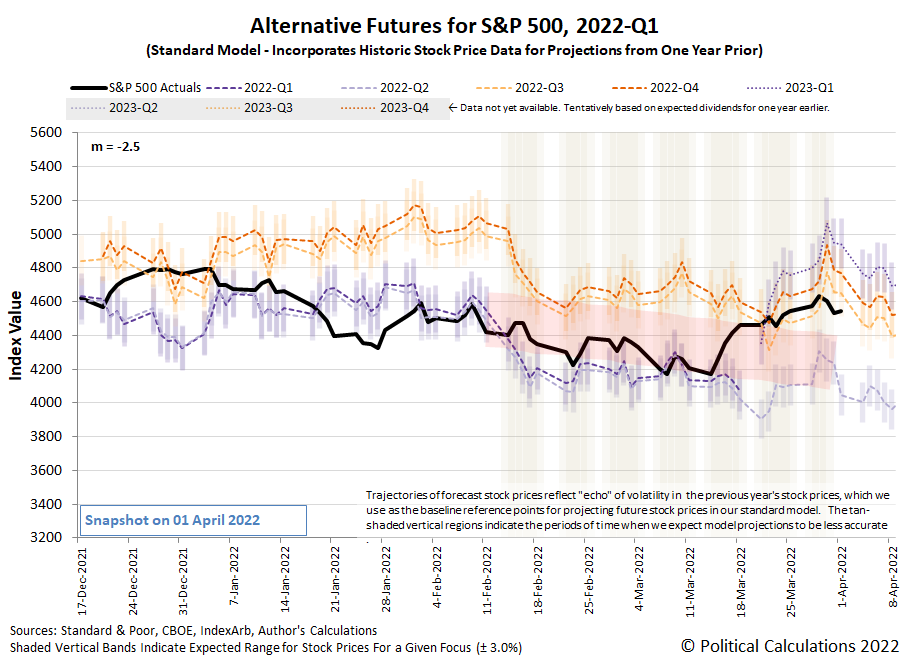

These are the kinds of changes the alternative futures spaghetti forecast chart is designed to track. You can see the dramatic positive change in stock prices that has taken place during the last few weeks in the latest update to our 2022-Q1 chart, where the magnitude and direction of the change in the S&P 500's trajectory is explained by investors refocusing their attention from 2022-Q2 toward the more distant future quarter of 2022-Q3 and its more positive expectations for the change in the year-over-year growth rate of dividends.

For that "soberness" that Jack Ablin is mystified hasn't appeared in stock prices, he'll have to wait until the expectations for future dividend growth change. If the bond market's pricing in recession, that expectation will be communicated to stock market investors through dividend cuts as distressed firms announce them.

Alternatively, he could wait until investors have a reason to refocus a significant portion of their attention on 2022-Q2. That would be a short and brutal path to sobriety, not to mention one that doesn't require any change in expections for future dividends.

If neither of those things happen, we have the scenario that Ed Yardeni described:

Strategist Ed Yardeni of Yardeni Research said March 8 may have marked a bottom for the stock market this year, believing stocks are gaining support from investors using equities as a hedge against inflation, which stands at its highest level in nearly four decades.

"The fog of war had masked the outlook, but the long-term bull market, punctuated by panic attacks, remains intact," he wrote on Tuesday.

That's the best case scenario at this point. But notice his caveats - what Yardeni describes is what we call chaos, where what he calls panic attacks are, for us, garden variety Lévy flights. That chaos, as we've described and quantified it, is the environment to which stock market investors have adapted, whether they recognize it as such or not.

After the math, it all comes down to that random onset of new information that determines both what investors expect and when. Here's our selection of market-moving headlines outlining what stock market investors had to absorb in the final week of March 2022.

- Monday, 28 March 2022

- Signs and portents for the U.S. economy:

- Oil slides about 7% on concerns of weaker Chinese demand

- U.S. Treasury yield curve divergence sends mixed recession signals

- Bigger stimulus developing in Japan:

- ECB minions say no risk of stagflation in Eurozone:

- S&P 500 climbs for third straight day as Tesla leads

- Tuesday, 29 March 2022

- Signs and portents for the U.S. economy:

- Tightening U.S. labor market underpins consumer confidence despite soaring inflation

- U.S. 2s/10s Treasury yield curve inverts

- Inversion of key US yield curve slice is a recession alarm

- Explainer-U.S. yield curve inversion: What is it telling us?

- Analysis-U.S. Treasuries yield curve flashes red to investors

- Oil drops 2% amid Russia-Ukraine peace talks, China lockdowns

- Fed minion warming up to bigger rate hikes, former minion says Fed minions made recession "inevitable":

- Fed's Harker expects 25-basis-point rate hikes, but open to 50 basis points

- Is a Recession Coming? The Fed Has Made It Inevitable

- Japanese government, BOJ minions looking to keep stimulus going and to prop up yen:

- Japan PM orders cabinet to compile relief package to combat rising prices

- BOJ policymakers saw need for easy policy despite rising prices - March meeting summary

- Bank of Japan ramps up battle to defend yield cap even as weakening yen raises economic risk

- ECB minion wants to increase 'risk-free' Eurozone interest rate to zero percent:

- Wall Street rallies on hopes Russia, Ukraine can resolve conflict

- Wednesday, 30 March 2022

- Signs and portents for the U.S. economy:

- Oil up 3% on tight supply, prospects of new Russia sanctions

- U.S. mortgage rates jump by the most in 11 years -MBA

- U.S. private payrolls rise solidly; corporate profits growth slows

- Fed minion says they won't think about stopping rate hikes until they hit 2.5%!

- Bigger trouble developing in Eurozone, China:

- German govt advisers slash GDP outlook, see recession risk

- 'Welcome back to the 1970s': Oil, gas prices push German inflation above 7%

- Germany girds for gas rationing, Europe on edge in Russian standoff

- China's March factory activity likely shrank amid virus outbreaks - Reuters poll

- Bigger stimulus developing in China:

- ECB minions say buckle up for stagflation, inflation will stop rising, and deadbeats will be cut off!

- Euro zone facing slower growth, higher inflation: ECB's Lagarde

- ECB tells banks to cut lending to indebted borrowers after binge

- Dow, S&P close lower after 4 days of gains as Russia bombs Ukraine

- Thursday, 31 March 2022

- Signs and portents for the U.S. economy:

- Oil slumps 7% as U.S. plans record crude reserve release

- Oil above $100/barrel to stay as market struggles to replace Russian barrels: Reuters poll

- OPEC+ says prolonged Ukraine conflict would be major blow to global economy

- Explainer-What is the SPR, the emergency oil stash Biden is tapping?

- U.S. consumer spending cools as goods outlays decline; labor market tightening

- Fed minions being possessed by rate hike groupthink:

- Bigger trouble developing in China, Eurozone:

- Chinese manufacturing, services contract together for first time since 2020

- Euro zone growth barely positive in first half: ECB's de Guindos

- ECB minions counting on inflation falling to 2%:

- ECB sees inflation stabilising around 2% target: Lane

- Analysis-End of an era in sight as euro area borrowing costs sweep above 0%

- Wall Street falls as S&P suffers biggest quarterly drop in two years

- Friday, 1 April 2022

- Signs and portents for the U.S. economy:

- Oil falls most in 2 years after oil stockpile release

- COVID weighing less and less on the U.S. job market

- U.S. unemployment rate drops to 3.6% as labor market rapidly tightens

- U.S. auto sales slide but demand for EVs is hot

- U.S. manufacturing sector activity slows in March; input prices surge - ISM

- Chief Fed minion worked on a weekend, Fed minions excited for lots of rate hikes:

- Fed Chair Powell worked the weekend after Russia's invasion began

- U.S. yield curve inverts after strong jobs data; world shares mixed

- Fed's Evans sees 7 rate hikes this year, but says that could change

- Bigger trouble developing in Mexico:

- BOJ minions want to keep stimulus going to get weaker yen:

- ECB minions hoping Eurozone residents don't notice inflation:

- Euro zone inflation hits new peak, deepening ECB's dilemma

- ECB needs time to analyse fallout from 'very high' inflation: Lane

- Europe can learn lessons from 1970s oil shock as rationing looms

- Wall Street posts modest gains as jobs report keeps Fed hikes on track

The CME Group's FedWatch Tool continued to project the Fed's next moves will be two consecutive half point rate hikes in May and June 2022 (2022-Q2), but added a third half point rate hike in July 2022 (2022-Q3). Those are followed by a resumption of quarter point rate hikes every six weeks with hikes in September 2022 (2022-Q3), November and December 2022 (2022-Q4), followed by more in 2023 with one each in February and March 2023 (2023-Q1) and one more in June 2023 (2023-Q2).

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth in 2022-Q1 has bounced back up to 1.5% after data showing more investment growth than previously expected was relea

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.