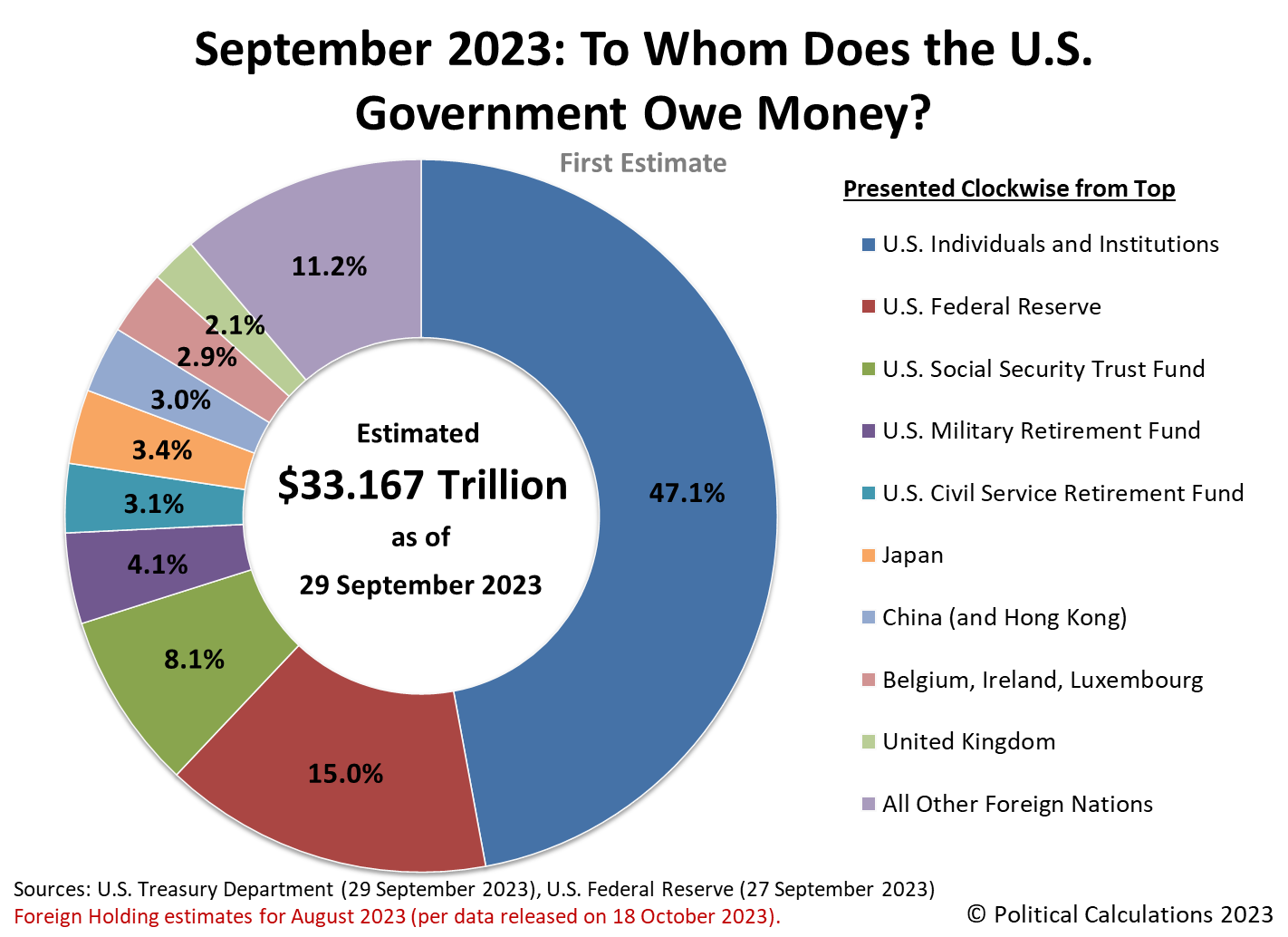

The U.S. government's total public debt outstanding through the end of its 2023 fiscal year on 29 September 2023 is nearly $33.167 trillion. The national debt increased by over $2.238 trillion since the end of the government's 2022 fiscal year.

To whom does the U.S. government owe all that money?

The following chart provides a first estimate of who the U.S. government's biggest creditors are through the end of its 2023 fiscal year along with the portion of the national debt they are owed.

The Overall Picture

Holding 15% of the total public debt outstanding, the U.S. Federal Reserve is once again the U.S. government's single largest creditor. However, its share of the national debt is down from the 18.3% it held last year as the Federal Reserve has reduced its holdings. In doing so, the Fed continued following the monetary policies it set in March 2022 when it began hiking interest rates to combat inflation unleashed by President Biden's policies.

Rising interest rates for U.S. government-issued debt securities have been attractive to U.S. individuals and institutions. Banks, insurance companies, investment funds, corporations, and individuals collectively increased their share of the national debt from 42.1% in 2022 to 47.1% in 2023.

Social Security's share of the national debt dropped from 8.9% in 2022 to 8.1% in 2023. This decline coincides with the ongoing depletion of its Old Age and Survivors Insurance trust fund because the program has been running in the red since 2009. By contrast, the combined share held by the government's military and civilian employee retirement trust funds increased from 6.3% to 7.2%.

Altogether, the portion of the U.S. national debt held by U.S. entities in 2023 is 77.4%, up from 75.7% in 2022.

That brings us to the second-most interesting year-over-year change in who owns the U.S. national debt. The amount of debt held by foreign entities was unchanged from 2022 to 2023 at $7.509 trillion.

Among the major foreign holders of U.S. government-issued debt securities, both Japan and China decreased their holdings over the 2023 fiscal year, while all other nations increased their net holdings enough to offset that decline. As for why, both Japan and China have been engaged in efforts to prevent the value of their currencies from falling too much with respect to the U.S. dollar, which has involved selling off their holdings of U.S. government-issued debt securities.

The following waterfall chart breaks down where most the money the U.S. government newly borrowed during its 2022 fiscal year came from:

So there you have it. The Federal Reserve, Social Security, Japan, and China have seen their share of the U.S. national debt fall, while pretty much everyone else increased the share they hold, with U.S. individuals and institutions increasing their share the most.

About the Data

The U.S. government's total public debt outstanding is the value recorded for 29 September 2023, the final day of the government's 2023 fiscal year, which also applies for the portion of the national debt held by the government-operated trust funds for Social Security, military and civilian government employees. Data for foreign holdings is based on estimates through August 2023 that was released on 18 October 2023. The Federal Reserve's holdings are those recorded on 27 September 2023.

Labels: national debt

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.