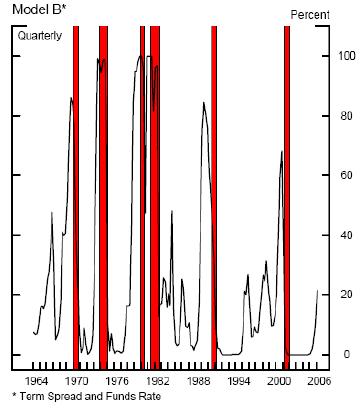

Previously, Political Calculations created a tool that allows the user to determine the odds of a recession occurring in the next 4 quarters given only the Federal Funds Rate and the spread between the 3-Month and 10-Year U.S. Treasury notes. The tool is built upon the work done by Jonathan Wright of the Federal Reserve Board, whose "Model B" appears to best predict future recessions. (Wright's paper is available as a 158KB PDF document.)

In reviewing the paper, I couldn't help noticing that the 50% probability level seemed to be a key cut-off in determining if there would or would not be a recession in the next twelve months. Basically, over the last 41 years, a recession followed if the 50% probability threshold for Wright's Model B was exceeded, while no recession occurred if this threshold was not exceeded. The following chart, taken from Wright's paper, illustrates this observation by showing the probability of recession measured between 1964 and the end of 2005, and when recessions were officially determined to begin and end:

We here at Political Calculations are always on the look-out for things we can turn into useful tools. So, when we saw this pattern, we recognized that we could create a visual representation of how close the U.S. is to a recession at any given time by determining what spread between the 3-Month and 10-Year Treasury notes that it would take for a given Federal Funds Rate to reach the apparently critical 50% probability level of a recession, and comparing it to the current bond yield spread.

Using our recession odds tool, we reverse-engineered the bond spread needed to produce a 50% probability of recession given various Federal Funds Rates. We found that a linear relationship exists between the bond spread and Federal Funds Rate, which is illustrated in the chart below:

In the chart above, note that all points that fall in the area below the horizontal axis represents the "inverted yield curve" condition that gets Wall Street analysts' collective panties in a bunch! We also find in the chart that the 50% probability threshold may even occur when the spread between the 3-Month and 10-Year Treasuries is flat (equal to zero) or even positive for Federal Funds Rates equal to or greater than 6.200%!

Because this is Political Calculations after all, we've built the following simple tool to determine the bond yield spread needed for the Federal Funds Rate you enter for the U.S. economy to have a 50% chance of recession in the next 12 months:

Now, all you need to do is determine if the current spread between the 3-Month and 10-Year Treasuries is higher or lower than the given value to see how concerned you should be about a looming recession in the future! Cool, huh?

Update: We might be guilty of false advertising if we didn't, in fact, include a visualization of the likelihood of recession! The following illustration tracks the Fed's latest tightening cycle and shows the spread between the 3-Month and 10-Year Treasuries on the date the Fed adjusted the Federal Funds Rate to the indicated level:

We'll also note that the probability of recession since January 31, 2006 (covering the three most recent Federal Funds Rate increases) has been stable around 26-27%.

Update 2: Welcome Econbrowser readers!

Labels: recession forecast, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.