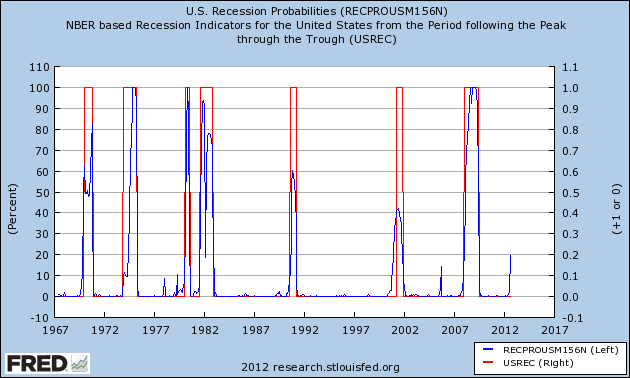

On 30 October 2012, a recession forecasting model developed by Marcelle Chauvet and Jeremy Piger reached what appears to be a critical threshold for anticipating a recession in the U.S. in the very near future:

The Reformed Broker's Joshua Brown comments (HT: Abnormal Returns):

Do you see the percentages on the left side of the chart? 20% is the line in the sand. We've never hit that level and NOT had a recession. In 2006 we got close (18%?) but that particular Great Recession would be a year and half in the making. Note that we're back at that 20% line again. And I can't think of anything that keeps the leading indicators from going through it to the upside - the Fiscal Cliff stuff could only speed its ascent.

One thing we should note is that the data in the chart only covers the period through August 2012 - this is a delayed reaction to a developing situation. The probability of recession in the U.S. suddenly surged to the 20% level from the 2% level recorded a month earlier pending future revisions.

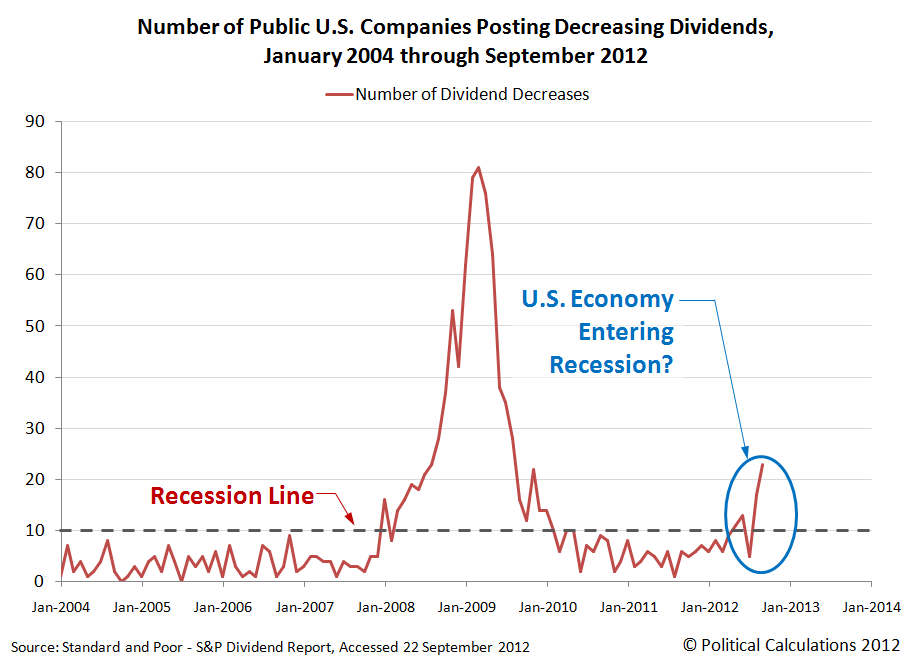

As it happens, we have another indicator which gave a slightly earlier signal that the U.S. economy is trending toward recession: the number of publicly-traded companies that have acted to cut their dividends. Here is what that data showed through the end of September:

We'd like to be able to update the chart through October 2012, however the aftermath of Hurricane Sandy has impacted Standard and Poor's operations, which has delayed the update of S&P's dividend action report [Excel spreadsheet].

As soon as that report has been updated, we'll post an updated version of our chart. In the meantime, we should note that this trend toward recession would seem to be occurring independently of whatever noise is going on in Washington D.C. with respect to the so-called fiscal cliff, which is confirmed by the Chauvet-Piger recession forecasting model, which does not consider that scenario.

We'll close by noting that what we're seeing in dividends now is not a result of the reactions to what we've described as the "dividend cliff". Here, there's really no hurry for companies to announce dividend cuts this year. Instead, the incentives are such that companies would more likely be announcing special dividend payments to beat the clock on the higher taxes for dividend income scheduled to begin in 2013, delaying the announcement of any plans they might be developing to cut dividends until the new year.

Previously on Political Calculations

Our previous posts on the rising likelihood of recession based on the number of U.S. companies acting to cut their dividends, presented in reverse chronological order:

- Dividends: U.S. Continuing Descent Toward Recession

- The Present According to Dividends: U.S. Entering Recession

- Declining Dividends Hinting at Recession

References

Chauvet, M. and J. Piger, "A Comparison of the Real-Time Performance of Business Cycle Dating Methods," Journal of Business and Economic Statistics, 2008, 26, 42-49.

Standard and Poor. Monthly Dividend Action Report. [Excel spreadsheet]. As last updated 28 September 2012.

Update 10 November 2012: Added "pending future revisions" as shown in boldface text above.

Labels: dividends, recession forecast

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.