This may surprise a lot of people, mainly because it stands in such contrast to the work product of their journalistic peers, but a lot of financial reporting is pretty well done.

But even financial journalists don't quite get the stories they cover 100% right. We have a great example of that today, featuring some really good reporting by Michael S. Derby of the Wall Street Journal, in which he does an excellent job describing why the stock market is selling off, but ends up putting the cart before the horse.

A world-wide equities sell off is driving investors to expect the Federal Reserve will wait longer to start raising short-term interest rates from near zero.

Participants in the fed funds futures market, where investors go to bet on possible movements in the Fed’s benchmark federal funds rate, shifted on Wednesday to project the central bank will begin raising interest rates sometime in the late third quarter or perhaps the fourth quarter of 2015.

Markets now see almost no chance of a Fed increase in rates coming next September, down from even odds a few weeks ago, said TD Securities economist Millan Mulraine in a note to clients. He noted investors are now putting a 50-50 chance on the Fed raising rates in October, and a 63% chance the move comes at the 2015 December Fed policy meeting.

The shift in market expectations comes as Fed officials are debating when to start raising rates. Several Fed officials expect lift off by the summer of 2015. Some want to move sooner and others want to wait until 2016.

Good reporting, but Derby gets it completely backwards at the very beginning. The sell off in stock prices most certainly did not drive investors to start expecting that the Fed would delay hiking interest rates until later in 2015. Instead, it is completely the other way around. The change in expectations that the Fed would delay hiking interest rates in the U.S. is what has caused stock prices to fall.

More specifically, that shift in expectations started to take place on Monday, 13 October 2014, and may be fully attributed to a speech that Federal Reserve minion Charles Evans gave to the National Council on Teacher Retirement on the subject of Monetary Policy Normalization: If Not Now, When? The timing of Evans' speech, and the dissemination of its content among Wall Street traders throughout the afternoon, directly coincides with the sudden shift of investors from focusing on 2015-Q2 in setting today's stock prices, to instead focus their attention on the more distant future quarter of 2015-Q3.

Here is what we noted in the update to our regular Monday post on that sudden shift in expectations later that day:

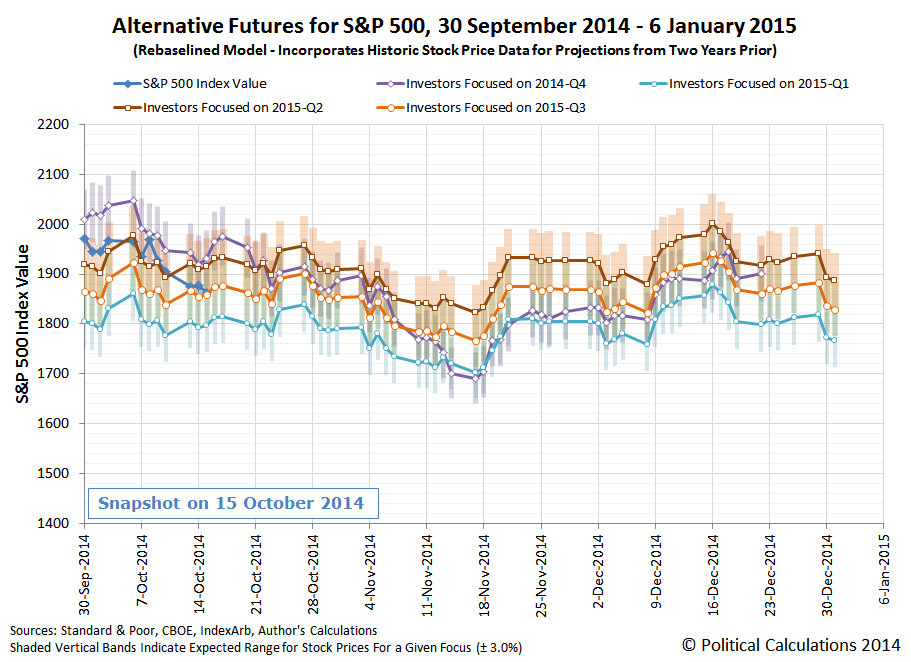

Update 13 October 2014, 8:20 PM EDT: Today's market action is what a shift in focus looks like - where investors suddenly shift their focus from one point of time in the future to another. Or, in terms of our rebaselined chart, from 2015-Q2 to 2015-Q3:

As for why investors shifted their focus to 2015-Q3, well, that's easy. One of the minions at the Federal Reserve indicated that economic weakness would lead the Fed to delay those interest rate hikes, which for the Fed's game of expectations, had been set to occur in the middle of 2015. With evidence of a weakening economy in the present mounting, it wouldn't take much for investors to shift their attention further forward in time as they could reasonably believe the Fed will be forced to delay.

It's a small change, but one with an amplified impact upon stock prices given the nature of how they work.

Remarkably, stock prices are still within our forecast range for 13 October 2014 assuming that investors had been focused on 2015-Q2 in setting today's stock prices - we've gone from one extreme to the other in just a matter of days. Whether this change is just a temporary noise event or actually a sustained shift in focus will become evident over the next several days.

Update 14 October 2014 8:06 AM EDT: From the WSJ - Despite Mixed Risks in U.S., Rate Timing Hasn't Shifted Much. Indeed!

We've now had the next several days to see if that shift would be sustained. It has. In fact, despite one of the more volatile days in recent market history, the S&P 500 closed at a value that is fully consistent with investors having shifted their forward-looking focus to 2015-Q3. At least, according to our rebaselined model of how stock prices work:

Up until Monday, the S&P 500 was largely tracking along with the trajectory associated with the expectations for 2015-Q2. In the previous weeks, that had meant a relatively steady decline in stock prices, with the exception of a very short-lived positive noise event on Wednesday, 9 October 2014, when investors were briefly distracted by a bright shiny object.

And then, Chicago Fed minion Charles Evans gave his speech, basically giving investors permission to anticipate that the recent onset of negative economic news indicating a deteriorating situation for the U.S. economy would lead the Fed to delay hiking short term interest rates until 2015-Q3, and that was all it took for stock prices to fall to the level they have.

In case you're wondering, it's having to cope with events like this that inspired us to include each of the trajectories that the S&P 500's stock prices are most likely to follow given how far forward in time investors are looking as they make their investment decisions today on our forecast charts.

So yes. It's almost as if we predicted it! Because we did. Because we can.

What we can't do, except in certain limited circumstances, is to anticipate in advance when such shifts in focus will occur. That aspect of how stock prices behave actually is random. It's a good thing that those factors are such a small part of what really drives stock prices.

In the meantime, even though it wasn't always true on 15 October 2014, by the closing bell, order was maintained in the stock market.

But will that last for very long? The suspense is terrible. We hope it will last!

On a closing note, looking back at the trading day that was, we can't help but think of Chicago Federal Reserve President Charles Evans' role in unleashing all that volatility. It is as if he were the very reincarnation of Mrs. O'Leary's cow....

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.