The S&P 500 (Index: SPX) rose sharply at the end of the second week of October 2019, boosted by news of the Fed's plan to buy $60 billion in Treasury bills each month well into 2020 and also the "phase one" announcement of a partial trade deal between the U.S. and China.

The following spaghetti forecast chart indicating the potential trajectories the S&P 500 might take depending upon how far into the future investors might be compelled to focus their forward-looking attention during 2019-Q4 shows that latest action:

We've added a redzone forecast to our chart, which is based on our assumption that investors are roughly equally splitting their forward-looking attention between 2019-Q4 and 2020-Q1 in setting today's stock prices, which we also assume will largely continue through 8 November 2019. This particular redzone forecast closely coincides with the trajectory that might apply if investors were to shift their attention to the much more distant time horizon of 2020-Q3, but we as yet see no evidence in the flow of new information shaping investor expectations that may be the case.

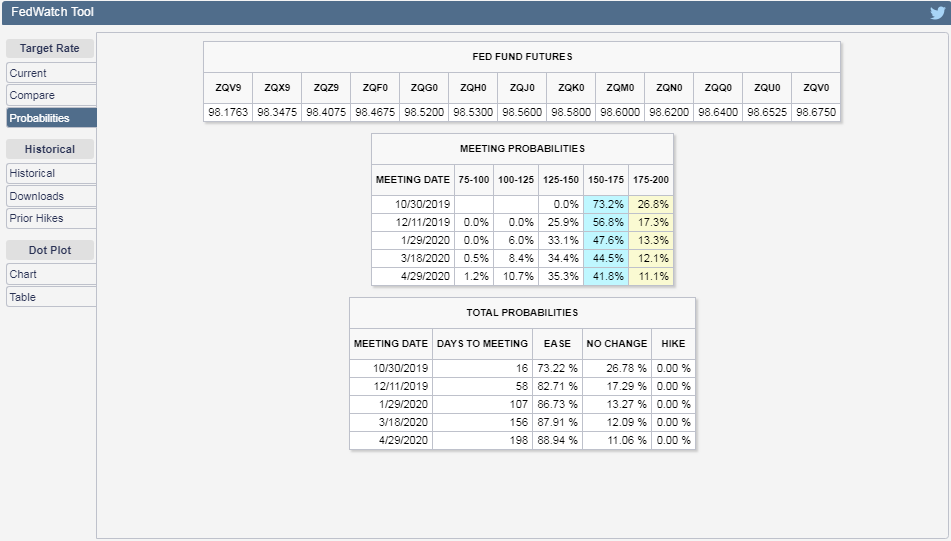

The Fed's action appears to have followed an emergency videoconference meeting of the Open Market Committee on 4 October 2019. With the practical assessment that the Fed has decided to re-initiate its Great Recession-era quantitative easing policies in all but name, investors have reconsidered the likelihood of the Fed also continuing to reduce the Federal Funds Rate in both 2019-Q4 and 2020-Q1. As of the close of trading Friday, 11 October 2019, investors seem to be betting on just one quarter point rate cut in 2019-Q4, coming as early as the end of October 2019, with a less-than-50% probability of another rate cut in 2020-Q1.

That change in expectations would account for the apparent split in focus between 2019-Q4 and 2020-Q4 in the alternate futures spaghetti forecast chart above, where the odds of a rate cut in 2020-Q1 are in flux. The headlines we believe reflect the flow of new information that contributed to shaping investor expectations during the trading week ending Friday, 11 October 2019 are below:

- Monday, 7 October 2019

- Oil prices drop as hopes fade for comprehensive U.S.-China trade deal

- Fed minions weigh next steps:

- Low inflation? Nothing to worry about, Fed's George says

- Fed's Kashkari says more easing needed, not sure how much

- Trump says U.S. economy entitled to 'substantial' interest rate cut

- Bigger trouble developing all over:

- Key Japan economic index falls, government changes view to 'worsening'

- German recession looms as industrial orders drop more than expected

- Wall Street falls amid caution on U.S.-China trade dispute

- Tuesday, 8 October 2019

- Oil eases on concerns over U.S.-China talks, weak demand signals

- U.S.-China strains over Hong Kong and minority rights hinder chance of trade deal

- Weak producer prices support another Fed interest rate cut

- Fed minions fixing to unleash more stimulus?

- Fed's Evans: I wouldn't mind another interest rate cut

- Fed's Powell: Outlook 'favorable', steps to address money market volatility coming 'soon'

- Powell: Time for Fed to expand balance sheet 'now upon us'

- Wall Street slumps as visa restrictions stoke U.S.-China worries

- Wednesday, 9 October 2019

- Oil steady as military action in Syria boosts prices, crude inventories weigh (Note: Turkey is the nation taking military action in Syria)

- Bigger stimulus developing in China:

- China to help ease fiscal strains on local governments amid tax cuts

- China's September new loans seen rising, more policy easing expected: Reuters poll

- Federal Reserve policymakers increasingly divided on way ahead, minutes show

- Wall Street advances on renewed trade deal optimism

- Thursday, 10 October 2019

- Oil prices rise as OPEC pledges decision on supply

- U.S., China resume high-level talks to end grueling trade war

- Trump says will meet with Chinese vice premier at White House on Friday

- China willing to reach agreeement with U.S.: Vice Premier Liu He

- U.S. weighing China currency pact as part of partial trade deal: Bloomberg

- ECB minutes show deep rift over policy as Draghi era closes

- Fed's Kaplan has 'open mind' on rate cuts, watching U.S. yield curve

- Wall Street rises on fresh hopes for U.S.-China trade deal

- Friday, 11 October 2019

- Oil rises 2% after reports of Iranian tanker attack

- Bigger trouble developing in China:

- Fed minions unleash more stimulus, talk up other potential changes to monetary policies:

- Fed to buy $60 billion in Treasury bills monthly to ensure 'ample' reserves

- Fed's Kashkari says officials should consider yield-curve control as a potential tool

- Fed's Rosengren urges patience on rates, with eye on consumer

- Fed's Kaplan says U.S. debt issuance top cause of reserves crunch

- "Phase One" U.S.-China trade deal:

- Trump says U.S., China have reached substantial phase-1 trade deal

- Trump sees 'good things' in trade talks; China dangles partial deal

- China has invited Lighthizer, Mnuchin for further trade talks: CNN

- Wall Street rises but pares gain after news of partial U.S.-China deal

The Big Picture's Barry Ritholtz outlined six positives and six negatives from the past week's economics and market-related news. One of the negatives is political noise, so on the whole, a net positive week!

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.