The S&P 500 (Index: SPX) continued to mostly move sideways during the third week of October 2020. Overall, it closed the trading week some 18.42 points (0.5%) lower than in the previous week, which is to say most of what happened during the week was day-to-day noise.

If investors are primarily focusing on 2020-Q4 in setting stock prices, we can expect more of the same next week. That assessment is based on coming toward the end of the redzone forecast range in this week's alternative futures chart.

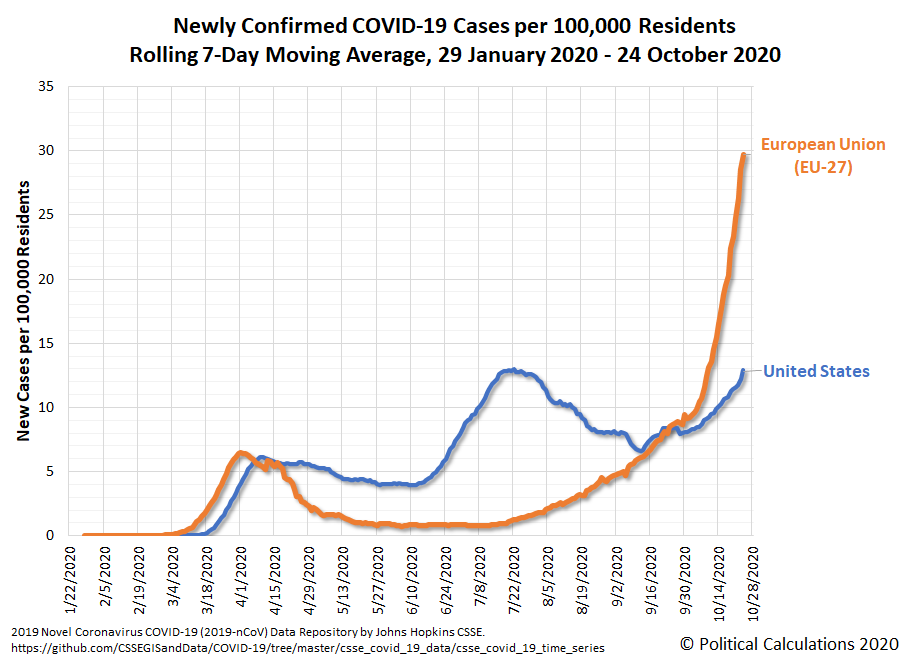

The mostly-noise driven action during the past week continues to be mostly influenced by the changing prospects of the U.S. government's next major stimulus bill. Perhaps a more serious fundamental issue is developing in Europe with its surge in coronavirus cases and corresponding lapse back into lockdown mode in several countries, which adds its own element of noise to the U.S. market. Here's a chart showing the rolling 7-day moving average trends in newly confirmed cases per 100,000 residents in both the European Union and the United States, where we find that Europe's rate of new cases is more than double than in the U.S.

Here's a second chart showing the rolling 7-day moving average trends in newly reported deaths per 100,000 residents in the E.U. and U.S., where we see the E.U.'s COVID-19 death rate has likewise surpassed the United States.

While the U.S. is doing far better than the E.U., we expect the increasing number and relative severity of lockdowns being imposed in various EU countries will negatively affect commodity markets and prices, which will put a damper on the business outlook for U.S. firms.

Overall, the general tone of the news during the past week was mixed, with several stories referencing the U.S. economy's stronger than expected performance in recent weeks, which perhaps helps explain why stock prices mostly moved noisily sideways rather than decidedly downward.

- Monday, 19 October 2020

-

- Signs and portents for the U.S. economy:

- Oil dips after OPEC+ meeting as Libyan supply boost weighs

- Worried about weak oil demand, OPEC pledges action

- Trump's payments to farmers hit all-time high ahead of election

- Fed minions learning to love higher inflation, chief Fed minion learning to love digital currencies:

- Fed's Harker: Tolerating higher inflation 'worth it' to help achieve employment goals

- Fed's Clarida says rates will stay near zero until inflation reaches 2%

- Fed's Powell: More important for U.S. to get digital currency right than be first

- Bigger trouble developing in Brazil:

- China shows signs of recovery:

- Chief ECM minion wants more stimulus, lower level minions wants no more, another sends up red flag on data quality, and yet another wants big bank mergers:

- Lagarde says ECB to maintain accommodative policy in response to coronavirus crisis

- ECB's Mersch warns against double counting as decision looms

- ECB's De Guindos says mergers can improve banks' profitability

- Wall Street closes lower as stimulus deadline nears without deal

- Tuesday, 20 October 2020

-

- Signs and portents for the U.S. economy:

- Oil up on U.S. stimulus hopes, rising virus cases keep prices in check

- U.S. single-family homebuilding, permits surge to more than 13-year high

- Trump pushes for major COVID-19 deal over Senate Republican objections

- U.S. coronavirus aid talks moving closer to deal-Pelosi aide

- Fed minions optimistic, pessimistic, worried about non-banks, but still believe they are all powerful:

- Fed's Evans sees less economic drag from new COVID-19 wave

- Fed's Quarles says pandemic stresses highlighted fragility in nonbanks

- NY Fed's Singh says central bank can ramp up, slow down, corporate bond purchases as needed

- Bigger trouble developing in Japan, Britain, Latin America:

- Exclusive: Bank of Japan to cut growth, inflation forecasts as pandemic pain persists - sources

- Britain's economic recovery faltering, Bank of England to step up spending: Reuters poll

- Latin America's recovery in doubt as fiscal worries mount, confidence wanes: Reuters poll

- Wall Street shares end higher on stimulus optimism

- Wednesday, 21 October 2020

-

- Signs and portents for the U.S. economy:

- Oil prices fall as inventory report reflects demand weakness

- U.S. economy recovering slowly, but some sectors struggling: Fed survey

- Where's the floor? Investors left guessing as U.S., Europe money market rates sink

- Fed minions pessimistic, uncertain, and want more U.S. government spending:

- Fed's Kaplan says U.S. economy will live with virus well into next year

- Fed's Mester says further study needed of monetary policy's affect on financial stability

- Fed's Brainard calls for more fiscal aid for economy

- Bigger trouble developing in Japan, Britain, Latin America:

- China shows signs of recovery:

- China's fiscal revenues rise 4.7% in third-quarter as economy gains steam

- China to balance stable growth and risk prevention: central bank

- China's 2020 auto production and sales could return to 2019 levels: government official

- Chief ECB minion goes on listening tour ahead of monetary policy revamp:

- S&P edges down in choppy session as U.S. stimulus talks drag on

- Thursday, 22 October 2020

-

- Daily signs and portents for stronger than expected U.S. economy:

- Oil ends higher, boosted by U.S. stimulus hopes

- U.S. weekly jobless claims fall; many unemployed losing benefits

- U.S. existing home sales blow past expectations in September

- U.S. economy's rebound sets up test of Fed's new pledge

- Wall Street closes higher, trade choppy as U.S. stimulus talks eyed

- Friday, 23 October 2020

- Daily signs and portents for the U.S. economy:

- Oil falls about 2% on Libyan output, COVID-19 demand concerns

- Exclusive: China eyes more corn imports as shipments surge, set to become top buyer

- Trump, Mnuchin say Pelosi must compromise to reach COVID-19 deal

- Fed minions worry about liquidity, think coronavirus has legs:

- Threats to U.S. Treasury market liquidity still exist, Fed says

- Fed's Kaplan says U.S. economy will live with virus well into next year

- Bigger trouble developing in the Eurozone:

- Euro zone economy at risk of double-dip recession: PMIs

- German factories hum, services shrink in two-speed economy: PMI

- Japan seeing signs of recovery:

- S&P, Nasdaq close higher as stimulus talks in spotlight

The Big Picture's Barry Ritholtz has outlined the positives and negatives he found in the past week's economics and markets news.

Update 28 October 2020: The S&P 500 dropped 3.5% today, with the die cast long before the market opened thanks to France's and Germany's decision to impose new nationwide COVID lockdowns, which will negatively impact the European and global economy. From our perspective, that news appears to have triggered investors to suddenly shift their forward-looking focus from 2020-Q4 toward 2021-Q1 in a new Lévy flight. The change comes just as we're reaching the end of the redzone forecast range:

This new shift is consistent with our nearly one month old observation that investors "may switch their focus back and forth between 2020-Q4 and 2021-Q1 severval times before the end of the 2020 calendar year". It's important to note that while we can anticipate the effect and the relative magnitude of the shifts when they do occur, they are not predictable because the timing of these shifts is essentially random. That is because they are prompted by the random onset of new market-moving information, like today's before-the-bell news of the Eurozone's new coronavirus lockdowns. At the same time, what makes the content of the news that drives these events so important is how it affects the time horizon for investors, or rather, how far forward in time they are looking when making their current day investing decisions.

What events might refocus investors back upon 2020-Q4? That answer may come sooner than you might think, but once again, it all hinges on the random onset of new information.

Labels: chaos, coronavirus, SP 500

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.