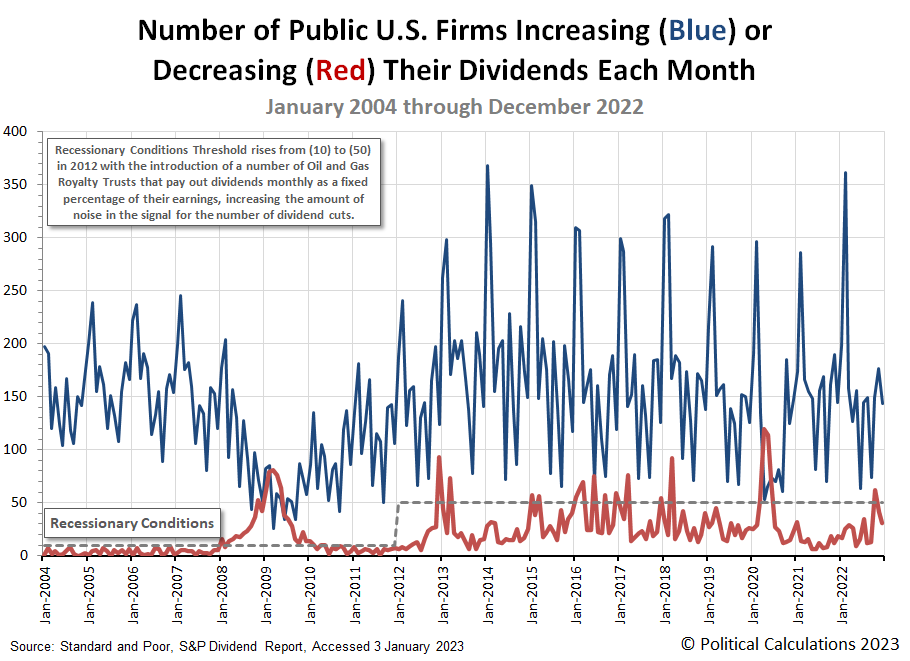

Dividend paying stocks in the U.S. stock market closed December 2022 with a mixed showing. Starting with the good news, the number of dividend reductions fell month-over-month. But the number of dividend increases also fell from November 2022's level, which darkens the picture. The following chart visualizes the number of U.S. firms either increasing or decreasing their dividends in each month from January 2004 through December 2022.

The mixed nature of the numbers are also evident in December 2022's dividend metadata. Here's the summary of those figures:

- 5,528 firms declared dividends in December 2022, an increase of 1,924 over November 2022's total. That figure is also an increase of 197 over the 5,331 recorded in December 2021.

- Some 135 U.S. firms announced they would pay a special (or extra) dividend to their shareholders in December 2022, an increase of 29 over the number recorded in November 2022, but a decrease of 33 from the 168 recorded in December 2021.

- 144 U.S. firms announced dividend rises in December 2022, falling by 33 from the 177 recorded in November 2022 and just one less than the number recorded back in December 2021.

- A total of 31 publicly traded companies reduced their dividends in December 2022, an decline of 10 from the number recorded in November 2022, but an year-over-year increase of 12 over December 2021's figure.

- Zero U.S. firms omitted paying their dividends in December 2021, continuing the unusually long trend established since June 2021.

A darker picture emerges when we tally up the quarterly data for dividend changes in 2022-Q4. Dividend reductions in particular are unambiguously worse than those recorded in the preceding quarter of 2022-Q3 and in a year-over-year comparison with 2021-Q4. The next chart visually summarizes the quarterly data for dividend increases and decreases over the past five quarters.

Going back to the monthly data, we captured 16 of December 2022's 31 dividend reductions. Here's the list, which includes eight firms in the real estate sector, which has been under pressure from the Federal Reserve's 2022 campaign to hike interest rates to fight President Biden's inflation. It also includes five firms that pay variable dividends, all in the oil and gas sector, which has been under pressure since oil prices peaked in June 2022 before beginning a 35% decline. Two firms in the consumer-oriented goods or services sector and one from the technology sector round out December 2022's dividend reduction sample.

- PC Connection (NASDAQ: CNXN)

- SL Green Realty (REIT-Office) (NYSE: SLG)

- PennyMac Mortgage Investment Trust (REIT-Mortgage) (NYSE: PMT)

- Douglas Emmett (REIT-Office) (NYSE: DEI)

- Alico (NASDAQ: ALCO)

- MFA Financial (REIT-Mortgage) (NYSE: MFA)

- Meritage Hospitality Group (OTC: MHGU)

- Ready Capital (REIT-Mortgage) (NYSE: RC)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Hugoton Royalty Trust (OTC: HGTXU)

- Cross Timbers Royalty Trust (NYSE: CRT)

- PermRock Royalty Trust (NYSE: PRT)

- Two Harbors Investment (REIT-Mortgage) (NYSE: TWO)

- Permian Basin Royalty Trust (NYSE: PBT)

- Granite Point Mortgage Trust (REIT-Mortgage) (NYSE: GPMT)

- AG Mortgage Investment Trust (REIT-Mortgage) (NYSE: MITT)

This month's sampling demonstrates, once again, why listing variable paying firms with reduced dividends along with firms that cut their dividends in tallying up the monthly numbers is both appropriate and useful. That's because all of these firms are dealing with deteriorating business conditions within their respective industries. They're not just dealing with the typical or seasonal noise that is otherwise always present in the market. Those investors who write off the dividend reductions announced by variable dividend payers as not worthy of mention because the companies haven't altered their formula for determing how much to pay out in dividends are missing the real picture.

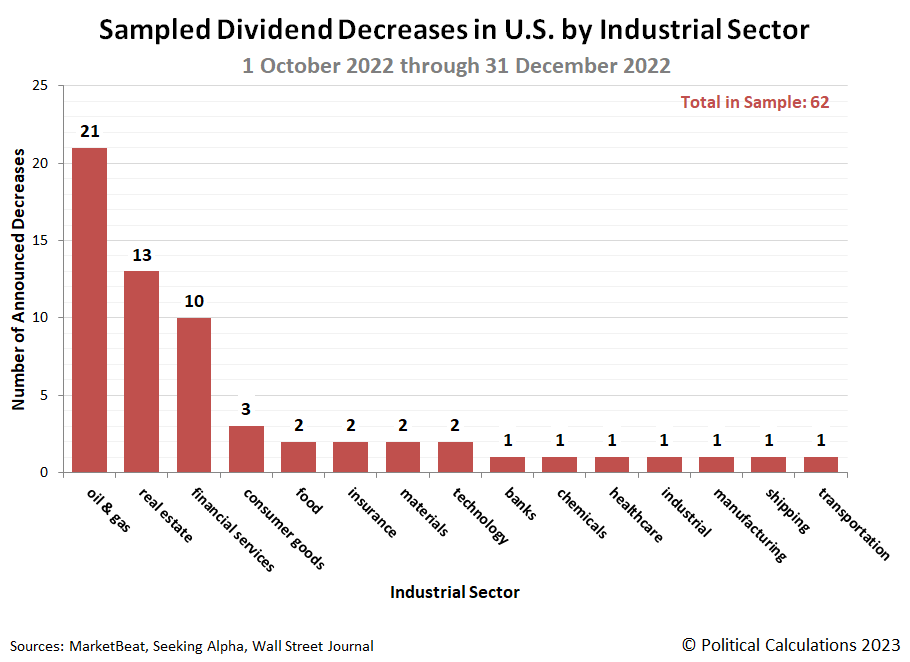

Taking a step back to look at the bigger picture for our sampling of dividend reductions over the past quarter, we find 2022-Q4 is the most negative for dividend paying firms since the aftermath of the Coronavirus Recession. Moreover, what stands out about the dividend reductions reported during 2022-Q4 is the breadth of affected industries. Our third chart illustrates that breadth of impact using our sampling from throughout the quarter:

In the end, we find December 2022 was the best month in the worst quarter since 2020-Q2. That's not saying much in the current market environment with 2023's recession expectations running rampant.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 3 January 2023.

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.