Bruce Bartlett's recent column Tax Rates has some interesting math that I've decided to immortalize with a tool here at Political Calculations(TM). Since the math revolves around information you have in your 2004 Form 1040 U.S. Individual Income Tax Return (reference this 180.2KB PDF document), I'll give you a few minutes to complete your return, if you haven't already, and have it ready to use with the calculator....

Okay, now that you've finished your return, let's put it to good use. We're going to calculate your average tax rate (the amount of taxes you paid relative to your income) and your marginal tax rate for 2004, or rather, the tax rate you paid on the highest dollar of your earnings last year. As noted in Bruce Bartlett's column, this latter information is really useful if you are planning to choose between a taxable versus a tax-exempt investment, since your marginal tax rate will determine which is more beneficial to you. Start by entering the indicated information from your 1040 form in the data input fields below, followed by your potential investment data:

Hopefully, this calculator has helped you make an investing decision based on your taxes from last year. If you expect that your income will be significantly different this year, you should re-run the calculator with new values to account for the difference, since it may make a world of difference in your choice of investments.

Update: Via e-mail, Bruce Bartlett notes the marginal tax rate computed by this calculator represents:

a first approximation of one's rate, because phase-outs and other provisions can greatly affect the rate one pays on a particular range of income.

The effects of these phase-outs and other provisions are important to note - you may find that once your income creeps above one of the many arbitrary income thresholds that define whether or not you are eligible for a particular allowance, deduction or tax credit, that it may be more advantageous to put your money in a tax-exempt investment even if the raw marginal tax rate determined by this calculator indicates you would be better off with a taxable one. Chalk another headache up to our ever growing more complicated tax code....

Labels: investing, taxes, tool

The most recent episode of The Apprentice offers a classic case study of how a project should be managed. In the episode, the two teams "Magna" and "Net Worth" were given the assignment of creating a "Do-It-Yourself" (DIY) workshop for this week's product placement sponsor Home Depot.

Each team's choice of a DIY project directly sealed their fates in the episode. Net Worth made the unfortuante choice of a rolling kitchen work table, which required a substantial amount of manual labor to successfully assemble. While the tip-off to the team that this particular workshop project was a poor choice should have come while they practiced assembling the table, the team made the critical mistake of not discarding the product and choosing a different one around which to build their workshop.

In effect, the team became too emotionally invested in making the rolling table project work. This irrational investment could be seen by their unwillingness to write-off the time that they had already invested and considering changing their product to one that offered a better opportunity for success while they still had time to do so. Eventually, this irrationality led directly to the team's failure, as when it came time to run their workshop, they were as spectacularly unsuccessful at assembling the table as they had been in practice.

By contrast, the DIY project selected by Magna's project manager was a model of simplicity, as noted by Suzanne Condie Lambert:

Craig informs Magna that its project is: a box. The box does not roll, fly, vibrate or explode. It's: a box.

It was so simple that the team's members all questioned whether or not it was a good choice. Fortunately for the team, project manager Craig stuck to his guns in selecting the project and the team enjoyed considerable success in running their workshop, which engaged families in the making and personalization of the box. In fact, if you're looking for something to do this weekend, your local Home Depot may be hosting it's own box workshop.

From a project management standpoint, the real secret to Magna's success in managing their assignment was scope control. By selecting a very simple product, Craig ensured that his team would not get bogged down by complexity in the way that Net Worth did. By keeping the underlying scope of the project simple, Magna made it possible to add a significant amount variability to their workshop, while still keeping the overall project simple. It's a lesson that more businesses, and project managers, could stand to learn.

Warren Meyer at the Coyote Blog has one of the single best descriptions of the options available to a small business owner in coping with the effects of an increase in the minimum wage upon their business that I've seen. It's a must-read for anyone living where a proposal to increase the minimum wage is on the table and who wants to understand the potential consequences of taking this action - especially if future increases may be linked to the cost-of-living index.

Aside from the link between the wage levels and employment levels itself, what I find unique in the debate about minimum wage levels is that as a society, we are very willing to place a disproportionate share of the negative consequences of increasing the minimum wage upon the youngest workers as well as upon the oldest, where both groups must bear the burden of increases in the cost of labor by being the most likely to be unemployed, all for the "benefit" of society as a whole.

Although one could argue that Warren's business is unique in that it primarily employs people above retirement age, who also receive income from Social Security, pensions, investments and other sources and would otherwise be unaffected, the same argument could be made of teenage and other entry-level workers who may fall back upon the resources of their families. While the "Mom-and-Dad" safety net lessens the direct impact of the minimum wage increase to the younger worker, it instead transfers the true cost of the increase to their parents, who frequently find themselves having to sustain their expenses in providing life's necessities to their offspring for a prolonged period of time, until opportunities in the entry-level job market allow their child to enter the workforce. [Editor's Note: Could this be a driving factor behind low birth rates in countries with high minimum wages?] Older workers, meanwhile, pay for the increase in minimum wage by having fewer choices available to earn income in their so-called "golden" years, which may negatively affect their standard of living while also adding to the costs to society in that they would be more likely to be dependent upon public benefits to make up their income shortfall.

Of the two affected groups, the effect of excluding the youngest working age members of society from the workforce carries the greatest economic costs. The World Bank confirms that the youngest workers represent the largest number of unemployed persons in the world, a fact that exacts remarkable costs upon the societies in which the opportunities for gainful employment are tightly restricted by those in power, whether driven by corruption or by the demand for more power and control. That a standard such as the minimum wage should be abused as a tool to benefit the haves (those with jobs or the power over jobs) over the have-nots (the unemployed) is simply deplorable.

The second part of this week's Carnival of the Capitalists is now up, and that brings us to our views about how this week's edition was handled by host Russell Buckley of The Mobile Technology weblog (link available from here).

Russell Buckley's experiment, which if you read the comments from the first edition, has clearly failed. As of this writing, I have not been able to find any note of the second edition from the Carnival's major booster, Instapundit, whose weekly support is essential in driving readership to the Carnival. There's an old business lesson to be learned here - when your product marketing (and yes, the Carnival of the Capitalists is a product) is dependent upon a single or highly influential distributor (such as Instapundit), you need to get their buy-in to any product changes since their support is essential to making your product successful in the marketplace. Hopefully, Russell Buckley is learning this lesson this week.

Venting aside, here's the best of the second batch:

- Brian Gongol at Gongol.com looks at What's Wrong with Socialism - an absolute must-read.

- Adam Crouch at The Raw Prawn plays into this engineer's car technology-loving spirit with his look at the marketing being Toyota's Scion entry-level products.

- The Golden Gate looks at the housing market in San Francisco this week and finds excessive regulation combined with the desire to impose more restrictions on property owners in the sarcastically titled post Capitalism - It's Not Good for San Francisco.

And finally, don't miss Political Calculations(TM) contribution this week: PRAs and the Baby Boomers.

Update!: A new, improved version of this calculator based on cohort life expectancy data published in 2002 is now available! If you would like to see how one's average remaining life expectancy has changed since 1989-1991, try this calculator first, then the new version!

Welcome Grand Rounds!

Good question, right? Given that this information is key to many of the debates surrounding public policy (Social Security, Medicare, etc.), I've decided to take some time to crunch through the remaining life expectancy numbers published in the National Center for Health Statistics' U.S. Decennial Life Tables for 1989-1991 (available online as a 429KB PDF document), which has the most recent official numbers published for the United States, in order to figure out, statistically speaking, how much time you have left!

Update: A knowledgeable reader has pointed out a basic flaw in my methodology in using the data outlined below to generate the math behind the calculator in this post. As it turns out, the data is based on period life expectancy data (wrong) versus cohort life expectancy data (correct). I had missed this important distinction in the NCHS document linked above. The difference between the two types of life expectancy data is as follows:

- Period life expectancy is based upon actual or expected death rates for a specified period of time (in this case, the period between 1989 and 1991.) As such, this data could only be used in forecasting life expectancy if and only if the death rate experienced during the period of record could be expected to remain unchanged going forward from when the data was collected.

- Cohort life expectancy is determined differently. Here, remaining life expectancy is tracked by recording the lifespan for those born in a given year until no one born in that year is still living. Consequently, cohort life expectancy data will reflect trends in changing death rates over time, which makes this data ideal for forecasting.

The difference between the two depends upon the trend in death rates. Given that a declining death rate has prevailed in the U.S. since the NCHS data was collected, forecasts based on this data will underestimate one's statistically remaining lifespan. So, if you're willing to proceed further, be assured that you will likely have more time left to you than what the calculator below would seem to indicate. Then again, if you're feeling particularly healthy, you could just skip down to the "Living to 100" calculator below....

First, here is the data from U.S. Decennial Life Tables' Table 2 (Men) and Table 3 (Women) presented in a single chart, along with the corresponding simplified math formulas that describe each set of data:

Click the chart for a larger image.

Now, as you might expect, it just wouldn't be Political Calculations(TM) if we didn't put a tool together to let you see where you might fall on the statistical scale:

Is That Data Good Enough?

While the values calculated above correspond with the average remaining life expectancy published by the NCHS, the question remains of whether these numbers are good enough to help you plan for the rest of your life. What if you're healthier than average, and may expect to live for much longer? What if you're not? Fortunately, there's a much more detailed tool on the web to help you find out!

Want to Live to 100?

The Living to 100 Calculator (which you may access without entering your personal contact information) is presented by the Alliance for Aging Research, and takes many of the factors that may directly affect your life expectancy into account, such as the quality of the air you breathe, whether or not you smoke, your diet, your health and your family's medical history, to name a few potential contributors. Give it a shot - you may find out that you have several more years to look forward to than you might have otherwise expected!

Labels: tool

Since looking at the Reid/Schumer Social Security calculator, I've had a nagging question about how the Democratic Duo went about determining the size of the payment you would receive from a Personal Retirement Account (PRA) under their math. The only guidance provided by the Democratic senators is in this 1-page PDF document, which says:

... the calculator converts your individual account into equal annual payments (e.g., if you have $100,000 in your private account, that can buy an inflation-adjusted annual benefit of about $7,000).

And that's all it says regarding how the money you would have accumulated in your account over your working life will be paid out to you in retirement. Obviously, they're talking about an ordinary annuity, but this leads to two basic questions:

- What kind of inflation-adjusted rate of return are you getting from the annuity?

- How long will the annuity provide payments?

Of course, when we have questions like these here at Political Calculations(TM), we like to throw a nice, simple calculator together to do the math. The problem is that in this case, the calculator that would directly solve for the annuity's rate of return or for the term of the annuity really wouldn't have much utility in the aftermarket for the tools that get developed here, since people who would pursue annuities as an investment vehicle would already know these things. So, instead of doing the math directly, I'm opting to do the math indirectly by providing a tool that determines what the regular payment for an annuity should be, then playing with the numbers until I get answers that match the Senators' assumptions. That said, here's the tool:

The rate of return default value of 4.25% provided above is taken from the government's Thrift Savings Program's Historical Annuity Rate Index for April, 2005. This rate of return is not adjusted for inflation - the easiest way to do this would be to subtract the inflation rate from the rate of return. The long-term rate of inflation in the U.S. is 3.3%, which means the inflation adjusted rate would be roughly 1.0%.

I have also arbitrarily set the default value for the term of the annuity at 20 years. This figure matches up with the upper end of average life expectancy for someone who retires at age 65, at least according to Social Security. In reality, if you plan to rely on an annuity for retirement income, the term should be paced by your remaining life expectancy once you retire, which is in itself a topic for another day.

For this project however, I kept adjusting the rate of return until I produced numbers close to those published by the Democratic Senators ($100,000 starting balance producing $7000 in annual payments.) I calculated the following numbers for the indicated investment term:

| Calculated Results | |

|---|---|

| Term of Investment (Years) | Inflation-Adjusted Rate of Return (%) |

| 10 | -6.009 |

| 20 | 3.443 |

| 30 | 5.657 |

| 40 | 6.420 |

It's left as an exercise for the reader to determine how realistic these values may be.

Labels: tool

This week's Carnival of the Capitalists has been broken into two parts by host Russell Buckley of The Mobile Technology weblog. It looks like my contribution will in Part 2, but in the meantime, here is the best of the first batch:

- GoodBasic takes a look at the corporatization of blogs, and notes several suitblogs. (Not to be confused with shoeblogs!)

- The Window Manager takes a long, steamy gawk at how various organizations within a corporation's internal bureaucracy can get in the way of succeeding at business, and argues that being willing to break the rules is key to being successful.

- Black market egg smugglers need to take note of the Coyote Blog this week, who outlines just what it takes to get a license to sell eggs, legally, in Kentucky.

As recently noted, the St. Louis branch of the Federal Reserve recently published a "what-if" study by economists Thomas A. Garrett and Russell M. Rhine that looked at whether or not Personal Retirement Accounts (PRAs) would have been beneficial to those who retired in 2003. In their study, Garrett and Rhine looked at alternative investments in either Certificates of Deposit (CDs) or in a Standard & Poor 500 (S&P 500) based mutual index fund. Their basic conclusion: PRAs would have been more beneficial for over 95% of the potential pool of recipients had the option been available to them.

Along these lines, the Heritage Foundation, home of the Political Calculations(tm) "Gold Standard" Social Security calculator, has also recently published its own study drawing many of the same conclusions. The report, by Senior Policy Analyst Kirk A. Johnson, found that for the baby boom generation:

- Personal retirement accounts would have increased retirement security by some 30 percent for baby boomers;

- Personal retirement accounts would have substantially increased the net worth of baby boomers, especially low-wealth families;

- About 98 percent of baby boomers would have been better off had they been able to take advantage of personal retirement accounts; and

- With personal retirement accounts, baby-boomer families could have increased their retirement wealth by between $41,000 and $214,000 at age 65, in inflation-adjusted 2001 dollars.

The Heritage Foundation has also published a detailed report in addition to the summarized version linked above. The study is particularly interesting in that in its simulation, lower income workers would be allowed to invest a significantly larger percentage of the portion of their income currently taxed for Social Security than higher income earners, allowing them to disproportionately benefit from the PRA option.

The downside to this kind of "what-if" analysis is that it is too late for the majority of the baby boom generation to be able to benefit from a PRA option for Social Security. That's not a real problem for them however, since the program will be capable of adequately supporting their retirement at promised levels throughout their expected lifespans. However, for those born after 1960, the projected inability of Social Security to provide retirement benefits at promised levels after 2041 *will* negatively impact them, as they may reasonably expect to live past the forecast depletion of the OASI Trust Fund in 2041, and have their benefits cut back as a result.

Now, for my two cents. The real secret to making any PRA option successful is twofold. First, the types of investment available to investors must be fully diversified, so that all one's eggs are not in a single basket marked "Enron," "Worldcom," etc., but are instead invested in large index funds, such as a Wilshire 5000 based index fund, or the type of investment options available through the Thrift Savings Plan, which distributes money invested, and risk, among a multitude of publicly traded stocks and other investment options. With this kind of investment, it's just not a big deal if one or two or a hundred companies go completely belly up because the other companies in the portfolio will grow at rates sufficient to take up the slack.

Second, the proposed PRA investor needs to have sufficient time for their investment to grow. There are a number of studies, most significantly the work of Wharton's Jeremy Siegel, that demonstrate that those investing in the stock market over the long term will win out over market volatility and risk in the end, with rates of return that those solely dependent upon Social Security can only envy. That's why I support PRA's for today's younger workers, and you should too.

Update: This post has been edited to correct a number of errors in grammar. It seems that once again, I have to learn to not write and post before that first cup of coffee in the morning....

Last week's episode of The Apprentice offered the opportunity to catch up on the current season to date, although as always, we here at Political Calculations(TM) believe the best way to review the show is through Suzanne Condie Lambert's weekly recap column. Favorite excerpts from the column, by episode:

- Week 1:

"Magna and Net Worth manage to make fast food unappealing in a way that America's obesity Cassandras only wish they could."

- Week 2:

"Brian says Trump should hire him back, because he's an 'all-star.' Which could be code for 'utter lunatic.'"

- Week 7:

"The golf is miniature, but the management is micro."

But in the world of the "what-if" scenario, the most tantalizing comment in this recap episode came from Week 4, aka the "Cucumber Porn" edition of The Apprentice, when Donald Trump, perhaps displaying the true acumen that led to his becoming a billionaire for the first time in the entire run of the series, considered firing everybody and starting over with new teams. How could you not come back to watch more?

For Social Security, the news from the program's Trustees' 2005 report that the program is now expected to become cash-flow negative in 2017 and will be also unable to sustain the currently promised level of benefits beyond 2041, both dates coming a year sooner than previously projected, is certainly not good. The good news in today's announcement, if it could be said to be so, is that retirement benefits will only need to be cut by 26% rather than the previously projected 27% at that time. Of course, that's very small comfort for anyone reasonably expecting to receive benefits past 2041.

Surprisingly, not everyone views this inability of the program to provide promised benefits as a problem. Here's an excerpt from the Associated Press report by Martin Crutsinger:

"Today's report confirms that the so-called Social Security crisis exists in only one place — the minds of Republicans," said Senate Democratic Leader Harry Reid of Nevada. "In reality, the program is on solid ground for decades to come."

Unsurprisingly, Senator Reid did not offer any suggestions of how to make up the missing 26% of promised benefits to today's younger workers who, for those born after 1960, would be the most affected demographic group. Mr. Reid also did not suggest when he would envision it would be appropriate for Congress to get around to reforming the Social Security retirement program.

All the more remarkable is that in postponing the reform of the program, Mr. Reid's inaction would only serve to make any future adjustment to sustain benefits at promised levels more draconian in nature. Since Mr. Reid and his fellow Democrats are ardently opposed to the various proposed Personal Retirement Account (PRA) options, this would suggest that the Democrats are either willing to substantially hike payroll tax rates and the level of taxable income to make up the expected deficit, or are otherwise planning to cement the retirement of today's workers at a permanently reduced level of benefits. In either case, the expected losers are not the President or the Republicans, as Mr. Reid would prefer, but the working people of the United States, who he claims to represent.

Update: Alarmingly, much of what I've commented upon has been agreed with by the editorial board of the Washington Post, who place this event in larger context.

The single most valuable resource in business news is not a single resource. Instead, the best place any business junkie can go to score the most recent information about trends, developments and the general state of an industry is the trade publication that supports it, and ideally, its online edition.

Here are a couple of cases in point. First, take a look at this March 21, 2005 article from Network World Fusion, which reviews how Canadian giant Nortel Networks is addressing its recent leadership lapses and accounting problems with its sales channel partners:

Clent Richardson, the executive in charge of rebuilding Nortel's once powerful brand, last month stood in front of roughly 200 sales channel partners and openly acknowledged the sins of the past. Not a quick, "mistakes were made" statement followed by 30 PowerPoint slides on a new strategy, but a lengthy, deep and even heartfelt discussion about past leadership, integrity, transparency and a lost focus on the customer.

The trade publication also captured the reaction of Nortel's sales partners, who were surprised by Richardson's forthright approach to repairing the company's relationships:

"I thought we were going to hear a lot more excuses," said one value-added reseller. "But that speech got my attention. Maybe they're really serious this time."

Time will tell if Clent Richardson's approach to rebuilding the Canadian giant's brand will ultimately succeed, but this kind of information provided by Network World could very well be used to provide critical decision-making ability today by the company's other business partners, vendors, customers and investors as to what degree they will continue to place trust in the company.

Now, look at this March 7, 2005 article (free, but registration required) from Nation's Restaurant News. The article focuses on how McDonald's Corporation is revamping its employee benefits programs to better attract and retain its workers and managers and spotlights the company's following initiatives:

- Partnering with 60 other major corporations to buy group medical coverage.

- Revamping its annual bonus program to a quarterly one, based on feedback with front-line employees.

- Encouraging more employees to save for retirement through an enhanced 401(k) program, which is available to hourly workers and managers.

- Improving its corporate training and employee development programs and enrolling substantially more franchisees and general managers in the company's headquarters-based Hamburger University training center.

Each of the items listed above will have a significant impact on McDonald's industry, and will impact how the company's competitors will seek to compete with the fast-food giant. Beyond the food service industry however, each of these initiatives may also affect public policy, including health care, education, retirement and other areas of public debate. The sad part is that it's an open question whether you would actually find out about any of the changes inside McDonald's from a more traditional news outlet, despite the company's nearly universal presence in communities throughout the U.S.

Regardless of the actual developments at both Nortel and McDonald's, if you had waited for government statistics to be published or for the item to be mentioned in a mainstream news outlet, you could have missed timely and critical information that you could have used - whether as an investor, job applicant, business partner, analyst or as a citizen. While the question is one of whether or not that's an opportunity cost you could afford, it might make for an interesting academic exercise to see just how far behind the information curve one could be and still be able to make effective business decisions.

Every now and then, I find it useful to create a post just for the purpose of being able to reference basic data without having to point at the original source ad nauseum, especially when the original source is a table full of data where I'm simply interested in one particular data point or a trend. With that in mind, here is a brief summary of the history of the taxes that support Social Security's retirement benefit program, that provides the information in a graphical format for easier consumption. Larger versions of the images may be seen by clicking on the smaller ones.

Where Your Social Security Taxes Go Now

Currently, your employer and/or you pay an amount into Social Security equal to 12.4% of your annual earned income, up until your income reaches the maximum taxable amount of $90,000. The taxes that are paid into Social Security are divided into two major programs. Approximately 1.8% of an individual's income is set aside to provide Disability Insurance (DI) benefits, while a amount roughly equal to 10.6% of their income is dedicated toward providing Old Age and Survivor's Insurance (OASI) benefits, from which all Social Security retirement benefits are paid. The percentages provided toward each program listed above are approximate since a fractional amount of your total taxes paid in cover Social Security's administrative costs. The following chart illustrates the overall distribution of your Social Security taxes:

The History of OASI Taxes

Since the ability of the OASI program to provide future retirement benefits is the focus of the present debate on reforming the program, we'll take a closer look at the history its funding. The following chart illustrates the changes in Social Security's OASI combined employer/individual tax rate and the corresponding level of taxable income over the life of the Social Security program:

Source: Tax Rates and Maximum Taxable Income for Social Security, Railroad Retirement and Railroad Unemployment Insurance Programs (available as a 226KB PDF document from the U.S. Government's Railroad Retirement Board)

In the chart above, the upper set of points correlates with the axis on the left, which shows the history of the OASI Tax Rate as a percentage of annual income, while the lower set of points correlates with the axis on the right, which depicts the history of the OASI Taxable Income cap.

The following charts show the percentage increase or decrease in the levels of both the OASI Tax Rate and the OASI Taxable Income cap over the life of the Social Security program. The first chart shows the magnitude of OASI Tax Rate changes expressed as a percentage of the previous tax rate level:

As you can see from this chart, the magnitude of changes in the OASI Tax Rate has tended to decrease over time, and has only stabilized around the 10.6% level in recent years. However, that doesn't mean that OASI taxes haven't continued increasing. Instead, the government has preferred to indirectly increase taxes by steadily increasing the amount of income that may be taxed. The chart below presents this data as a percentage increase or decrease in the previous level of the amount of taxable income:

The Supplemental Security Income Program

One of the more common misconceptions related to the distribution of Social Security taxes is related to the Supplemental Security Income (SSI) Program, which provides monthly benefits to people who are age 65 or older, or are blind or disabled, and have limited income and financial resources. Although the SSI program is managed by the Social Security Administration, no Social Security taxes go toward paying these benefits. Instead, the funds for SSI benefits are drawn directly from the U.S. Treasury's general fund, which is where all other tax revenue collected by the federal government is pooled. For more information about the SSI program, see the Social Security Administration's booklet Understanding SSI.

Labels: social security

John Winsor at Beyond the Brand is hosting this week's Carnival of the Capitalists. Favorite posts of the week include:

- Willisms' Will Franklin asks a good question in looking at whether personal accounts can attain solvency for Social Security.

- The QandO Blog's Dale Franks looks at the effect that Social Security privitization may have on the stock markets. I asked the same question here a while back, so it's nice to see a different take on the potential outcomes.

- As an MBA student, I can really appreciate Josh Kaufman's Personal MBA Program. I'd go for Josh's program in a heartbeat if it weren't for one thing - having to convince a potential employer that you *really* have the knowledge of an MBA! Alas, until Josh is fully accredited and issues real sheepskin diplomas, I can only recommend the reading list!

Among the most distressing things that come from Washington D.C., aside from taxes, regulations and budgets, are the words of politicians in their full partisan mode of operation. One of the most recent contributions to the national stress level comes from California senator Barbara Boxer (D), who has come flat out against the U.S. Constitution in seeking to use the U.S. Senate's parliamentary rules to obstruct the final up-or-down votes for the President's judicial nominations with which the Democratic Party disagrees:

Why would we give lifetime appointments to people who earn up to $200,000 a year, with absolutely a great retirement system, and all the things all Americans wish for, with absolutely no check and balance except that one confirmation vote. So we're saying we think you ought to get nine votes over the 51 required. That isn't too much to ask for such a super important position. There ought to be a super vote. Don't you think so? It's the only check and balance on these people. They're in for life. They don't stand for election like we do, which is scary.HT: Radioblogger, who also has the full audio transcript of Senator Boxer's remarks.

While it might be fun to suggest that the same requirement to attain 60% of a vote in order to assume any important office in the nation, say for a seat in the U.S. Senate, I'm afraid that the authors of the Constitution placed more faith in simple majorities for the day-to-day operations of the government than our current day senators do from the Democratic Party. But then again, it's not like they didn't present options for future generations that would be constitutional, of which Senator Boxer and her cohorts could take advantage.

What do I mean? Having actually read the U.S. Constitution, I was able to identify at least two means by which today's Democratic Party senators could make their wishes come true:

- They could change the Constitution through the amendment process to make it do exactly what they propose.

- They could seek to impeach the judges they don't like.

Of course, the first method would mean that the sponsors of such an amendment would need to convince two-thirds of the members of both the House of Representatives and the Senate to go with their super majority scheme (see, the Constitution's authors *could* have made judicial appointments require a super majority if they really wanted to!). They would then need to get three-fourths of the state legislatures to ratify the new amendment.

The second option would be somewhat easier, in that they would just need to get a simple majority in the House of Representatives to impeach a judge they didn't like, then they could get a simple majority in the Senate in the judge's impeachment trial to remove the offending judge from power.

Of course, both these constitutional methods would take more than today's Democratic Party senators seem to have to offer: real work and real majorities. The filibuster approach being advocated by the Democratic senators is simply the lazy way to achieve their desired end result of blocking a simple majority vote for or against the President's judicial nominees. The shame for them, as Senator Boxer has acknowledged, is that a super majority vote is not required by the Constitution.

It may just be the sheer proliferation of the so-called "reality" or "unscripted" television shows among today's entertainment choices, but I have become rather taken with the display of business sense and sensibilities delivered straight from Trump Tower each week known as "The Apprentice." For me, it's not so much the "Survivor" aspect of the show, or its "human" drama (where do they get these people anyway?), or the display of ego, unfettered brand marketing (Trump this, Trump that, Trump etc.) or pervasive product placements (Yahoo! HotJobs anyone?), as much as its the "what-if" nature of the business task undertaken each week by the Apprentici (although those seeking to place each episode into its proper cultural context should turn to the Arizona Republic's Suzanne Condie Lambert's wrap-up for each week's episode. Essential reading!)

Take the task of the very first episode of the series into consideration. What if you had to sell lemonade in New York City? Where would you set up your lemonade stand? How much would you charge? Where would you get your lemonade? How long would it take you to change things if business wasn't going well, and what would you change? I admit I'm more of a business junkie than most, but I find the expanding series of questions that arise from the business task in each episode fascinating. Then again, I know I'm probably not alone in finding a show interesting based on my real-world interests - there is at least one guy out there who watches HBO's "Deadwood" for the economics!

Calvin Coolidge's most famous observation is that "the chief business of the American people is business." And he was right - we see this fact reflected each week in "The Apprentice," as we can visualize ourselves in the selected business situations depicted in each episode. At least, that is, until Martha Stewart begins handing out the tasks, in which case all bets may be off....

Update: Welcome fans of Will Franklin's Willisms!

I have previously looked at the issue of accuracy in elections, but until now, I haven't provided a tool to do the math. Speaking of which, here is how accuracy in an election within a given voting precinct should be determined (the method is similar to that used to predict the likelihood that a complex manufactured assembly is free of defects):

| Precinct Election Accuracy (%) | = | Number of Ballots Counted | - | Number of Discrepancies | * | 100 |

|---|---|---|---|---|---|---|

| Number of Ballots Counted | ||||||

Once this calculation is performed for each voting precinct in an election, the next step is to multiply the results together to arrive at the odds the overall election results are accurate:

| Overall Election Accuracy | = | Accuracy for Precinct 1 | * | Accuracy for Precinct 2 | * | et cetera |

|---|

The calculator below will perform this math by assuming that the number of reported discrepancies is distributed among the indicated number of precincts. As such, the results calculated will represent the best case outcome in determining election accuracy, since a higher concentration of discrepancies in a given precinct will reduce the actual election accuracy below the level calculated.

Warning: The calculator will not work for especially large numbers of precincts. This condition is a constraint of the JavaScript programming language. If you are looking to calculate the accuracy for a major election, you may need to break it down into smaller pieces, and then multiply the percentage odds for each piece together to arrive at your desired solution.

So now, having done the math, what does it take to determine if an election is accurate enough to declare a winner? To my way of thinking, I believe that the following two conditions must be met for an election to be certified as being representative of the actual ballots cast in the election:

- The margin of victory must be greater than the number of reported discrepancies.

- If the first condition is not met, the percentage odds of the election being accurate determined for the case where the number of reported errors are equally distributed among the number of precincts reporting discrepancies must be greater than 50%.

I believe the conditions listed above are the minimum necessary to be able to accept the outcome of an election as being generally accurate. Every voter in the democratic process is entitled to have confidence in the outcome of an election, and it is up to each public election official within a democracy to ensure that these minimal levels of accuracy are maintained. If they are not, then these same public officials should be held strictly accountable for failing to ensure the integrity of the voting process. Otherwise, how else are we supposed to be able to judge how well democracy actually works?

Labels: tool

Welcome Carnival of the Capitalists!

Chalk it up to the public nature of the internal conflicts brewing within the black corporate cauldron of the Walt Disney Company, where a longstanding dispute between major shareholders Roy Disney and Stanley Gold and company Chief Executive Officer (CEO) Michael Eisner on the company's direction has just resulted in the latter's announced early departure from the head post, but I've been thinking about the nature of corporate succession in an environment of ethical controversy. In the Disney case, company insider and board member Robert Iger can expect to face significant challenges to his ascension of the CEO post as the result of the company's board of directors having failed to clearly define their process for his selection for the company's shareholders. This lack of transparency comes with a huge cost to Disney's shareholders, as both the shareholders' confidence in the Disney Board of Directors combined with the almost assured future expense of continuing the company's corporate turmoil will burden the company's performance for some time to come.

As a former employee of the Boeing Company, I have been following the Boeing Board of Directors' recent decision to ask for CEO Harry Stonecipher's immediate effective resignation with some interest. While I could comment upon the reasons the board has put forward for their decision, as many others have, what I find most remarkable is the environment in which the board's decision occurred and its timing.

Boeing's Ethical Environment

The decision to dismiss Stonecipher came little more than a week after the U.S. Air Force lifted a suspension that had prevented the company from bidding upon military satellite launch contracts since July 2003. The Air Force's suspension was based on the ethical misconduct of low-level Boeing managers who had obtained confidential documents related to competitor Lockheed-Martin's bid for the same contracts Boeing was also pursuing. Another negative consequence of Boeing's conduct was to have the launch contracts it did win taken away.

The company's efforts to regain the ability to bid on the satellite launch contracts had also been complicated by the independent misconduct of former Chief Financial Officer (CFO) Mike Sears, whose efforts to secure a contract to lease commercial 767 aircraft converted into aerial fuel tankers to the Air Force led him to offer jobs with Boeing to senior Air Force procurement officer Darleen Druyan and her daughter, while Druyan still had decision-making authority over the proposed contracts. The resulting scandal led to the ouster of both Sears and then-CEO Phil Condit. Sears went on to face criminal charges for his misconduct and was recently sentenced for his role in the scandal. The contract to supply the converted 767s has since been torn up.

Had the Stonecipher affair occurred independently of these events, the Boeing Board of Directors' decision to oust Stonecipher would be seen as an overreaction. However, as SG Cowen analyst Cai von Rumohr noted, "in Boeing's circumstances, there was no way they could overlook it. The company is really trying to get beyond this image of kind of hiding the bad dirt."

A Problem of Timing

In making the decision to dismiss Harry Stonecipher as CEO however, Boeing's Board of Directors may have also crossed another ethical line - this one defined by the Board's timing of its decision. Although the Board clearly had knowledge of Stonecipher's personal misconduct for several weeks before it took action, it also held off on taking action until after the Air Force had lifted its suspension of the company's ability to bid on satellite launch contracts. By holding off the disclosure of the problems they knew they had with the company's CEO, it appears that Boeing's board members were calculating that once the Air Force lifted their suspension, the Air Force would be unlikely to re-impose those sanctions. In effect, Boeing's Board of Directors gambled that the company would profit from knowledge they were willing to keep secret that could otherwise have negatively affected the Air Force's decision and in turn, Boeing's bottom line.

This kind of calculation made by members of a corporate board isn't uncommon. Newsweek recently reported on the circumstances at personal information tracker ChoicePoint - where even though that company's board of directors had knowledge of a breach in the company's security that would expose thousands of people in its database to identity theft, it still allowed ChoicePoint executives to sell large amounts of stock for months before publicly acknowledging the problem. That these lapses are not uncommon is a sign that many of the boards of directors of Corporate America are not exercising the due diligence that is required by their company's shareholders to oversee their company's operations and practices in selecting their leadership.

Choosing the Next CEO

If the boards of directors of Corporate America are serious about facing up to the demands of fostering high ethical standards within their businesses, they need to be fully transparent in providing their shareholders with the data they need to assess the basis of the board's decisions, particularly where the company's leadership is concerned. At Boeing, this transparency will mean placing a spotlight on the requirements for ethical behavior that it will demand of its next CEO. It also means shining a light on the Board of Directors as well.

Note: Former CEO Phil Condit's biography appears to have returned to Boeing's web site! Also, much of the background information for this post was taken from a Seattle Post-Intelligencer article Boeing Leader Ousted, which offered an excellent summary of the company's recent ethical transgressions while placing recent events in context.

[Full Disclosure Statement: I worked for Boeing for more than a decade, leaving the company as part of the massive layoffs that came as part of the aftermath of the September 11 terrorist attack's effect upon the commercial aviation industry. I own some 5 shares of Boeing common stock.]

Update: Welcome Carnival of the Capitalists!

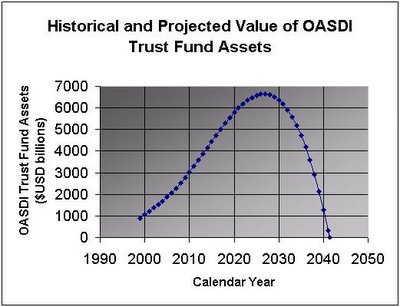

Mise à jour: Lecteurs bienvenus d'optimum.tooblog.fr!I should probably credit (or blame) James Burke for his influence upon my outlook, but in recently looking at the historical data and the future projections for the value of the assets held by Social Security's Old Age and Survivors and Disability Insurance (OASDI) Trust Fund, I was struck by a pattern I recognized in the data. Here is the information from the tables linked above presented in graphical format for the years under which the OASI tax rate component of Social Security taxes, or rather, the portion of Social Security taxes dedicated to providing pension and survivor's insurance benefits, is maintained at a rate of 10.6% [the OASI tax rate data is provided in this 266KB PDF document from the Railroad Retirement Board]:

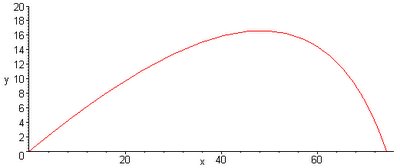

The pattern I recognized in the data, which appears from the mid-to-late-1990s onward as a long and steady ramp upward that levels off as it reaches a peak followed by a rapid descent, would be immediately apparent to any engineer, physics student, artillery gunner, or the players and fans of football, baseball or golf - it's the trajectory (or flight path) of a projectile (like a ball) moving through a viscous (drag-inducing) medium (such as air):

Projectile Motion of a Cannonball with Drag

Source: http://www.yorku.ca/marko/ComPhys/Cannon/Cannon.html

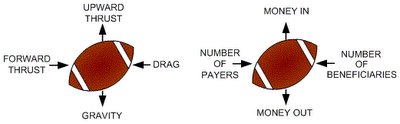

Recognizing this similarity, the question then becomes "how realistic is this analogy?" Before I go further, let's illustrate the basic forces acting on a projectile in flight and compare them to the equivalent economic and demographic forces acting upon the Social Security OASDI Trust Fund:

Equivalence Between Projectile and Economic/Demographic Forces

In the illustration above, the upward thrust component is the equivalent of the amount of money coming into the OASDI Trust Fund. This component is affected by the Social Security OASI tax rate, the incomes of those being taxed, and the length of their working careers. The gravitational component is the equivalent of the amount of money required to be paid out from the Trust Fund, which is affected by the amount of benefits promised and the post-retirement life expectancy of the beneficiaries. The forward component of thrust is directly represented by the number of Social Security tax payers, and the negative component of thrust is directly represented by the number of program beneficiaries.

So how does this scenario match up with history? Look at it this way - in 1983, the U.S. government recognized that the Social Security system, as it was then, would not be capable of meeting the retirement needs of the baby-boom generation without substantial cuts in promised retirement benefits. So, the government passed legislation that changed Social Security from a purely "pay-as-you-go" system, where nearly every dollar collected was almost immediately paid back out in the form of retirement benefits, into a system that would accumulate a substantial surplus in the OASDI Trust Fund for the purpose of supporting the future retirement of the baby-boom generation. Beginning in 1984, every affected income earner in the U.S. had their Social Security OASI tax rate increased from 7.11% to 10.4%. This tax rate peaked in 1990 through 1992 at 11.2% and has since settled at a level rate of 10.6%.

In effect, the U.S. government reared back and threw a forward pass with the upward component of thrust provided by the increase in the Social Security tax rate and the forward component of thrust provided by the number of Social Security taxpayers in the U.S. work force. Unfortunately, the quarterbacks of that era didn't recognize that the opposing force of demographics in the form of a significantly increasing number of beneficiaries who would be living longer combined with the gravitational pull of automatically increasing benefit payments would cause the pass to fall short, now forecast to crash to earth in 2042.

Now the question becomes "can we do anything practical with this analogy?" I think the answer is: maybe. It seems to me that the real goal in reforming the Social Security system is to keep the ball from hitting the ground, so to speak. The proposed reforms that are put forward have to demonstrate that they will not permanently deplete the OASDI Trust Fund, since this fund represents the ability of Social Security to continue providing promised levels of benefits into the future. Metaphorically speaking, the program reformers will need to intercept the ball in mid-flight and relaunch it to provide for the program's long-term stability and sustainability. The "forces" acting on the ball would represent the means by which its trajectory may be altered through actuarial means, such as tax rate increases, cuts in promised benefits, increasing the age of retirement, changing the amount of income that may be taxed, etc. As it stands, I just think its cool that I'm finally getting some mileage out of my old Physics textbook.

Update: PrestoPundit notes another convergence between economics and physics.

Update: If you prefer economic metaphors of the fluid flow/water-tank variety, see Fred Cederholm's contribution at the Baltimore Chronicle.

In the Economic Policy Institute's daily Economic Snapshot for March 9, 2005, EPI's senior fellow William E. Spriggs misses the bigger tax picture in discussing the cap on income upon which Social Security taxes may be assessed.

Arguing that "we have perversely lowered the tax burden for the highest-earning 6% of America," by not assessing Social Security taxes against earned income above $90,000 (for 2005), Spriggs disregards the progressive rate structure of the federal income tax system. One would expect that if Spriggs' argument held water, we would see a dip in the percentage of taxes paid relative to income for those earning more than the Social Security taxable income cap. Instead, we see that there is no such dip (see the table for Sample Annual Taxes for Various Income Levels) in the total tax burden for higher income earners, and in fact, these individuals' total tax burden as a percentage of total federal payroll and income taxes paid against their income rises as their income increases.

If I'm being honest, to quote Simon Cowell, I was surprised at this outcome. I did expect to see a dip in total tax burden around the area where the Social Security taxable income cap kicks in. Instead, it seems that instead of paying more taxes into Social Security, higher income earners are paying considerably more into the U.S. Treasury's general fund.

I know Arnold Kling has argued that mathematics should not be a focus for higher learning in economics, but here's a perfect example of where running some numbers could have saved some embarrassment.

Attention Readers!

I have modified my review for the Heritage Foundation's Social Security calculator to link to information released by the Heritage Foundation yesterday (March 9, 2005) on their Policy Weblog, which provides details about the development of their calculator and also suggests a means for individual users to adjust the amount of their income going into a PRA. I have also modified my summary of Social Security calculator reviews to reflect the new information.

More interestingly, the folks at Heritage hint that a new version of their calculator may appear within the next couple of weeks. We'll have to wait until then to see what new bells and whistles they have in the works....

The Federal Reserve Bank of St. Louis has published a report by Thomas A. Garrett and Russell M. Rhine in the March/April edition of its Review (available as a 311KB PDF document) that provides a historical analysis that compares how Private Retirement Accounts would have fared next to Social Security in providing retirement income to people who retired in 2003, had the option been available during their working years. The authors found that:

From our numerical analysis, we find that over 99 percent of the U.S. population would have earned a greater return by investing in the S&P 500, and over 95 percent would have earned a greater return by investing in 6-month CDs relative to the current Social Security system.

Demonstrating that PRAs would be a better option for providing retirement income for 95 out of 100 workers. Even taking market volatility into account (the period considered included the most recent market downturn, as well as all other market downturns over the past 56 years, which coincides with the working years of a 2003 retiree), Garrett and Rhine found that:

Despite these market fluctuations, a long-term investment in the S&P 500 for a 2003 retiree would have yielded a greater monthly income than is provided under the current Social Security system.

When you consider that the hypothetical 2003 retiree in the report would have faced a stock market that had been significantly depressed by the combination of the bursting of the Internet-stock bubble in 2000 and the aftermath of the September 11, 2001 terrorist attacks occurring at the worst possible time in their careers, right before retirement, the authors' findings make the proposed PRA option for Social Security even more compelling. Hat Tip: Divison of Labour via the Economics Roundtable.

Interestingly, the Economics Roundtable also highlights a post from Nathan Newman's Laborblog, which trumpets the recent action of the AFL-CIO in successfully driving the retail brokerage house Edward Jones out of a pro-Social Security reform coalition. The AFL-CIO was able to achieve this result by leveraging the more than $400 billion it collectively controls through its various members' pension plans by threatening to withdraw all of its business from Edward Jones and advocating to its membership that they should end their personal business at the firm as well.

Would I be alone in wondering what kinds of investments the AFL-CIO pension plan managers are making with their members' lifelong contributions to provide for their income in retirement?

Update: Apparently not! Larry Kudlow answers my rhetorical question in his post Dirty Pool.

Now that there is some serious discussion around the blogosphere supporting the idea of lifting the income cap upon which Social Security taxes may be paid as part of the larger reform that may occur in that arena, it might help put things in better context to see just where and how the taxes that affect your paycheck are figured.

Payroll Taxes

Payroll taxes are taken out of your paycheck as a direct percentage of your income. These taxes are not adjusted for inflation. The payroll tax for Social Security is 6.2% of your income. Your employer (or you again if you're self-employed) contributes an amount also equal to 6.2% of your income toward Social Security, but this amount is exempt from both federal and state income taxes. The total amount paid by your employer and/or you in Social Security taxes is 12.4% of your income. At present, Social Security taxes are only paid on the first $90,000 of your income, which also serves to cap the amount high-income earners may receive from the program in retirement benefits.

The payroll tax for Medicare is 1.45% of your income, or a total of 2.9% when you factor in the federal and state income tax exempt amount paid by your employer. There is no cap on earned income that may have the Medicare payroll tax assessed against it.

Federal Income Taxes

The following table illustrates the progressive income tax structure in the U.S. Given the overall complexities of the U.S. tax code, I've opted to present the following employer withholding tax tables for 2005 as a simplified proxy for the real code, which at last count, would fill over 6,000 letter-sized pages. The following annual withholding information was taken from IRS Publication 15 (available online as a 373KB PDF document.) The income threshholds are adjusted each year for inflation.

| U.S. Income Tax Withholding Rates and Brackets for 2005 | |||||

|---|---|---|---|---|---|

| Tax Rate (%) | Single | Married | |||

| Low End Threshold ($USD) | High End Threshold ($USD) | Low End Threshold ($USD) | High End Threshold ($USD) | ||

| 0 | 0 | 2,650 | 0 | 8,000 | |

| 10 | 2,650 | 9,800 | 8,000 | 22,600 | |

| 15 | 9,800 | 31,500 | 22,600 | 66,200 | |

| 25 | 31,500 | 69,750 | 66,200 | 120,750 | |

| 28 | 69,750 | 151,950 | 120,750 | 189,600 | |

| 33 | 151,950 | 328,250 | 189,600 | 333,250 | |

| 35 | 328,280 | None | 333,250 | None | |

Sample Taxes for Various Income Levels

The following table provides the federal income taxes, Social Security taxes and Medicare taxes that would be withheld from your paycheck for various annual income levels:

| Sample Annual Taxes for Various Income Levels | |||||

|---|---|---|---|---|---|

| Annual Income ($USD) | Federal Income Tax ($USD) | Social Security Taxes ($USD) | Medicare Taxes ($USD) | Total Taxes ($USD) | Percentage of Income (%) |

| 30,000 | 3,745 | 1,860 | 435 | 6,040 | 20.1 |

| 60,000 | 11,095 | 3,720 | 870 | 15,685 | 26.1 |

| 90,000 | 19,203 | 5,580 | 1,305 | 26,088 | 29.0 |

| 120,000 | 27,603 | 5,580 | 1,740 | 34,923 | 29.1 |

| 150,000 | 36,002 | 5,580 | 2,175 | 43,757 | 29.2 |

| 180,000 | 45,805 | 5,580 | 2,610 | 53,995 | 30.0 |

| 240,000 | 65,605 | 5,580 | 3,480 | 74,665 | 31.1 |

| 300,000 | 85,405 | 5,580 | 4,350 | 95,335 | 31.8 |

| 3,000,000 | 1,029,840 | 5,580 | 43,500 | 1,078,920 | 36.0 |

What if the income cap on Social Security taxes goes away?

I have put together a tool (Your 2005 Paycheck) that will let you estimate what your paycheck will look like after the payroll taxes and federal income taxes outlined above are withheld from it. When I originally developed the calculator, I never accounted for the income cap on Social Security taxes, so without any real planning on my part, I've managed to set it up so those of you with incomes over $90,000 can see what the proposed elimination of this cap would do to your paycheck. Considering that those individuals with annual paychecks over $92,663 represent the top 10% of all income tax payers, who pay in nearly 66% of all income taxes collected (at least according to 2002 data), I figure they might be interested in seeing what the additional dent to their paycheck might look like!

The upcoming version of this tool will incorporate state-by-state income tax withholding, and will also do the proper math for calculating the Social Security tax. It seems like the work never stops around here....

Attention former Los Angeles Times readers!

Before I begin, let me say that I never thought I'd be shilling for a mainstream news outlet, but for those of you out there in Los Angeles who, like me, are addicted to both the smell of newsprint and the desire get those coupons out of the Sunday paper, you might want to consider doing the following:

Subscribe to the Arizona Republic instead, and have it mailed to you.

So why might you do such a thing?

First, consider the reasons why you've chosen to drop your subscription in the first place. More likely than not, you have come to the conclusion that the LA Times is a highly slanted news outfit that, more often than not, also gets the job of basic news coverage wrong too. (Reference: Patterico's Pontifications, Hugh Hewitt).

Now, consider why the Arizona Republic rather than some other newspaper in California.

- You would be trading the newspaper for the second largest metropolis in the U.S. for the fifth largest - not that big a drop.

- It's close - you would probably receive it on a next-day basis, assuming that there's not such a demand that the publisher doesn't start printing it in California for home delivery there....

- You would get a newspaper that actually notices things many other mainstream outlets ignore - for example, editorial page writer Doug MacEachern actually negatively commented on Senator Robert Byrd's comparison of President Bush and the Republican Party with Adolf Hitler and the Nazis. Think any of these other major news outlets would offer a comparable editorial? Can you think of any in California?

- You trade the writing of Barbara Demick et al for the writing of columnist Robert Robb, business section writer Russ Wiles, rising star Suzanne Condie Lambert (whose Thursday coverage of the previous week's "The Apprentice" is priceless.) You would also get the writing of "Paul Krugman"-in-training Jon Talton, but the others more than make up it!

So there you go. Five (counting whatever reason you used to justify cancelling your LA Times subscription in the first place) good reasons to make the switch. And if you haven't canceled your subscription yet, have some fun when you do by telling them which newspaper you're switching to (even if it isn't the AZ Republic!) If that doesn't get them thinking, who knows what will?

There has long been a crosscurrent in mainstream U.S. journalism that puts the desire to collect coverage from areas of the world where the free practice of journalism is severely restricted ahead of the journalist’s mission of reporting the news of the world that is. Fully manifested, this desire of newsroom editors to get exclusives from regions hostile to a free press results in their news outlets becoming little more than a platform for propaganda rather than a true accounting of what life is really like behind the repressive regime’s borders. We saw this pattern most recently with Eason Jordan’s decision to make this trade-off with CNN’s coverage of Saddam Hussein’s Iraq just for the sake of being able to transmit live reports from within that country.

Today’s example of this dysfunctional relationship was first presented in the Los Angeles Times’ front page article "North Korea, Without the Rancor" by Barbara Demick, which appeared on March 3, 2005. This article has now been followed by another article by the same author in the March 4, 2005 edition of the LA Times "N. Korea Lists Conditions for Negotiations." The first article mainly provides a sympathetic platform advancing the propaganda of the “benevolent father leader” of the internationally isolated nation rather than any real insight into the lives of North Koreans under the world’s most totalitarian dictatorship. The second article continues advancing the agenda of the North Korean dictatorship, describing how "miffed" the North Korean dictator was at U.S. Secretary of State Condoleeza Rice’s description of North Korea as an "outpost of tyranny," and in tone seems far more concerned with providing a voice to the dictator’s petty demands and perceived slights received at the hands of the U.S. than in challenging the validity of the dictator’s claims.

So why do mainstream news outlets continue doing this dance of acquiescence with these tyrants? To understand why, we need to go back to the 1930s, when the New York Times commissioned reporter Walter Duranty to cover the Soviet Union in the days of Josef Stalin. Duranty was all too willing to provide a voice for Stalin’s propaganda in exchange for access, and all through the era of Stalin’s five-year plans that led to the deaths of millions through forced starvation in the Ukraine, readers of Duranty’s reports from the region had no indication that anything bad was happening. It was not until the 1950s when the atrocities that occurred under Stalin were revealed to the world by Nikita Khrushchev that Duranty’s reporting was itself exposed to be little other than a collection of Stalin’s lies and propaganda. For his "reporting," Duranty won the Pulitzer Prize for correspondence in 1932.

Maybe that Pulitzer Prize explains it all. The continuing trade-off by news editors of truthful reporting for access would suggest that the main lesson they learned from the Duranty case is that if you can get away with it for long enough, you will reap rewards. Even with the benefit of 20-20 hindsight, Walter Duranty’s Pulitzer Prize has never been rescinded. It stands today as a monument to the benefits of buying exclusives and access at the small cost of free, truthful reporting. And never mind the price of blood, which is the true legacy of Walter Duranty. You would think a clear conscience would be worth more to an editor.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.