Welcome to the Friday, October 31, 2008 All Hallow's Eve edition of On the Moneyed Midways, the only place where you'll find the best posts from the week's past money and business related blog carnivals gathered for your easy weekend reading!

Welcome to the Friday, October 31, 2008 All Hallow's Eve edition of On the Moneyed Midways, the only place where you'll find the best posts from the week's past money and business related blog carnivals gathered for your easy weekend reading!

In reviewing our top selections after having selected them for this week's edition, we can't help but notice the theme of fear running through most, but not all of them. Here's a sample of the fear-based questions and issues each of the best contributions to this week's blog carnivals are considering:

- Are you really required to fund your child's college education? What could they do if you didn't?

- Well qualified people are wondering if they can get a loan to buy a house. Can they?

- What does an Obama or McCain presidency mean for you moneywise?

- Is the idea of investing just one big lie?

- Is bankruptcy really bad?

These fear-facing posts and The Best Post of the Week, Anywhere! await you below!...

| On the Moneyed Midways for October 31, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Are Children Entitled to a College Degree? | SavingAdvice | Joe Morgan wonders where it was "written that we as parents need to gift a college education to our children" and argues that a non-traditional path to higher education is the key to affordability. |

| Carnival of HR | Abolish the Performance Review | Three Star Leadership | Wally Bock dissects what's wrong with performance reviews and simply explains what manager need to do to be good managers. Hands down, The Best Post of the Week, Anywhere! |

| Carnival of Personal Finance | Obama vs McCain: The Presidential Candidates Sound Off On Your Money | Digerati Life | Jacques Sprenger outlines what we know of this year's presidential candidates and what each means for your money. |

| Carnival of Real Estate | What Sort of Loan Can I Get? | Searchlight Crusade | Dan Melson recently had two "very qualified" pending homebuyers ask if they would even be able to get a loan. In this post, he outlines how lender requirements of borrowers have changed and what options for financing exist in today's real estate market. Absolutely essential reading! |

| Money Hacks Carnival | Is Investing a Big Fat Lie? | The Shark Investor | The Shark Investor wonders if we're all wrong about investing in general or if investors have been putting their money in the wrong things at the expense of investing in real wealth. |

| Festival of Frugality | Driving Slower to Save Gas | Christian PF | Can you really save gas (and money) by driving slower? Economist Jim Hamilton did the math. We built the tool. But Bob, only just having heard that it might work, actually tested it out for himself! |

| Carnival of Money Stories | Bankruptcy Recovery: Lessons Learned | Ask Mr. Credit Card | Jenna and her husband declared bankruptcy a couple of years ago, and they're surviving. She explains what they learned and what they would have done to avoid going there. Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

But how much was it really worth?

We've been systematically working through to the answer to that question. Previously, using a third party copy of a public record that indicated that the house at 5046 S Greenwood Ave in Kenwood, Illinois had been purchased for $825,000 on 25 August 2000.

With that data point, we next assumed that properties in Senator Obama's neighborhood were growing in value at or near the same rate at the rest of the Chicago metropolitan area and projected the property's value forward in time based on that presumption. We found that in June 2005, when Senator Obama closed on the property, it would have been worth $468,502 less than what he paid. Projecting forward to the end of the second quarter of 2008, it would be worth $1.37 million.

Then all that changed. Newsweek's Michael Isikoff published professional appraisal data from November 2005 that allowed us to precisely determine the rate at which real estate in Senator Obama's neighborhood appreciates. As it happens, in Senator Obama's neighborhood, property values have historically grown at a much slower rate than that seen generally throughout Chicagoland.

Getting the Numbers Right

Today, we're going to go back and redo our property value projections, but first, we're going to revisit the value that the previous owners of Barack Obama's house paid for it. We're starting there, because in reviewing previous news articles, we found a pretty big discrepancy between the copy of the public record detailing the value of the transaction and what was being reported in the media.

Here's the Boston Globe's Binyamin Appelbaum description of the house that Obama bought back on 16 March 2008:

Its 6,400 square feet included six bedrooms, six bathrooms, and a wine cellar for 600 bottles. It had been renovated five years earlier in high style: antique Chinese washbasins, mahogany bookshelves, a granite kitchen floor.

It was a fitting home for a new senator. And it was a good deal. The list price was $1.95 million, but the Obamas paid $1.65 million, the same price the sellers had paid five years before.

Leaving aside Appelbaum's slobbering prose description of the house's luxurious features, he's reporting that the Wondisfords purchased the property for $1.65 million.

So how much did they really pay? If they paid $1.65 million as Appelbaum reports, then that $825,000 figure we previously found is way off. If that $825,000 figure is right, then the house is bizarrely overpriced, as the Wondisfords purchased the house *after* it had been fully renovated with all those wonderful luxury features that a drooling Binyamin Appelbaum believes befits a new U.S. Senator, so their value should be fully reflected in the price they paid.

Digging Deeper

To find out, we went digging into the public database records of the Cook County Recorder of Deeds, which are available on their website. Sure enough, we found the public database record of the Trustees Deed for the Wondisford's purchase of the house (Document Number 00661600), which was executed on 19 July 2000 and recorded on 25 August 2000:

We noticed however that the record for the Property Description (UPIN: 20-11-115-004-0000) didn't match that for all the other public records associated with the property (UPIN: 20-11-115-026-0000).

Searching the Cook County Recorder of Deeds transaction database by the house UPIN identifier turned up additional records, including the mortgage amounts documented for the Wondisfords' purchase of the property in 2000. Here, we believe we found the source for a lot of erroneous reporting regarding the price the Wondisfords paid for the house when they originally purchased it.

There are two separate mortgage records for the Wondisfords' purchase of the property at 5046 S Greenwood Ave in the Hyde Park neighborhood of Chicago:

| Recorded Mortgage Documents for 5046 S Greenwood Ave, Kenwood, IL | ||||||

|---|---|---|---|---|---|---|

| Document Number | Document Type | Grantor | Grantee | Executed | Recorded | Amount |

| 00603541 | Mortgage | Frederic E. Wondisford Sally Radovick | Emigrant Mtg Co. | 19 July 2000 | 08 August 2000 | $ 1,237,500 |

| 00603542 | Mortgage | Frederic E. Wondisford Sally Radovick | University of Chicago | 19 July 2000 | 08 August 2000 | $ 412,500 |

We see the execution dates for these two mortgages fully coincide with the execution dates listed on the Trustees Deed. What this tells us is that both were prepared on the day the negotiation for the property was concluded.

We also see that if we add these values together, we obtain a value of $1.65 million, the same amount we see mentioned in all the media reports that provide this information. But, if we take the larger amount of $1,237,500 and subtract the lesser $412,500 from it, we obtain a value of $825,000, the amount recorded on the Trustees Deed.

So Which Is Right?

The answer is neither, but we'll note that the real answer is already evident in these records!

The amount for which the Wondisfords purchased the property that Barack Obama would buy from them less than five years later is $1,237,500. We know this is the case since the University of Chicago is the Grantee on the smaller mortgage.

At the time, the Wondisfords were in the process of moving from Massachusetts to Chicago since they had been hired away from Harvard University by the University of Chicago's medical school. As with most corporate relocations, the hiring firm will provide relocation assistance for its new employees.

Here, we presume that the Wondisfords had not yet concluded the sale of their previous residence in Massachusetts, so the University of Chicago assisted them by loaning them up to one third of the value of the new residence they would acquire in Chicago to cover their down payment, allowing them to settle in before beginning work in September 2000. The University of Chicago would then be recompensated when the Wondisfords completed the sale of their previous home in Massachusetts.

We confirm that the $412,500 is exactly one third of $1,237,500, which we recognize as being the Wondisfords' negotiated purchase price for the house at 5046 S Greenwood Ave in Chicago.

Finally! How Much Was Obama's House Really Worth When He Bought It?!

Now that we have the data and the tool to do something useful with it, the rest just falls into place! We've projected the actual value of Senator Obama's property all the way from the third quarter of 2000 through the second quarter of 2008 in the chart below, and calculated the amount that Senator Obama overpaid for the property:

We find that in June 2005, the actual market value of Senator Obama's would be $1,427,830. Since he paid $1,650,000, that figure represents an overpayment of $222,170.

Projecting forward, we see a bump in his property valuation where Senator Obama acquired a 10 foot by 150 foot long strip adjacent to his property (one-sixth of the "Rezko Lot") in the first quarter of 2006. That transaction took place in January 2006.

And going into today, we find that the most current value that we can project for the house that Barack Obama bought in June 2005 is $1,436,420. Considering the expanded property, we estimate the total value of Barack Obama's primary residence to be $1,516,705 as of the end of the second quarter of 2008.

You can use the tool below to confirm our estimates for Barack Obama's house (not including the expansion of his lot):

What Does This Tell Us About Obama

There is no question that Barack Obama knew the property was overvalued. We recognize this in that his first bid for the house was for just $1.3 million, which as we saw yesterday, would put it right in line with the other properties that have recently sold that are very comparable to the house on paper!

His second bid, $1.5 million, as compared to the true value of $1.43 million, was high, but not outrageously so. His third, "successful" bid of $1.65 million more than vaults over that line.

More disturbing, if we accept that the only thing keeping him from spending the $1.95 million the previous owners were originally asking was his inability to get that much money, what could the United States be in for should Senator Obama become President Obama? Remember, the amount of money he could get was the only constraint he had in the transaction! Ethical constraints, as recognized by his reliance upon favors done for him by shady political associates, were absent from the beginning.

Discounting that apparent reliance upon receiving favors from political associates for his personal benefit, we find that the price that Barack Obama paid for his house reveals a serious lack of fiscal discipline, all the more remarkable for it being on display in the largest single financial transaction of his life to that date. Rather than carefully steward his own money, he instead sought to fulfill his vision of "a fitting home for a new senator."

He might be President. What price will America be compelled to pay to fulfill his grandiose ambitions? And how much will it cost to fix the certain damage?

Previously on Political Calculations

- How Much Is Barack Obama's House Worth Today?

We find, using the value of a comparable property sold in August 2008, that 1.43 million seems to be right after accounting for the luxury features his house incorporates! That doesn't include the additional strip of land he bought in January 2006, but turns out to be amazingly close to what we found using projecting data forward from the past. We've got the values bookended!

- Return to the Rezko Lot

New information about the appraised value of the "Rezko Lot" led us to revisit our analysis of the transactions involving this lot and 2008 Democratic party presidential candidate Barack Obama we had originally presented in The House That Obama Bought

- The House That Obama Bought

Now obsolete! Here, using that data and assumptions that we have replaced with new information, we showed that at a minimum, 2008 Democratic Party presidential nominee and current Senator Barack Obama (D-IL) paid $360,738 more than his house in Chicago was worth in 2005. At a maximum, he overpaid by as much as $468,502 for the property where his family now resides.

- Barack Obama's Big Mac Attack

Our tongue-in-cheek look into the negotiations and transactions surrounding Senator Obama's purchase of his current home - kind of a fun introduction to the relative valuations involved, all in the context of a trip to McDonald's! Remarkably, even though we've redone all our calculations, this post stands the test of time!

- Does Senator Joe Biden Have a House Problem? (Part 1)

We looked into suggestions that Senator Biden unduly benefited from the purchase of the property where he built his current home. We introduced our analytical method for projecting the value of real estate properties in this post.

- Does Senator Joe Biden Have a House Problem? (Part 2)

Here, we looked into long-standing allegations that have dogged Senator Biden regarding whether or not he unduly profited from the sale of his previous home in 1996. We originally couldn't make a determination, but thanks to one of our intrepid readers, we were able to find that he did not. Also, where we first built a tool to do the math!

Labels: personal finance, politics, real estate, tool

2008 Democratic Party presidential candidate Senator Barack Obama (D-IL) purchased his current primary residence, a 6400 square foot house on a 70 foot by 150 foot lot in Kenwood, Illinois for 1.65 million U.S. dollars in June 2005. In January 2006, he purchased a 10 foot wide by 150 foot long strip on the south side of his property for $104,500, bringing the full dimensions of his property lot to 80 feet by 150 feet, increasing its size from 10,500 square feet to 12,000 square feet.

How much do you suppose his house is worth today?

In this post, we're going to pretend that the value for which Senator Obama acquired his property was not wildly inflated above its true market value. We'll first consider the value of the original 10,500 square foot property and project its value forward through the end of the second quarter of 2008. We can only take it this far since the OFHEO data for metropolitan Chicago that provides the Four-Quarter Percent Change in OFHEO MSA-Level House Price Indexes only extends through this far.

We will however adjust our projected value for Senator Obama's home to account for the much slower rate of home value appreciation that we found for his neighborhood yesterday. Here, we recognize that property values in Senator Obama's long established and prestigious Hyde Park neighborhood grow at an average annualized rate of 4.8% below the typical rate of growth seen generally throughout metropolitan Chicago.

So, for example, if home prices in Chicago grow at an average annual rate of 10.7% over a period of time, as they have averaged since 1990, properties in Senator Obama's neighborhood would only see their values increase at an average annual rate of 5.9% over the same time interval, a negative 4.8% neighborhood growth rate "premium"!

We've entered this basic data into our tool for projecting the value of real estate properties in Chicago, Illinois for any quarter ranging from the third quarter of 1976 up through the second quarter of 2008.

Using this data, we find that the value of Senator Obama's home, not including the additional 1,500 square foot 10 foot by 150 foot strip he purchased in the January 2006, would today be worth $1,659,926.35, provided we continue to assume that it was worth the $1.65 million Senator Obama paid for it in June 2005.

Repeating this same exercise for the $104,500 purchase price of that 1,500 square foot strip in the first quarter of 2006, we find that its value today would be $101,262.20. Combining these two values together would put the total value of Senator Obama's primary residence through the end of the second quarter of 2008 at $1,761,188.65.

How do you suppose that value compares to the recent sale of similar properties? Would Senator Obama's purchase price of $1.65 million be supported in the same way we found the 1996 sale price of 2008 Democratic party vice-presidential nominee Senator Joe Biden's previous home to be by the valuation of similar properties in today's real estate market?

What's cool is that we can now answer that! While difficult to find 6,400-6,500 square foot homes on 10,500-10,700 square foot lots that have sold recently near Senator Obama's primary residence in Chicago, we did find one very nearly identical property that sold in August 2008 just a block and a half away! The table below presents a side-by-side comparison of the property Senator Obama purchased in June 2005 and the August 2008 comparable property transaction:

| Comparison of Estimated Current Value of Senator Obama's Home and Recently Sold Comparable Property | ||

|---|---|---|

| Description | 5046 S Greenwood Ave (Senator Obama's Property) | 5211 S University Ave (Nearly Identical Property) |

| Structure Square Footage | 6,400 sq. ft. | 6,546 sq. ft. |

| Lot Square Footage | 10,500 sq. ft. | 10,660 sq. ft. |

| Transaction Value (Year of Transaction) | $1,650,000 (2005) | $1,300,000 (2008) |

| Estimated Value in 2008-Q2 (U.S. Dollars) | $1,659,926 | $1,300,000 |

Once again, please note that we've presented the data for Senator Obama's original property (purchased in 2005) in this table, as the lot size is much more directly comparable to the recent property sale data we have obtained from Zillow.

Please also note that despite having greater square footage for both house and lot, the value of the most similar property on paper to Senator Barack Obama's property purchased in 2005 is valued at over $350,000 less. That suggests that Senator Obama should have paid, at most, only $1.3 million for his property in 2005.

Update 30 October 2008: Being more generous to Senator Obama, if we assume that the property could command a luxury premium compared to the nearly identical on paper property given how it was renovated in 1998-1999 to include more luxurious features, such as mahogany bookshelves, a granite kitchen floor and a 600 bottle wine cellar, we can increase that amount by perhaps as much as 10% to $1.43 million.

No matter how we slice it though, it's very unlikely that it would command a luxury premium of 27% over the comparable $1.3 million property, which is the premium needed to reach the $1.65 million level which he paid. And under no realistic circumstance can we get to a luxury premium of 50% over the comparable property, which would be what it would take to get to the sellers' asking price of $1.95 million.

While the sellers may have asked for $1.95 million, and while Senator Obama may consider himself to have "saved" $300,000 from that asking price, we find that the evidence continues to mount that he was really taken to the cleaners in the transaction.

In itself, that would be simply embarrassing and perhaps a singular example of poor judgment over his personal finances, but neither unethical nor unlawful. Unfortunately, the favors Senator Obama realized on his behalf in his efforts to acquire the property whose asking price was so far beyond his reach transform the entire set of affairs into a demonstration of phenomenally poor judgment. The kind of judgment where an exceptionally high cost is being paid, all to satisfy Barack Obama's vision of a home befitting a U.S. Senator.

We wonder what bizarrely inflated prices a President Obama would compel Americans to pay to realize his other visions.

Coming Soon

In this post, we used current day data from 2008 to determine what Senator Obama's house was really worth in 2005. You might think that with that new information showing how property values are really changing over time in Senator Obama's neighborhood that we'd be revisiting our previous look at The House That Obama Bought. You would be right - and as a bonus, we have other new information about those transactions not yet revealed anywhere else!

Previously on Political Calculations

- Return to the Rezko Lot

New information about the appraised value of the "Rezko Lot" led us to revisit our analysis of the transactions involving this lot and 2008 Democratic party presidential candidate Barack Obama we had originally presented in The House That Obama Bought.

- The House That Obama Bought

Our follow up to this post, in which we show that at a minimum, 2008 Democratic Party presidential nominee and current Senator Barack Obama (D-IL) paid $360,738 more than his house in Chicago was worth in 2005. At a maximum, he overpaid by as much as $468,502 for the property where his family now resides.

- Barack Obama's Big Mac Attack

Our tongue-in-cheek look into the negotiations and transactions surrounding Senator Obama's purchase of his current home - kind of a fun introduction to the relative valuations involved, all in the context of a trip to McDonald's!

- Does Senator Joe Biden Have a House Problem? (Part 1)

We looked into suggestions that Senator Biden unduly benefited from the purchase of the property where he built his current home. We introduced our analytical method for projecting the value of real estate properties in this post.

- Does Senator Joe Biden Have a House Problem? (Part 2)

Here, we looked into long-standing allegations that have dogged Senator Biden regarding whether or not he unduly profited from the sale of his previous home in 1996. We originally couldn't make a determination, but thanks to one of our intrepid readers, we were able to find that he did not. Also, where we first built a tool to do the math!

Labels: real estate, tool

New information has surfaced that forces us to change our estimation of the value of the so-called "Rezko Lot," the vacant lot immediately adjacent to Senator Barack Obama's primary residence in Kenwood, Illinois.

We had previously found that the growth in the value of parts and whole of the Rezko lot grew over time from August 2000 through December 2006 in almost perfect synchronization with the average growth rate of real estate for the entire city of Chicago, as recorded for each quarter spanning the period of the various transactions involved by the Office of Housing Enterprise Oversight (OFHEO). The chart below summarizes our previous findings:

It would now appear that the near-perfect synchronization of the valuations of the parts and whole of the Rezko Lot that we had previously observed is too perfect.

We base that statement upon the recent publication of the values determined by professional appraisals performed in November 2005, prior to when Senator Barack Obama purchased one-sixth of the "Rezko Lot." The remaining five-sixths of the lot was sold in December 2006 to a developer-acquaintance of Antoin "Tony" Rezko. Newsweek's Michael Isikoff reports on the property's appraisals determined in November 2005, which surfaced in the legal case of an appraiser against his former employer:

In the lawsuit, filed in Cook County Circuit Court last week, Conner claims that he was asked to review the bank's appraisal of the property purchased by Rezko after the bank learned that he was selling a slice of it to Obama. Conner says he concluded that the bank's appraisal of the property was "overvalued" by $125,000 and that, based on comparable prices of nearby properties, the vacant lot that the Rezkos paid $625,000 for was worth no more than $500,000. To back up his own conclusion, he included as an exhibit an appraisal that Obama paid for in November 2005, which assessed Rezko's property to be worth $490,860—about the same as Conner's assessment and also far less than Rezko and his wife paid for it. The president of Mutual, Amrish Mahajan, personally approved the loan to Rezko's wife and had an "established relationship" with Rezko, according to the lawsuit.

We now have an assessment of the value of the property determined independently of both Barack Obama's and Tony Rezko's transactions, which sets the value of the entire Rezko lot at $490,895 in November 2005, or for our analytical purposes, the fourth quarter of 2005 (2005-Q4). Combined with the previous owner's purchase price for the property of $415,000 in August 2000, we can now precisely determine how the prices of real estate in Barack Obama's neighborhood had to have changed over time with respect to the average rate of change of real estate in Chicago to be valued at these levels. Our new findings are presented in the chart below:

We can now confirm that real estate properties in Barack Obama's neighborhood appreciated at an annualized rate some 4.8% below the average rate of appreciation for the entire Chicago metropolitan area between August 2000 and November 2005. What's more, we can now determine that the recorded purchase price exceeded the actual value of the property by $146,172 at the time the property transaction was closed on 15 June 2005, with a purchase price of $625,000.

We've modified our companion tool for tracking the values of real estate properties in Chicago over time to reflect this negative neighborhood "premium":

It would appear that Senator Barack Obama doesn't live in such a hot neighborhood, as it would appear to significantly drag behind the typical growth rate of real estate values in Chicagoland. Even worse, the original purchase price of his current residence now appears even more bizarrely overvalued itself.

That's not the only evidence we have that Barack Obama's home is located within a neighborhood that seriously lags behind that of adjacent neighborhoods and the city of Chicago at large. As we noted in our previous look at these transactions (emphasis ours):

It occurred to us at this point that these rates of housing appreciation would represent the average rates at which real estate prices changed in Chicago during this period. Since Chicago is large enough to feature local hot and cold spots within its total real estate market, it made sense to attempt to establish if the neighborhood in which these properties are might carry a premium rate of appreciation, on top of the Chicago real estate market average.

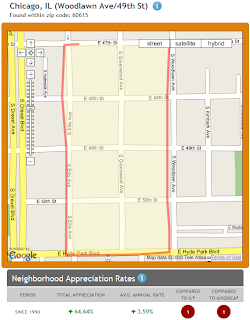

For that data, we turned to NeighborhoodScout.com. The properties both fall in the south edge of the area identified as the Woodlawn Ave/49th St neighborhood, in which properties have appreciated at an annualized rate of 3.59% since 1990, well below the average for Chicago.

Because the properties lie at the south edge of this neighborhood, we considered that the price of properties in this zone might more closely follow the appreciation rate of the neighborhood to the south, the 52nd St./Greenwood Ave. neighborhood. Since 1990, that neighborhood featured an average annualized rate of appreciation of 12.16%.

Using our tool for finding the annualized growth rates and percentage changes of values over time to find out if that latter proposition is indeed the case, we find that over the period spanning the transactions involving the Rezko lot, it appreciated at an annualized rate of 3.30%. It would then appear that there is no special premium one gains by living in Senator Barack Obama's neighborhood in terms of real estate appreciation - in fact, it would appear to be a huge bargain for everyone who lives there but the 2008 Democratic party presidential nominee himself (not to mention his close associates.)

Which perhaps explains why more recent attempts to sell the remaining five-sixths portion of the old Rezko lot have failed, given that the seller, former Rezko associate and attorney Michael Sreenan (also a significant Obama political campaign donor), has been asking $1.5 million for it. By our back of the envelope math, that's over $1.0 million more than it's worth today.

As always, you're welcome to check our numbers yourself! Our Chicago-area valuation tool is above, our tool for finding annualized growth rates and percentage changes over time is below....

We'll have take another look at Barack Obama's house very soon.

Update 28 October 2008 (10:00 PM PDT): Modified and added portions of text for greater clarity.

Labels: politics, real estate, tool

Greg Mankiw finally answered the question that we've been waiting all election season to find out: "How will John McCain's or Barack Obama's tax proposals affect Greg Mankiw?"

Greg Mankiw finally answered the question that we've been waiting all election season to find out: "How will John McCain's or Barack Obama's tax proposals affect Greg Mankiw?"

Of course, that's not the question he's really asking, but it sure is fun to phrase it that way! Instead, he's really asking a much more fundamental question: "How will either Barack Obama's or John McCain's tax proposals affect the incentives that those at the top end of the income spectrum have to invest in the U.S. economy?"

That's an important question to answer because even small percentage changes in how much income is taken away from those earning income at these levels represent huge sums of cash. It's the kind of big money that top income earners can put to productive work in the economy that can either launch a new economic boom or that can seal an economic bust if they choose otherwise.

And that's why we've created the tool below. We compare both John McCain's and Barack Obama's tax proposals to current law, so we can compare whether or not either presidential candidate's tax proposals will increase incentives to invest compared to current law (or each others) or will encourage the well-to-do to just sit on the economic sidelines.

Better still, we also make it possible for you to test drive different tax policy scenarios yourself. Just modify our default data as you see fit, and we will effectively give you the power to manipulate the behavior of the rich and famous too. How cool is that?!

For this tool, we are assuming that the capital gains tax rate and the tax rate applied to dividends are equal. As an aside, we note that the Wall Street Journal article from which Greg Mankiw extracted the data didn't account for Medicare taxes (1.45%) which applies to all income under current law. Barack Obama's proposal to eliminate the taxable income cap for Social Security adds 6.2% to this figure, which we should also note will increase the risk that the program will not be able to support promised benefits to Social Security recipients in future economic downturns.

Beldar further explains why this all matters:

Wealth grows out of work done at the margin. New jobs are created out of work done at the margin and the investment dollars that work generates.

Someone living paycheck to paycheck is contributing to the economy, but he or she isn't going to be the guy or gal who's actually helping to grow the economy in a significant way. But when you have someone who's making it okay — who's getting by — and he's considering whether to do the additional work needed to generate that marginal dollar, his decision whether to do the work or not is going to relate in a very big way to what happens to that dollar.

That's just a sampling. As they say, read the whole thing....

Labels: investing, politics, taxes

Welcome to the Friday, October 24, 2008 edition of On the Moneyed Midways, your nearly three-years-old one-stop-shop for finding the best posts from the past week's business and money-related blog carnivals!

Welcome to the Friday, October 24, 2008 edition of On the Moneyed Midways, your nearly three-years-old one-stop-shop for finding the best posts from the past week's business and money-related blog carnivals!

Would you reject the best advice of those whom you asked for it? Are your doctor's biases affecting the quality of your health care? Could a coat of paint save you $2,000? Could you come out ahead with the government's takeover of Fannie Mae and Freddie Mac?

The answers to these questions and more, including The Best Post of the Week, Anywhere! are just a few scroll wheel turns away....

| On the Moneyed Midways for October 24, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Did Fannie and Freddie's Demise Help Me? | Economic Crunch | Polly Poorhouse wonders if she's benefitting from the government's desire to not own thousands of homes after Fannie Mae and Freddie Mac were both reabsorbed fully back into the government. |

| Carnival of Personal Finance | Accepting the Bailout for the Van | The Happy Rock | Absolutely essential reading! The Debt Defier posed a question to his readers on whether he should accept a gift from his mother that would pay off a van, then completely ignored their advice! |

| Carnival of Real Estate | Red Flag Warning…. | 805 Local | Joyce Zangmeister provides a basic checklist that homebuyers should use when considering the physical condition of a house. |

| Cavalcade of Risk | Getting Past Physician Biases to the Correct Diagnosis | Health Business Blog | David E. Williams considers the problem of doctors replacing sound diagnostic practices with their biases and health prejudices and offers solutions to avoid the errors that arise from doing so. |

| Festival of Frugality | Does Advertising Really Make You Spend More? | Sound Money Matters | Aryn reflects on what kind of advertising affects her buying decisions and discusses how advertising is changing to become more effective. |

| Festival of Stocks | Hedge Fund Implosion | SOX First | Leon Gettler spotlights what will likely be the next focus of investor panic: hedge funds facing what are effectively a run on the bank! |

| Carnival of Money Hacks | How to Write an Effective Complaint Letter | Two Pennies Earned | Amy L. Fontinelle dots the Is and crosses the Ts in The Best Post of the Week, Anywhere! A very good subtitle to this post would be "how to get positive results in a bad situation!" |

| Carnival of Money Stories | How I Save $2,000 by Being Creative and What Else Did I Discover | The Personal Financier | The Personal Financier and his wife had been shopping for a brand new bed. Could applying a coat of paint to their old bed be a $70 mistake or a $2000 savings? |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.