The S&P 500 (Index: SPX) retreated 0.3% from the previous week's close to reach a value of 4079.09 during the trading week ending on Friday, 17 February 2023. That puts the index 15% below its record high peak of 4,796.56 set back on 3 January 2022.

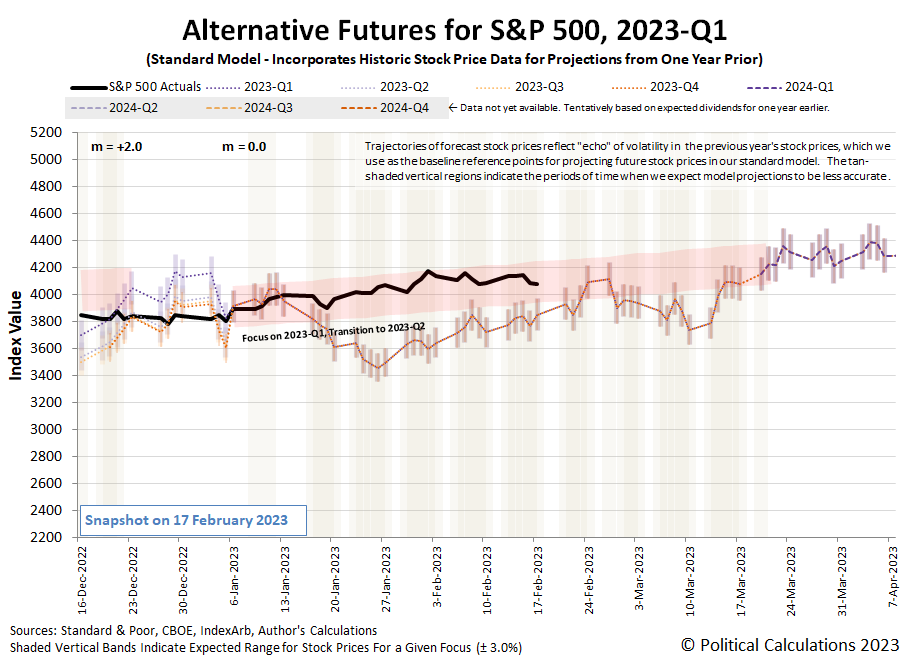

Picking up where we left on in last week's analysis, we've modifed our assessment for when the latest shift in the dividend futures-based model's multiplier occurred. We're now looking at Friday, 6 January 2023 as the date marking when the multiplier changed from +2.0 to roughly zero, based on how stock prices behaved in the weeks leading up to and in the weeks since that date.

The latest update to the alternative futures chart shows how it looks after updating it to account for the apparent change in market regime at that time.

The question now is what changed around that time to cause the change in market regime?

The need to periodically have to answer questions like this is why we make a point of documenting the market-moving news headlines of the week. Here are the previous editions of our ongoing S&P 500 chaos series that overlap this period. Here are the relevant editions:

- The S&P 500 Ends 2022 Back in Bear Territory (Trading week ending 3 January 2023)

- 2022's Volatility Continues Into 2023 for the S&P 500 (Trading week ending 10 January 2023)

- Brightening Outlook for 2023 Dividends Boosts S&P 500 (Trading week ending 17 January 2023)

The biggest potential needle mover we see in the headlines over this period is the end of the Chinese government's zero-COVID lockdowns following popular protests. Given China's role as a major producer of goods consumed in other countries and the economic disruption its failed three-year old policy was having on global supply chains, the sudden change in its government's policy would have global impact as details of the lifting of its lockdowns became known. Much like how the onset of 2020's coronavirus pandemic initially triggered the first change we ever observed in real time of the dividend futures-based model's multiplier, it would make sense that the end of the Chinese government's economically destructive COVID response would be accompanied by another shift in the multiplier.

Before we move onto other topics, what we've just described is a working hypothesis that may be adapted or even dropped as we get more and better information. Stock prices are influenced by a lot of moving pieces and there are many other factors that are also at work at any given time. To filter through the noise to develop this hypothesis, we're not just looking for the potential to cause a change in market regime, but also for factors that aren't regularly present in the market because historical data suggests such regime changes do not happen often. We think any successful competing hypothesis would have to likewise meet that requirement.

One way we can check the hypothesis is to see what happened with expected future dividends in response to the new information. Positive dividends would be expected to arise from the end of China's zero-COVID lockdowns and their disruptive effect on supply chains. And quite literally, they have. As touched on in the older editions of the S&P 500 chaos series highlighted above, the outlook for the S&P 500's dividends have brightened considerably in the weeks since the market regime changed. We'll take a closer look at when and how much they changed later this week.

Here are the market moving headlines of the week that just was, which may someday be useful to return to for reference weeks or years from now....

- Monday, 13 February 2023

-

- Signs and portents for the U.S. economy:

- Oil edges higher as market weighs Russian supply cuts amid demand fears

- U.S. companies face more pain as expected ‘earnings recession’ looms

- Egged on by economists, Fed minions say they're ready to hike interest rates higher:

- At least two more Fed rate hikes and no cut this year, say economists

- Fed's Bowman says more interest rate hikes needed to tame inflation

- BOJ minions meet the new boss:

- At BOJ's helm, MIT-educated Ueda to put theory into practice

- Shock BOJ appointment sparks rush for Japanese economist's obscure texts

- BOJ's expected new chief Ueda to let data guide exit timing- ex-staff

- Weighing up Ueda, investors cool on hawkish BOJ bets

- Japan's weak Q4 GDP rebound poses challenge for BOJ's exit path

- ECB minions identify who they see as losers:

- Wall Street ends sharply higher as investors eye inflation data

- Tuesday, 14 February 2023

-

- Signs and portents for the U.S. economy:

- Rents push up U.S. consumer prices; inflation gradually cooling

- Oil prices dip on U.S. crude reserve release, inflation pressure

- U.S. small business sentiment improves in January - NFIB

- Fed minions keep door open to peak policy rate above 5.1%

- Fed's Williams says more rate rises needed to control high inflation

- Fed not yet done on hikes but likely close, Harker says

- Fed must be ready to hike rates for longer than now expected, Logan says

- Fed looks to services prices as last leg in inflation fight

- Bigger trouble developing in Eurozone:

- German wholesale price index up 10.6% y/y in January

- German housing shortage hits highest level in 20 years - ZIA

- Central banks expected to gear up for last rate hikes before pausing:

- ECB minions upset by high employment:

- Wall Street ends mixed as inflation data supports rate worries

- Wednesday, 15 February 2023

-

- Signs and portents for the U.S. economy:

- Bigger stimulus developing in China:

- ECB minions thinking Eurozone inflation may fall faster than they think, bigger rate hikes expected:

- Euro zone inflation could fall faster than thought, ECB's De Cos says

- ECB 50-basis-point hike in March a done deal, May and June undecided: Reuters poll

- S&P 500 ends higher after strong retail sales data

- Thursday, 16 February 2023

-

- Signs and portents for the U.S. economy:

- U.S. single-family housing starts, building permits tumble in January

- Philadelphia Fed manufacturing gauge plunges unexpectedly

- U.S. labor market still tight; monthly producer inflation accelerates

- Fed minions want more rate hikes:

- Bigger stimulus developing in China:

- Central bank minions starting to put rate hikes on hold:

- ECB minions thinking about smaller rate hikes, don't think they've had much effect, may need a new plan, and worry about their credibility:

- ECB's Panetta calls for small rate hikes as inflation falls

- ECB says rate hikes have yet to be felt, even as more loom

- Analysis-ECB faces new communication challenge as inflation falls

- ECB's Makhlouf says long way to 2% target; credibility 'at risk'

- Wall Street ends down sharply as data fuels rate-hike worries

- Friday, 17 February 2023

-

- Signs and portents for the U.S. economy:

- Fed minions not seeing data they want to see, say that makes them want to hike rates more:

- More Fed policymakers point to higher rates in inflation fight

- Barkin: Not much signal in recent elevated jobs, retail numbers

- Bigger stimulus causing bigger trouble in China:

- Bigger trouble developing in the Eurozone:

- German producer prices ease, but at lower pace than expected

- Germans worry about inflation, say it causes financial pain - survey

- BOJ minions have inflation, new boss to worry about:

- Japan consumer inflation rate seen accelerating to over 41-year high: Reuters poll

- With Japan's new central bank boss, Kishida bids farewell to Abenomics

- ECB minions looking forward to more rate hikes and no rate cuts in 2023:

- Hawkish ECB comments push up rate-hike expectations

- ECB's Villeroy sees summer rate peak, no cut this year

- S&P 500 ends down as investors fret about interest rates

The CME Group's FedWatch Tool continues to project a quarter point rate hike at the Fed's upcoming 22 March (2023-Q1) meeting, followed by another at its 3 May (2023-Q2) meeting. After this week however, it now projects another quarter point rate hike at the Fed's 14 June (2023-Q2) meeting, with rates topping out in a target range from 5.25%-5.50%. After that, the FedWatch tool anticipates the Fed will hold rates steady until 13 December 2023 (2023-Q4), when it projects a quarter point cut.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the first quarter of 2023 rose to +2.5% from its previous +2.2% estimate. The so-called "Blue Chip consensus" forecast still predicts a growth rate of less than +1.0%, and quite possibly a negative real GDP growth rate for 2023's first quarter.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.