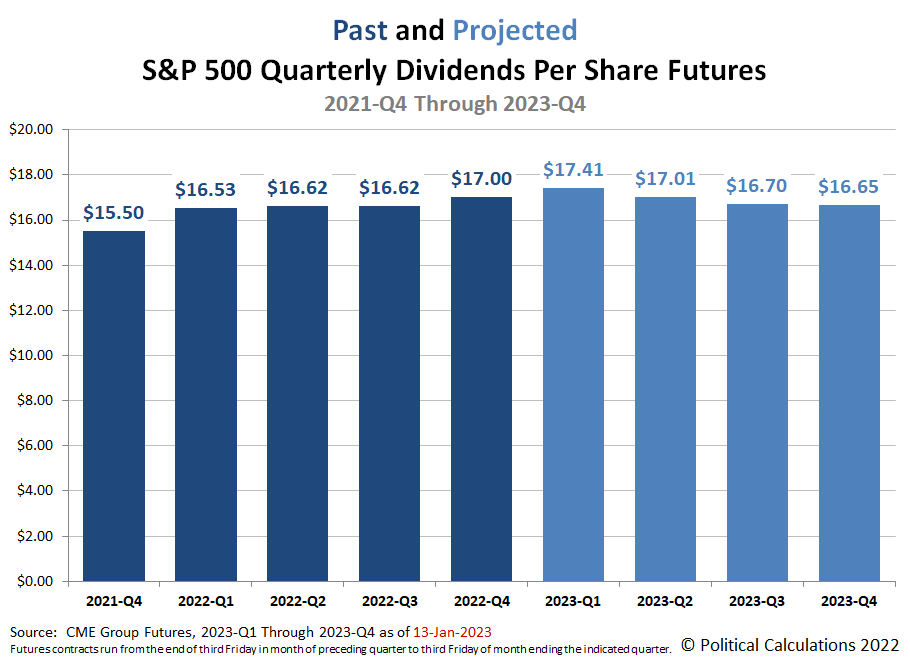

We're seeing a remarkable change in investors' expectations for 2023's dividends for the S&P 500 (Index: SPX). The outlook for quarterly dividends has brightened considerably from the outlook we featured just a few weeks ago. Instead of falling year-over-year from the levels recorded in 2022, the CME Group's quarterly dividend index futures are now projecting they'll show positive gains with respect to last year's results for all but the fourth quarter at this writing.

The following chart shows the expectations for the S&P 500's quarterly dividends per share as of Friday, 13 January 2022.

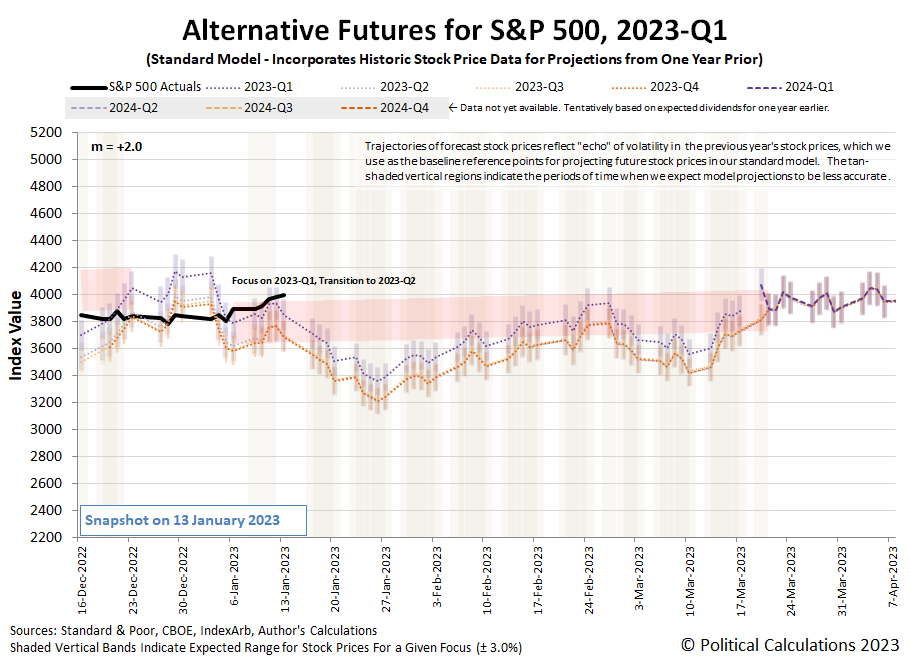

That change in expectations for dividends has boosted the outlook for stock prices through the first quarter of 2023. The dividend futures-based model is now projecting a more positive trajectory for stock prices, as indicated by the slightly upward slope of the redzone forecast range indicated on the latest update for the alternative futures chart.

Also during the past week, investors shifted more of their attention toward the current quarter of 2023-Q1. The S&P 500 ended the trading week at 3,999.09, rising to the high side of the redzone forecast range. That change is consistent with how we described stock prices would behave in that scenario in the previous edition of the S&P 500 chaos series.

How long might that last? That remains to be seen, but you can see some of the positive change in sentiment in the week's market-moving headlines, where expectations strengthened that the Fed's nearly year-old series of rate hikes will come to an end in this current quarter.

- Monday, 9 January 2023

-

- Signs and portents for the U.S. economy:

- Oil jumps 3% on demand optimism as China borders reopen

- Analysis-Some ocean shipping rates collapsing, but real price relief is months away

- Fed minions looking ahead to next rate hike:

- Bigger stimulus developing in China:

- ECB minions have wage inflation, slowing Eurozone economy to worry about:

- ECB sees 'very strong' wage growth ahead in next few quarters

- Around 40% of German companies expect output decline in 2023 - IW institute

- S&P 500 near flat as investors weigh chances of less aggressive rate hikes

- Tuesday, 10 January 2023

-

- Signs and portents for the U.S. economy:

- U.S. small-business sentiment skids to half-year low

- U.S. imports of containerized goods retreat to pre-pandemic level

- U.S. banks get ready for shrinking profits and recession

- U.S. wholesale inventories rise strongly in November as demand falters

- Oil edges higher as petroleum demand set to touch record next year

- Fed minions don't want to get involved in social policy:

- Bigger trouble developing in Japan:

- Japan Nov household spending unexpectedly falls 1.2% year/year

- Consumer inflation in Japan's capital exceeds BOJ target for 7th month

- Bigger stimulus rolling out in China:

- ECB minions thinking they should stop rate hikes:

- Wall St ends higher, Powell comments avoid rate policy

- Wednesday, 11 January 2023

-

- Signs and portents for the U.S. economy:

- Fed minions signal smaller rate hikes ahead:

- Bigger stimulus developing in China:

- Milder recession developing in Eurozone:

- Bigger trouble developing all over:

- BOJ minions looking forward to fighting higher inflation:

- ECB minions excited about keeping rate hikes going:

- ECB's Villeroy sees rate hikes at a 'pragmatic pace' in coming months

- ECB will keep raising rates 'significantly' at sustained pace, De Cos says

- Stocks rally, bond yields fall with bets on easing U.S. inflation

- Thursday, 12 January 2023

-

- Signs and portents for the U.S. economy:

- Oil rises over 1% on China demand hopes, U.S. inflation in focus

- U.S. inflation retreating as consumer prices fall; labor market still tight

- Fed policymakers signal rate-hike slowdown coming, but no easing

- Fed's Bullard says latest inflation data step in right direction

- Fed's Harker ready to downshift to 25 basis-point interest rate hikes

- Bigger trouble, stimulus developing in China:

- China's exports seen cooling further in December on weak global demand, COVID woes- Reuters poll

- China consumer inflation accelerates in Dec; PPI falls with soft demand

- China growth seen rebounding to 4.9% in 2023, more stimulus on the cards - Reuters poll

- BOJ minions starting to wonder if never-ending stimulus has unintended consequences, feel more upbeat:

- BOJ to review side-effects of massive easing at next week's meeting -Yomiuri

- BOJ faces further test to its yield control as inflation creeps up

- BOJ more upbeat on regional Japan, wage prospects

- Wall St ends up as data suggests inflation may be on downward trend

- Friday, 13 January 2023

-

- Signs and portents for the U.S. economy:

- Oil posts biggest weekly gain since October on China hopes, dollar slump

- Yellen warns of U.S. default risk by early June, urges debt limit hike

- Fed minions losing money, say they're balancing risks:

- Fed says surging interest costs cut what it handed back to Treasury in 2022

- Fed's Powell noted "balance of risks" in rate hike path from 2018 onwards, transcripts show

- Bigger trouble, stimulus developing in China:

- China Dec coal imports slip as COVID spike dampens industrial activity

- China central bank to maintain or increase policy-loan liquidity - Reuters poll

- Better than expected, but still bad, economic news for the Eurozone:

- Central bankers signal they're ready to stop hiking rates:

- BOJ minions rethinking never ending stimulus as Japanese inflation doubles their target:

- BOJ may tweak yield control this year if wage hikes broaden - ex-central bank official

- Japan Dec core CPI tipped at 41-year-high 4.0%, twice BOJ's 2% target - Reuters poll

- ECB minions readying for next rate hike, start gearing up for recession impact:

- ECB's Kazaks pushes back on rate cut bets as core prices rise

- ECB tells bankers to get picky with risky clients, including hedge funds

- S&P 500 ends at highest in month, indexes gain for week as earnings kick off

The CME Group's FedWatch Tool continues to project quarter point rate hikes at both the Fed's upcoming 1 February and 22 March (2023-Q1) meetings, with the latter representing the last for the Fed's series of rate hikes that started in March 2022. The FedWatch tool then anticipates the Fed will maintain the Federal Funds Rate at a target range of 4.75-5.00% through November 2023. After which, developing expectations for a U.S. recession in 2023 have the FedWatch tool projecting a quarter point rate cut in December (2023-Q4). Or rather, no change at all from last week!...

We did see change for the Atlanta Fed's GDPNow tool's latest projection for real GDP growth in the fourth quarter of 2022, which increased to +4.1% from last week's +3.8% estimate. The BEA will issue its first estimate of 2022-Q4's GDP later this month, on 26 January 2023.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.