The biggest market moving story for the S&P 500 (Index: SPX) in the final full trading week of September 2024 continued to be the stimulus measures the Chinese government will use to boost China's troubled economy. That story similar to what played out last week, with one key difference. Instead of leaving it up to speculation for what they would do, China's government followed through and rolled out several measures to juice the country's economy.

That boosted stock prices, especially in China and throughout Asia, which saw their best week since 2008. But lots of U.S. companies will benefit from increased economic activity in China, which is why the S&P 500 climbed along with news of China's stimulus rollout on Monday, Tuesday and Thursday. The index ended the week up 0.6% from the previous week at 5,738.17. The S&P even a new record high of 5,745.37 on Thursday before retreating a little over 0.1% to close the week.

That small increase was enough to keep the index' trajectory tracking along in the upper portion of the redzone forecast range indicated in the latest update of the alternative futures chart.

Here's a more complete sampling of the market-moving news headlines from the week that was.

- Monday, 23 September 2024

-

- Signs and portents for the U.S. economy:

- Oil settles lower on weak euro zone business activity

- US Manufacturing PMI Plunges To 15-Month Lows; Prices Are Soaring Again

- Fed minions really worried about jobs in U.S. and will keep cutting rates because of their fears, really don't want to be holding so many Mortgage Backed Securities:

- Fed officials say risks to jobs warranted rate cut as debate shifts to pace of easing

- Fed's Kashkari says 50 basis points rate cut was 'right decision'

- Fed paper sketches out slow slog to unload central bank's mortgage bonds

- Bigger stimulus slowly developing in China:

- Bigger trouble developing in Eurozone, ECB minions say Eurozone exports can't compete well enough:

- Euro zone business activity unexpectedly contracts in September, PMI shows

- Euro zone exporters facing persistent competitiveness struggle, ECB says

- Nasdaq, S&P, Dow ended slightly higher in a rather muted trading session

- Tuesday, 24 September 2024

-

- Signs and portents for the U.S. economy:

- Oil climbs on China stimulus, Middle East conflict and hurricane risk

- Fed's rate cut offers limited relief for US factories facing China competition

- US fiscal profile set to weaken under next administration, Moody's says

- US monthly house prices edge up in July

- Bigger stimulus finally arrives in China:

- China's central bank unveils most aggressive stimulus since pandemic

- China Panics: Cuts Multiple Rates And Reserve Ratio Requirements, Goes All-In To Prop Up Stocks

- China's central bank unveils broad easing measures to revive economy

- China stimulus pushes global shares to new peak, boosts commodities

- China's bigger troubles showing up in Japan, BOJ says they won't rush to raise Japan's already low interest rates:

- Bigger trouble developing in Eurozone, ECB minions thinking they'll need to cut rates well into 2025:

- Exclusive: German economy expected to contract again in 2024, say sources

- ECB's Knot sees rate cuts through the first half of 2025

- S&P 500, Dow close at new highs as mining stocks rise on China stimulus boost

- Wednesday, 25 September 2024

-

- Signs and portents for the U.S. economy:

- Shippers scramble for workarounds ahead of looming US East Coast port strike

- US 30-year mortgage rate slips to 6.13%, refinancing jumps

- Oil declines as investors weigh whether new China stimulus will boost demand

- Worries develop over possibility Fed minions 'outsize' rate cut will enable inflation:

- Fed's bumper rate cut revives 'reflation specter' in US bond market

- Fed's Kugler strongly supported half-percentage-point rate cut

- Bigger stimulus not enough to offset bigger trouble developing in China?

- China's monetary volleys miss key threat to economic growth

- China weighs injecting $142 bln of capital into top banks, Bloomberg News reports

- BOJ minions waiting for new political leadership to set direction:

- ECB minions get data to support their next rate cut in October:

- Dow, S&P 500 end lower, back off record highs; Nasdaq edges up

- Thursday, 26 September 2024

-

- Signs and portents for the U.S. economy:

- Oil prices slide on prospects Saudi Arabia to raise output

- US second-quarter economic growth unrevised; GDI revised sharply higher

- US 30-year fixed-rate mortgage dips to 6.08%, lowest since Sept 2022

- Fed minions thinking about how to make emergency funds more easily available to banks, how to shrink their balance sheet, and how to better use interest rate benchmarks:

- Fed's discount window can be normal funding source for banks, Barr says

- NY Fed's Perli says there is plenty of room left to run in shrinking Fed holdings

- Fed's Williams announces new effort on reference rates

- Bigger stimulus rolling out in China:

- ECB minions thinking about when, how much to cut Eurozone interest rates:

- Wall Street ticks to another record as stocks worldwide rally

- Friday, 27 September 2024

-

- Signs and portents for the U.S. economy:

- US consumer spending, inflation rise moderately in August

- Oil steady but set for weekly drop on higher supply outlook

- Fed minions increasingly expected to deliver another half point rate cut in November 2024:

- Bigger trouble leads to bigger stimulus developing in China:

- China's industrial profits suffer biggest slump this year, adds to economic woes

- China launches late stimulus push to meet 2024 growth target

- BOJ minions bracing to continue keeping interest rates in Japan low:

- Japan factory output seen down on weak overseas demand, typhoon disruptions: Reuters poll

- Core inflation in Japan's capital matches BOJ target

- Bigger trouble developing in Eurozone leading ECB minions to think about cutting rates again:

- S&P 500 ends week up more than 1% as favorable data, China stimulus ripple through markets

The CME Group's FedWatch Tool projects more rate cuts ahead. It projects better than even odds of another half point rate cut on 7 November 2024, followed by a continuing series of 0.25%-0.50% rate cuts at approximate six-to-12-week intervals well into 2025.

The Atlanta Fed's GDPNow tool's projection of the real GDP growth rate for the current quarter of 2024-Q3 rose to +3.1% from the previous week's forecast of +2.9% growth.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a smiling Wall Street bull looking at a news ticker in Times Square that says 'CHINA TO STIMULATE ECONOMY'" We tweaked the text in the image to say ‘CHINA STIMULATES ECONOMY’ to make it up to date for this week.

Quantum computing is an innovation that promises to revolutionize how computers will work in the future. But at this early stage of the technology's development, it's still rare to find it doing anything faster than what can be done with conventional computing technologies, much less doing anything more impressive than what today's computers can do.

That state of affairs is starting to change. In the following video, physicist Ben Miles finds an application where a quantum computing system is not only better than conventional computing technology, it's breakthrough application is much closer to being deployed to perform a useful task in the real world than you might have believed.

The potential to replace today's satellite based Global Positioning System (GPS) for navigation is a major step forward for the technology. That the development is being driven by a growing need to defeat GPS-spoofing electronic warfare technologies will speed the development and adoption of these new quantum computing systems.

Labels: ideas, technology

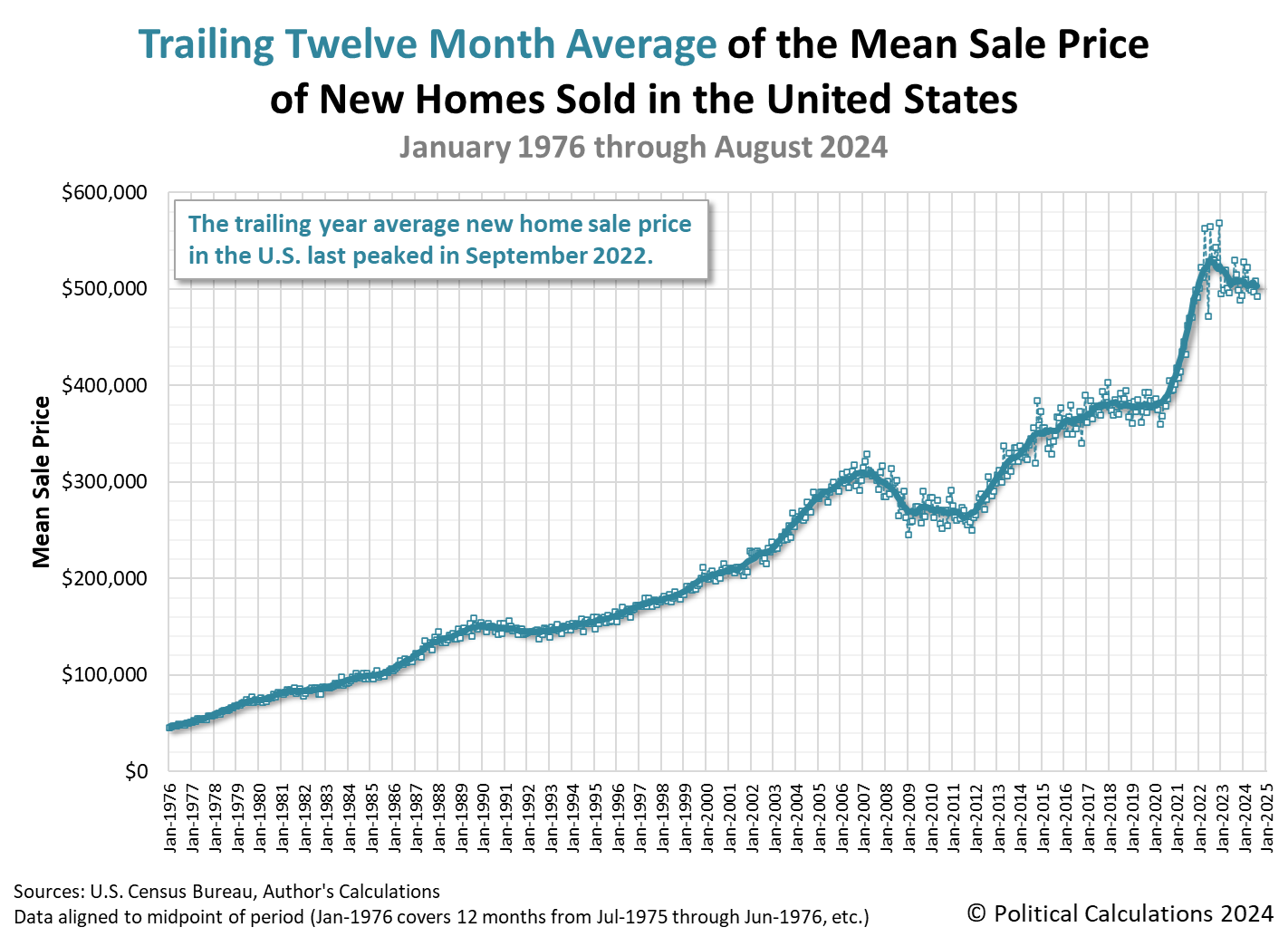

New home sales in the U.S. were surprisingly muted in August 2024 after rising sharply in July after mortgage rates dropped below seven percent.

That's surprising because 30-year conventional fixed rate mortgages continued falling in August to average 6.5% during the month. Yet, new home sales were down for the month. The initial estimate puts the number of sales in August 2024 at an annualized figure of 716,000 new homes sold, which is 4.7% less than July 2024's revised estimate of 751,000 new home sales.

Those lower sales totals are also surprising because new home prices dipped in August 2024. The initial estimate of the average price of a new home sold was $492,700, down from July's revised estimate of $508,200, which itself was down from the initial estimate of $514,800 for the month. The first estimate of the median new home sale price was $420,600, a decrease from July 2024's revised figure of $429,000, which was just $900 less than July's initial estimate.

The three following charts track the trends for the U.S. new home market capitalization, the number of new home sales, and their sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through August 2024.

At $31.06 billion, August 2024's initial estimate is higher than July 2024's revised figure. July 2024's initial estimated trailing twelve month average new home market cap of had been $31.30 billion, which has fallen to $31.01 billion following the downward revisions.

Those decreased estimates in light of August 2024's falling mortgage rates and new home sale prices raise the question of just how strong the U.S. new home market is. The speculation being advanced in the media is that new home buyers held off buying until the Federal Reserve lowered the Federal Funds Rate in mid-September 2024 to get even lower mortgage rates. Here's an example of that thinking from the National Association of Home Builders:

Expectations of the Federal Reserve beginning the first in a series of rate reductions kept potential home buyers in a holding pattern in August....

The problem with this thinking is that if buyers were doing that, the logic of waiting until mortgage rates might decrease would have held in July 2024 when interest rates were even higher. Why would homebuyers rush to sign a contract to buy a new house in July when they could get a much cheaper mortgage payment for by waiting until August or later?

Meanwhile, a lot of Americans who already own homes acted to take advantage of falling mortgage rates in August 2024 to refinance their mortgages. Since rates are falling and are expected to continue falling, why wouldn't the buyers of new homes buy at higher rates with a plan to refinance later after they've dropped more?

At least then, they wouldn't be homeless and sitting outside the new home they want to buy while waiting for mortgage rates to fall.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 September 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 September 2024.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of people waiting for mortgage rates to fall before buying a new home".

Labels: market cap, real estate

Where do you fall on the distribution of income in the United States?

We can help you answer this question using the data that the U.S. Census Bureau has collected on the total money income earned by individual Americans as well as for the families and households into which Americans gather themselves!

If you're a visual person, we'll first present the U.S. income distribution information with an animated chart, which will cycle through three charts presenting the cumulative distribution of income for U.S. individuals, U.S. households, and U.S. families (follow these links for static versions of the charts).

To use these charts, first find the income that applies for you on the horizontal axis, then move directly upward to the curve that defines the cumulative distribution of income. Once you've found your place on S-shaped curve in each chart, look directly to the vertical scale on the left hand side of the chart to determine your approximate U.S. income percentile ranking. Each of the charts will be displayed for five seconds and will cycle back to the beginning after running through each of the charts. The charts will also indicate the median and average income earned by each category.

Now, let's find out more precisely where you really fit into the 2023 distribution of income! To find out where you, your family or your household ranks among each of these categories, just enter your personal income, your family's income, which includes the incomes of your spouse and other family members who live with you, and also the combined income of just the people who live within the walls of the same household that you do, into the following tool. We'll do some quick math and provide a more better estimate of the percentage of all American individuals, families and households that you outrank given the incomes you enter than you can get from scanning the animated chart. We'll also break down the numbers for your Individual income to tell you how you compare to your fellow male and female Americans. If you're accessing this article through a site that republishes our RSS news feed, please click through to our site to access a working version of our tool.

Our tool should be able to place most people within half a percentile of their actual income percentile. A percentile of zero indicates that you are at the very bottom end of the U.S. income spectrum, while a percentile ranking of 100 indicates that you are effectively at the very top end. A percentile rank of 50.0 puts you at the median, where 50% of the U.S. population would have a higher income and 50% has a lower income.

For our readers who live outside of the United States, you can still get in on the action if you convert your income from your local currency into U.S. dollars first!

If you want a more precise estimate of your income percentile ranking within the U.S., please check out Don't Quit Your Day Job's Income Percentile Calculator. DQYDJ uses a more refined version of the U.S. Census Bureau's income data to estimate the distribution of total money income within the United States, which means that compared to our tool, which will put you in the right seating section of the ballpark, PK's tool can put you in the right row of that seating section.

Finally, if you're looking for the income data for 2024, please note that the U.S. Census Bureau will report the data it collects for this year sometime in September 2025. The data for 2024 won't even be collected until March 2025, when Americans will be preparing their income tax returns for the 2024 tax year and have all the records needed to do that. The Census Bureau's statisticians will then take the next six months to analyze all the income data they collect before reporting their results.

References

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table PINC-01. Selected Characteristics of People 15 Years and Over, by Total Money Income in 2023, Work Experience in 2023, Race, Hispanic Origin, and Sex. [Excel Spreadsheet]. 10 September 2024.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table PINC-11. Income Distribution to $250,000 or More for Males and Females: 2023. Male. [Excel Spreadsheet]. 10 September 2024.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table PINC-11. Income Distribution to $250,000 or More for Males and Females: 2023. Female. [Excel Spreadsheet]. 10 September 2024.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table FINC-01. Selected Characteristics of Families by Total Money Income in: 2023. [Excel Spreadsheet]. 10 September 2023. Accessed 10 September 2024.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table FINC-07. Income Distribution to $250,000 or More for Families: 2023. [Excel Spreadsheet]. 10 September 2024.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table HINC-01. Selected Characteristics of Households by Total Money Income in: 2023. [Excel Spreadsheet]. 10 September 2024.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table HINC-05. Percent Distribution of Households, by Selected Characteristics Within Income Qunitile and Top 5 Percent in 2023. [Excel Spreadsheet]. 10 September 2024.

U.S. Census Bureau. Current Population Survey. Annual Social and Economic (ASEC) Supplement. Table HINC-06. Income Distribution to $250,000 or More for Households: 2023. [Excel Spreadsheet]. 10 September 2024.

Image credit: Microsoft Copilot Designer. Prompt: "A picture of people climbing stairs with increasing wealth at each step."

Labels: income distribution, tool

The U.S. Census Bureau released its annual estimate of median household income in the United States for 2023 earlier this month. At $80,610, it has nearly doubled 2000's median household income of $41,990.

Since the Census Bureau releases its annual estimates in September of the year following the year to which its income data belongs, that leaves room for others to fill in the picture for how median household income is changing throughout the year. That includes firms like Motio Research and institutions like the Federal Reserve Bank of Atlanta, which both provide monthly estimates of median household income.

How do these monthly estimates compare with the Census Bureau's annual estimates? The answer to that question can be found in the following chart that shows their monthly estimates and a couple of others for the period from January 2000 through December 2023.

Monthly median household estimates based on monthly survey data collected through the U.S. Census Bureau's Current Population Survey were pioneered by Sentier Research, who covered the period from January 2000 through December 2019, after which the firm exited from business as its founders retired. In December 2023, Motio Research picked up that mantle, providing historic estimates back to January 2010.

In between, Political Calculations helped fill the gap for monthly median household income estimates using an alternate methodology that doesn't rely on survey-based income data. Speaking of which, with the U.S. Census Bureau's release of its annual estimate, we have revisited the data and revised our estimates for the period from March 2021 to the present, which we'll discuss in greater detail in a separate post on the topic. We previously telescoped our method to generate monthly estimates of median household income backward to January 1986.

The Atlanta Fed doesn't directly report its monthly median household income estimates but presents that data as part of its analysis of housing affordability.

Regardless of source and with rare exceptions, most monthly median household income estimates are within a few percentage points of each other and also the annual estimates produced by the U.S. Census Bureau.

Image credit: U.S. Census Bureau. We modified the public domain image to make it more generally applicable beyond reporting the median household income from 2022.

Labels: median household income

The S&P 500 (Index: SPX) had a banner week. After falling on Wednesday, 18 September 2024 just hours after the U.S. Federal Reserve acted to cut interest rates by a surprising half percent, the index went on close at a new all-time high on Thursday, 19 September 2024, before sliding 11.09 points on Friday to close out the week at 5,702.55.

Something doesn't seem right about that description of what happened in the trading week that was, does it? Since a larger-than-expected rate cut should have been especially beneficial for interest-rate sensitive businesses, why did the S&P 500 fall on Wednesday when the Fed's delivered its "outsized rate cut"? Why did investors wait until the next day to send the S&P 500 to a new record high?

Let's start with the hypothesis of the announced rate cut being "larger-than-expected". The evidence suggests investors had more than fully absorbed the Fed would be cutting rates by that amount. That evidence can be seen in the form of how the stocks of the very interest rate-sensitive real estate sector of the U.S. economy traded during the week. Here's a chart showing how the Vanguard Real Estate Index Fund (ETF: VNQ) has been trading over the past month.

This ETF had been rising in anticipation of the Fed's September 2024 rate cuts in the three weeks leading up to the actual week of the rate cut. But in the week of the rate cut itself, it fell, even on the day the S&P 500 index hit closed at its new record high. That's not likely something that would have happened if the Fed's rate cut had been unexpectedly large because that new information would immediately signal an improved business outlook for the real estate sector. That this ETF composed of interest rate-sensitive real estate stocks fell by a small amount during the week confirms the Fed's "outsize" rate cut was more than well anticipated.

At this point, let's turn to how Thursday new record high close for the index was reported on the day it happened. Here's an example of that reporting:

Wall Street's reaction to Wednesday's developments was a bit of a rollercoaster. Immediately after the Fed's rate cut announcement, the S&P 500 (SP500) spiked to a record high. Later, it whipsawed in volatile trade but managed to hold on to gains during Powell's press conference. It then eventually closed out the session in the red.

But after a night to digest the Fed's actions and Powell's comments, market participants took reassurance from the central bank's willingness to be aggressive so as to guide monetary policy effectively. That in turn fueled hopes that the Fed would be able to successfully deliver a soft landing, and led to Wall Street ripping gains on Thursday.

That's an incredibly touchy-feely claim of how market participants are purported to have behaved. Especially at a time when most U.S. market participants, perhaps the people who pay the closest attention to the factors that affect U.S. markets, who had already judged the Fed's rate cut was in line with what they were expecting, were either winding down from the day's trading or sleeping.

Sounds pretty unlikely. So what really happened that night to alter the perspective of market participants? We can surmise it had to be new information not previously known to U.S. market participants, which probably arose outside the U.S.

To find out what that might be, we need to know when that new information arrived. We can use the trading for S&P 500 futures to identify when the previous perspective of investors was superseded. The next chart shows the past week's trading in the S&P 500's continuously traded futures (ETF: SPX):

On the chart, we've identified the approximate break point after which we can say the previous perspective for the index no longer held: 9:30 PM Eastern Time on Wednesday, 18 September 2024.

From there, we only needed to identify a potential market moving headline with the potential to alter what investors' perspective for the S&P 500's outlook, occurring within 2-4 minutes of that time.

That truly market moving news was published by Hong Kong's South China Morning Post at 9:34 AM in Hong Kong, which coincidentally is 9:34 PM in New York. Spoiler alert: it has nothing to the Fed's never-before-seen ability to deliver a "soft landing" and everything to do with how the Fed's action makes room for stimulus for China's economy:

As the US Federal Reserve officially kicked off a rate-cutting cycle, China and other Asian economies are likely to see more room to carry out easing policies and boost growth, analysts said.

That news was enough to boost China's stock prices and because the outlook of Chinese firms improved, it improved the outlook of U.S. firms that do substantial business with those firms, which in turn, boosted the S&P 500 index. That influence also answers the question of why U.S. real estate firms did not join the rest of the index in its rise to a new height on Thursday. As they say, real estate is all about location, location, location. This is an example of when the same can be said for the stocks of real estate firms in the U.S.

The SCMP has since followed up with another story explaining how the Fed's rate cut would benefit China's economy:

“The development of China’s economy and capital markets still depends on stable domestic demand, and the recovery of China’s internal growth momentum cannot be resolved by relying on Fed rate cuts or further domestic monetary policy easing,” said Wei Hongxu, a researcher at Anbound, a Beijing-based public policy consultancy.

“For China, the Fed’s shift to a rate-cutting cycle narrows the policy gap between the two countries and reduces the interest-rate differential, expanding room for domestic monetary policy,” Wei said, adding that the negative impact of a potential US economic growth slowdown on China’s foreign trade cannot be ignored.

Unfortunately, some of that momentum was lost on Friday when China's central bank declined to take quick advantage of the room it had been gifted by the Fed's large rate cut. The PBOC did not cut its own interest rates, although that doesn't rule out such an action in the future or other options for China's government to support its struggling economy.

And so, the S&P 500 closed down on the day. Meanwhile, the overall trajectory of the index continues to fall within the latest redzone forecast range for the dividend futures-based model's alternative futures chart.

While we've focused on the biggest market moving stories of the week, other stuff happened too. Here's a quick rundown:

- Monday, 16 September 2024

-

- Signs and portents for the U.S. economy:

- As Fed cuts loom, health of US economy could determine markets' path

- Oil prices edge higher ahead of Fed interest rate decision

- World counting on Fed minions to cut U.S. interest rates, U.S. politicians want really big cut:

- Why Fed rate cuts matter to world markets

- US interest rate futures see higher odds of super-sized Fed move

- Bigger trouble, stimulus developing in China:

- China opposes US tariff hikes, vows steps to defend its firms' interests

- Downbeat China factory output, retail sales add to urgency for stronger stimulus

- China new home prices fall at fastest pace in over 9 years in Aug

- JapanGov minions don't want BOJ minions to think about hiking interest rates:

- ECB minions getting excited to deliver another Eurozone rate cut, unsure of how big and when:

- Nasdaq, S&P, Dow trade mixed with Fed rate decision looming

- Tuesday, 17 September 2024

-

- Signs and portents for the U.S. economy:

- Oil prices set to snap two-day winning streak ahead of Fed decision

- Big oil companies defeat US consumer lawsuit over production, prices

- Exclusive: US to seek 6 million barrels of oil for reserve, amid low oil price

- Biden won't block potential strike at East Coast ports, administration official says

- Fed minions wondering how big their rate cut should be, and also about what to do with their balance sheet:

- With Fed's rate cut at hand, debate swirls over how big a move

- Most brokerages expect 25 bps rate cut from Fed on Wednesday

- Sahm rule creator sees 50-bps Fed rate cut on labor market worries

- Fed to go big on first rate cut, traders bet

- Fed rate cut uncertainties rattle balance sheet outlook

- Bigger trouble, stimulus developing in China:

- BOJ minions get data that will let them avoid more rate cuts:

- Nasdaq, S&P 500, Dow end little changed a day ahead of pivotal Fed rate decision

- Wednesday, 18 September 2024

-

- Signs and portents for the U.S. economy:

- What does a Fed rate cut mean for the economy and consumers?

- Oil slips for first day in three ahead of Fed decision

- US single-family homebuilding surges, rising supply a near-term constraint

- US 30-year mortgage rate falls to two-year low of 6.15%

- Port strike on US East Coast would spark supply-chain glitches from outset, shipping firm exec says

- Fed minions deliver bigger rate cut, say they did it to keep U.S. economy "in a good place":

- Federal Reserve cuts benchmark rate by 50 basis points

- Fed delivers oversized rate cut as it gains 'greater confidence' about inflation

- Fed Chair Powell says interest rate cut made to maintain strong U.S. economy

- Fed's Powell: Central bank forecasts don't point to urgent action

- Wall Street Reacts To Today's 50bps "But No Crisis" Rate Cut

- Fed rate-cutting cycle could be shallower than expected

- Fed Bowman's dissent is first from Fed governor since 2005

- Bigger trouble, stimulus developing in China:

- JapanGov minions say economy is doing just fine, thank you:

- S&P erases 1% gain, ends lower after Fed delivers supersized rate cut, says in no rush

- Thursday, 19 September 2024

-

- Signs and portents for the U.S. economy:

- Oil prices little changed as US rate cut fails to boost sentiment

- US 30-year fixed-rate mortgage falls to 6.09%

- US existing home sales drop in August; supply improves

- Some Fed minions wonder if they did the right thing:

- Fed (finally) joins a global rate-cutting cycle

- Ex-Kansas City Fed chief sees renewed inflation risk after large rate cut

- Fed's big cut may have been closer call than lone dissent suggests

- Bigger stimulus developing in China:

- China to ramp up policy steps to revive economy but no 'bazooka' stimulus seen

- China expected to trim main policy rate and lending benchmarks: Reuters poll

- BOJ minions decline to raise rates, but say they might:

- ECB minions being looked at to deliver next rate cut in October 2024 as bigger trouble develops in Eurozone economy:

- Big Fed cut puts an ECB move next month on traders' radar

- German economy could shrink again in Q3, Bundesbank warns

- S&P closes above 5,700 and Dow ends above 42K in historic firsts as Wall Street soars

- Friday, 20 September 2024

-

- Signs and portents for the U.S. economy:

- Oil prices set to end week higher after US rate cut

- FedEx sends a shiver throughout the transportation and logistics sectors with soft guidance

- Auto parts sector faces recession headwinds, but some will do better than others - analyst

- Fed minions expected to deliver smaller rate cuts in months ahead, read data very differently from each other:

- Fed to cut rates by 25bps in Nov and Dec, approach neutral level sooner

- US inflation data cemented big cut for one Fed official, dissent for another

- Bigger trouble developing in China (and Japan):

- China dairy farms swim in milk as fewer babies, slow economy cut demand

- China's Collapsing Economy Adds To Headwinds For Japanese Automakers

- China unexpectedly leaves benchmark lending rates unchanged after Fed’s jumbo cut

- BOJ minions leave interest rates alone, search for credible monetary policy as yen falls:

- BOJ signals no rush in raising rates again, keeps policy steady

- Yen slides as BOJ governor steers clear of rate hike talk

- ECB minion says they won't know much about Eurozone economy until December 2024, not sure if they'll cut rates in October:

- Bumper Fed week ends with S&P sitting above 5,700 and Dow at a new record close

The CME Group's FedWatch Tool projects additional rate cuts ahead. After the Fed announced a half point reduction in the Federal Funds Rate on Wednesday, 18 September, the FedWatch tool is projecting nearly even odds of another half point rate cut on 7 November 2024, followed by a continuing series of 0.25%-0.50% rate cuts at approximate six-week intervals well into 2025.

The Atlanta Fed's GDPNow tool's projection of the real GDP growth rate for the current quarter of 2024-Q3 rose to +2.9% from the previous week's forecast of +2.5% growth.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a Wall Street bull sitting at a kitchen table and eating breakfast while reading a newspaper with the headline 'FED RATE CUT GOOD FOR CHINA ECONOMY!'"

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.