For a week where the full U.S. Treasury yield curve inverted as stock prices were quite volatile, the week didn't end all that much differently than the previous week did.

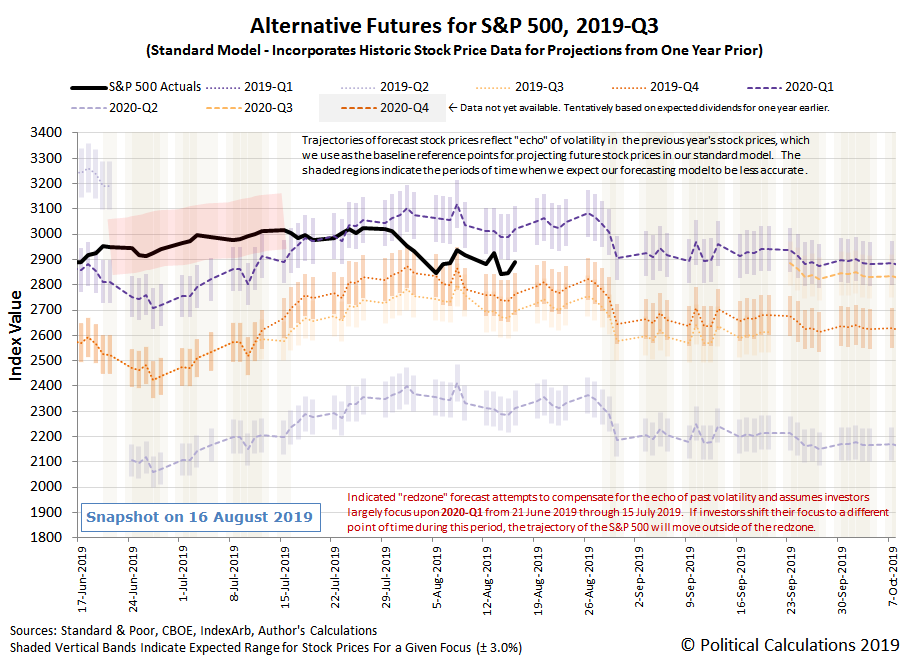

By the end of the week, the S&P 500 (Index: SPX) was about one percentage point lower than a week earlier, as investors continued splitting their forward-looking attention betweeen 2019-Q4 and 2020-Q1. And while investors flirted with focusing more closely on 2019-Q4 during the week, there wasn't enough in the news to shift it more fully onto that particular point of time in the future.

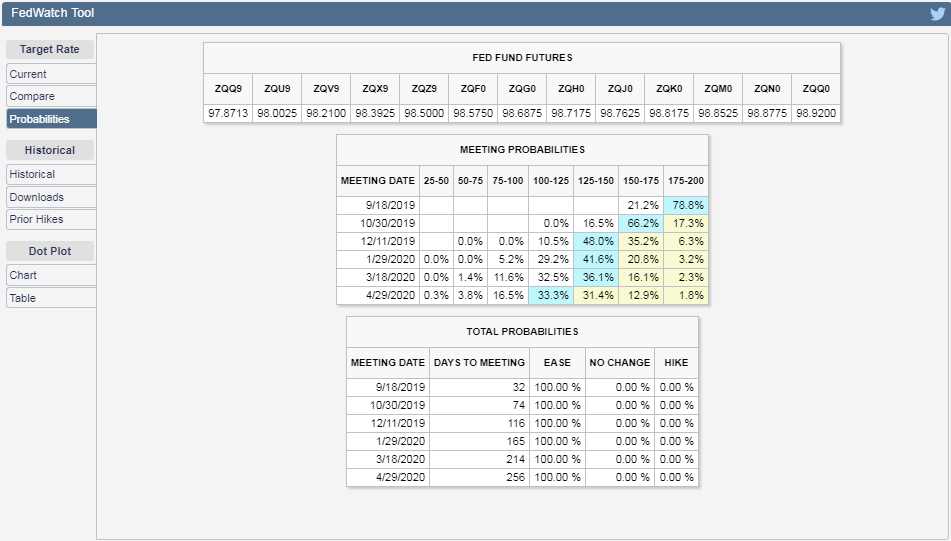

At this point, investors are betting the Federal Reserve will be forced to act aggressively to cut short term interest rates in a bid to revert the yield curve, with the CME Group's FedWatch Tool now projecting as many as four quarter point rate cuts in the four quarters ahead:

We think the uncertainty of the timing of rate cuts between 2019-Q4 and 2020-Q1 is what is holding investors' attention on these two future quarters for now, but the potential deterioration of economic circumstances that would lead to the increased probability of rate cuts extending into 2020-Q2 could spark a much more negative reaction in stock prices should investors have reason to really focus on that particular future quarter.

There's also the potential that changes in the expectations for dividends in any of these upcoming quarters will have an impact on stock prices as well. Fortunately, dividend futures have so far been largely stable, where much of the outsized volatility we've seen may be attributed to investors shifting their time horizons in setting their expectations.

That's why we make a point of tracking the market moving headlines each week, which we've presented below. The random onset of new information plays a large role in setting the forward-looking focus of investors.

- Monday, 12 August 2019

- Oil steadies as Saudi, Kuwait signals offset demand fears

- Bigger trouble developing in China all over:

- China's July new loans dip more than expected, further policy easing seen

- Brazil economic activity index falls in second-quarter, pointing to recession

- Singapore slashes 2019 GDP forecast as global risks expand

- Wall Street falls on geopolitical tensions, recession fears

- Tuesday, 13 August 2019

- Oil soars near 5% as U.S. delays tariffs on some Chinese goods

- Bigger trouble developing in China:

- China July industrial output growth falls to 17-year low as trade war escalates, retail sales disappoint

- China's July steel output eases on environmental curbs, shrinking margins

- China's property investment slows in July as Beijing tightens curbs

- Global motor manufacturing slump hits oil demand: Kemp

- Trump delays tariffs on Chinese cellphones, laptops, toys; markets jump

- Tech leads Wall Street higher as tariff delay sparks rally

- Wednesday, 14 August 2019

- Stocks, oil plunge on growing signs of global slowdown

- Shrinking German economy 'on edge of recession' as exports stutter

- U.S. curve inverts for first time in 12 years; 30-year yield tumbles

- Trump Says Fed Should Cut Rates as Global Growth Concerns Jar Markets

- Yellen says U.S. 'most likely' not entering a recession: FOX Business

- Dow posts biggest one-day drop since October as recession fears take hold

- Thursday, 15 August 2019

- Oil deepens slide on recession fears, China's trade threats

- Trump says China talks 'productive'; Beijing vows tariff retaliation

- U.S. curve inverts for first time in 12 years; 30-year yield tumbles

- U.S. 30-year yields drop to fresh record low below 2%

- 'Crazy inverted yield curve' vexes Fed, with no clear resolution

- S&P 500, Dow gain as upbeat retail sales offset recession fears

- Friday, 16 August 2019

- Oil rises alongside equities, but downbeat OPEC outlook caps gains

- Bigger trouble developing

in Chinaall over: - Hong Kong on brink of recession as trade war, political protests escalate

- Japan exports seen shrinking for eighth month in July, core inflation weak: Reuters poll

- Bigger stimulus developing

in Chinaall over: - To spur consumption, China preps plan to boost disposable income by 2020

- Germany ready to ditch balanced budget in case of recession: Spiegel

- Mexico's central bank cuts rates for first time in 5 years as economy sputters

- China to rely on reforms to lower real interest rates, cabinet says

- Thailand plans $10 billion stimulus to support economy

- Fed minions weighing rate cuts:

- Exclusive: Fed's Mester weighing argument for U.S. rate cut

- Fed's Kashkari says rate cut likely needed to help U.S. economy

- Wall Street ends sharply higher on German stimulus optimism

Looking for the bigger picture of the week's news than the headlines we've noted above? Barry Ritholtz lists seven positives and only five negatives in the week's economics and market-related news.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.