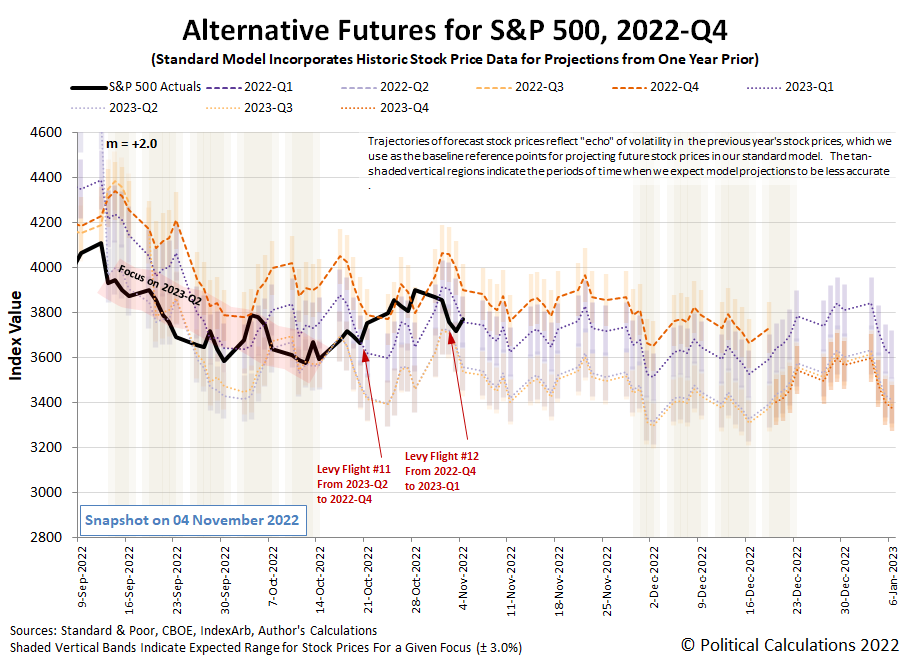

If it seems like it was just a week ago that we issued a cautionary note that the S&P 500 (Index: SPX) would face a downward movement if investors shifted their attention to any point in the future other than 2022-Q4, that's because it was.

We said it would absolutely happen before the end of 2022-Q4. But we didn't have to wait very long at all, because it happened last week. The latest update to the dividend futures-based model's alternative futures chart shows it as the twelfth Lévy flight event of 2022, as investors refocused their attention on the first quarter of 2023.

The cause of the shift was easy to find in the week's newstream. It's directly tied to changing expectations for how the Federal Reserve's Federal Open Market Committee (FOMC) will be changing the Federal Funds Rate in upcoming months. The FOMC concluded a two day meeting on Wednesday, 2 November 2022, announcing it would immediately hike interest rates by three quarters of a percent, but it was Fed Chair Jerome Powell's press conference following the announcement that prompted investors to immediately shift their expectations for the future timing of when and how high the Fed's rate hikes will top out.

The CME Group's FedWatch Tool captured the associated change in expectations for the Fed's future rate hikes. After the announcement, it continued to project a half point rate hike on 14 December (2022-Q4). But in 2023, the FedWatch tool anticipates the Federal Funds Rate rising to a target range of 5.00-5.25% in 2023-Q1 and holding at that level until a quarter point rate cut might takes place in December (2023-Q4). As would be expected, the change for how high and, more importantly, when the Fed's series of rate hikes will peak in 2023-Q1 is behind the shift of investors' time horizon from 2022-Q4 to 2023-Q1. The trading week ended with investors having focused nearly all their forward-looking attention on the first quarter of 2023, fully accounting for the amount by which the S&P 500 dropped from the previous week.

Other stuff happened too during the week, which helps provide context for the environment in which these changes happened. Here's our summary of the week's market moving headlines:

- Monday, 31 October 2022

-

- Signs and portents for the U.S. economy:

- Expectations setting in for Fed minions:

- Bigger trouble developing in China, Japan, Eurozone:

- China's factory, services activity skids on relentless COVID curbs

- Japan's factory output falls for first time in four months as firms battle rising costs

- Euro zone inflation soars past forecasts to new record high

- Wall Street ends strong month on weaker note; focus on Fed meeting

- Tuesday, 1 November 2022

-

- Signs and portents for the U.S. economy:

- U.S. manufacturing activity slowest in nearly 2-1/2 years in October -ISM

- U.S. construction spending unexpectedly rebounds in September

- U.S. labor market still tight, but some rays of hope in inflation fight

- Explainer-Several parts of the U.S. yield curve are inverted: what does it tell us?

- Oil up nearly 2% as weaker dollar offsets China concerns

- Bigger trouble developing in China, Japan, South Korea:

- China's Oct factory activity shrinks as COVID curbs hit output, demand - Caixin PMI

- Japan Oct factory growth hits 21-month low as China conditions worsen -PMI

- South Korea's Oct exports post worst fall in 26 months

- ECB minions committing to keep raising interest rates, thinking about selling off its holdings of Eurozone government debt:

- ECB must keep raising rates even if recession risks rise, Lagarde says

- ECB could start shrinking debt pile from start of 2023, Nagel says

- Wall St slips as jobs data dents hopes for Fed rate deceleration

- Wednesday, 2 November 2022

-

- Signs and portents for the U.S. economy:

- Oil prices gain by tight supply; other risk assets swoon on Fed rate hike

- White House says Fed rate hike will help lower inflation, tame housing market

- Fed minions deliver big rate hike, say they're going to slow down but rates will top out higher than they previously indicated and the coming recession won't be the soft kind:

- Fed delivers fourth 75 bp hike, signals scale-back coming

- Fed's Powell: 'Ultimate level' of rates likely higher than earlier estimates

- Fed's Powell: "Ultimate level of interest rates will be higher than previously expected"

- Powell Pulls Rug Out From Euphoric Fed Statement Reaction, Terminal Rate Spikes

- Fed's Powell: 'Soft landing' chances have narrowed

- Powell says Fed officials recommitted to meeting new ethics standards

- Bigger trouble developing in China:

- Debt risks of top real estate firms are prominent - China bank regulator

- China COVID curbs exact wider business toll on Yum, EV maker Nio

- Bigger stimulus developing in China:

- Bigger trouble developing in the Eurozone:

- Euro zone factory downturn deepened in Oct as demand slumped

- Energy crisis putting most German firms under duress -survey

- Moody's cuts outlook for European banks, including Germany's, on credit woes

- COVID, Ukraine war cost German economy 420 billion euros - study

- BOJ minions exploring ways to keep never-ending stimulus alive:

- BOJ's Kuroda: Making yield curve control more flexible a future option

- BOJ may tweak yield targets next year, says ex-central bank policymaker Sakurai

- ECB minions looking forward to delivering more rate hikes:

- Wall Street drops as Powell signals Fed not close to done

- Thursday, 3 November 2022

-

- Signs and portents for the U.S. economy:

- Banks raise Fed terminal rate forecasts after Powell's hawkish tone

- Oil slips 2% on China demand worries, U.S. rate hikes

- U.S. is not in recession, White House not preparing for one - officials

- Fed minions expected to hike Federal Funds Rate above 5% in 2023-Q1:

- Bigger trouble developing in China:

- China's rich provinces post slower growth than national economy on COVID curbs

- Explainer-What's behind Hong Kong's tightening cash conditions?

- Central bankers continue rate hike mania:

- Central banks stay firmly in rate hike mode but slowdown on cards

- Bank of England raises rates by most since 1989 even as long recession looms

- BoE Bailey says 75 basis points is not the new norm for rate hikes

- Expert View: Bank of England lifts UK rates to 3% in historic hike

- Hong Kong raises rates after Fed, flags more increases in borrowing costs

- ECB minions claim they're more than halfway to last rate hike, won't copy Fed:

- ECB's Centeno says large part of rate hikes already complete

- ECB can't just mimic Fed in fight against inflation, Lagarde says

- ECB should hike interest rates further to combat inflation, Nagel says

- ECB's Panetta warns against bigger-than-expected rate hikes

- Wall St down for fourth straight day on Fed rate hike worry

- Friday, 4 November 2022

-

- Signs and portents for the U.S. economy:

- U.S. job growth strong in October, but cracks emerging

- Oil settles up 5% as further interest rate hikes loom

- Fed minions say all's well with U.S. financial system, ready to slow down rate hikes as economy slows:

- Fed says financial system holding up through turbulent year

- Fed officials keep rate-hike pivot on the radar despite strong jobs data

- Bigger trouble developing in the Eurozone, China, Japan:

- Euro zone downturn deepens, points to winter recession

- China's Oct exports seen cooling further as global demand weakens- Reuters poll

- Japan economy set to slow sharply as global inflation, recession risks hurt- Reuters poll

- ECB minions focusing on inflation while Eurozone heads into winter recession:

- Wall St rallies to close out soft week after jobs report

The Atlanta Fed's GDPNow tool's projection for real GDP growth in 2022-Q4 is +3.6%, up from its estimate of +3.1% at the end of the previous trading week. There's a big gap between its current projection and the so-called "Blue Chip consensus", which anticipates near zero growth in 2022-Q4. We'll see how these economic growth projections evolve during the rest of the quarter.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.