The relative affordability of the typical new home sold in the U.S. improved in January 2023.

This improvement came thanks to the combination of falling median new home sale prices, lower mortgage rates, and a rising median household income.

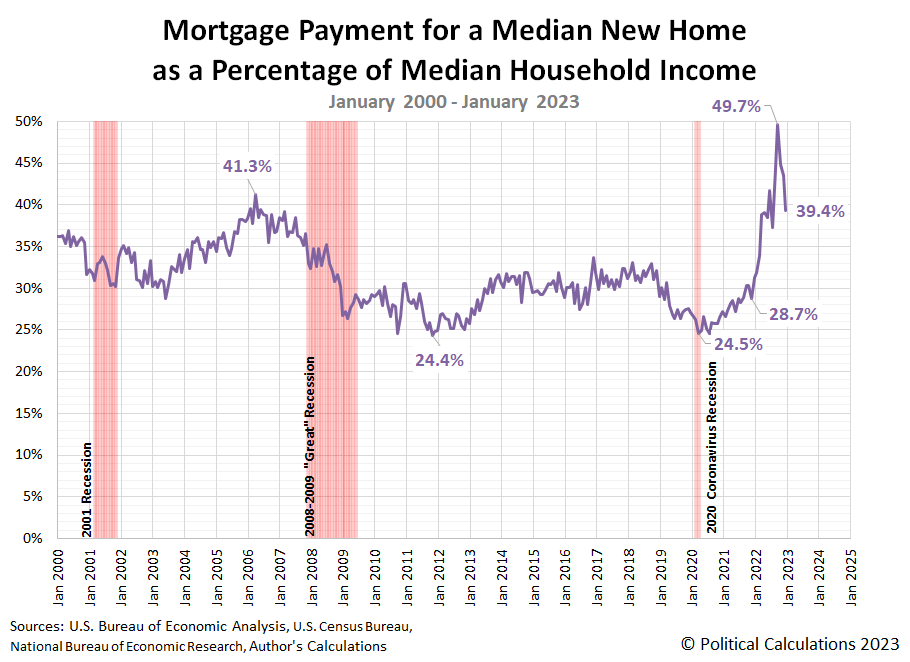

All three of these factors contribute to the trend shown in the following chart, which tracks the mortgage payment for the median new home sold in the U.S. as a percentage of median household income. The chart shows that after peaking at 49.7% in October 2022, the average 30-year conventional mortgage payment for a new home sold in the U.S. has fallen to consume only 39.7% of the income of a household at the middle of the spectrum of U.S. income earners.

That relative decline in cost means new homes have fallen to be about as affordable as they were during the peak of the U.S. housing bubble in 2006. Which is to say the typical new home sold in the U.S. is still far from affordable.

Looking forward, we already know mortgage rates averaged close to the same in February 2023 as they did in January. The bad news is that's because they reversed January 2023's downward trend. For affordability however, that may be a positive because of the downward trend for new home sale prices and rising trend for median household income.

March 2023 however may present a very different picture, because mortgage rates entered the month on an uptrend.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 February 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 February 2023.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 5 March 2023. Note: Starting from December 2022, the estimated monthly mortgage rate is taken as the average of weekly 30-year conventional mortgage rates recorded during the month.

Image credit: Photo by Towfiqu barbhuiya on Unsplash.

Labels: personal finance, real estate

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.