The S&P 500 (Index: SPX) rose to end the trading week at 4137.64, up 0.8% from the previous week's close.

The main factor in the week's market moving headlines pointing to that outcome is the increasingly likelihood that the Federal Reserve's series of rate hikes that began back in March 2022 are much closer to being over. Better-than-expected inflation reports during the week and an increasingly likelihood of recession are instead raising the prospect the Federal Funds Rate will reach a peak target range of 5.00-5.25% in May 2023, which investors are betting will transition into a series of rate cuts starting as early as July 2023.

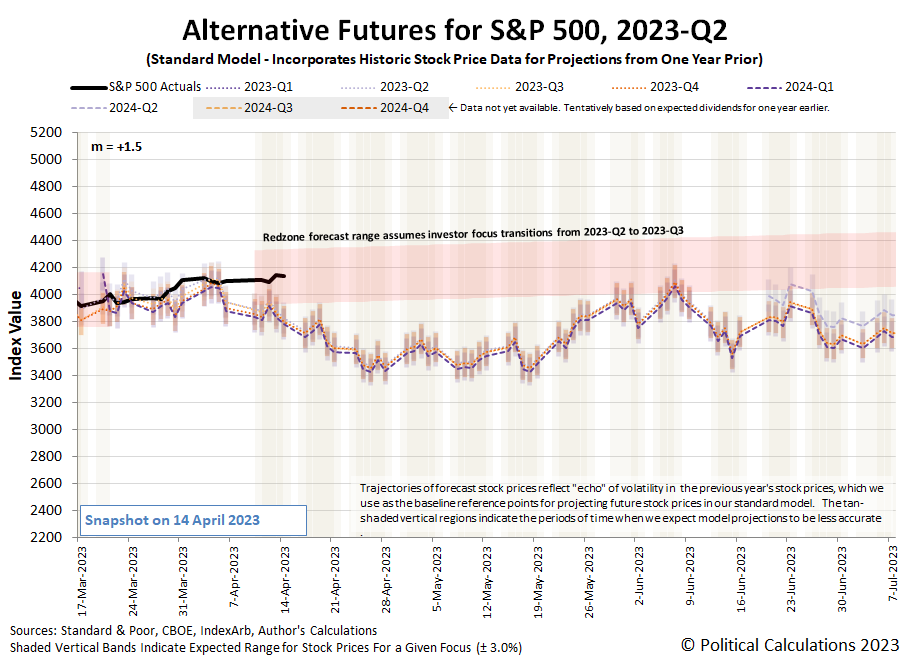

We've updated the alternative futures chart to show a new redzone forecast range that runs from 10 April 2023 through 18 July 2023, during which we assume investors will transition their focus from the current quarter of 2023-Q2 to the more distant future quarter of 2023-Q3. We anticipate a higher volatility for stock prices may apply during this period, which we're indicating with a wider forecast range of ±4% rather than a typical ±3%.

Here's our weekly summary of those market-moving headlines we mentioned earlier.

- Monday, 10 April 2023

-

- Signs and portents for the U.S. economy:

- BofA sees 'meaningful risks' of Q2 U.S. economic contraction

- Oil settles lower as rate-hike worries balance tighter supplies

- Fed minions claim monetary policy did not cause bank failures, outsider thinks they might be done with rate hikes:

- Fed's Williams doubts monetary policy spiked banking sector stress

- Fed might not need to hike rates in May as economy slows, says BlackRock

- BOJ minions to keep never-ending stimulus alive!

- ECB minions thinking about more rate hikes:

- Wall Street ends mixed with inflation data, earnings on tap

- Tuesday, 11 April 2023

-

- Fed minions starting to have second thoughts about more rate hikes, think they'll be shrinking their balance sheet for several years:

- Fed's Goolsbee: Prudence, patience needed on rate hikes

- Fed's Williams says interest rate path is data dependent

- Fed's Harker wants interest rates to get above 5%, then sit

- Fed's Kashkari: Recession possible, but high inflation would be worse

- NY Fed report sees several more years of balance sheet contraction

- Bigger trouble, stimulus developing in China:

- China's consumer, factory prices skid as demand falters

- China's new loans hit record on policy support, mortgages

- IMF getting nervous about financial stability, doesn't think central banks should halt rate hikes to prevent more:

- IMF warns bank failures highlight 'perilous' financial stability risks

- IMF chief economist: stability risks should not deter central bank inflation fight

- Central bankers pausing rate hikes:

- ECB minions thinking inflation may become entrenched:

- Wall St ends mixed as inflation data comes into focus

- Wednesday, 12 April 2023

-

- Signs and portents for the U.S. economy:

- Fed minions expected to deliver quarter point rate hike in May 2023, less sure of next steps:

- Fed rate hike in May still the odds-on bet

- Several Fed officials considered rate pause in March, minutes show

- Bigger trouble developing all over?

- China's trade likely extended declines in March on weak demand: Reuters poll

- Bank of Canada holds rates, strikes hawkish tone as recession fears fade

- BOJ minions to continue never-ending stimulus:

- ECB minions thinking about bigger rate hikes or pausing them:

- Wall Street closes lower after Fed minutes, inflation data

- Thursday, 13 April 2023

-

- Signs and portents for the U.S. economy:

- U.S. producer prices unexpectedly fall in March

- Biden's subdued reaction to OPEC+ cuts foreshadows economic slowdown, carries risk

- Fed minions expected to hike rates one last time as next move:

- China export data confirms atmospheric CO2 signal, but doesn't dispel worries:

- Bigger trouble developing in U.K.:

- Bank of England's Pill says latest UK data is disappointing

- Britain's Hunt: GDP figures show there's 'no room for complacency'

- Strikes weigh on UK economy which stagnated in February

- ECB minions thinking about quarter point rate hike as next move:

- Wall St rallies to higher close as inflation data feeds Fed pause hopes

- Friday, 14 April 2023

-

- Signs and portents for the U.S. economy:

- US manufacturing output falls in March; rebounds in first quarter

- US retail sales post second straight monthly drop; factory output falls

- U.S. banks highlight office real estate as next big worry

- Some Fed minions thinking one more rate hike and done, others thinking they want more rate hikes, looking forward to "mild" recession:

- Exclusive-Fed can 'hit the mark and hold' with one more rate hike, Bostic says

- Fed's Waller: Not much progress on inflation, higher rates needed

- Fed's Goolsbee says mild U.S. recession feasible

- Slow rebound from zero-COVID lockdowns, bigger stimulus developing in China:

- China's first-quarter GDP growth seen rebounding to 4.0%, 2023 rate seen at 5.4% - Reuters poll

- China's PBOC set to inject fresh funds via medium-term policy loans -survey

- New boss of BOJ minions says all's good with Japan's economy:

- New BOJ chief Ueda sticks to upbeat view on wages, global economy

- Japan inflation seen persisting, export slowdown to push up trade deficit - Reuters poll

- BOJ executive warns of 'extremely high' uncertainty over Japan's economy

- IMF sees BOJ keeping negative rates, scope for tweak to yield cap

- ECB minions still excited about hiking rates:

- Wall St dips to lower close as rate hike bets firm, banks jump

The CME Group's FedWatch Tool estimates a 83% chance the Fed will Federal Funds Rate by a quarter point to a target range of 5.00-5.25% at its upcoming meeting on 3 May (2023-Q2). After that, the FedWatch tool anticipates a series of quarter point rate cuts starting from 26 July (2023-Q3) and continuing at six-to-twelve-week intervals through the CME FedWatch tool's available forecast period, which extends through 25 September 2024 (2024-Q3). The CME FedWatch Tool's most distant forecast anticipates the Federal Funds Rate will reach a target range of 2.75-3.00% at that date.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the first quarter of 2023 rebounded to +2.5% from the previous week's estimate of +1.5%. The so-called Blue-Chip consensus predicts it will be +1.5%, or rather, that's the average of ten forecasts that anticipate real GDP growth anywhere from +0.3% to +2.5% for 2023-Q1). The GDPNow tool is now fully looking backward instead of forward and will continue to do so until the U.S. Bureau of Economic Analysis releases its advance estimate of real GDP on 27 April 2023.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.