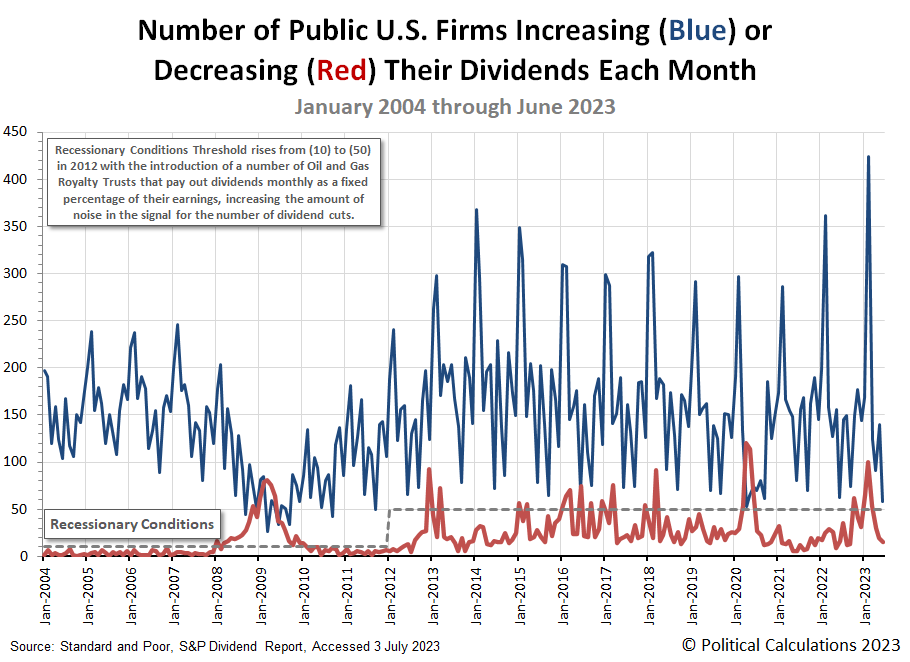

June 2023 marked the end of a mixed quarter for dividend paying stocks in the U.S. stock market. Compared to 2023-Q1, the second quarter recorded significantly fewer dividend decreases, which would ordinarily be an indication of an improved market environment. But it also saw substantially fewer dividend increases, which is the opposite of a sign of robust health for the U.S. stock market.

The same pattern played out in the month-over-month changes for the stock market's dividend payers. Fewer dividend increases, fewer dividend decreases. The reduction in dividend decreases was welcome after May 2023's elevated level, but the absence of more dividend increases is a cause for concern.

As for why the stock market is experiencing that pattern, our working hypothesis is the Fed's ongoing series of rate hikes that began in March 2022 and which only just paused after the most recent quarter point hike took effect in May 2023 is negatively impacting certain publicly-traded firms. While we find direct evidence for their effect in the composition of firms announcing dividend decreases, which we'll discuss later in this analysis, the reason the Fed is implementing rate hikes provides an explanation for why so many fewer firms have increased their dividends. Namely, 2021 and 2022's inflation has come home to roost and the now much higher cost of doing business in an inflationary environment is cutting into corporate earnings, limiting the ability of firms to increase their dividends.

Let's first look at the quarterly data. The following chart shows how the U.S. stock market's dividend increases and decreases recorded in the second quarter of 2023 compares with the four quarters preceding it.

Compared to the preceding quarter of 2023-Q1, the dropoff in number of firms announcing dividend increases during 2023-Q2 especially stands out. The number of dividend decreases represents a more positive development over this short time frame.

But that perception fades somewhat when we compare 2023-Q2 with the second quarter of 2022. The year-over-year changes indicates business conditions have taken a turn for the worse for publicly traded firms in the U.S over the past year.

Let's turn next to monthly data. The next chart tracks the number of U.S. firms that announced they would either increase or decrease their dividends in each month since January 2004.

We've presented June 2023's dividend metadata in the following table, showing how the number of declarations, the favorable changes for dividend increases, resumptions, and extra dividends and negative changes for dividend decreases and omissions have changed both Month-over-Month (MoM) and Year-Over-Year (YoY):

| Dividend Changes in June 2023 | |||||

|---|---|---|---|---|---|

| Jun-2023 | May-2023 | MoM | Jun-2022 | YoY | |

| Total Declarations | 4,904 | 4,093 | 811 ▲ | 4,698 | 206 ▲ |

| Favorable | 100 | 230 | -130 ▼ | 111 | -11 ▼ |

| - Increases | 58 | 140 | -82 ▼ | 63 | -5 ▼ |

| - Special/Extra | 41 | 87 | -46 ▼ | 46 | -5 ▼ |

| - Resumed | 1 | 3 | -2 ▼ | 2 | -1 ▼ |

| Unfavorable | 15 | 20 | -5 ▼ | 16 | -1 ▼ |

| - Decreases | 15 | 20 | -5 ▼ | 16 | -1 ▼ |

| - Omitted/Passed | 0 | 0 | 0 ◀▶ | 0 | 0 ◀▶ |

Let's next drill down into the data for dividend decreases, which tells us where the pressure points for distress are to be found in the U.S. economy. Our sampling of dividend declarations included fifteen dividend reduction announcements, matching the total recorded by Standard and Poor. We're trying something new in how we're presenting the list by explicitly identifying whether the indicated firm pays a fixed dividend, a variable dividend, or a hybrid dividend consisting of both fixed and variable components. Previously, we had utilized color coding to distinguish the types from one another, which we've found is often overriden by sites that republish content from our RSS news feed.

We'll also note that our dividend declaration sources have only recently starting providing sufficiently detailed data to distinguish a hybrid dividend payer from a variable dividend payer. In the case of hybrid or variable payers, an announced decrease is most likely occurring in the variable component of these firms' dividends, which may more often be an indication of typical period-to-period variability than an automatic indication of distress. We treat the period-to-period variation for variable and hybrid dividend payers like background noise, where we are only concerned if the number of firms announcing decreased dividends rises above a threshold that implies an increased level of distress is affecting their industrial sector.

With all that in mind, here's the list of June 2023's dividend decreases. Following the link for the company's name will take you to the news source for the reported decrease:

- Urstadt Biddle Properties (REIT-Retail) (Fixed) (NYSE: UBP)

- Citizens Holding (Fixed) (NASDAQ: CIZN)

- Sabine Royalty Trust (Variable) (NYSE: SBR)

- New York Mortgage Trust (REIT-Mortgage) (Fixed) (NASDAQ: NYMT)

- Hudson Pacific Properties (REIT-Office) (Fixed) (NYSE: HPP)

- Redwood Trust (REIT-Mortgage) (Fixed) (NYSE: RWT)

- Chimera Investment (REIT-Mortgage) (Fixed) (NYSE: CIM)

- AFC Gamma REIT-Specialty (Fixed) (NASDAQ: AFCG)

- Trinseo S.A. (Fixed) (NYSE: TSE)

- Cherry Hill Mortgage (REIT-Mortgage) (Fixed) (NYSE: CHMI)

- Paramount Group (REIT-Office) (Fixed) (NYSE: PGRE)

- Permianville Royalty Trust (Variable) (NYSE: PVL)

- Cross Timbers Royalty Trust (Variable) (NYSE: CRT)

- San Juan Basin Royalty Trust (Variable) (NYSE: SJT)

- Two Harbors Investment (REIT-Mortgage) (Fixed) (NYSE: TWO)

The number of variable dividend payers announcing lower dividend payouts, primarily from the oil and gas industry, falls within the background noise range we expect for the industry given how the price of oil has changed in recent months. What's more significant is the number of Real Estate Investment Trusts (REITs) announcing reduced dividend payouts for their shareholders. These firms are particularly sensitive to rising interest rates, which tells us the Fed's series of rate hikes are indeed having a negative effect on them.

Here's a bigger picture looking at how announcements of dividend decreases have been distributed among the firms whose announcements have been included within our sampling during the past quarter of 2023-Q2.

Firms in the oil and gas sector lead the chart, with 24 dividend reductions declared during 2023-Q2, which is mainly attributable to the decline in oil prices that took place during the quarter. The next three categories however are made of up the kinds of firms most negatively affected by the Fed's ongoing series of rate hikes that began in March 2022, real estate (14), financial services (9), and banks (5). These sectors combine for a total of 28 decreases during the quarter, outnumbering the dividend reductions in the oil and gas sector. In doing that, 2023-Q2 has repeated the pattern from 2023-Q1.

Rounding out the total dividend reductions in our sample, there were three each in the chemical, consumer goods, and shipping industries, and one each in the industrial goods, manufacturing, media, mining and utility sectors. The total number of dividend reducing firms in our sample is 66 for the quarter.

Federal Reserve officials have been signaling they'll hike rates again later this month. We anticipate the negative impact from that particular pressure point for the U.S. economy isn't quite done yet.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. 3 July 2023.

Image credit: Stock Dividend by Nick Youngson on Picpedia. Creative Commons. Attribution-ShareAlike 3.0 Unported (CC BY-SA 3.0). Alpha Stock Images.

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.