A quick story in three charts. First, here are the primary trends we've observed in the seasonally-adjusted initial unemployment insurance claims figures produced by the BLS since January 2006, through the most recently reported data:

Next, here is the residual distribution of the same data, which accounts for the changing level of the new jobless claims data due to the trends we've observed:

Finally, here is a closeup view of the residual distribution for the current trend in new filings for unemployment benefits, which we've projected forward through the end of July 2011, so you can get a sense of what figures to expect the U.S. federal government to report through the end of the next month. We expect these values to hold while the current trend remains in effect:

More information about the major trends in new U.S. layoffs is available here.

Labels: jobs

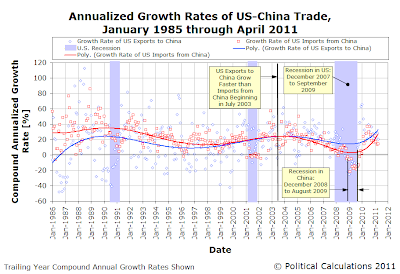

Previously on Political Calculations, we discovered that we can use international trade data to diagnose the relative health of national economies.

The way this works is to consider that a growing economy will demand more goods - a portion of which will be imported from outside the country. By measuring the growth rate of both imports and exports between two nations, we can determine how relatively "healthy" the economies of both nations are.

Our favorite two nations to look at are the U.S. and China. When we looked at the international trade through May 2010 between these two nations, we found that both the U.S. and China had growing economies following recessions and that China's economy seemed to be driving the U.S. economy.

Today, nearly a year later, we find that both nations would appear to have growing economies, but that after the Chinese economy surge in the last quarter of 2009, and the U.S. economy surging in the first half of 2010, both the U.S. and Chinese economies are growing much more slowly.

A special concern now is that the rate of growth of U.S. imports from China is slowing, which indicates that economic growth in the U.S. is comparatively weaker than it is in China.

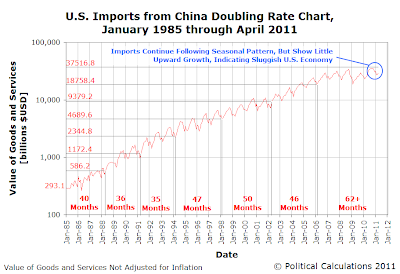

We confirm that outlook in examining our doubling rate chart showing the level of U.S. imports from China from January 1985 through April 2011.

Here, we see that it has been more than five years since the U.S. doubled the amount that it imports from China, which is significantly more than the 3 to 4 years that these imports doubled in the twenty years from 1985 through 2005.

By contrast, see that the value of U.S. exports to China has almost doubled since January 2009, which is putting the period since that time on a pace to potentially beat the shortest doubling time recorded for the value of U.S. exports to China of 32 months, which was set between January 2001 and July 2003.

We suspect that this extremely rapid rate of growth for U.S. exports to China is being largely driven by the China's massive economic bubble, so we would anticipate that U.S. exports may drop considerably once that bubble enters into its deflation phase.

Which like all economic bubbles, will happen. It's only a matter of when and how.

Labels: trade

Say what you will about President Barack Obama, he lets nothing stand in the way of his vision. Especially reality.

While we've known about the President's primary character flaw for some time, we were still highly amused when he decided to blame technological change for putting bank tellers out of work in the United States. Once again, we have another clear cut example of the President's highly cloistered worldview, which only seems to apply in some other world that no one else is able to observe.

But don't take our word for it. Here is the President, in the President's own words, from back on 14 June 2011:

"There are some structural issues with our economy where a lot of businesses have learned to become much more efficient with a lot fewer workers. You see it when you go to a bank and you use an ATM, you don't go to a bank teller, or you go to the airport and you're using a kiosk instead of checking in at the gate."

Well, we decided to put that claim about bank tellers and ATMS to the test. The chart below shows what we found when we dug up the relevant data:

What we find is that the number of both bank tellers and ATMs have generally risen over the past 10 years. The number of both bank tellers and ATMs has fallen in recent years, most likely due to the closure of failed banks, given the distress in that industry since 2008.

So we see that ATMs have been losing work during Obama's presidency too!

Not that President Obama pays attention to these kinds of things. We're sure he's focused on "better" things. Like perhaps new green ATM job programs!

Data Sources

First, here's the annual data for the number of tellers, from the U.S. Bureau of Labor Statistics:

- 1999 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2000 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2001 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2002 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2003 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2004 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2005 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2006 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2007 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2008 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2009 National Occupational Employment and Wage Estimates, 43-3071 Tellers

- 2010 National Occupational Employment and Wage Estimates, 43-3071 Tellers

Here are our sources for the number of automated teller machines in the U.S. for the years from 1999 through 2009 (at this writing, we're not aware of the figure for 2010):

- ATM Use in the United States - 1999-2008

- ATMs by the Numbers - 2009

Two weeks ago, we revealed that the earnings future data for the S&P 500 was suggesting that 2012 would a year of little to no earnings growth for the private sector of the U.S. economy.

Over the past week, the future outlook for investors in 2012 took a turn for the worse as the expected future dividends data for the S&P 500 began to deteriorate.

The change marks the first time since early 2010 that we've seen anything resembling a sustained downward trend in this particular data stream. The negative change comes after the S&P 500's expected future dividends per share essentially went flat after 22 May 2011. It is especially significant in that changes in the growth rate of dividends per share provides the fundamental signal for driving changes in the growth rate of stock prices.

The bottom line is that if the stock market's dividend futures have gone negative, so has the real outlook for the U.S. economy in 2012.

Sometimes, you just need to go for the ride....

2CELLOS Luka Sulic and Stjepan Hauser playing their arrangement of Welcome To The Jungle by Guns N' Roses (HT: Innocent Bystanders).

Labels: none really

What are the unintended consequences of taxing U.S. businesses so much more on their payrolls than their corporate incomes?

This isn't necessarily an intellectual exercise - this is something that has been the case since 1978, when the amount of taxes paid by U.S. businesses first began regularly exceeding the amount of taxes they collectively paid on their business incomes.

Yesterday, we hypothesized that U.S. businesses would respond by shifting jobs outside of the United States, since that would be the most likely way they could preserve their revenues while avoiding the employers' portion of U.S. payroll taxes.

Today, we'll go a step further - we'll hypothesize that the jobs that would most likely be displaced in this way would most likely be in manufacturing. The reason why is because manufacturing is something that isn't necessarily location specific, as most service type occupations are.

For example, it doesn't really matter much where your mobile phone is manufactured - it could be in Europe, or Asia, here in America or in Africa for that matter - no matter where it might have been produced, it will still be the same mobile phone.

By contrast, the service occupations that support your mobile phone will be location specific. You can likely easily find local outlets for your service provider, which must be fairly close to where the customers for mobile phone service are.

To find out what's happened since 1978, we've created a chart showing the number of people who have been recorded as being employed in manufacturing in the United States from 1960 through 2010 (indicated on the left scale), against which we are showing the amount of U.S. direct investment abroad over the same period (indicated on the right scale), which indicates how much American businesses have invested in places other than the U.S.

Since that money has gone outside of the U.S., we're showing that value as a negative quantity. Aside from that, we've scaled our chart so that the numbers of manufacturing employees and the amount of U.S. direct investment abroad for 1978 are close to each other on the chart, and then we adjusted the vertical scales so that the horizontal gridlines on both scales would line up. Here are our results:

What we observe is that when federal payroll tax collections on businesses were lower than corporate income taxes, the number of Americans employed in manufacturing generally rose.

After 1978 however, as federal tax collections on U.S. employer payrolls have steadily risen to become the dominant form of taxation on U.S. businesses, the number of manufacturing employees has generally fallen. We see that there appears to be somewhat of a correlation between the two data streams.

There's more to it than just taxation however, as is pointed out in Andrew Butter's insider look, which is absolutely essential reading, at what other factors induced U.S. manufacturers to move out of America. We'll simply observe for our part that the disproportionate taxation of U.S. businesses on their payrolls would provide an ongoing financial incentive to drive such a change.

Data Sources

Bureau of Economic Analysis. U.S. International Transactions Accounts Data. Table 1. U.S. International Transactions [Millions of dollars] - Line 51. Release Date: March 16, 2011.

Federal Reserve Bank of St. Louis. All Employees: Manufacturing (MANEMP), Thousands, Monthly, Seasonally Adjusted. Accessed 19 June 2011.

Labels: business, economics, taxes

Let's say that you run your own business, which is located in the United States. If you've been running your own business since 1978, you've probably noticed that you pay a lot more taxes in the form of the employers' portion of federal payroll taxes than you do in outright corporate income taxes.

That's perhaps not so surprising, since the U.S. federal government has pretty much traded employer payroll taxes for corporate income taxes going back all the way to 1946. Over that time, as the amount of money the government collects from taxes on employer payrolls has increased, the amount of money the government collects from corporate income taxes has decreased, almost dollar for dollar.

Now, as a business owner who is always looking to reduce your expenses, how might how you pay your taxes affect how you go about doing that with your annual tax bill?

If the majority of taxes you pay to the federal government is in the form of the employers' portion of federal payroll taxes, you would likely consider one of the following options:

- Reduce the incomes of the people on your payroll.

- Reduce the number of people on your payroll.

The first option is difficult to pull off in practice. Thanks to the effect of inflation over time and competition for your employees services, it's unlikely that you'll ever negotiate a pay cut for your employees that would stick for long.

The second option though might be more viable. You can perhaps work to make your employees become more productive, doing more with fewer people.

But there are limits to how productive you can make your employees, especially if you work in a competitive environment where your competitors are making similar investments, where the gains you might make might be very short-lived.

And then, what if the work your employees do is such that you must still maintain a good number of people on your payroll. Especially if having too few people would means your business would lose out on business, and revenue, that it might otherwise earn.

One way to get around that obstacle would be to keep people on your payroll, but to put them on your payroll in a way that avoids your having to pay U.S. federal payroll taxes on them. The obvious solution here would be to outsource work to other firms, particularly to those outside the jurisdiction of U.S. tax laws.

You might get lucky and find foreign firms who can already do the work that your business needs to have done, but then, you might not get lucky and you'll have to find a way to build a portion of your business over again, but in a foreign land.

That takes money. A lot of money. And since 1978, that's exactly what a lot of U.S. businesses appear to have done. The chart below reveals the U.S. Bureau of Economic Analysis' data on the exponential growth of U.S. business direct investment abroad since 1960.

From 1960 through 1977, U.S. direct investment abroad grew at an average annual rate of 9.69%, which means that the total amount of U.S. investments abroad would double once roughly every 7.4 years. But then, that was before the amount of taxes that businesses pay on their payrolls in the U.S. regularly began exceeding the amount of their corporate income tax bills.

From 1978 through 2010, as the amount of taxes businesses have to pay for having employees has grown and grown, businesses have increased the amount of their investments in their businesses outside of the U.S. at a much faster pace. Since 1978, U.S. direct investment abroad has grown at an average annual rate of 11.24%, which means that the amount of direct investment by U.S. businesses outside of the U.S. has been doubling every 6.4 years.

The growth rate of U.S. direct investment abroad is even steeper than that if we use 1982 as our starting point. Since 1982, U.S. direct investment abroad has grown at an average rate of 12.25%, which corresponds to direct investment abroad doubling in size every 5.9 years.

The period since 1982 is significant because the very next year marked a significant and permanent increase in the tax rates that apply for federal payroll income taxes. On 20 January 1983, the National Commission on Social Security Reform recommended hiking payroll taxes to prepare for the retirement of the Baby Boom generation. On 20 April 1983, those recommendations became law as the Social Security Amendments of 1983.

These payroll tax increases could well have provided the increased financial motivation for U.S. businesses to increasingly invest so much more outside the United States, where they could avoid the U.S.' relatively higher taxes. We'll soon check into the unintended consequences to the U.S. economy from this single change in U.S. tax policy and its incentive effect upon U.S. businesses.

Labels: taxes

Looking back over the past fifty years, we find that before 1978, U.S. corporations and businesses paid the largest portion of their taxes in the form of federal corporate income taxes. After 1978, they paid the largest portion of their taxes in the form of the employers' portion of federal payroll taxes.

Despite these changes, the total amount that U.S. corporations and businesses pay in federal taxes as a percentage of annual GDP has been fairly steady through all that time, typically ranging between 4.5% and 5.5% of annual GDP, at least outside of the deep recessions or short-lived economic booms that have taken place since 1960.

Food for thought: For the years since 1978, what is the most significant outcome of that single change in how U.S. corporations pay the majority of their taxes?

The Chronicle of Higher Education came out with a cool interactive graphic showing the economic value of a bachelor's degree by college major.

But, there's a problem with presenting data like this - it makes the user one-step removed from being able to quickly visualize where their major of interest ranks among others. Worse, because when you highlight over a given academic category to drill down into the actual major of interest, the pop-up display that appears covers over the adjacent majors, making it time-consuming to see how it compares to those other fields.

Now, it's not anywhere near as pretty, but we've compiled all the data presented in the Chronicle's interactive graphic into the dynamic table below, which will allow you to sort the data by academic category, major and even the median salary by clicking the column headings (if you're accessing this post through an RSS feed, you'll need to click through to our original post to gain that functionality!)

We've also added the U.S. Census' data for 2009 on the median earnings of all income earners, as well as all those who work in full-time, year round occupations, and also those who have earned bachelor degrees and who work in full-time, year round occupations for comparison purposes. Enjoy!

| Median Salaries by Occupation, 2010 |

|---|

| Category | Major | Median Salary |

|---|---|---|

| Agricultural and Natural Resources | Food Sciences | $65,000 |

| Agricultural and Natural Resources | Agricultural Economics | $60,000 |

| Agricultural and Natural Resources | Forestry | $60,000 |

| Agricultural and Natural Resources | Agricultural Production and Management | $50,000 |

| Agricultural and Natural Resources | Natural Resources Management | $50,000 |

| Agricultural and Natural Resources | Plant Science and Agronomy | $50,000 |

| Agricultural and Natural Resources | Agriculture (Miscellaneous) | $47,000 |

| Agricultural and Natural Resources | Agriculture (General) | $45,000 |

| Agricultural and Natural Resources | Animal Sciences | $44,000 |

| Arts | Film, Video and Photographic Arts | $46,000 |

| Arts | Commercial Arts and Graphic Design | $45,000 |

| Arts | Fine Arts | $45,000 |

| Arts | Music | $42,000 |

| Arts | Drama and Theater Arts | $40,000 |

| Arts | Studio Arts | $40,000 |

| Arts | Visual and Performing Arts | $40,000 |

| Biology and Life Science | Microbiology | $60,000 |

| Biology and Life Science | Biochemical Sciences | $53,000 |

| Biology and Life Science | Environmental Science | $51,000 |

| Biology and Life Science | Biology (General) | $50,000 |

| Biology and Life Science | Biology (Miscellaneous) | $50,000 |

| Biology and Life Science | Zoology | $50,000 |

| Biology and Life Science | Molecular Biology | $45,000 |

| Biology and Life Science | Physiology | $45,000 |

| Biology and Life Science | Ecology | $44,000 |

| Biology and Life Science | Botany | $42,000 |

| Business | Business Economics | $75,000 |

| Business | Actuarial Science | $68,000 |

| Business | Management Information Systems and Statistics | $67,000 |

| Business | Finance | $65,000 |

| Business | Operations Logistics and e-Commerce | $65,000 |

| Business | Accounting | $63,000 |

| Business | Business (General) | $60,000 |

| Business | Business Management and Administration | $58,000 |

| Business | Marketing and Marketing Research | $58,000 |

| Business | Human Resources and Personnel Management | $55,000 |

| Business | International Business | $55,000 |

| Business | Business (Miscellaneous) | $53,000 |

| Business | Medical Administration | $53,000 |

| Business | Hospitality Management | $50,000 |

| Communications and Journalism | Journalism | $51,000 |

| Communications and Journalism | Advertising and Public Relations | $50,000 |

| Communications and Journalism | Communications | $50,000 |

| Communications and Journalism | Mass Media | $45,000 |

| Computers and Mathematics | Mathematics and Computer Science | $98,000 |

| Computers and Mathematics | Applied Mathematics | $76,000 |

| Computers and Mathematics | Computer Engineering | $75,000 |

| Computers and Mathematics | Computer Science | $75,000 |

| Computers and Mathematics | Mathematics | $67,000 |

| Computers and Mathematics | Information Sciences | $66,000 |

| Computers and Mathematics | Computer and Information Systems | $62,000 |

| Computers and Mathematics | Computer Programming and Data Processing | $56,000 |

| Computers and Mathematics | Computer Adminstration Management and Security | $55,000 |

| Computers and Mathematics | Computer Networking and Telecommunications | $55,000 |

| Computers and Mathematics | Communication Technologies | $50,000 |

| Education | Education (Miscellaneous) | $50,000 |

| Education | Secondary Teacher Education | $46,000 |

| Education | Physical and Health Education Teaching | $45,000 |

| Education | Mathematics Teacher Education | $45,000 |

| Education | Science and Computer Teaching Education | $44,000 |

| Education | Scoence and Computer Teacher Education | $43,000 |

| Education | Art and Music Education | $42,000 |

| Education | Education (General) | $42,000 |

| Education | Language and Drama Education | $42,000 |

| Education | Social Science or Teacher Education | $42,000 |

| Education | Special Needs Education | $42,000 |

| Education | Teacher Education (Multiple Levels) | $41,000 |

| Education | Elementary Education | $40,000 |

| Education | Early Childhood Education | $36,000 |

| Engineering | Petroleum Engineering | $120,000 |

| Engineering | Aerospace Engineering | $87,000 |

| Engineering | Chemical Engineering | $86,000 |

| Engineering | Electrical Engineering | $85,000 |

| Engineering | Naval Architecture and Marine Engineering | $82,000 |

| Engineering | Mechanical Engineering | $80,000 |

| Engineering | Metallurgical Engineering | $80,000 |

| Engineering | Mining and Mineral Engineering | $80,000 |

| Engineering | Civil Engineering | $78,000 |

| Engineering | Engineering Mechanics, Physics and Science | $78,000 |

| Engineering | Environmental Engineering | $75,000 |

| Engineering | Industrial and Manufacturing Engineering | $75,000 |

| Engineering | Environmental Engineering | $70,000 |

| Engineering | Engineering (General) | $70,000 |

| Engineering | Materials Engineering and Materials Science | $69,000 |

| Engineering | Engineering (Miscellaneous) | $69,000 |

| Engineering | Biomedical Engineering | $68,000 |

| Engineering | Electrical Engineering Technology | $68,000 |

| Engineering | Architectural Engineering | $65,000 |

| Engineering | Industrial Production Technologies | $65,000 |

| Engineering | Mechanical Engineering-Related Technologies | $64,000 |

| Engineering | Architecture | $63,000 |

| Engineering | Engineering Technologies (Miscellaneous) | $62,000 |

| Engineering | Engineering Technologies (General) | $60,000 |

| Engineering | Biological Engineering | $55,000 |

| Health | Pharmacy Pharmaceutical Sciences and Administration | $105,000 |

| Health | Nursing | $60,000 |

| Health | Treatment Therapy Professions | $60,000 |

| Health | Medical Technologies Technicians | $58,000 |

| Health | Medical Assisting Services | $56,000 |

| Health | Health and Medical Adminstrative Services | $55,000 |

| Health | Community and Public Health | $48,000 |

| Health | Nutrition Sciences | $46,000 |

| Health | Medical and Health Services (General) | $45,000 |

| Health | Miscellaneous Health Medical Professions | $42,000 |

| Health | Health and Medical Preparatory Programs | $40,000 |

| Humanities and Liberal Arts | United States History | $57,000 |

| Humanities and Liberal Arts | Art History and Criticism | $50,000 |

| Humanities and Liberal Arts | History | $50,000 |

| Humanities and Liberal Arts | English Language and Literature | $48,000 |

| Humanities and Liberal Arts | Humanities | $48,000 |

| Humanities and Liberal Arts | Liberal Arts | $48,000 |

| Humanities and Liberal Arts | Other Foreign Languages | $48,000 |

| Humanities and Liberal Arts | Philosophy and Religious Studies | $48,000 |

| Humanities and Liberal Arts | Anthropology and Archaeology | $45,000 |

| Humanities and Liberal Arts | Area Ethnic and Civilization Studies | $45,000 |

| Humanities and Liberal Arts | Composition and Speech | $45,000 |

| Humanities and Liberal Arts | French, German, Latin, and Other Common Foreign Language Studies | $45,000 |

| Humanities and Liberal Arts | Linguistics and Comparative Language and Literature | $45,000 |

| Humanities and Liberal Arts | Intercultural and Internatinoal Studies | $44,000 |

| Humanities and Liberal Arts | Theology and Religious Vocations | $38,000 |

| Industrial Arts and Consumer Services | Construction Services | $70,000 |

| Industrial Arts and Consumer Services | Transportation Sciences and Technologies | $64,000 |

| Industrial Arts and Consumer Services | Electrical and Mechanic Repairs and Technologies | $57,000 |

| Industrial Arts and Consumer Services | Cosmetology Services and Culinary Arts | $46,000 |

| Industrial Arts and Consumer Services | Physical Fitness, Parks, Recreation, and Leisure | $43,000 |

| Industrial Arts and Consumer Services | Family and Consumer Sciences | $40,000 |

| Law and Public Policy | Public Administration | $59,000 |

| Law and Public Policy | Criminal Justice and Fire Protection | $50,000 |

| Law and Public Policy | Prelaw and Legal Studies | $49,000 |

| Law and Public Policy | Public Policy | $48,000 |

| Physical Sciences | Oceanography | $70,000 |

| Physical Sciences | Physics | $70,000 |

| Physical Sciences | Physical Sciences | $69,000 |

| Physical Sciences | Atmospheric Sciences and Meteorology | $67,000 |

| Physical Sciences | Geology and Earth Science | $62,000 |

| Physical Sciences | Chemistry | $58,000 |

| Physical Sciences | Science (Multidisciplinary or General) | $55,000 |

| Physical Sciences | Nuclear, Industrial-Radiology and Biological Technologies | $52,000 |

| Psychology and Social Work | Industrial and Organizational Psychology | $53,000 |

| Psychology and Social Work | Psychology (Miscellaneous) | $45,000 |

| Psychology and Social Work | Psychology (General) | $45,000 |

| Psychology and Social Work | Communication Disorders Sciences and Services | $40,000 |

| Psychology and Social Work | Social Work | $39,000 |

| Psychology and Social Work | Human Services and Community Organization | $38,000 |

| Psychology and Social Work | Couseling Psychology | $29,000 |

| Social Science | Economics | $70,000 |

| Social Science | Statistics and Decision Science | $67,000 |

| Social Science | Political Science and Government | $59,000 |

| Social Science | Geography | $54,000 |

| Social Science | Social Sciences (Miscellaneous) | $51,000 |

| Social Science | International Relations | $50,000 |

| Social Science | Social Sciences (General) | $49,000 |

| Social Science | Criminology | $48,000 |

| Social Science | Social Sciences (Interdisciplinary) | $48,000 |

| Social Science | Sociology | $45,000 |

| Median Income | All Income Earners in 2009 | $26,134 |

| Median Income | Full Time, Year Round Income Earners in 2009 | $42,401 |

| Median Income | Full Time, Year Round Bachelor Degree Holding Income Earners in 2009 | $56,864 |

We may be tweaking the presentation of data in the median earnings column, where our dynamic table sorting routine has trouble may have trouble properly ranking six-figure incomes.

Labels: education

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.