Every four years, we celebrate Leap Day as the shortest month of February gets extended by an extra day and we have to cope with the idea that 29 February is just like any other day.

That's an inaccurate statement, because there are years where you would think there might be a 29 February inserted into the calendar, but isn't. Those are years that can be divided evenly by 100 and the next time that 29 February will be left out of the calendar after a four year interval will be in 2100.

But that's not quite right either, because there are plans to insert a 29 February into the calendar for 2400. And every 400 years after that.

It's all very complicated, but fortunately in the leap year of 2016, Matt Parker took the time to not only explain why 29 February keeps getting added to the calendar when it does and why it doesn't when you think it should, but also how to fix it so calendars make more sense.

Glad to have that all sorted! Now if we can just get him working on fixing daylight savings time.

Labels: math, none really

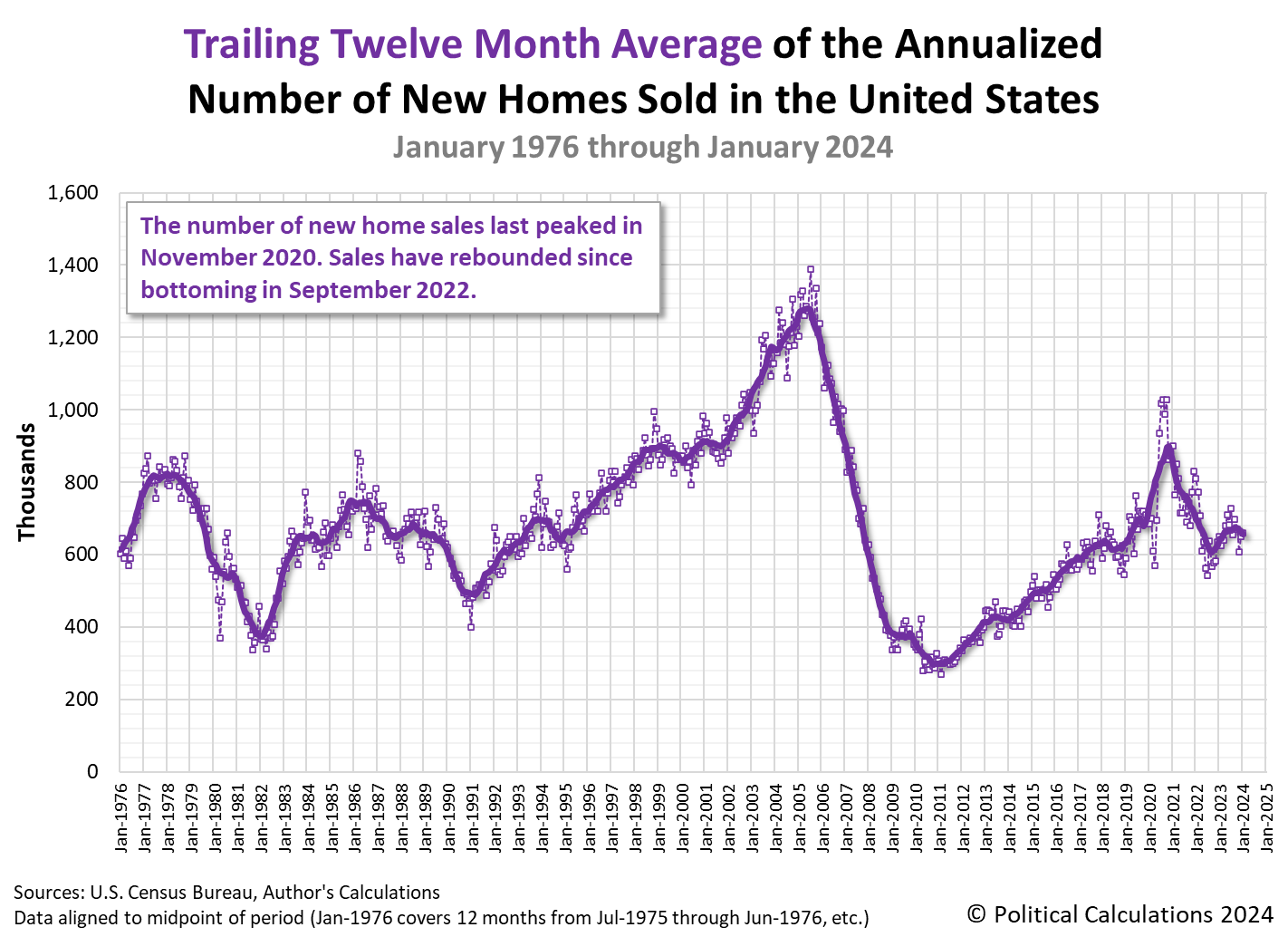

The market capitalization of the U.S. new home market dipped in January 2024. At an initial estimate of $26.63 billion, it was down about 1% from December 2023's revised estimate of $26.98 billion. The valuation of new homes sold in the U.S. has been trending downward since September 2023, when it recorded a value of $28.30 billion.

The new home market cap also remains some 11.6% below its post-housing bubble peak of $30.12 billion, which was recorded in December 2020. That month represents the high water mark for the recovery of U.S. new home builders following the deflation of the early 2000's housing bubble.

The U.S. Census Bureau's initial estimate of the average price for a new home sold in January 2024 is $534,300, which is up significantly from December 2023's revised estimate of $493,400. The seasonally-adjusted and annualized number of new homes sold in January 2024 is 661,000, which was an increase from the preceding month's 651,000. These upward changes were not enough to alter the downward trend for the U.S. new home market cap however.

The following charts track the trends for the U.S. new home market capitalization, number of new home sales and new home sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through January 2024.

Considering the state of the market, the same "golden handcuffs" phenomemon that has hamstrung the existing home sales market in 2022 and 2023 is both very real and has continued into 2024. The phenomenon is boosting new home sales, which could have even higher in January 2024 if not for unusually cold weather, particularly in the southern region of the United States.

Both these factors are prominently mentioned in news reports on January 2024's new home sales figures.

Sales of new U.S. single-family homes rose less than expected in January amid a sharp decline in the South region, but demand for new construction remains underpinned by a persistent shortage of previously owned homes.

New home sales increased 1.5% to a seasonally adjusted annual rate of 661,000 units last month, the Commerce Department's Census Bureau said on Monday. The sales pace for December was revised lower to 651,000 units from the previously reported 664,000 units.

"The new side of the housing market continues to greatly outperform when measured against the market for existing homes," said Daniel Vielhaber, an economist at Nationwide. "As the existing home inventory shortage persists, buyers continue to be pushed into the market for new homes."

Economists polled by Reuters had forecast new home sales, which account for about 14.2% of U.S. home sales, would rise to a rate of 680,000 units. Large parts of the country experienced freezing temperatures in January, which could have kept some potential buyers home. The frigid weather weighed on retail sales, homebuilding and factory production in January.

To see what they mean about unseasonably cold weather in much of the U.S. Census Bureau's "South" region, we pulled the NOAA's climate data for January 2024. Here are maps showing what average temeratures are in the lower 48 contiguous states and where temperatures were either unseasonably warm or cold.

The number of sales were up in the Northeast, Midwest, and West, significant portions of which were unseasonably warm. That sales were down in the South with unseasonably cold weather is consistent with the hypothesis new home sales were affected by January 2024's weather.

The same article also indicates U.S. mortgage rates also crept back up toward the 7.0% threshold during the month. We'll check out the effect of that on the affordability of new homes in the very near future.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 February 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 February 2024.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "A photograph of a new home that is under construction."

Labels: real estate

You've almost certainly seen marketing for medications that combine two different kinds of medicine into one tablet or pill. A common example is over-the-counter cold medication that combines a fever reducer with a decongestant, which can be argued makes sense. If you have both a fever and a stuffy nose, you can see the logic. It's convenient and it may be cheaper to buy a single product that combines two medications than buying the two medications separately.

But how often does that make sense? For example, it's pretty easy to find over-the-counter medications like Advil (ibuprofen) and Tylenol (acetaminophin) at very low prices. But GlaxoSmithKline (GSK) is selling a product that combines both these medications into a single pill under it's Advil brand name. We recently found it at Walmart, where you can get 144 coated caplets made with 125 mg of ibuprofen and 250 mg of acetominophen each for $17.98, which is about $0.125 per pill.

What would we need to do to duplicate that dosage with separate ibuprofen and acetaminophen pills to find that cost? We found we couldn't find the specific amount of each medication in a single pill, but what if we had a precision pill cutter? What would it take to divide up the pills to get these specific dosage amounts?

Starting with the 100 coated caplets with 200mg of Advil-branded ibuprofen we can get at Walmart for $9.98, we could divvy up the caplets and remake them to have 125 mg of ibuprofen each and have the equivalent of 160 pills that would cost a little under $0.062 each.

We can do something similar with the containers of regular strength Tylenol with 100 tablets of 325 mg acetaminophen that we can also buy at Walmart for $6.97. Pulling out our precision pill cutter again to remake these tablets into pills with a dose of 200 mg acetaminophen each, we would have 162-and-a-half pills, each costing a little under $0.043.

The cost for our equivalent pills of 125 mg of ibuprofen and 200 mg of acetaminophen works out be about $0.105 when buying each medication separately. That's 16% lower than the $0.125 per pill cost of the "dual action" pills that GSK markets. This is also using the brand-name version of these medications. We could almost certainly get the cost even lower by switching to generic sources. But it also means that at a minimum, GSK is pocketing an extra two cents a pill according this math!

Let's keep in mind there's nothing special about the dual action pill that either makes it work better or easier to take than the single-action pills. That point is driven home by Dr. Josh Bloom of the American Council on Science and Health, who gives a bit of history and describes what studies say about how effective the medication is:

In 2020, Glaxo-SmithKline received FDA approval to sell Advil Dual Action, a combination of ibuprofen and acetaminophen in one pill containing 125 mg of ibuprofen (1) and 250 mg of acetaminophen. The directions tell you to take two caplets every eight hours (no more than six per day), making the combined daily dose 750 mg of ibuprofen and 1,500 mg of acetaminophen. In a press release, GSK writes: [my emphasis]

The submission in support of today’s approval of Advil Dual Action was based on data from seven clinical studies, three of which were pivotal efficacy and safety studies in pain relief. The data supports a pain relief indication and demonstrates that the fixed-dose combination achieves superior efficacy compared to the individual monocomponents of ibuprofen (250mg) and acetaminophen (500mg) alone (as evidenced by appreciable improvements in acute pain symptoms across multiple pre-specified endpoints).

Sleaze alert!

GSK probably doesn't want you to read or understand the paragraph above. Why? Because the company isn't comparing the efficacy of Advil Dual Action to a combination of ibuprofen and acetaminophen pills taken together. The key word here is "alone." When taken together, there is good evidence that the two drugs work better than either alone.

Ibuprofen plus paracetamol combinations provided better analgesia than either drug alone (at the same dose), with a smaller chance of needing additional analgesia over about eight hours, and with a smaller chance of experiencing an adverse event.

Derry, et. al, Cochrane Library 24 June 20 https://doi.org/10.1002/14651858.CD010210.pub2

However, the company does not compare the combination of the two drugs to its product; it just compares its product to both alone. Will the same doses of the two separate pills together work as well? Bet the house on it.

A two-cent a pill savings may not sound like much. For you, every time you buy 50 of the dual action pills instead of the single-action versions, it's an extra dollar out of your pocket without much of any additional benefit. Multiply you by millions of others like you who might buy these dual action pills, and you'll find its very big money for GSK.

Unless the convenience is worth the extra price you're paying, odds are this is a case where two pills are better than one.

Image credit: Microsoft Copilot Designer. Prompt: "A pill cutter splitting one pill into two pills."

Labels: health care, personal finance

The S&P 500 (Index: SPX) rose over 1.6% during the trading week ending on Friday, 23 February 2024. The index closed out the week at 5,088.80, a new record high.

It was a trading week when there was really only one big stock market story. Shares of Artificial Intelligence (AI) capable computer chip maker Nvidia (Nasdaq: NVDA) surged on Thursday, 22 February 2024, rising 16.4% above it's previous day's close to reach $785.38 per share as the company reported blowout earnings and boosted its business outlook.

On Friday, 23 February 2024, the company was knocking on the door of a $2 trillion market capitalization, surging past online retailing giant Amazon (NASDAQ: AMZN) and joining Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) in that accomplishment. Together, the S&P 500's big three components of MSFT, AAPL, and NVDA represent over one-sixth of the total value of the index.

Since NVDA is a component of the S&P 500, its surging share price prompted the entire index to rise by 2.1% on Thursday, 22 February 2024. As our longtime readers know, any daily change of 2% or more qualifies as an "interesting" day for the stock market.

The following update to the alternative futures chart shows how this action affected the trajectory of the S&P 500 during the week that was.

Even with Nvidia's blowout earnings report, investors remain focused on the second quarter of 2024 in setting the trajectory of the S&P 500. We find it running near the upper end of the redzone forecast range we've added to account for the past volatility of stock prices the dividend futures-based model uses as base reference points for projecting the index' potential future trajectories. The new redzone forecast range will run through the end of March 2024.

There was more stuff that happened to shape the future expectations of investors during the past week, which reinforces this observation. Here are the Presidents Day holiday-shortened trading week's market moving headlines.

- Tuesday, 20 February 2024

-

- Signs and portents for the U.S. economy:

- Oil prices hold near 3-week highs on Middle East tensions, China demand

- NYCB stock rout prompts US bank regulators to conduct health checks

- Fed minions expected to start rate cuts in June 2024:

- Fed to cut US rates in June, risks skewed towards later move: Reuters poll

- US hard landing bets rise in rate options market after Fed hikes

- Bigger stimulus developing in China:

- China slashes mortgage reference rates to revive property market

- China central bank leaves key policy rate unchanged under shadow of Federal Reserve

- Bigger trouble developing in Eurozone:

- Nasdaq, S&P, Dow close in the red as tech stocks slide in run-up to Nvidia results

- Wednesday, 21 February 2024

-

- Signs and portents for the U.S. economy:

- Oil dips as investors weigh up US rate cut outlook

- Tumbling US natural gas prices prove unstoppable, hurting producers

- Fed minions dare not start cutting rates too soon, didn't like January 2024's inflation data, thinking about what's next for managing its balance sheet:

- Fed worried about cutting rates too soon, minutes of January meeting show

- US inflation data for January made Fed's job 'harder,' Barkin says

- Fed officials will dive into balance sheet debate at March FOMC

- Bigger stimulus developing in China:

- Nasdaq ends well off session low, S&P and Dow stage reversal ahead of Nvidia's results

- Thursday, 22 February 2024

-

- Signs and portents for the U.S. economy:

- Oil settles higher as pressure mounts in the Middle East

- US farmers face harsh economics with record corn supplies in silos

- US existing home sales rise to five-month high in January

- Fed minions send mixed messages on 2024 rate cuts:

- Fed's Waller sees 'no rush' to cut interest rates

- Fed's Harker: Timing of first central bank rate cut may be close

- Fed's Jefferson sees progress on inflation, says rate cuts linked to broad set of data

- Fed's Cook: need more confidence on inflation before cutting rates

- Bigger stimulus developing in China:

- BOJ minions watch Japan stock market hit first new high in decades:

- ECB minions losing money:

- Dow jumps, Nasdaq and S&P each post best day in over a year on Nvidia euphoria

- Friday, 23 February 2024

-

- Signs and portents for the U.S. economy:

- Fed cautious on a rate cut case that has yet to be made

- Bigger stimulus developing in China:

- Bigger trouble still developing in China:

- China's new home prices extend declines despite policy support

- China's woes won't slow US economy, but excess capacity a concern, says Treasury's Adeyemo

- Central bank minions losing money hand over fist:

- ECB minions say they'll resist cutting interest rates too soon:

- Nasdaq, S&P, Dow gain more than 1% each for the week, boosted by Nvidia euphoria

The CME Group's FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2), unchanged from last week.

Meanwhile, the Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) remains at +2.9%, as its next update will be on 27 February 2024.

Image credit: Microsoft Bing Image Creator. Prompt: "An artificial intelligence computer chip with the letters NVDA in the middle."

The Bureau of Labor Statistics issued its 2023 report on union members in the U.S. work force last month. The report was a mixed one for labor unions, which saw an increase in the number of Americans who are union members, but a decrease in their percentage among all wage and salary earners.

The report itself makes for dry reading, because it's mostly a text summary of information that's been otherwise compiled into data tables. For us, that's an opportunity because it's the kind of information that begs to be visualized.

For example, the report presents information on union membership in both the private and public sectors of the U.S. economy, but falls short in its presentation. Here's an excerpt (boldface emphasis ours):

In 2023, 7.0 million employees in the public sector belonged to unions, compared with 7.4 million workers in the private sector. (See table 3.)

In the public sector, both union membership and the union membership rate (32.5 percent) were little changed over the year. In 2023, the union membership rate continued to be highest in local government (38.4 percent), which employs many workers in heavily unionized occupations, such as police officers, firefighters, and teachers.

The number of union workers employed in the private sector increased by 191,000 to 7.4 million in 2023, while the unionization rate was unchanged at 6.0 percent. Industries with high unionization rates included utilities (19.9 percent), transportation and warehousing (15.9 percent), educational services (12.9 percent), and motion picture and sound recording industries (12.1 percent). Low unionization rates occurred in finance (1.2 percent), professional and technical services (1.3 percent), food services and drinking places (1.4 percent), and insurance (1.5 percent).

Those are certainly numbers. Fortunately, they are numbers that are relatively easy to visualize. We've done that with the following chart visualizing a portion of the data we emphasized and adding some basic text to tell the bigger story.

Presenting the data this way provides a visual sense of how the numbers in the both private and public sectors directly compare with each other. The alternative would be to go down to Table 3 in the report and then scroll up and down within it to where the referenced data. Using the stacked bar chart format also visually communicates the share of union members among all workers in each sector.

We added the "By the Numbers" text to explicitly state the percentage data and the year-over-year increase in union membership. We also added a bonus data point, describing the now seven decade-long trend in falling union membership the BLS report only partially covers because they've only been reporting it for four decades.

In any case, there's quite a lot of data within the report that may be interesting, like the percentage breakdown of union members by occupation or industry. Some of it may even be worth visualizing, but we'll leave that as an exercise to other dataviz enthusiasts! How would they make this report more visually engaging?

References

U.S. Bureau of Labor Statistics. Union Members - 2023. Table 3. Union affiliation of employed wage and salary workers by occupation and industry, 2022-2023 annual averages. [PDF Document]. 23 January 2024.

Pew Research Center. 10 facts about American workers. [Online Article]. 29 August 2019.

Image credit: Stable Diffusion. Prompt: "A stacked bar chart with two bars, shades of green."

Labels: data visualization, demographics

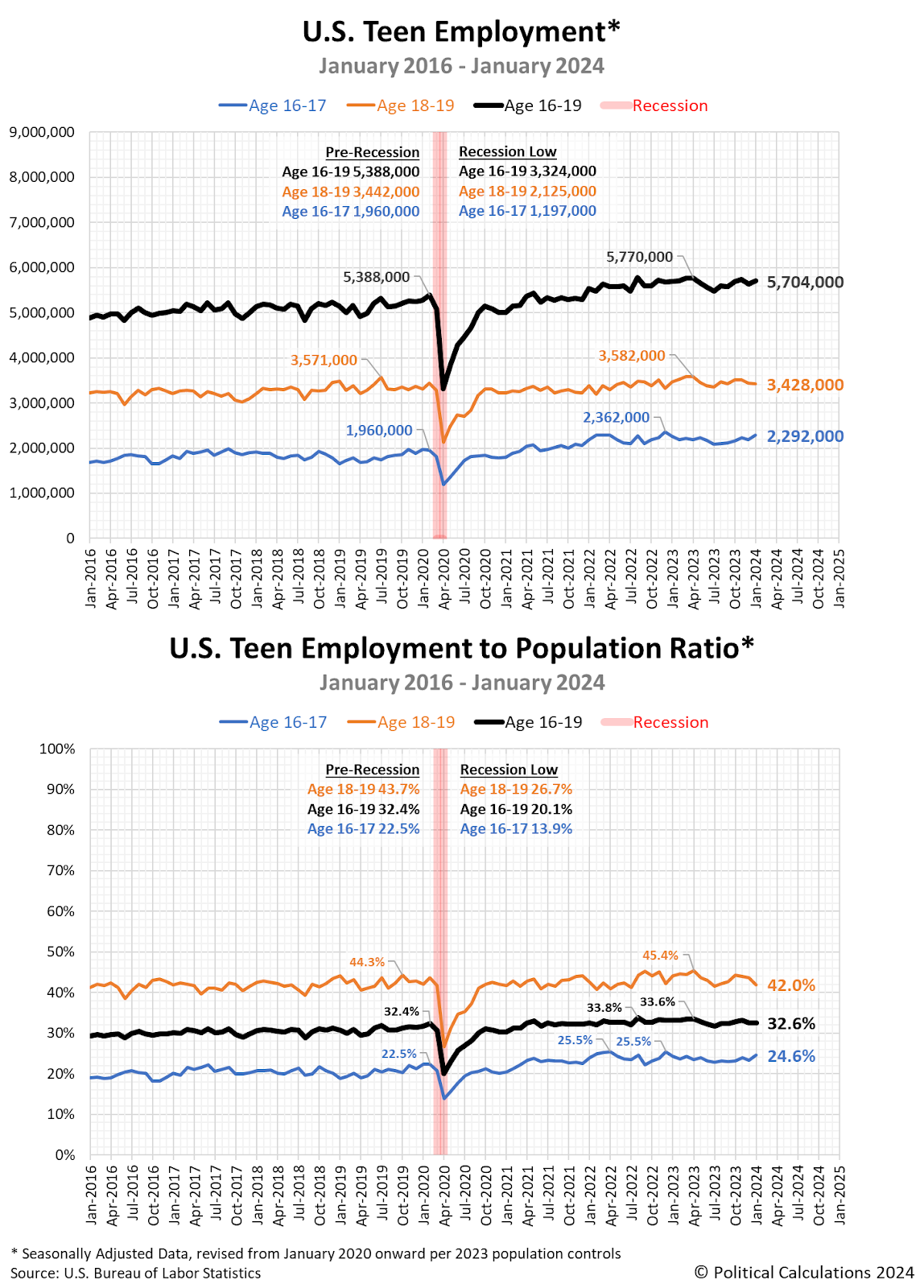

After ending 2023 on a down note, the employment situation for U.S. teens was mostly unchanged in January 2024.

That's good news, particularly for younger teens. This demographic has finally broken out of its 2022 downward trend, having recorded increases in the seasonally-adjusted number of Age 16-17 with jobs in five of the last six months. According to the Bureau of Labor Statistics data, there were 2,292,000 working 16-17 year olds in January 2024, about 200,000 more than in July 2023.

But for the overall teen employment situation to be flat, that means a more negative story for older U.S. teens, whose seasonally-adjusted employment figures dipped slightly from the previous month to 3,428,000. While that number didn't change much from December 2023, the percentage share of working older teens declined to 42.0% of the Age 18-19 population in January 2024, down from December 2023's 43.6%.

For the combined population of working teens, the net overall change in seasonally adjusted employment for the combined Age 16-19 population was an increase of 66,000 to 5,704,000. There was no change recorded for this age cohort's employment-to-population percentage from December 2023 to January 2024.

All these changes are shown in the following charts presenting the seasonally-adjusted data for the number of employed teens and the teen employment-to-population ratio from January 2016 through January 2024.

Because the Bureau of Labor Statistics subjects each of these data series to its own seasonal adjustment, you'll find the figures presented in the chart for Age 16-17 year olds and Age 18-19 year olds do not necessarily add up to the combined total for Age 16-19 year olds. If you are looking for employment numbers that do add up properly, you'll want to access the non-seasonally adjusted data available at the BLS' data site.

Reference

U.S. Bureau of Labor Statistics. Labor Force Statistics (Current Population Survey - CPS). [Online Database]. Accessed: 16 February 2024.

Image Credit: Microsoft Bing Image Generator. Prompt: "A teenager looking for a job".

Labels: data visualization, demographics

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

Since our last update three months ago, expectations for the S&P 500's earnings slumped in the near term and are stretching out the recovery from 2022's earnings recession. The S&P 500's earnings per share had been expected to return to their March 2022 peak of $197.91 during the first quarter of 2024, but that full recovery now looks to be delayed until after June 2024.

The following chart reveals how the latest earnings outlook has changed with respect to previous snapshots:

Here is a summary of the major observations that may be seen in the changes of Standard & Poor's earnings projections from 8 November 2023 to 14 February 2024:

- Earnings for 2023-Q4 decreased from a projection of $196.02 to $189.74. These earnings are still being reported, so this value is not yet final.

- Projected earnings for 2024-Q1 dropped from $199.17 to $190.54. This change suggests near-zero earnings growth during the first quarter of 2024.

- S&P projects faster earnings growth during the second half of 2024.

- Despite that faster anticipated growth, the S&P 500's earnings per share is still expected to dip from $220.70 to $217.99 at the end of 2024.

If you look at the historic earnings expectations shown on the chart, particularly the period since 2021, you'll notice a negative pattern in which later projections for earnings are less optimistic than the projections that preceeded them. With 2024-Q1's anticipated earnings per share looking to be nearly unchanged from 2023-Q4's level, should that pattern hold, our spring update may show the start of a "double-dip" earnings recession for the S&P 500.

About Earnings Recessions

Depending on who you talk to, an earnings recession has one of two definitions. An earnings recession exists if either earnings decline over at least two consecutive quarters or if there is a year-over-year decline over at least two quarters. The chart identifies the periods in which the quarter-on-quarter decline in earnings definition for an earnings recession is confirmed for both the Pandemic Earnings Recession (December 2020-December 2021) and the new earnings recession (March 2022-December 2022) according to the first definition. The regions of the graph shaded in light-red correspond to the full period in which the S&P 500's earnings per share remained below (or are projected to remain below) its pre-earnings recession levels.

Let's define what a "double-dip" earnings recession would be in case that becomes relevant at the time of our next update. This term describes the situation where after having begun to recover, the S&P 500's earnings per share stops rising and falls without having recovered to its pre-earnings recession level.

Our next snapshot of the index' expected future earnings will be in three months.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 14 February 2024. Accessed 17 February 2024.

Image credit: Stable Diffusion DreamStudio Beta. Prompts: "The word 'EARNINGS' and "The word 'Recession'". We combined the two AI-generated images to produce the "Earnings Recession" graphic.

After breaking through the 5,000 milestone to set a new record high last week, the S&P 500 (Index: SPX) retreated from that lofty level. The index dropped 0.4% from last week's close to end the trading week at 5,005.57.

You wouldn't think it from that description, but the S&P 500 did manage to eke out a new record high of 5,029.73 on Thursday, 15 February 2024. But the bigger news of the week was the stock market's response to two reports about inflation in the U.S. The first report on the Consumer Price Index prompted a 1.4% drop on Tuesday, 13 February 2024. The second report on the Producer Price Index sparked a half percent decline on Friday, 16 February 2024.

Both reports indicated higher-than-expected inflation to start 2024. Together, that new information affected investor expectations for the timing of when the Federal Reserve will begin cutting interest rates in 2024. The CME Group's FedWatch Tool's projections of when the Fed is expected to start a series of rate cuts has shifted. It now projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2), six weeks later than previously anticipated.

Here is this week's update of the dividend futures-based model's alternative futures chart.

Looking forward, we're coming up on a several week long period where the echoes of past volatility in stock prices affect the dividend futures-based model's projections. This situation arises because of the model's use of historic stock prices as the base reference points from which its projections are developed. The next update for the chart will feature a new redzone forecast range to account for this echo effect.

In the meantime, here are the market-moving headlines for the week that was.

- Monday, 12 February 2024

-

- Signs and portents for the U.S. economy:

- Job cuts spill beyond tech sector

- Real estate pain for US regional banks is piling up, say investors

- Oil settles little changed; demand concerns offset Middle East tensions

- Bigger trouble developing in the Eurozone:

- Rising Distress in Germany Signals a Lot More Struggles Ahead

- German commercial property prices post biggest-ever drop, data shows

- Euro zone banks face new slate of risks, supervisor warns

- Nasdaq, S&P, Dow end mixed as Wall Street's bull run takes a beat ahead of CPI

- Tuesday, 13 February 2024

-

- Signs and portents for the U.S. economy:

- Rising rents push US inflation higher; rate cuts still expected in 2024

- Labor worries, costs drag small business sentiment down by most in 13 months -NFIB

- Oil up on geopolitical tension, gains capped by fading Fed rate-cut hopes

- Number of US farms falls and size increases, census shows

- Fed seen waiting longer to cut rates as inflation stays elevated

- ECB minions ready to let inflation data decide next steps, bigger trouble developing in the Eurozone:

- Number of rate cuts will depend on inflation data, ECB's Lane says

- Germany is an unfit man, economy isn't in shape, finance minister says

- Wall St ends sharply lower as hot inflation sparks sell-off

- Wednesday, 14 February 2024

-

- Signs and portents for the U.S. economy:

- Oil falls by more than $1/bbl on US crude build, security threat worries

- Cisco to cut more than 4,000 jobs, lowers annual revenue forecast

- Frigid temperatures chill US retail sales, factory production

- Fed minions not so sure about "soft" landing for U.S. economy:

- Bigger trouble developing in Japan, Nikkei predicts BOJ minions will keep never-ending stimulus alive:

- Japan unexpectedly slips into recession, Germany now world's third-biggest economy

- Japan Enters Recession With Nikkei About To Hit All Time High

- Bigger trouble developing in Eurozone, ECB minions want to take some time to think about it:

- Euro zone Q4 GDP confirmed flat q/q, up 0.1% y/y

- ECB needs 'some time' before cutting rates: de Guindos

- Nasdaq, S&P, Dow end higher as Wall Street regains footing after CPI sell-off

- Thursday, 15 February 2024

-

- Signs and portents for the U.S. economy:

- Fed minions thinking about taking some time before acting to cut interest rates:

- Bigger trouble developing for Eurozone banks:

- ECB minions say they're in no rush to start cutting rates:

- ECB policymakers push back on hasty rate cuts even as inflation falls

- ECB must avoid hasty rate cut, says Lagarde

- Nasdaq, Dow extend rebound from CPI sell-off to second straight day; S&P closes at record

- Friday, 16 February 2024

-

- Signs and portents for the U.S. economy:

- Strong services price increases lift US producer inflation in January

- Oil edges up as geopolitical tensions offsets weaker IEA demand outlook

- Fed minions excited to hold rates where they're at until data tells them to start cutting them, getting worried about banks' exposure to distressed commercial real estate:

- Fed seen taking time on rate cuts amid inflation pressures

- Fed needs time, data, patience on inflation fight: Daly

- Fed's Bostic open to summer time rate cut - CNBC

- Fed's Barr says supervisors more aggressive, honing in on interest rate risk

- BOJ minions say they'll think about ending never-ending stimulus after they hit their inflation target:

- ECB minions say lack of productivity in Eurozone will keep inflation high:

- Wall Street slides as hot producer price data crimps rate cut bets

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) declined to +2.9% from last week's estimate of +3.4%.

Image Credit: Microsoft Bing Image Generator. Prompt: "An editorial cartoon of a worried Wall Street bull looking backward over its shoulder at a bear. The bear has the word 'Inflation' written on it."

Umbrellas are an example of a successful and very well established invention. By some estimates, they have been around in their basic form for over 4,000 years.

That basic form, an assembly of sticks and cloth that can be deployed to provide either shade from the sun or shelter from falling precipitation, has been generally stable over all that time. It consists of a central shaft around which a collapsible frame of ribs with attached fabric is supported. Most modern innovations of umbrella technology represent tinkering improvements to this basic form, mostly with the introduction of new materials like steel and waterproof fabrics. Perhaps the biggest innovation in that form factor came in the 1920s with Hans Haupt's invention of the pocket folding umbrella. Haupt paired a collapsible central shaft with folding ribs in a design that was much more compact and easier to carry.

That doesn't mean the umbrella cannot be improved. Anyone who has used an umbrella knows its main pain point: you have to dedicate the use of at least one of your hands to hold it.

But what if you didn't have to hold an umbrella to use it? What if you could eliminate its central shaft and the need to hold the umbrella altogether?

The answers to those questions are explored by JohnX at his I Build Stuff Youtube channel in the following ten-minute video. He's taken the umbrella to the next level using modern drone technology and shows the trial and error process of how he developed his prototype:

This is genuine outside the box thinking. While he doesn't quite eliminate the central shaft, he does succeed in minimizing it to fit within the umbrella's canopy. Along with a modified quadricopter drone.

Time will determine if JohnX' prototype flying drone umbrella will become a common, everyday ordinary object. It certainly has potential and we can see where it may have use when combined with hundreds of other flying umbrella drones at outdoor sports events or music performances. Taken to the next level, a fleet of umbrella drones could replace the expensive retractable roofs on modern sports stadiums or keep the next Woodstock music festival from becoming an unholy muddy mess.

HT: Core77.

Labels: ideas, technology

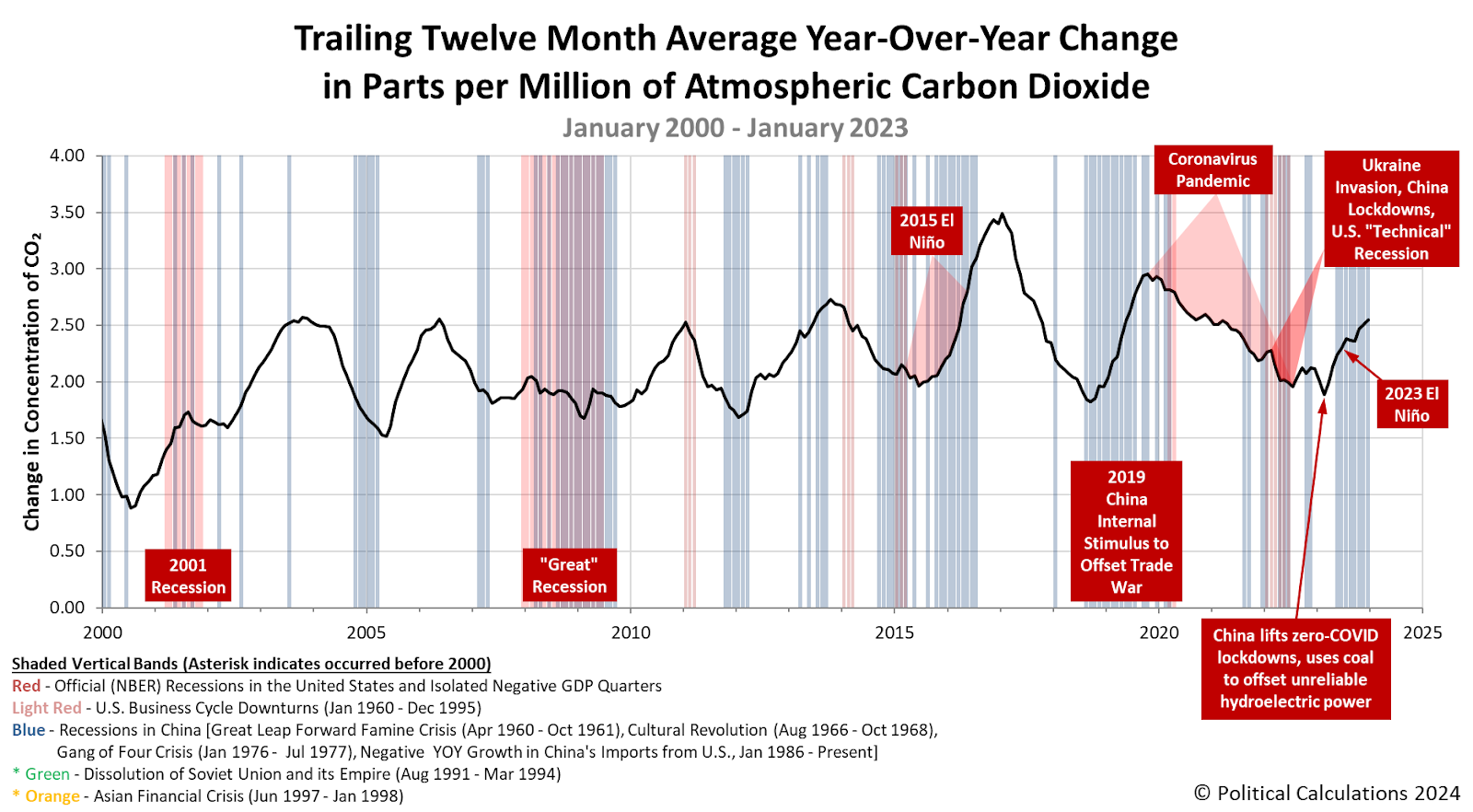

January 2024 saw the pace at which carbon dioxide accumulates in the Earth's atmosphere increase for the fourth month in a row. The change is consistent with positive economic growth on the planet and China's ongoing efforts to stimulate it's faltering economy in particular.

As the world's large producer of carbon dioxide emissions, largely produced by its growing fleet of coal-fired electricity generation plants, and also the world's largest exporter of consumer goods, the CO₂ emissions produced as China powers its economy tells us a lot about the state of the global economy.

Since the country lifted its zero-COVID restrictions in late December 2022, its economy has expanded, which has increased the rate of carbon dioxide accumulation in the atmosphere. But it has also faltered, pointing to uneven economic growth within the country.

The following chart illustrates that effect using the remote Mauna Loa Observatory's measurements of the concentration of atmospheric carbon dioxide. We trace that impact as the trailing twelve month average of the year-over-year change in CO₂ accumulation presented against the background of major economic and environmental events.

China's economy has increasingly struggled with deflationary pressures in recent months. Without intervention, these pressures would be expected to slow China's economy, the effects of which would also slow the rate at which the carbon dioxide it produces enters into the atmosphere.

But China's government has a history of staging interventions within the nation that have global impact. The implementation of new, larger economic stimulus efforts could soon be on tap.

Beijing responded to past bouts of deflation with forceful monetary easing and big fiscal stimulus measures. China is expected to boost fiscal stimulus again this year, but its plans won’t be clear until a national budget is released in March....

Economists generally see a need to boost demand for goods and services, with the government either directly channeling more money into the economy or encouraging banks to lend more to businesses and households. Calls are growing for the authorities to adopt more aggressive policies than rate cuts and trims to the amount of money banks must hold in reserve with the central bank — steps already taken in 2023, to modest effect. To durably boost consumer confidence and get people spending, the government will need to end the slump in the property market.

How it ultimately does that is something that will almost certainly be able to be measured by how fast the concentration of carbon dioxide in the Earth's air is changing. So goes China's economy, so goes atmospheric carbon dioxide.

References

National Oceanographic and Atmospheric Administration. Earth System Research Laboratory. Mauna Loa Observatory CO2 Data. [Online Data]. Updated 5 January 2024.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "Digital art concept of carbon dioxide emissions being used to measure economic growth."

Labels: economics, environment

The total value of goods the United States exchanged with every other nation on Earth declined in 2023. According to initial estimates for 2023, the total value of U.S. exports dropped by $48.3 billion from 2022's level to $2,016.8 billion. Total U.S. imports dropped by $158.4 billion to $3,084.1 billion.

The combined net change is a reduction of $206.7 billion, which is the first to be recorded for a calendar year following 2020's Coronavirus Recession.

While the decline in trade with China continues to be the big story for U.S. trade, the overall decline in trade is not limited to just that nation. The net value of goods exchanged between the U.S. and the rest of the world also fell throughout 2023.

The following chart shows the monthly progression of that decline. The good news is it appears to be leveling out, but the bad news is the trajectory for trade is far below the potential of how high it could have grown during 2023.

Trade between the U.S. and the world has been shrinking since February 2023 as a result of President Biden's trade policies. After peaking in February 2023, we estimate the value of goods the U.S. exchanges with the world excluding China has cumulatively fallen by $282 billion with respect to how large it would have grown had it simply continued following its trend from October 2022 through February 2023.

The Biden administration implemented trade restrictions on the export of semiconductor chips to China on 7 October 2022, which is why we use this month as a reference. Since that action primarily affected trade with China, the trend from October 2022 through February 2023 represents a baseline trajectory of how trade was growing between the U.S. and the rest of the world excluding China before the Biden administration's destructive new trade policies were imposed.

When we exclude the value of goods exchanged between the U.S. and China, we find the cumulative loss of trade and the rest of the world (without China) from February 2023 through December 2023 adds up to $185.5 billion. In December 2023, the gap between the counterfactual for trade between the U.S. and the world clocked in at $42.0 billion, while the gap in trade between the U.S. and the world excluding China was $30.4 billion.

References

U.S. Census Bureau. Trade in Goods with China. Last updated: 7 February 2024.

U.S. Census Bureau. Trade in Goods with World, Not Seasonally Adjusted. Last updated: 7 February 2024.

Image credit: Port of Seattle cranes by Ron Clausen on Wikimedia Commons. Creative Commons Attribution-Share Alike 4.0 International.

Labels: trade

We last presented a picture of the future for the dividends of the S&P 500 (Index: SPX) in mid-December 2023. At the time, we commented on how much the brighter the outlook for quarterly dividends had become since we presented our regular mid-quarter snapshot of the future for dividends from just a month earlier.

Now that its time for our regularly scheduled quarterly snapshot, let's see how things have changed. We find the outlook for the S&P 500's dividends per share has continued to brighten during the past two months. Unlike politics, since expectations for dividends are a fundamental driver of stock prices, this change has provided the underlying momentum needed to boost the index to the new all-time highs it is now hitting.

In the following animated chart, we show how much those expectations have changed for each future quarter of 2024. The chart presents both historic (darker blue) and projected (lighter blue) dividend futures data for the S&P 500 from CME Group for the period from 2021-Q4 through 2024-Q4. In the chart, while the data for 2023-Q4 changes from a projected value (lighter blue) to a historic value (darker blue), the real action happens in the projections for each quarter of 2024.

Looking at the current quarter of 2024-Q1, the projected cash dividend to be paid to S&P 500 investors by the end of the quarter has risen by 40 cents a share, or by 2.2%, from the $17.88 per share expected on 15 December 2023 to the $18.28 expected as of 9 February 2024. Meanwhile, the other future quarters of 2024 show similar gains.

More remarkably, half that change has taken place since 1 February 2024. That date marks when the megacap company Meta Platforms (NASDAQ: META), the S&P 500 component formerly known as Facebook, made the surprise announcement it would initiate a dividend payment to its shareholders. The dividend futures data for the S&P 500 responded by jumping 20 cents a share after the announcement to reach the $18.28 per share figure that is currently projected for the quarter.

There is some speculation that two of the stock market's other megacap firms, Alphabet (NASDAQ: GOOG and GOOGL) and Amazon (NASDAQ: AMZN) may also initiate a dividend. However it is much too early to say if a phenomenon like the speculation bubble that preceded the 2013 announcement that Apple (NASDAQ: AAPL) would re-initiate its dividend will repeat in 2024, driven by what investors hope will happen with these two firms. But it is certainly fun to think about!

More About Dividend Futures Data

Dividend futures indicate the amount of dividends per share to be paid out over the period covered by each quarter's dividend futures contracts, which start on the day after the preceding quarter's dividend futures contracts expire and end on the third Friday of the month ending the indicated quarter. So for example, as determined by dividend futures contracts, the now "current" quarter of 2024-Q1 began on Saturday, 16 December 2023 and will end on Friday, 15 March 2024.

That makes these figures different from the quarterly dividends per share figures reported by Standard and Poor. S&P reports the amount of dividends per share paid out during regular calendar quarters after the end of each quarter. This term mismatch accounts for the differences in dividends reported by both sources, with the biggest differences between the two typically seen in the first and fourth quarters of each year.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "A fortune teller who predicts the future of stock market dividends."

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.