Looking for the best business, economics, entrepreneurial, investing, marketing, personal finance and frugal living blog posts of the week? You've come to the right place! Each Friday, Political Calculations scans the major blog carnivals for each of these categories and picks the best contributions from each.

Looking for the best business, economics, entrepreneurial, investing, marketing, personal finance and frugal living blog posts of the week? You've come to the right place! Each Friday, Political Calculations scans the major blog carnivals for each of these categories and picks the best contributions from each.

But that's not all! We also select one post each week as being The Best Post of the Week, Anywhere!(TM) So, why not kick off the weekend by scrolling down and reading through the top selections for this week!

| The Best Posts of the Week Ending April 28, 2006 | |||

|---|---|---|---|

| Carnival | Contributor | Post | Comment |

| Carnival of the Capitalists | The Coyote Within | Postcards from Over the Edge | Adrian Savage outlines 10 random thoughts about working life - a much needed dose of sanity in today's world! |

| Carnival of the Capitalists | Financial Methods | Voting for Inflation | Michael Cale's take on the "unvirtuous" cycle of the minimum raise is dead on - well worth reading! |

| Carnival of the Capitalists | The Real Returns | Secular Bear Market? | Since 2000, it's often been said that U.S. stocks are in a secular bear market. The Real Returns shows that a porfolio consisting of annual $1000 investments into the Vanguard 500 mutual fund is not! |

| Carnival of Debt Reduction | MightyBargainHunter | Debt Reduction When You're Upside Down | John (aka MightyBargainHunter) examines the options available for new homeowners who might be entering the situation where they owe more money than their house is worth. |

| Carnival of Investing | My 1st Million at 33 | My Hunting Trip for a Money Manager | If you've been looking for someone to manage your investments (personal, IRA, etc.), frugal's search for a competent manager. Be sure to scroll down in the comments for the answers to frugal's quiz! |

| Carnival of Marketing | J. Timothy King's Blog | Building Brand Image: 2 Lessons | J. Timothy King re-teaches two key lessons of marketing with his recent experience ordering products through Wine.com and having them "Fedex"-ed. The Best Post of the Week, Anywhere!(TM) |

| Carnival of Personal Finance | Inchoate Random Abstractions | Are All MBAs Created Equal? | Do you have to get an MBA from a top institution to get the best opportunities? Ira looks at research that says "yes." |

| Festival of Frugality | Blogging Away Debt | Toyota Echo - The Perfect Car for the Frugal-Minded | High gas prices at the pump got you down? Looking for a more economical alternative to your current guzzler? Tricia raves about her Toyota Echo (which has been replaced by the Toyota Yaris!) |

Previous Editions

- On the Moneyed Midways – April 21, 2006

- On the Moneyed Midways – April 14, 2006

- On the Moneyed Midways – April 7, 2006

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – March 24, 2006

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – St. Patrick's Day 2006 Edition

- On the Moneyed Midways – March 10, 2006

- On the Moneyed Midways - The inaugural edition from March 3, 2006!

Tired of high gas prices? Are you looking at possibly trading in your old car for a newer, much more fuel efficient model? Would doing so really save you money?

Tired of high gas prices? Are you looking at possibly trading in your old car for a newer, much more fuel efficient model? Would doing so really save you money?

Once again, Political Calculations(TM) builds the tools to help you answer questions like these! Enter the indicated data in the table below and we'll figure out if getting a newer car makes economic sense in your future!

Update 25 March 2008: Welcome WSB-TV and Clark Howard fans! To help fill in a gap that Clark found in what we covered in this tool, here's a site that provides you with the total operating costs for just about every car running on America's roads and allows you to compare different models from different years. So, if you're looking at that more fuel efficient used car that Clark suggested, you'll be able to get the numbers you need for the tool below to find out if it really makes sense for you!

Useful Resources

Having trouble getting data for your prospective new car purchase? You might find the following sites useful in getting information for the input data table above:

- Edmunds.com

The best one-stop shop for new and used car shopping data on the planet. Includes mileage data, trade-in values for your old car, typical annual maintenance costs and reviews of all the new models!

- Bankrate.com

The place to go to find current auto loan rates as well as tools for determining what your monthly payment will be!

- Insure.com

One stop shop for auto insurance information and quotes. Assuming you just don't call up your current auto insurance provider....

Previously on Political Calculations

- What If We Bought Cars for the Poor Instead of Light Rail Systems?

- Comparing Standard and Hybrid Cars

- Rediscovering Nature

- Do Hybrids Really Save Money?

- Paying Off Your Loan

- How Much Do You Pay in Gas Taxes?

Labels: gas consumption, tool

Previously, we took the latest edition of the Fortune 500 and extracted the top ten employers from among the biggest US-based private sector companies. Today, we have a new list where we show just who the most profitable industries of the Fortune 500 are, ranking them according to their Earnings-to-Revenue ratio!

As an added bonus, we've put the data into a dynamic table format, which means that you may sort the data according to the various column headings from high to low, or from low to high (by clicking the column heading a second time.)

| Most Profitable Companies in the 2006 Fortune 500 |

|---|

| Sectors | Revenues (millions $USD) | Profits (millions $USD) | Earnings/ Revenue (%) |

|---|---|---|---|

| Mining, Crude Oil Production | 0,101,060.5 | 0,027,421.6 | 27.1 |

| Computer Software | 0,069,308.9 | 0,017,651.1 | 25.5 |

| Savings Institutions | 0,033,318.6 | 0,005,894.6 | 17.7 |

| Commercial Banks | 0,520,267.4 | 0,091,671.4 | 17.6 |

| Pharmaceuticals | 0,244,146.8 | 0,042,487.3 | 17.4 |

| Internet Services & Retailing | 0,034,078.8 | 0,005,851.0 | 17.2 |

| Education | 0,004,286.1 | 0,000,678.6 | 15.8 |

| Network & Other Communication Equipment | 0,100,065.8 | 0,015,665.1 | 15.7 |

| Tobacco | 0,082,481.5 | 0,012,107.3 | 14.7 |

| Payroll Services | 0,011,403.2 | 0,001,552.1 | 13.6 |

| All U.S. Sectors | 4,851,909.0 | 0,551,908.0 | 6.7 |

2005 was definitely a big year for the crude oil producers in the Mining and Crude Oil Production sector! Here's a quick list of the companies that Fortune listed in this sector (and their rank within the Fortune 500!):

2005 was definitely a big year for the crude oil producers in the Mining and Crude Oil Production sector! Here's a quick list of the companies that Fortune listed in this sector (and their rank within the Fortune 500!):

- Occidental Petroleum (133)

- Devon Energy (219)

- Burlington Resources (298) – Acquired by ConocoPhillips in 2006.

- Apache (299)

- Anadarko Petroleum (314)

- Kerr-McGee (320)

- Chesapeake Energy (451)

- EOG Resources (528)

- XTO Energy (541)

- Pioneer Natural Resources (708)

- Noble Energy (761)

- Newfield Exploration (870)

- Pogo Producing (978)

Collectively, these companies account for $75,868 million USD in Revenue, $24,865.6 million USD in Profits and have an Earnings-to-Revenue ratio of 32.8%.

By comparison, the "Big Oil" companies with which most people are familiar are grouped together in Fortune's Petroleum Refining industrial sector, which collectively has $929,998.3 million USD in Revenue, $74,493.6 million USD in profits and an Earnings-to-Revenue ratio of 8.0%.

The top company in the Petroleum Refining sector is ExxonMobil (1), who also topped the Fortune 500 in both revenue and profits. The oil giant raked in $339,938 million USD in Revenue and $36,130 million in Profits, earning an Earnings-to-Revenue ratio of 10.6%, less than a third of the average profitability of the crude oil producers in 2005!

This latest edition of On the Moneyed Midways, where the best posts from the blogsphere's business, personal finance, investing, debt reduction and entrepreneurial carnivals are gathered each Friday, has a slight wrinkle this week. Reviewing as many carnivals as we do to produce OMM, we've rather come to dread sorting through them all to find the best posts of the week. It's nothing personal against the various hosts, but there are, after all, much better ways to put them together than bare bones text to make the overall reading experience enjoyable.

This latest edition of On the Moneyed Midways, where the best posts from the blogsphere's business, personal finance, investing, debt reduction and entrepreneurial carnivals are gathered each Friday, has a slight wrinkle this week. Reviewing as many carnivals as we do to produce OMM, we've rather come to dread sorting through them all to find the best posts of the week. It's nothing personal against the various hosts, but there are, after all, much better ways to put them together than bare bones text to make the overall reading experience enjoyable.

That's why this week's winner of the Best Post of the Week, Anywhere!(TM) award is one of the blog carnivals themselves, where the host went above and beyond the normal call of duty in assembling their carnival! But, don't fear – you'll still be able to tell what we found was the actual best post of the week!

| The Best Posts of the Week – April 21, 2006 | |||

|---|---|---|---|

| Carnival | Contributor | Post | Comment |

| Carnival of the Capitalists | Tim Worstall | Corporate Profits and Social Security Privatisation | In last year's debate of U.S. Social Security reform, three well-known economists authored a paper stating the predicted returns from the stock market in President Bush's proposal were mathematically impossible. Tim Worstall caught one of the authors implicitly acknowledging their paper's central argument is wrong. |

| Carnival of the Capitalists | sox first | Ethics as a Core Competency | Leon Gettler nearly claimed The Best Post of the Week, Anywhere!(TM) award with this entry on what it takes to define ethical standards in today's businesses. |

| Carnival of the Capitalists | Fire Someone Today | Playing Berber or chump in the souks of Marrakech | Bob Pritchett may have gotten a great deal or been completely ripped off in his recent shopping expedition in a far corner of the world. |

| Carnival of Debt Reduction | Young and Broke | Look at those low, low Rates!… NOT! | The U.S. Congress is looking to cut the deficit by changing how the Stafford student loan works. Amanda finds that means much higher student loan payments if these student loans aren't consolidated by July 1! |

| Carnival of Entrepreneurship | Jack Yoest | Illegal Interview Question: Are You an American Citizen? | It's hard enough to find talented people to hire for your enterprise without running afoul of anti-discrimination laws. Jack Yoest draws on his H.R. management experience to show the right and wrong way to ask questions. |

| Carnival of Investing | Five Cent Nickel | Max that Roth! (Again) | Savvy savers like nickel find that maxing out your annual contributions to a Roth IRA is a very good idea that becomes an excellent idea if you need it as a source of emergency savings! |

| Carnival of Personal Finance | Indie Mission | 5 Rules for Buying at Big Box Stores | Anyone who's shopped at Costco or Sam's Club can appreciate Persephone's Daughter's advice on how to keep from breaking your budget! |

| Carnival of Personal Finance | Career Intensity | Get a New Job Offer Every Month | Want to jump start your career? Dave Lorenzo finds that "creating opportunity is not just a good idea – it is your responsibility." |

| Festival of Frugality | Stocks for Me | Frugal Stock Market Choices | Jose Anes provides the perfect post for anyone who wants to begin investing but doesn't have a lot of cash built up to get started. |

| Festival of Frugality | Punny Money | The Ninetheenth Festival of Frugality | Nick of Punny Money shows how to put a small (less than 25 posts) carnival together! The 19th Festival of Frugality is The Best Post of the Week, Anywhere!(TM). Excellent design, graphics and commentary. In short, very well done! |

Previous Editions

- On the Moneyed Midways - April 14, 2006

- On the Moneyed Midways – April 7, 2006

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – March 24, 2006

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – St. Patrick's Day 2006 Edition

- On the Moneyed Midways – March 10, 2006

- On the Moneyed Midways - The inaugural edition from March 3, 2006!

is this lousy review of their top 10 suggestions for slowing climate change! Whether it's halting global warming, stopping the next ice age, or no climate change at all, how effective are Yahoo!'s suggestions at reducing climate change? Let's get right to it, shall we?

is this lousy review of their top 10 suggestions for slowing climate change! Whether it's halting global warming, stopping the next ice age, or no climate change at all, how effective are Yahoo!'s suggestions at reducing climate change? Let's get right to it, shall we?

1. Change a Light Bulb. Really. Yahoo! led off with a good suggestion here. We did the math and can show that that Compact Fluorescent (CF) lamps do, in fact, use substantially less energy than incandescent light bulbs and, more importantly, saves dollars in the long run.

But will replacing your regular incandescent light bulb with a CF lamp decrease climate change? No. At least, not in any measurable way.

2. Leave Your Car in the Dust. We're pretty sure that Yahoo! doesn't mean that you should leave your car unwashed. Instead, the idea here is that you should carpool or take public transportation. The good news is that you can save some money by doing so. The bad news is that unless you live within easy walking distance between where your preferred mode of public transportation goes and everywhere you actually need to go, you'll lose more time (remember, time = money!) than you might save. Doubly so if your public transportation option stops everywhere public transportation stops. Then again, if you lived in a linear city, it might be worth it!

So, will leaving your car in the dust decrease climate change? No. At least, not in any measurable way.

3. Power Up. Yahoo! suggests that you get your electricity from "green" power producing resources. Did you know some power companies sell consumers electricity that has been produced using renewable resources, such as wind or solar-generated power, and will even give you the option of purchasing electricity for your home use that are specifically produced at these facilities for just a small premium above the regular price! The best part? The electricity that the utility delivers looks just like the same stuff that's produced by burning carbon-based fuels, but we're sure that you will be able to tell the difference.

Will buying your electricity from these sources decrease climate change? No. At least, not in any measurable way.

4. Drive Smart. You could drive a hybrid car or some other alternative fuel vehicle. Or, more interestingly, you could buy something called a TerraPass, which offsets the impact of the emissions produced by your car by decreasing emissions from other sources. So, for instance, you could buy a TerraPass, and the TerraPass people might go out and shoot a cow. That's right. A volatile-organic-compound-emitting cow. Dead. Well, on second thought, that's probably not what they would do, even though I'm pretty sure they enjoy hamburgers as much as the rest of us. Well, okay, maybe they don't enjoy hamburgers either....

Will any of these options decrease climate change? No. At least, not in any measurable way.

5. End the Junk Mail Trail. Yahoo! says we can save trees and the energy used in paper production by taking our names off the mailing lists of the direct-mail advertisers. Seeing as the trees used in paper production are pretty much grown like crops for the purpose, I wonder what crop might replace them. Still there's that energy used in paper production that might be saved. Or used elsewhere. I don't think the Yahoo! people put all that much thought into this one, although that shouldn't stop you from taking your name of mailing lists - it's rather nice to just get mail from people billing you.

Will taking your name of mailing lists decrease climate change? No. At least, not in any measurable way.

6. Power Down. Shut down your computer when you're not using it. Yahoo! claims you could save from $100 to $400 a year in electricity costs by doing so! Of course, if you're burning through that much electricity, it probably means you're due for an upgrade since today's computers are Energy Star compliant, meaning they power themselves down to a fraction of their active electricity consumption when not in use.

Will powering down your computer while you're not using it decrease climate change? No. At least, not in any measurable way.

7. Buy Local. According to Yahoo!, produce grown in the U.S. travels 1500 miles, on average, to reach your grocery store. Yahoo! goes on to say that you can "save on fuel by buying from local growers," or by creating "your own community garden."

This suggestion shows why Yahoo!'s climate change reducing suggestion Number 2 doesn't compute. Even if it travels 1500 miles, produce travels by the foodstuff equivalent of public transportation. Replacing this transportation with the thousands of trips that the fellow members of your community would need to make to support local growers really doesn't make a whole bunch of sense - especially when you multiply those thousands by thousands of communities. Plus, you need to consider that all of you are getting city mileage instead of eco-friendly highway mileage! Unless, that is, you're driving that hybrid from suggestion Number 4.

The community garden idea is a nice one though, and you should give it serious consideration when deciding what crop to put in the space that your community is currently using to grow trees for paper production for its junk mail.

Will buying local reduce climate change? No. At least, not in any measurable way.

8. Geek Out. Well, the list was created by the people at Yahoo! But seriously, their suggestion is that you use portable solar power generating cells to charge your personal electronic accessories. We think that's a neat option and when all electronic assessories are equipped with built-in solar cells and sufficient battery life to last through the night, we'll upgrade as needed. Then again, according to Yahoo!, we could pay the power company a little extra to only provide us electricity produced through solar power generating facilities that we can't tell apart from electricity produced through other means. Either way, geeky.

Will geeking out by charging up your personal electronic accessories with solar power sources decrease climate change? No. At least, not in any measurable way.

9. Wash and Wear. We like this one! The newest and most efficient washing machines use a lot less energy than older ones. We like modern technology and newer, more efficient products that also save labor rank highly with us. Yahoo! also recommends that we line-dry our clothes, which is nice if you have the time and space to do so, and neighbors that don't mind seeing your laundry hanging outside your home for extended periods of time doesn't hurt either.

But, will getting a new washer and line-drying your clothes reduce climate change? No. At least, not in any measurable way.

10. Chip In. No, it's not enough to follow Yahoo!'s suggestions - you must give money to the organizations that are hard at work at reducing climate change. They've been at it for quite some time now, so if you must give your limited supply of money to just one of these organizations, you should give it to the one that can prove, beyond any shadow of reasonable doubt, that it has slowed climate change the most. And why not? That's the highly effective organization that deserves your money the most.

I think you know, by now, what comes next....

Labels: environment, saving energy

Update (2 May 2006):Russ Wiles of the Arizona Republic reports that the I-bond rate has come in at 2.4%, as the fixed-rate portion of the I-bond's yield was increased from 1.0 to 1.4%.

Earlier this week, the Bureau of Labor Statistics issued the March 2006 Consumer Price Index for Urban Consumers (CPI-U). Using Political Calculations' tool for predicting the future I-bond rates, we find that the small increase in this inflation index in the six months between September 2005 and March 2006, is likely to result in the rate of the upcoming I-bond being set between 1.8% and 2.2%. If the Treasury department maintains the fixed-rate portion of the I-bond at 1.0%, the rate will fall in the middle of this range at 2.0%.

But, don't take our word for it. The tool below is set up to do the math for you!

The 2.0% rate corresponds with the current fixed rate portion of the I-bond being set at 1.0%.

The new I-bond rate also reflects a sharp decrease from the previous I-bond rate of 6.73%. Given that current 6-month Treasury bond yield, which matures in October 2006, is coming in at 4.72%, the new rate looks especially unappealing.

MyMoneyBlog , who follows the I-bond much more closely than we do here at Political Calculations, offers the following speculation on what the U.S. Treasury might do, and when, to make the I-bond more attractive:

I would probably recommend waiting until May, the government might jack up the fixed rate sky-high, which could make I-Bonds a possibly good long-term investment. Probably still not a very good short-term investment.

MyMoneyBlog is also predicting that the fixed-rate portion of the I-bond will be increased to be in the range of 1.1-1.4%, so be sure to re-run the prediction tool with these figures!

Are teachers underpaid? Compared to the average worker, the most recent data released by the American Federation of Teachers (available as a 480KB PDF document) suggests that the answer is no.

For the 2003-2004 school year, the average teacher's salary in the U.S. was $46,597. By comparison, the AFT's report indicates that the average earnings of a worker in the private sector in the U.S. was $37,765, meaning that the average teacher in the U.S. makes 23% more money than the average U.S. worker.

The problem with this measure is that it represents the average of all U.S. workers, not just those who have to go through similar levels of education and training to become a teacher. Teachers argue that compared to other professional occupations, which require a similar number of years of post-secondary education, they are underpaid. But is this true?

Part of the problem with answering this question is that compared to other professions, educators work on a totally different calendar. While the typical professional employee will work an average of 8 hours a day, 260 days per year, the average teacher only spends 6 hours of a day in the classroom for 180 days out of the year.

To be fair, teachers must also spend a not-insignificant amount of time outside the classroom involved in administrative activities (such as class preparation and grading), so any real comparison of teachers pay vs. the pay of other workers must take this factor into consideration.

So that's what we do! Political Calculations(TM) latest tool finds what the equivalent pay of a teacher would be if they worked the same number of hours annually as other workers. Just enter the indicated data and the tool will take care of the rest:

Just running some back of the envelope numbers, a teacher would have to put in a little over 5.5 hours per school day, above and beyond their classroom time, to have their number of hours worked equal the total for a typical full-time worker.

The results above may be compared with the average annual pay of other professions (one of the best resources is the earnings data maintained in the U.S. Bureau of Labor Statistics' Occupational Outlook Handbook) to see just how well teachers are truly faring in the U.S. today!

Note: An added constraint must be added for comparing the pay of teachers to other similarly educated professions. Teachers must pass through a large number of vocational courses, which is driven in large part by the requirements of the accrediting bodies that oversee the profession. As a result, those who graduate with degrees in education lack the same level of rigorous academic development found in other disciplines, such as business, science, engineering, law, medicine, etc. The most comparable professions therefore are those professions that require a similar level of vocational undergraduate courses, such as journalism, nursing or fine arts.

What is the best state in the U.S. for teachers in terms of pay? And how does that compare to the average worker?

Political Calculations latest ranking table seeks to help you find the answer to these questions, along with how your home state might compare with others, and even goes so far as to show how the average teacher's pay compares to that of the average worker in a given state! The data is taken from the most recent data released by the American Federation of Teachers (available as a 480KB PDF document).

The data below is presented in a dynamic table format, which means that you can sort the data from low to high, or high to low by clicking the column headings. Go ahead – you know you want to see who comes out on top!

| 2003 Average Teachers', Workers' Earnings |

|---|

| State | 2003 Average Teachers' Earnings | 2003 Average Workers' Earnings | Ratio of Teachers' to Workers' Earnings (%) |

|---|---|---|---|

| Alabama | 38,282 | 31,567 | 121 |

| Alaska | 51,136 | 36,504 | 140 |

| Arizona | 42,624 | 34,602 | 123 |

| Arkansas | 39,226 | 28,494 | 138 |

| California | 56,444 | 41,864 | 135 |

| Colorado | 43,318 | 38,891 | 111 |

| Connecticut | 56,516 | 48,935 | 115 |

| Delaware | 51,122 | 40,884 | 125 |

| Dist. of Columbia | 62,909 | 57,914 | 109 |

| Florida | 40,598 | 32,915 | 123 |

| Georgia | 45,848 | 36,863 | 124 |

| Hawaii | 45,456 | 31,974 | 142 |

| Idaho | 40,111 | 28,272 | 142 |

| Illinois | 53,820 | 40,574 | 133 |

| Indiana | 45,791 | 33,395 | 137 |

| Iowa | 38,381 | 30,220 | 127 |

| Kansas | 38,622 | 31,794 | 121 |

| Kentucky | 39,831 | 31,658 | 126 |

| Louisiana | 37,123 | 30,615 | 121 |

| Maine | 39,864 | 30,229 | 132 |

| Maryland | 50,303 | 39,155 | 128 |

| Massachusetts | 53,274 | 46,569 | 114 |

| Michigan | 54,474 | 39,484 | 138 |

| Minnesota | 45,010 | 38,693 | 116 |

| Mississippi | 36,217 | 27,138 | 133 |

| Missouri | 38,247 | 33,944 | 113 |

| Montana | 37,184 | 25,659 | 145 |

| Nebraska | 39,635 | 29,924 | 132 |

| Nevada | 43,211 | 34,320 | 126 |

| New Hampshire | 42,689 | 37,685 | 113 |

| New Jersey | 53,663 | 45,981 | 117 |

| New Mexico | 38,469 | 28,941 | 133 |

| New York | 55,181 | 47,902 | 115 |

| North Carolina | 43,211 | 33,313 | 130 |

| North Dakota | 35,411 | 27,197 | 130 |

| Ohio | 47,791 | 34,607 | 138 |

| Oklahoma | 35,061 | 29,264 | 120 |

| Oregon | 47,829 | 33,819 | 141 |

| Pennsylvania | 52,640 | 36,483 | 144 |

| Rhode Island | 54,809 | 34,865 | 157 |

| South Carolina | 41,162 | 30,241 | 136 |

| South Dakota | 33,236 | 26,751 | 124 |

| Tennessee | 40,318 | 33,495 | 120 |

| Texas | 40,476 | 37,442 | 108 |

| Utah | 38,976 | 30,522 | 128 |

| Vermont | 43,009 | 31,572 | 136 |

| Virginia | 43,936 | 38,142 | 115 |

| Washington | 45,437 | 38,673 | 117 |

| West Virginia | 38,496 | 28,359 | 136 |

| Wisconsin | 41,687 | 32,998 | 126 |

| Wyoming | 39,537 | 29,148 | 136 |

| U.S. Average | 46,597 | 37,765 | 123 |

All data in the table above, with the exception of the average worker's earnings for the District of Columbia, are taken from the American Federation of Teachers' salary survey report. The average District of Columbia worker’s earnings were taken from the U.S. Bureau of Labor Statistics data for 2002.

All in all, not bad for a profession that typically only works some 180 days of the year, compared to 260 days for a typical full-time worker!

Labels: education

Welcome to the Friday, April 14th edition of Political Calculations' On the Moneyed Midways, the first "übercarnival" dedicated to rounding up the best posts from each of the blog carnivals dedicated to business, debt reduction, economics, frugal living, investing, personal finance and entrepreneurship, and the best of the best wins Political Calculations' Best Post of the Week, Anywhere(TM) award. On the Moneyed Midways is presented every Friday, making it perfect for the weekend reader – not only can you quickly find the best posts of each carnival, you can also catch up with the carnivals themselves in one place!

Welcome to the Friday, April 14th edition of Political Calculations' On the Moneyed Midways, the first "übercarnival" dedicated to rounding up the best posts from each of the blog carnivals dedicated to business, debt reduction, economics, frugal living, investing, personal finance and entrepreneurship, and the best of the best wins Political Calculations' Best Post of the Week, Anywhere(TM) award. On the Moneyed Midways is presented every Friday, making it perfect for the weekend reader – not only can you quickly find the best posts of each carnival, you can also catch up with the carnivals themselves in one place!

Now that you know what OMM is all about, let's get to what you'd rather be doing than your taxes this weekend….

| The Best Posts of the Week – April 14, 2006 | |||

|---|---|---|---|

| Carnival | Contributor | Post | Comment |

| Carnival of the Capitalists | Ripples | Think of a blog as a thought transmitter | David St. Lawrence shines again with an essay comparing the world of difference between the instant communication of ideas via the Internet and blogging vs. the old methods of publishing. |

| Carnival of the Capitalists | Photon Courier | An Engine with |

David Foster writes on the intersection of an old invention and newly invented methods of finance and what it might mean to the economic development of the most impoverished areas of the world. Winner of this week's Best Post of the Week, Anywhere(TM) award! |

| Carnival of the Capitalists | Slow Leadership | How to Kill Creativity | For a business to be successful in the long haul, it must value creativity in its employees. Carmine Coyote finds that far too many organizations place barriers in the way of pursuing creative solutions. |

| Carnival of Debt Reduction | Personal Finance Advice | Budget Busters: The 4 E's of Overspending | Emergencies, embarrassment, emotion and easy are the 4 "E"'s of overspending - Jeffrey Strain describes each and how to avoid them (and the debt they can bring!) |

| Carnival of Entrepreneurship | Marketing Comet | What Should I Name My Business? | All prospective entrepreneurs have to answer this question (certainly all those not pursuing the franchise route.) J.D. Moore outlines the common sense considerations that might have led Shakespeare to ask: "What's in a name?" |

| Carnival of Investing | "D"igital Breakfast | Sun Tzu and the Art of Making or Buying a Sandwich | Winner of the Best Post Title of the Week, Anywhere(TM) award, Tom breaks his homemade sandwich down into individual components, finds the unit prices, and compares the total assembled cost to a co-worker's store bought sandwich and find it to be cheaper. Sure, he forgot to factor in his own labor and operating costs (rent, utilities, etc.) but still entertaining! |

| Carnival of Investing | The Real Returns | Balanced/Hybrid Fund Performance | The Real Returns finds that a hybrid fund provides a better return than the sum of two funds representing its components. A must read for IRA or 401(k)/403(b) investors! |

| Carnival of Personal Finance | Ask Uncle Bill | You, Inc. | Uncle Bill reveals how the U.S. tax code strongly favors the small business owner. |

| Carnival of Personal Finance | Money and Investing | Clutter Reduction | Ane is cleaning house and cleaning up at the same time - find out all the modern options for clearing one's house of clutter! |

| Festival of Frugality | The Family CEO | The Price Book, Part I | The Family CEO is capitalizing on sale prices for items at the grocery store by keeping track of what the items normally cost in a price book. |

| Festival of Frugality | Frugal Upstate | Just Hit It | Anyone with young kids nearing their next birthday can appreciate Jenn's post on how to make a piñata from scratch! |

Previous Editions

- On the Moneyed Midways – April 7, 2006

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – March 24, 2006

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – St. Patrick's Day 2006 Edition

- On the Moneyed Midways – March 10, 2006

- On the Moneyed Midways - The inaugural edition from March 3, 2006!

About the Picture

A special hat tip goes out to Rex Hammock who included the image of Steve Martin on a carnival midway from Martin's 1979 opus "The Jerk" in this week's Carnival of Entrepreneurship. Rex explains why the image is relevant, aside from being on a carnival midway:

As those who work with me know, one of my favorite business-lesson movie moments takes place in a scene set on a carnival midway in the Steve Martin movie, The Jerk (sorry for my movie tastes). In this scene, Martin's character, Navin R. Johnson, is taught the secret key to all entrepreneurial success: sell something for more than you pay for it. "Ahhhh!" says Johnson, when he discovers this secret from his mentor, "It's a profit deal!"

Indeed.

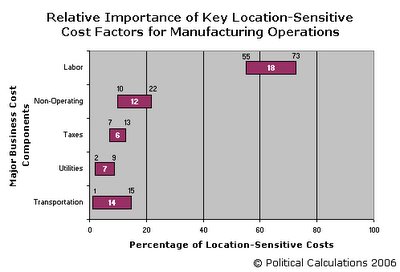

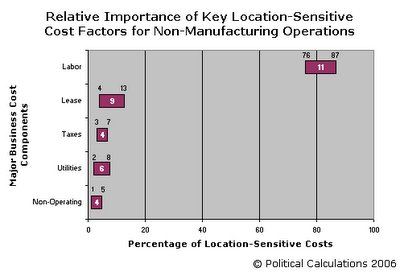

Previously, we looked at a study by KPMG that provided a snapshot of the relative costs of launching a new business in several nations, which found the lowest costs of doing so to be in Singapore. But since every business in the world can't locate its new facilities in Singapore to take advantage of its low operating costs (they wouldn't be the lowest for long if they did!), what location-sensitive cost factors would drive a business' decision to pick one nation over another?

Rather than the absolute magnitude of the various cost components for each nation, the key factors that would influence the decision of where to locate a new operation lie in the type of expense and the variation within each component.

In its study, KPMG broke the various location-sensitive cost components down into the relative percentages of the total cost of starting and running a new business for ten years (Exhibit 5.1 of the 1.7MB PDF document of the report.) The following charts show the relative importance of these cost components for both manufacturing and non-manufacturing operations:

The charts above provide a quick way to see both the full range of the relative magnitude of each of the various major location-sensitive cost components for each of the nine nations of KPMG's study, as well as the degree of variation between the nations.

For a manager tasked with site selection, the degree of variation of the various cost components is what drives the decision to place the business in one nation over another. Here's why: By trading off the options for different locations, the business owners get to better control where their scarce resources go. In this case, the scarce resource is the money the businesses must devote to operating their new facilities.

Why, for instance, would a business select a nation that would require them to pay a higher percentage of their costs in the form of taxes, for which their business might receive very little benefit, when they could instead locate their operation where they may face higher labor costs, but for which they might receive a much larger benefit for the business itself (in the form of actual labor)? What other compelling options would have to be factored into the business' decision making to make the high-tax nation, in this case, represent the best choice?

No one claims this process is easy. There are many factors, both knowable and unknowable, that will determine whether the decision is the right one or not.

If you were that manager, what trade-offs would you choose to make? If you're right, that's great! Fame and/or fortune will be your reward. But how willing to be wrong are you? The wrong choice could not only wreck your career, it could kill your business too!

In the end, it's really just a question of your confidence in your own decision making ability and how willing you are to take a chance. Because if you're that manager and you're not willing to take any risk, perhaps you should consider a different line of work altogether.

Then again, you might just be French....

If you could locate your new business anywhere in the world, where would you build it?

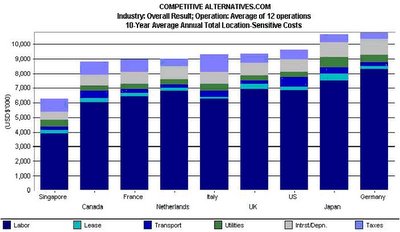

Global accounting firm KPMG International recently released its analysis of the Competitive Alternatives available to new business site selection teams around the globe (HT: The Tax Foundation). Here's KPMG's description of their study:

The study is an expansion and update of previous KPMG publications, and measures the combined impact of 27 significant business cost components that are most likely to vary by location. The study covers 17 industry operations in nine industrialized countries: Canada, France, Germany, Italy, Japan, the Netherlands, Singapore, the United Kingdom and the United States.

The basis for comparison is the after-tax cost of startup and operations, over 10 years.

Overall, what the study found is summarized in the following chart, which details the total annual cost comparison for the nations included in the study:

In reading the chart, we find that Singapore has, by far, the lowest costs for launching and operating a new business through its first ten years. The nations of Canada, France, the Netherlands, Italy, the UK and the US are all closely competitive in location-sensitive costs with one another, while Japan and Germany are substantially more expensive than the rest.

In other words, if the total cost of launching and operating a new business for ten years were the key driving factor in selecting the location of a business, in 2005, Singapore would win, hands down.

The decision of where to locate a business' operations is substantially more complicated, as total cost becomes just one of many considerations. Highly influential, but non-cost related factors include: location of major customers and competitors, location demographics, available infrastructure, etc.

Who might have guessed that the U.S. would have the third-highest costs of the world's major economies?

Seen on the bookshelf with recent economics releases: The Armchair Economist, The Undercover Economist

and Freakonomics

. Is it just me, or does this combination of titles give the impression that economists are people who are likely to be lounging around, skulking about, or freaking out while doing their econ thing? Then again, maybe the job description should be changed to make it clear that the field is limited to people who are lazy, sneaky and/or freaky.

If this doesn't, what does keep Mary Matalin up at night?...

What can we learn about the real viability of biodiesel fuel when government subsidies for producing the stuff are attracting the same people who couldn't build a government-subsidized monorail?

Ah, Detroit. Finally, someone has a realistic answer for its problems.

Will Snakes on a Plane take the place of Road House in the hearts of moviegoers? And what ever happened to the promised sequel anyway? Seems that we're still awaiting the conclusion to the story of what Michael J. Nelson called "the finest American film ever made by Rowdy Herrington."

How likely is it that there will be a recession in the next 12 months? Well, now you can find out for yourself with Political Calculations' latest tool, which does the math developed by the Federal Reserve Board's Jonathan Wright in The Yield Curve and Predicting Recessions (HT: Econbrowser's James Hamilton), where the specific formulation used in the following tool was outlined).

In the tool below, enter the current bond yields for the 10-Year Treasury Bond and the 3-Month (91-Day) Treasury Bond. You'll also need to enter the Federal Funds Rate. The tool will determine the probability of a recession occurring in the next 12 months from the spread between the treasury bonds and factoring in the Federal Funds Rate, according to Wright's Model B:

Update (22 September 2006): We've developed a tool for visualizing the odds that will help you quickly determine where we are in terms of recession risk!

Update (15 November 2006): We've provided some guidance on how to make the recession call!

Using this model, a combination of two factors greatly increases the likelihood of a recession:

- An inverted yield curve (a negative spread produced when the 10-year treasury bond yield rate drops to be lower than the 3-month treasury's yield).

- A high federal funds rate.

How well will this method work in predicting future recessions? Time will tell, but for now, James Hamilton reports that it does appear to be a factor in setting the Fed's policy:

According to Model B, the low values for the spread that we saw last summer were not a source of concern for future economic activity because a fed funds rate below 4% was so low by historical standards. Research like this seems to have played a role in Fed Chair Ben Bernanke's assessment that

I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come, for several reasons. First, in previous episodes when an inverted yield curve was followed by recession, the level of interest rates was quite high, consistent with considerable financial restraint. This time, both short- and long-term interest rates--in nominal and real terms--are relatively low by historical standards.

As for James Hamilton's assessment of the Fed's recession predicting model:

... if we accept Model B at face value, a couple more 25-basis point bumps by the Fed would put the funds rate at 5.25% and likely push the spread into negative territory. From the table above, that starts to make a recession look like a pretty good possibility.

Think Bernanke wants to take that gamble? I'm betting he won't.

We here at Political Calculations are hoping (not betting) he won't.

Labels: recession forecast, tool

It's not often that we get ahead of the blogging curve here at Political Calculations, but it's really nice when we do! Earlier this week, Rob May (aka BusinessPundit) was commenting on the site statistics of the latest Carnival of the Capitalists that he hosted at Jotzel, writing (emphasis mine):

Also note that traffic numbers are about 1/5 what they used to be, in large part because of the proliferation of carnivals and because Instapundit, the only big-time blogger to consistently link to carnivals, decided to put a box on the side of his site instead of direct links in his blogflow. Damn those low barriers to entry in the blog carnival business. Maybe it's time for a carnival of business blog carnivals, that takes the best posts from each business blog carnival and posts them in one place.

So, welcome to Political Calculations' ongoing weekly roundup of the best posts from the blog carnivals dedicated to business, economics, entrepreneurship, investing, personal finance and frugal living! Each Friday, we present what we find to be the best posts from each carnival, and we also award one post each week with the title of being "The Best Post of the Week, Anywhere"(TM)!

But, enough chatter – the best posts of the week await….

| The Best Money Posts of the Week – April 7, 2006 | |||

|---|---|---|---|

| Carnival | Contributor | Post | Comment |

| Carnival of the Capitalists | Six Sigma | How DMAIC Improve Processes | An entry-level introduction to Six Sigma methods and tools for quality improvement. The post also provides an example of the kind and magnitude of improvement that these techniques might bring to your business' operations. |

| Carnival of the Capitalists | Buyout Blog | How to Translate Financial Reports into Action Items | Tom O'Neill shows how drilling down into the processes of how a business operates can lead the way to better bottom line results. |

| Carnival of Investing | Ask Uncle Bill | The Sage of Omaha and the Wayback Machine | Uncle Bill revisits Warren Buffett's investment wisdom from 25 years ago when he correctly anticipated what it would take to turn around the financial markets following Jimmy Carter's malaise. |

| Carnival of Personal Finance | The Debt Hater | Climbing Out of Your Grandaddy's Ditch | The Debt Hater takes a wide-ranging look at the difference in net worth between blacks and whites, as well as the causes of generational poverty, and proposes generational bootstrapping as the way to close the gap. The Best Post of the Week, Anywhere(TM)! |

| Carnival of Personal Finance | Entrepreneur's Journey | What Is the 80-20 Rule and Why It Will Change Your Life | Yaro Starak's contribution almost earned the top honor this week for being the Best Post of the Week, Anywhere, but was barely edged out by the Debt Hater. Yaro demonstrates how to apply Pareto's 80-20 Rule to practical, everyday life. |

| Carnival of Debt Reduction | MightyBargainHunter | Which debt to reduce first? | The MightyBargainHunter offers advice to a recently married couple with two mortgages on which they should pay off first, the logic of which applies to two loans of any type! |

| Festival of Frugality | Money and Values | Cable TV for -$7 | Penny Nickel was only looking to reduce the monthly Internet bill by bundling the service with the cable provider's bare-bones cable TV offering. Imagine the surprise then when the TV was turned on to reveal that they had the expanded basic cable package - at the same price! |

| Festival of Frugality | Blueprint for Financial Prosperity | Low Cost Weekend Ideas: Visit Local Wineries | Jim launches a new series on low cost ways to enjoy the weekend. First stop: local wineries! |

| Carnival of Entrepreneurship | Marketing and Entrepreneurship | Workouts, pain, growth and entrepreneurship | Michael Cage takes a key lesson learned in improving physical fitness performance and applies it to business. |

Previous Editions

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – March 24, 2006

- On the Moneyed Midways – March 31, 2006

- On the Moneyed Midways – St. Patrick's Day 2006 Edition

- On the Moneyed Midways – March 10, 2006

- On the Moneyed Midways - The inaugural edition from March 3, 2006!

Here at Political Calculations, the month of April means two things:

- 1. U.S. Income Tax returns are due.

- 2. Fortune has released its annual ranking of the largest U.S. companies by revenue!

While we can't pretend to be too happy about the first item on the list, the release of the Fortune 500 rankings represents a treasure trove of accumulated data that let's us measure the economic performance of the publicly-traded titans of the U.S. economy.

Our first dip into Fortune's 2006 data pool has produced another annual ranking: the top 10 companies by number of employees! The static table below provides the indicated companies' rank within the Fortune 500, their industry, the number of their employees reported this year, the number of their employee recorded last year and the percentage change between the two numbers:

| 2006 Fortune 500 Top 10 Employers | |||||

|---|---|---|---|---|---|

| Rank | Company | Industry | 2006 Number of Employees | 2005 Number of Employees | Pct. Change |

| 2 | Wal-Mart Stores | General Merchandisers | 1,800,000 | 1,600,000 | 12.5 |

| 109 | McDonald's | Food Services | 447,000 | 438,000 | 2.1 |

| 44 | United Parcel Service | Mail, Package & Freight Delivery | 407,000 | 384,000 | 6.0 |

| 33 | Sears Holdings | General Merchandisers | 355,000 | 380,000 | -6.6 |

| 14 | Home Depot | Specialty Retailers | 345,000 | 325,000 | 6.2 |

| 29 | Target | General Merchandisers | 337,000 | 300,000 | 12.3 |

| 10 | Intl. Business Machines | Computers, Office Equipment | 329,373 | 329,001 | 0.1 |

| 3 | General Motors | Motor Vehicles & Parts | 327,000 | 324,000 | 0.9 |

| 7 | General Electric | Diversified Financials | 316,000 | 307,000 | 2.9 |

| 8 | Citigroup | Commercial Banks | 303,000 | 290,500 | 4.3 |

Note: The number of employees for Sears Holdings in 2005 was determined by adding the number of employees of the pre-merged Sears Roebuck and Kmart Holdings for that year.

The top ten employers of the Fortune 500 index collectively employed 4,966,373 people in 2006, a 6.2% increase from the 4,677,501 they employed in 2005. Of the 10 companies, only Sears Holdings reduced its headcount following the merger of Sears Roebuck and Kmart Holdings in 2005.

Overall, the 2006 Fortune 500 companies employed 24,746,142 people, with the top 10 companies by number of employees representing some 20.1% of that total. By itself, Wal-mart Stores accounts for 7.3% of the total employment of the Fortune 500!

In the world of business failures, the words "management turmoil" and "bankruptcy" are often found together (here's a Google search to prove it!) To be blunt, the failure of a CEO to address management turmoil within their business, or rather, their failure to effectively deal with any persistent and consuming conflicts between the senior executives of an organization is one of the key factors in determining whether or not a business will ultimately survive.

Examples abound of distressed companies whose path toward bankruptcy court was ensured through turmoil in its management ranks. The following short list was compiled by taking the list of the largest corporate bankruptcies in U.S. history, and reducing it to those companies who filed for bankruptcy last year (2005). The links point to news articles mentioning conflicts among each company's management team that coincided with their bankruptcies:

So, what's a good manager to do to turn a situation like this around at their company?

Turnaround specialist CFO Alternatives LP offers the following five-step program to save the distressed business:

- Stabilize cash flow and "stop the bleeding".

- Ascertain the current and future viability of the business through an intense one to two-week evaluation.

- Develop a clear understanding of the company’s situation and alternative courses of action.

- Determine if adequate management resources are available to implement the turnaround plan.

- Restructure the business consistent with the turnaround plan.

While all the steps are important, the fifth step is ultimately what decides the success or failure of a distressed company. We have, right now, several highly visible experiments that will make or break the careers of the managers who have been tasked with rehabilitating several major companies, which include Ford and General Motors. Both of these companies' poor performance in recent years has been characterized in part by management turmoil. We will find out soon enough if the current generation of management leaders will be successful in restructuring both companies enough to ensure their survival.

Update: Management turmoil rocks Political Calculations' favorite business analysis subject Air America Radio! Will the company's new leaders, the fourth generation in just two years, follow the five-step turnaround plan and save the business? Or is this just a light tap on AAR's acceleration pedal toward bankruptcy? Stay tuned!

Labels: business

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.