In 2006, the taxes that support workers compensation insurance in a number of states were skyrocketing out of control. So much so that many businesses were seriously looking at uprooting their operations and moving cross country to where they could operate less expensively. The state of New York was no different from many stories being told by many business owners across the nation:

In Buffalo, Curtis Screw Co. LLC pays more than $4,000 per employee – a total of $1 million a year – for workers’ compensation. At the company’s virtually identical facility in North Carolina, the cost is $550 per worker.

In the Hudson Valley, the Pawling Corp. saw comp costs jump 26 percent in 2006, even though worker injuries were declining. In most states, the manufacturer of architectural and engineered products calculates, workers’ comp expenses would be half the cost in New York.

Across the Empire State, employers tell similarly troubling stories. The Business Council’s recent survey of members found business leaders ranking workers’ comp second only to health-care costs as a threat to New York’s competitive position.

Today, we're going to show you what happened to workers compensation tax rates from that distressing point in 2006 to 2008 in pictures, taking advantage of some of the data visualization tools available at IBM's ManyEyes site. First, let's look at a treemap of average workers compensation tax rates on a state-by-state basis for 2006 - we've made the data available, along with an interactive version of the two maps below:

In the treemap above, the states with the highest average workers comp taxes appear in the upper left hand corner (indicated by the largest squares with the darkest coloring), with states with lower workers comp taxes appearing in descending order lower in the column and progressively lower in the columns to the right. The state with the lowest average workers compensation taxes in 2006 appears in the lower right hand corner of the treemap as the smallest rectangle with the lightest color tinting.

Next, let's repeat that exercise again, but this time, with the date for 2008:

In the 2008 chart, we see that many states reacted to the pressure placed upon them by their business communities to change their workers compensation taxes in such a way to become more equal to those rates of other states, which we observe in the relative size of each state's average workers comp tax rates represented in the treemap have become more equal across all the states.

But which states made the biggest changes? It would take a lot of back and forth review of the two treemaps above to be able to pick out which states significantly reduced their workers comp tax rates, which ones may have increased them, and which didn't alter them at all.

And that's where the last treemap we'll show comes into play! ManyEyes also offers a data visualization tool where you can compare changes over time in treemap charts. Here, we show the treemap that applies to where average workers comp tax rates were set in 2008, but use color to indicate the magnitude and direction of how each state changed their workers compensation tax rates from 2006 to 2008:

Here, we see that most states reduced their workers comp tax rates between 2006 and 2008, which is indicated by the number of states with a blue-tint, but that states like California, Nebraska and Florida reduced them by the greatest percentage amount, which has the bluest tint.

Meanwhile, we find that a handful of states went in the opposite direction, indicated by the orange-tints, sharply increasing their workers comp tax rates, such as Georgia, South Dakota and Ohio, who are indicated with the deepest orange tint.

We also see that the workers compensation tax rates for the two states mentioned in the excerpt above, New York and North Carolina, actually converged toward each other, with New York's workers comp tax rates falling and North Carolina's tax rates rising sharply!

But the most remarkable thing we observe is the evidence supporting the idea that tax rates will tend to converge toward an equilibrium level over time thanks to competition between the states. The real winners in this process are both the businesses, who benefit from lower taxes, and the states, which succeed by avoiding driving business activity out of their jurisdictions through excessively high taxes!

Labels: data visualization, taxes

Last Friday, Fox Business Network's Charlie Gasparino caught our attention with a story reporting that a well-known securities analyst is actively suggesting that Citibank (NYSE: C) may be inflating its earnings through accounting manipulations, with an unusual level of animosity growing between the analyst and Citibank's senior leadership:

An all-out war has broken out between Citigroup CEO Vikram Pandit and a prominent securities analyst who is saying that the big bank may be cooking the books by inflating its earnings through an accounting gimmick, FOX Business Network has learned.

The analyst, Mike Mayo, of the securities firm CLSA, has been telling investors that Citigroup (C: 3.74 ,+0.08 ,+2.32%) should take a writedown, or a loss on some $50 billion of “deferred-tax assets,” or DTAs. That is a tax credit the firm has on its financial statement that Mayo says is inflating profits at the big bank by as much as $10 billion.

For a large institution like Citibank that has trillions of assets on its books, $50 billion may not seem like a lot of money. A writedown of this amount of money would have a significant impact however:

Since then Citigroup has been profitable, albeit marginally. Though it posted a loss for the full year of 2009, after it repaid a government bailout loan during the fourth quarter and began to unwind Uncle Sam's ownership stake. One reason Citigroup may be unwilling to write off its DTAs: to do so may sink the troubled bank back into unprofitability.

To find out if Citi's accounting practices should be suspect, we applied the tool we developed specifically to answer the question "Are They Cooking the Books?", which may be used to find a company's F-Score (or "fraud score"). The F-score provides an indication of the likelihood that a company's financial reports have been manipulated in inappropriate ways.

The F-score was developed by Patricia M. DeChow, Weili Ge, Chad R. Larson and Richard G. Sloan in a 2007 paper, in which they developed a statistical model using data from the late 1970s through the early 2000s to determine if a company's books have been subjected to potentially illegitimate accounting manipulations.

We populated our tool with data we found in Citibank's annual report for 2009 and reposted it below. Just click the "Calculate" button to find Citibank's F-Score.

In the tool above, a positive indication of potential fraud for the F-Score is a value greater than 1.00, but that doesn't necessarily mean that the firm in question is cooking their books. Rather, the inventors of the F-Score suggest that it's an indication that a further, more detailed investigation into the particular company's finances is warranted.

When we ran the tool however, we found that Citibank has an F-Score of 0.90. In a sense, that suggests that Citibank is potentially skirting the edge of accounting manipulations, as a solid financial institution would be much more likely to have a very low F-score.

So we're on the fence in making the call one way or another with respect to Citibank's potential for having committed accounting fraud. Consequently, we believe that only a much more detailed audit of Citi's accounting procedures and records would be capable of resolving the issue.

If the SEC wants to give the impression that it actually has any teeth when it comes to investigating potential accounting fraud among publicly traded companies, a thorough review of Citibank's accounting going back to 2005 would be a good place to begin demonstrating it.

Welcome to the Friday, August 27, 2010 edition of On the Moneyed Midways! Each week, we review hundreds of blog posts contributed to each of the past week's major business and money-related blog carnivals to point you to the best posts we found in each, naming one as being The Best Post of the Week, Anywhere!

Welcome to the Friday, August 27, 2010 edition of On the Moneyed Midways! Each week, we review hundreds of blog posts contributed to each of the past week's major business and money-related blog carnivals to point you to the best posts we found in each, naming one as being The Best Post of the Week, Anywhere!

But today's edition brings us to a bit of a sea change in the world of blogs and blogging - the growth of video on the web!

We've highlighted posts before that have made use of embedded video, but this week has really struck us by how far the the ability of bloggers to incorporate video elements into their posts has come. And that's why we've created a new title to award blog posts that present highly rewarding video material that focus on business and money matters: "Absolutely essential viewing!

The best posts we found in the week that was await you below. Happy weekend reading and viewing!

| On the Moneyed Midways for August 27, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Best of Money | How to Graduate from College Without Student Loan Debt | Money Help For Christians | In a nutshell, Craig Ford says it takes a lot of work, whether it be a job or pursuing a number of other options to make school less expensive. |

| Carnival of Debt Reduction | Is a Balance Transfer Worth It? | Bargaineering | Sometimes, it doesn't make sense to transfer a balance from one credit card to one that charges a lower interest rate. Jim Wang works through the math you need to do to see whether transfering your balance makes sense for you! |

| Carnival of Personal Finance | A Simple Trick to Get Your Credit Card Interest Charges Waived | Len Penzo dot Com | Len Penzo's trick for making credit card interest charges go away is so mind-boggling simple that it likely never occurs to most people who might be able to take advantage of it. Absolutely essential reading! |

| Cavalcade of Risk | Laurie Santos: How Monkeys Mirror Human Irrationality | This Scientific Life | grrlscientist embeds a TED lecture given by Laurie Santos into "monkeynomics," which reveals that people aren't as separated from monkeys as they might like! Absolutely essential viewing! |

| Festival of Frugality | 16 Unbelievable Shopping Disasters Caught on Tape | ShopGala | Say, what's the worst thing that might happen to you now that the ever-lengthening Christmas shopping season is getting started in earnest? ShopGala runs through a number of video clips showing what might go wrong as you shop. |

| Carnival of Money Stories | Should I Buy Life Insurance Even Though I Don't Need It? | My Personal Finance Journey | Jacob Irwin asks an interesting question: "would it be a wise investment decision to lock in a life insurance term rate now (at age 24 when I do not need it) than to wait until I do need life insurance?" The answer, plus a link to the online spreadsheet tool he put together to help anyone answer the question for themselves, qualifies as The Best Post of the Week, Anywhere! |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - August 27, 2010

- On the Moneyed Midways - August 20, 2010

- On the Moneyed Midways - August 13, 2010

- On the Moneyed Midways - August 6, 2010

- On the Moneyed Midways - July 30, 2010

- On the Moneyed Midways - July 23, 2010

- On the Moneyed Midways - July 16, 2010

- On the Moneyed Midways - July 9, 2010

- On the Moneyed Midways - July 3, 2010

- On the Moneyed Midways - June 25, 2010

- On the Moneyed Midways - June 18, 2010

- On the Moneyed Midways - June 11, 2010

- On the Moneyed Midways - June 4, 2010

- On the Moneyed Midways - May 28, 2010

- On the Moneyed Midways - May 21, 2010

- On the Moneyed Midways - May 14, 2010

- On the Moneyed Midways - May 7, 2010

- On the Moneyed Midways - April 30, 2010

- On the Moneyed Midways - April 23, 2010

- On the Moneyed Midways - April 16, 2010

- On the Moneyed Midways - April 9, 2010

- On the Moneyed Midways - April 2, 2010

- On the Moneyed Midways - March 26, 2010

- On the Moneyed Midways - March 19, 2010

- On the Moneyed Midways - March 12, 2010

- On the Moneyed Midways - March 5, 2010

- On the Moneyed Midways - February 26, 2010

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

The origin of all math starts simply with progressing through the following sequence of numbers:

| ... | 1 | 2 | 3 | 4 | 5 | 6 | ... |

The "..." above indicates that we can continue indefinitely, because there is no point at which we might run out of numbers. The act of going through this progression is called "counting." We can count "forward" as we've shown above, or we can count backwards:

| ... | 6 | 5 | 4 | 3 | 2 | 1 | ... |

Once again, there is no limit to how far we can count backwards, as we could continue by progressing through zero and on through an infinite series of negative numbers.

The mathematical operations of addition and subtraction directly tie into the process of counting. Addition is the process of counting forward from a specified starting point, while subtraction is the process of counting backwards from a specified starting point. Let's consider an example of addition:

2 + 3

We read this problem from left to right. It tells us to start at the value of 2, then count forward (which is indicated by the "+" symbol) 3 steps before stopping:

| Start | Stop | ||||||

| ... | 1 | 2 | 3 | 4 | 5 | 6 | ... |

| Step 1 | Step 2 | Step 3 |

The solution to the example then is 5, the value at which we stop counting forward.

Subtraction works just like addition, but in reverse. If we have:

5 - 3

We again read the problem from left to right. It tells us to start at the value of 5, then count backwards (which is indicated by the "-" symbol) 3 steps before stopping:

| Start | Stop | ||||||

| ... | 6 | 5 | 4 | 3 | 2 | 1 | ... |

| Step 1 | Step 2 | Step 3 |

The solution to this example then is 2, the value at which we stop counting backwards.

We should note that these basic mathematical operations remain unchanged even when working with numbers that incorporate parts of whole numbers, such as fractions or decimals. While these types of values may require some extra processing to get to the point where you can simply count forwards or backwards to obtain the solution, the processes of either counting forwards or backwards are performed the same.

And now, you know as much or more about this most basic kind of math as New Jersey's public officials and we're sorry to have to say, much, much more than media personality Rachel Maddow:

While Governor Christie simply erred in the calculation, as much as any human being, including us, is likely to do on occasion, Ms. Maddow's poorly executed attempt at criticism while repeating the error has the effect of making her appear to be incredibly clueless.

Fortunately for innumerate media personalities like Ms. Maddow, we can help. Here's a tool that anyone who needs to subtract a value in decimal format from another can use to arrive at the correct solution, which we'll format to provide the result to the nearest hundredth (for innumerate media personalities, that's the nearest 1/100 of a whole number, which makes it really useful for performing subtraction operations that involve quantities of money!)

We could go to the trouble of creating a special tool just for media personalities seeking to do addition without publicly embarrassing themselves as well, but let's see if we can score a deal from a major network and get paid beaucoup bucks for the development work! After all, we just did the subtraction job pro bono to demonstrate our capabilities, and to be blunt, network head honchos reading through this far, it's not like you're never going to have another problem with your on-air talent attempting to perform any kind of mathematical operation without assistance. You need us!

Update: Well, how embarrassing for Ms. Maddow! Apparently her network had to go to the trouble and expense of re-shooting that segment of her show to whitewash her display of innumeracy for Internet posterity!

Because sometimes, we just get the urge to pop off a few rounds....

Here are more fun animations of the complex mechanisms that make everyday machines work (via Core77 and kottke)....

Labels: none really, technology

How much will health insurance premiums turn out to be in 2010?

To answer those questions, we're returning to the the Kaiser Family Foundation's 2009 Annual Survey of Employer Health Benefits, which tracks the growth of employer-provided health insurance over time.

Using that established trend, we would project that the average health insurance premium for single coverage would be $5,265 in 2010, while the average health insurance premium for family coverage would be $14,452.

But it's not quite as simple as that! In looking closer at the trend lines with respect to the actual data, we find that there's a bit of a sine wave type deviation from that otherwise straight line trend. A deviation that would seem to directly pace the relative strength of the U.S. economy, falling below the linear trend line in years of recession and rising above it in years of strong economic performance.

Which is exactly what we should expect! Assuming that the recession that began when the economy last peaked in December 2007 is still influencing the rate of growth of health insurance, we should expect that those premiums for 2010 will fall below the level our first-cut projections would indicate.

Which is exactly what we should expect! Assuming that the recession that began when the economy last peaked in December 2007 is still influencing the rate of growth of health insurance, we should expect that those premiums for 2010 will fall below the level our first-cut projections would indicate.

They also shouldn't deviate far from the overall trend. So what we'll do is to simply take the average annual dollar increase for each kind of plan (which is given as the slope in the equations presented in our chart above) and add those values to the respective premium values for 2009.

Doing that, we define the lower end of the range into which we can reasonably expect average health insurance premiums to fall in 2010. We therefore would anticipate that the average premium for single coverage health insurance will fall between $5,098 and $5,265 and the average premium for family coverage will be between $14,166 and $14,452.

The weaker the economy, the closer to the low end of that projection. Likewise, the stronger the economy, the closer to the high end of that projection.

The weaker the economy, the closer to the low end of that projection. Likewise, the stronger the economy, the closer to the high end of that projection.

The other neat thing about this exercise is that it provides an objective means for evaluating how effective the recently passed law reforming health care insurance in the United States is in reducing the costs of these premiums. We will be able to do that by comparing the trajectory in health insurance costs established prior to the reform against what they will be as a result of the reform.

Unless, that is, there really aren't any savings from the reform to be had, in which case, we still have a pretty straightforward means of projecting future premium levels.

Labels: health care

How do small firms compare with big businesses where health care insurance is concerned?

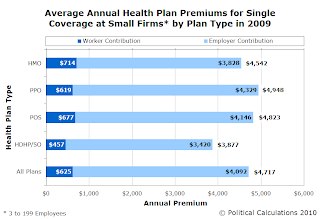

To find out, we've mined the Kaiser Family Foundation's 2009 Annual Survey of Employer Health Benefits, which breaks the data down by plan type. And since the Kaiser folks didn't present their data graphically within their report, we've gone the extra mile to fill the gap in their coverage to do that for you!

| Health Insurance: Single Coverage at Small vs Large Firms | |

|---|---|

|

|

What we find is that on average, the health insurance at large firms for single individuals is more expensive than than typically found at small firms, which we see carries across all types of health plans. Likewise, we see that the portion of premiums paid by workers versus the share of health insurance paid by their employers is also less across the board for all types of plans.

In terms of the types of plans themselves, we find that High Deductible Health Plans with Savings Options (HDHP/SO) is the least expensive regardless of firm size. Interestingly, Health Maintenance Organizations (HMOs) are the second most inexpensive kind of plan for small firms, while these plans are the most expensive for large firms.

The narrowest difference between small and large firms for single coverage are Point of Service (POS) plans, whose total costs are within $29 of one another. Preferred Provider Organizations (PPOs), whose total cost is within $35 of one another. For both types of plans however, we see that employees at small firms are much more likely to have to cover a smaller portion of these plan costs than their peers at large firms.

The average cost of health insurance plan for single coverage in 2009 was $4,824.

| Health Insurance: Family Coverage at Small vs Large Firms | |

|---|---|

|

|

We see many of these same patterns repeated for family coverage, although here, we find one major difference: the employees at large firms pay a lot smaller portion of the cost of their health insurance premiums.

The differences can be significant. For example, for HMO plans, we find that while the total premium for a large firm costs $1,638 more than at a small firm, the employee of a small firm pays $1,825 more out of their own pocket to cover their share of that cost. The smallest difference is that for HDHP/SO plans, where a family coverage plan costs $1,626 more at a large firm than at a small one, while a worker at a small firm pays $490 more out of their pocket to cover their share of that plan than a worker does on average at a large firm.

We'll close by observing that the average cost of a health insurance plan for family coverage in 2009 was $13,375.

Labels: health care

If you ran a state government, what would you do to be prepared for a major economic downturn in your state?

If you ran a state government, what would you do to be prepared for a major economic downturn in your state?

Believe it or not, most politicians and bureaucrats don't live in a total vacuum, despite recent evidence to the contrary. If they know that trouble lies ahead, they prepare for it.

Of course, that's mainly due to self-interest. Having risen to positions of power, many seek to continue in their positions for as long as possible. And part of that means having to cope with the downside to any less-than-desirable economic policies they may have when the economy can no longer support their follies.

For instance, the one thing that most threatens the ability of those in power to remain in power is whether the people who can vote them out of office have recently lost their jobs. If times are bad, and a politician or bureaucrat wishes to continue pursuing their wasteful or economically destructive policies to support their own personal gravy train, whether driven by ideological or corruption-based motives, then they have to compensate in such a way that makes it possible for them to survive the downturn.

The traditional solution that our power-hungry, ideologically-motivated and corruption-driven politicians and bureaucrats have come up with to deal with that problem often comes in three parts (stop us if it sounds all too familiar....):

- Blame businesses or other scapegoats for the job losses.

- Provide jobless benefits that:

- Make some people "grateful" for what you've done for them.

- Keep most people from getting so angry at you that they'll do whatever it takes run you out of power.

- Increase the jobless benefits over time, especially if you plan to keep doing things that will continue hurting the job situation.

To pay for providing those jobless benefits, governments use Unemployment Insurance (UI) taxes. Here, businesses are required to pay a percentage of an employee's income to cover the cost of providing unemployment benefits, with the tax rate varying by occupation - employers in highly cyclical industries can expect to have to pay more than employers in less volatile industries, for example. In the United States, these taxes are applied at the state level.

It occurs to us that we can use average UI tax rates to get a sense of which states' politicians and bureaucrats expected that the conditions they created for economic growth in their states were such that they would have to deal with the consequences of significantly higher unemployment thanks to their insider knowledge of the likely effects of their economic policies.

Here, we would expect a state whose politicians and bureaucrats recognize that they've systematically disadvantaged themselves economically will very consciously set average unemployment insurance tax rates higher than they would otherwise so they can support higher levels of joblessness or higher levels of jobless benefits. Here, what they would set otherwise would be determined by the level of unemployment insurance benefits they would expect to pay out to support the kind of cyclical variations that would really be expected for their state's mix of jobs.

After all, if they really believed that their policies really promoted positive economic growth and job creation, they wouldn't need to set unemployment insurance taxes much higher than that level. Unless they know something to the contrary.

The chart below shows what we found when we looked at the most recent data for average unemployment insurance tax rates from 2009. We've made the interactive version of the map we generated, along with our dataset, publicly available through IBM's ManyEyes data visualization site:

As it happens, another ManyEyes user, crampell, created a map showing the seasonally-adjusted rate of unemployment for each state as of July 2009:

Already we can see some correlations between where we find high unemployment rates and where we find high unemployment insurance taxes.

But now, we'll create a job weakness index by multiplying the two rates together - the states with the highest index values would be those with the unique combination of both high UI taxes and high unemployment - or rather, where politicians and bureaucrats realized that they would have to support high unemployment with the highest unemployment insurance tax rates imposed on the state's dramatically reduced workforce (the interactive version is available here):

We find that Michigan, Rhode Island and Oregon round out the top three states where politicians most expected to have to deal with the high unemployment rates they eventually realized due to their poor economic policies.

The important thing to realize here is that these states UI tax rates were not set overnight - in most cases, they were set in place years ahead of when the unemployment they would be supporting arrived, confirming that the politicians in these three states were well aware of their relative economic weakness.

That they were also telegraphing that their economic policies would be unlikely to promote the kind of job growth it would take to genuinely turn their states economic situations around years in advance appears to have escaped their attention....

Welcome to the Friday, August 20, 2010 edition of On the Moneyed Midways! OMM is your one-stop shop for finding the best of the past week's money and business-related blogging as we review each of the past week's money and business-related blog carnivals!

Welcome to the Friday, August 20, 2010 edition of On the Moneyed Midways! OMM is your one-stop shop for finding the best of the past week's money and business-related blogging as we review each of the past week's money and business-related blog carnivals!

But we go beyond just finding the best post of each blog carnival! We also identify one of those posts as being The Best Post of the Week, Anywhere!, and we identify the near-contenders for that title as being Absolutely essential reading!

And it all begins below.... Thank you for reading this edition of OMM and have a great weekend!

| On the Moneyed Midways for August 19, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Best of Money | 5 Lessons from a Homeless Entrepreneur | Christian PF | Joe Plemon discusses what we can learn from the story of Travis Lloyd Kevie, who bought a six-pack, broke into a vacant bar, put up an "Open" sign and began serving customers, then kept his "business" going by using the money he made from that first six-pack to buy more. He had earned over $1,300 in cash and merchandise by the time he was arrested just four days later.... The Best Post of the Week, Anywhere! |

| Carnival of Debt Reduction | Choosing Between Debt Consolidation Options | Reduce Debt Faster | Need to repackage your debt? RDF reviews the various options to help you identify which might be the best method for you. |

| Carnival of HR | Jimmy Buffett on Strategic Human Resources Issues | The Human Race Horses | Mike Vandervoort mines Jimmy Buffett's classic "Fruitcakes" (what else?) for the valuable HR lessons it offers that are encoded within the song's lyrics! |

| Carnival of Personal Finance | Ahhhhh I Did Something So Freakin' Stupid! | Budgets Are Sexy | As best as we can tell, J. Money doesn't make many money mistakes, but thanks to using the wrong plastic card while standing at a ATM some three different times in one week, he'll be paying a lot more than the value of the money he took out…. |

| Festival of Frugality | How to Make Your Mortgage Interest Tax Deductible | Investing Thesis | If you're Canadian, it turns out that you *can* get a tax deduction for your mortgage interest - provided you can prove you're reinvesting the money and not using it for personal expenses. Dan Tout goes into the details for how to make that work for you. |

| Carnival of Money Stories | Free Money? | This Scientific Life | grrlscientist should be happy to be getting a refund for a medical bill she paid twice, but instead finds she's very, very angry. So much so that she's given up on ever returning to work or live in the U.S. ever again, all because of a hospital's bungled financial record-keeping that made it onto her credit report. Absolutely essential reading! |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - August 20, 2010

- On the Moneyed Midways - August 13, 2010

- On the Moneyed Midways - August 6, 2010

- On the Moneyed Midways - July 30, 2010

- On the Moneyed Midways - July 23, 2010

- On the Moneyed Midways - July 16, 2010

- On the Moneyed Midways - July 9, 2010

- On the Moneyed Midways - July 3, 2010

- On the Moneyed Midways - June 25, 2010

- On the Moneyed Midways - June 18, 2010

- On the Moneyed Midways - June 11, 2010

- On the Moneyed Midways - June 4, 2010

- On the Moneyed Midways - May 28, 2010

- On the Moneyed Midways - May 21, 2010

- On the Moneyed Midways - May 14, 2010

- On the Moneyed Midways - May 7, 2010

- On the Moneyed Midways - April 30, 2010

- On the Moneyed Midways - April 23, 2010

- On the Moneyed Midways - April 16, 2010

- On the Moneyed Midways - April 9, 2010

- On the Moneyed Midways - April 2, 2010

- On the Moneyed Midways - March 26, 2010

- On the Moneyed Midways - March 19, 2010

- On the Moneyed Midways - March 12, 2010

- On the Moneyed Midways - March 5, 2010

- On the Moneyed Midways - February 26, 2010

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

On Sunday, 25 July 2010, Venezuelan President Hugo Chávez threatened to cut off oil supplies from his nation to the United States.

On Sunday, 25 July 2010, Venezuelan President Hugo Chávez threatened to cut off oil supplies from his nation to the United States.

Since Venezuela is the U.S.' fifth-largest supplier of petroleum products, having delivered just under 10% of the total amount of oil the U.S. has imported from outside its borders since January 2005, you would think that his threat to cut off that supply, combined with his historical animosity toward the United States, might cause a stir in the world's oil markets.

He likely thought it would too. After all, making such threats has worked for him in the past.

But the world's markets didn't react to the Venezuelan head honcho's latest threat to cut off his country's delivery of oil to the United States. At the very least, not in any noticeable way.

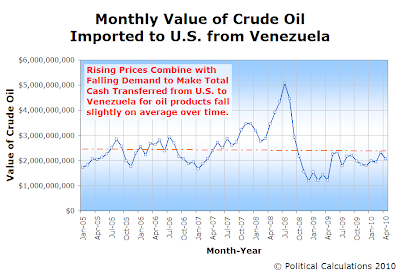

And we can show you why. First, let's take a look at the price per barrel Venezuela has received from the United States since January 2005.

Since December 2008, oil prices began rising quickly again as the U.S. economy recovered somewhat from the crisis it went through at the end of 2008, before changing trajectory to rise at a more steady pace in June 2009, slowing converging in the months since with the long term rate of price increases observed since January 2005.

Our next chart shows how many barrels of crude oil that the United States has imported from Venezuela over the same period of time.

On a quick side note, we find that on average, each dollar increase in the price of a barrel of oil being imported from Venezuela coincides with a reduction in the quantity of barrels delivered of nearly 782,000.

Next, we'll look at what all that means for Hugo Chávez' monthly cash flow for selling his nation's oil to the United States. In our next chart, we've calculated the total cash the Venezuelan dictator receives each month from the U.S.

We also see a boom and bust cycle. We observe that Chávez really benefited from rising oil prices from mid-2007 through July 2008, followed by a major deficit in his monthly revenue for oil after oil prices crashed. Since May 2009, we see that he has enjoyed a nice, steady monthly income from his oil sales to the United States.

But instead of being able to live in comfort on his nice, fixed income, the problem for Hugo Chávez is that he went on a bit of a spending binge during the boom times, using the immense wealth he gained when oil prices were high to fund the nationalization of many businesses and industries in Venezuela and to increase social spending to maintain popular support for his ever-tightening grip on power.

In turn, his actions have significantly reduced the amount of economic activity that the Venezuelan economy can generate compared to what it used to be capable of generating due to the increased risks of doing business imposed by increased inefficiency and corruption stemming from his centralized command of Venezuela's economy.

That malfeasance is evident even at a fundamental economic level, as shortages of even basic foodstuffs have become common as he has attacked businesses who cannot survive by supplying goods at the prices he dictates for "hoarding" wealth.

That malfeasance is evident even at a fundamental economic level, as shortages of even basic foodstuffs have become common as he has attacked businesses who cannot survive by supplying goods at the prices he dictates for "hoarding" wealth.

As a result, Venezuela is foundering because the cash it takes to support Chávez' actions has become increasingly scarce in recent months.

To deal with the consequences of his actions, Chávez has had to take some pretty extraordinary steps in recent months and weeks to keep Venezuela solvent, doing things like tapping the fund he set up to support domestic economic development to cover a shortfall in operating expenses for Venezuela's government-owned national oil production entity and concocting a deal with China to pay his nation's debt to that country with oil shipments.

Even with those deals, Venezuela tops the list of countries most at risk of defaulting on their debt as measured by Credit Default Swap premiums.

Ultimately, all these things contribute to why the attempt to influence world oil markets by threatening to cut off the supply he controls to his nation's largest customer fell so flat. The United States is estimated to absorb well over half of Venezuela's entire oil production, and the world knows how dependent Chávez has become on the money that trade brings him. The effort was clearly delusional.

We therefore find that given current circumstances, Hugo Chávez has become economically impotent. He simply cannot afford to deliver on his economic saber-rattling threats and expect to remain in power for long.

It is possible that he may still believe that his word holds sway over the world's oil markets. Here though, we should remember that we are talking about the same man who ordered that the remains of Simón Bolívar, the man who liberated much of Latin America from Spanish control in the early nineteenth century, be exhumed for testing and apparently, also for intimate conversations.

Then again, even serious whack jobs can create serious problems for other nations and world markets, especially if they really do have the means to turn off the spigots of oil from their countries and disrupt the world's available supply of oil. And Chávez certainly might under different circumstances.

Which is what we think Hugo Chávez may hear whenever Simón Bolívar's remains whisper to him in their detailed dialogues....

Labels: trade

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.