Having looked at who the largest holders of the U.S. national debt were at the end of the 2010 U.S. government's fiscal year yesterday, we wondered if we could use some of that data to gain some insight into who the rising powers have been in the world over the past decade, as well as which nations have seen their power fade over that time. Here, it occurred to us that we could measure that change in relative power by seeing which nations used their growing economic strength to acquire larger and larger shares of the U.S. national debt.

So we mined the data the U.S. Treasury has on the foreign ownership of U.S. government-issued debt going back to March 2000 to find out.

Altogether, at the end of the U.S. government's fiscal year in 2010, non-U.S. entities owned 4.324 trillion dollars worth the U.S. government's total public debt outstanding, or rather, 31.9% of the $13.561 trillion that the U.S. government has borrowed from all sources to cover all of its spending through 30 September 2010. That figure represents 47.9% of the total amount of the debt held by the public at that time.

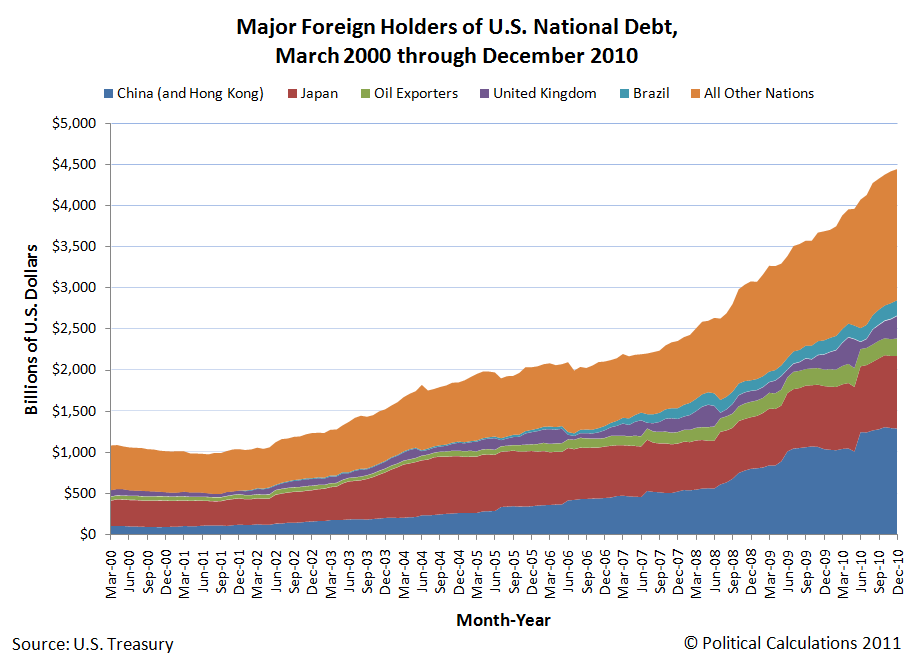

Here's how the the amount of debt held by the largest major foreign holders of the U.S. federal government's debt at the end its 2010 fiscal year has changed from March 2000 through December 2010:

The largest foreign holders of the U.S. national debt on 30 September 2010 were China (mainland and Hong Kong), followed by Japan, "Oil Exporters", the United Kingdom and Brazil.

Let's next take a closer look at the relative percentage share of that foreign-held debt attributed to each of these nations has changed from March 2000 to December 2010:

What we find is that China's share of all the U.S. national debt held by foreign powers and institutions has risen from 10.2% in March 2000 to 29.2% in December 2010. Brazil's relative share of the total portion of the U.S. national debt held by foreign entities has grown from not being large enough to be specifically recorded in either 2000 and 2001 to 4.2% of all the U.S. government's foreign-held debt in December 2010.

Meanwhile, the relative shares for Japan, the United Kingdom, "Oil Exporters" and all other foreign nations has fallen. Japan saw the largest relative share decline for a single nation in going from holding 28.4% of U.S. government-issued debt in March 2010 to 19.9% in December 2010. All other foreign nations combined saw their relative share drop from 50.2% in March 2010 to 35.9% in December 2010.

Looking forward, given the magnitude of the earthquake and tsunami-related destruction in Japan, we should expect that the Japanese will act to cash in a good portion of their U.S. debt holdings to help raise the money that they'll need for recovery, which will further reduce that nation's share of U.S. government-issued debt.

Finally, there is a very large elephant in the room as to which nation has seen its relative share of the U.S. debt change the most over the past decade, which we've left out of this analysis and will get to soon....

Notes

"All Other Foreign Nations" are all those except China (for which we've included Hong Kong), Japan, United Kingdom, Brazil and "Oil Exporters."

"Oil exporters" include Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria.

Data Sources

U.S. Treasury Department. Monthly Statement of the Public Debt of the United States, September 30, 2010. Table III - Detail of Treasury Securities Outstanding, September 30, 2010.

U.S. Treasury Department. Major Foreign Holders of Treasury Securities. (December 2009 through December 2010). Accessed 11 March 2011.

U.S. Treasury Department. Major Foreign Holders of Treasury Securities (March 2000 through December 2009). Accessed 14 March 2011.

Labels: national debt

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.