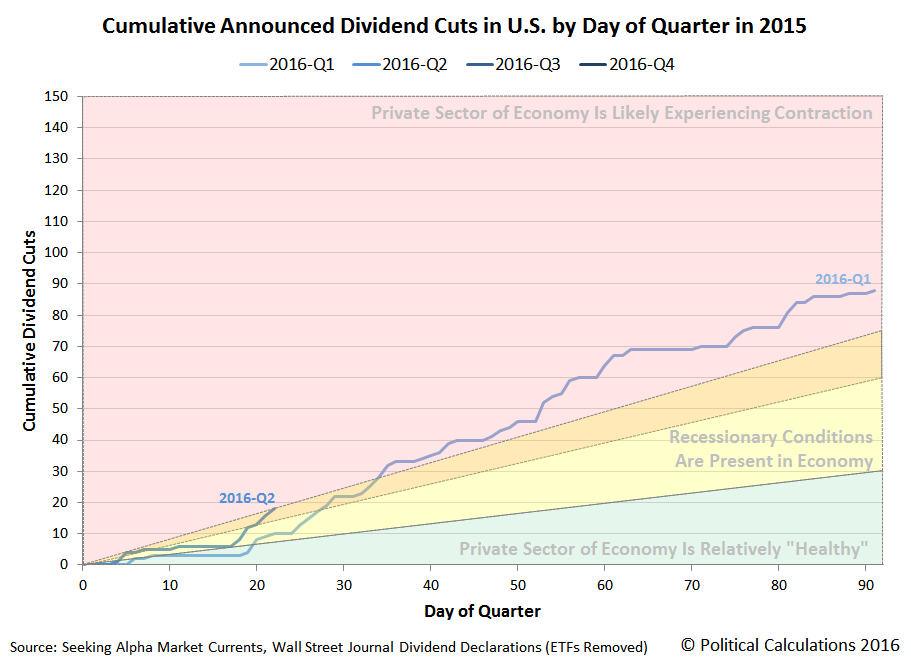

Through Friday, 22 April 2016, the pace at which publicly-traded U.S. companies are cutting their dividends is much higher than what was recorded at the same point of time during the first quarter of 2016.

But compared to a year ago, the rate at which U.S. firms are cutting dividends is about the same, if slightly ahead of schedule on account of the way that weekends and holidays are falling in the current year.

In 2015-Q2, although the quarter started off sluggishly, economic conditions improved as the quarter went on, which was reflected in a slowing rate for newly announced dividend cuts. Which ideally should be the case following the immediately preceding quarters that have been characterized by an elevated number of announced dividend cuts, particularly for firms that set the amounts of their cash dividend payments independently of their earnings. Simply put, if they assess their business' outlook for the future adequately, they shouldn't need to take the painful action of announcing further dividend cuts.

One company that has announced a dividend cut in 2016-Q2 didn't pass that test: Noble Corporation (NYSE: NE), which had previously announced a significant dividend cut in October 2015. The company's owners and management had previously reduced their quarterly dividend by 60% from $0.375 per share to $0.15 per share, which has now been decreased by 87.6% from that lower level to $0.02 per share as the company attempts to improve its fiscal situation.

So far in 2016-Q2, we've acquired a sample of 18 firms announcing dividend cuts, 13 of which are unsurprisingly in the oil and gas industries, 2 in finance, and 1 each in the mining, technology and real estate investment trust sectors of the stock market. Through the same number of days of trading in 2015-Q2, we saw 15 firms announce dividend cuts a year ago, with 12 in the oil industry and 3 in the mining industry. The economic distress in 2016-Q2 is therefore still largely concentrated in the oil sector, but is more broad-based than we observed a year ago.

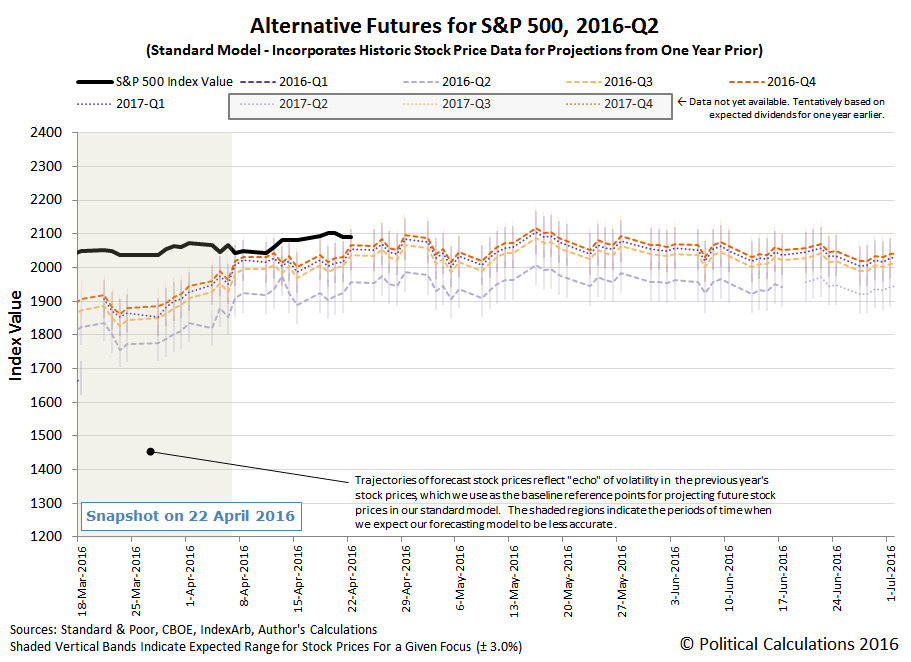

Meanwhile, as expected, the S&P 500 did little more that largely move sideways during the third week of April 2016.

For reference, here are the week's most influential headlines, which when combined with the expectations that investors have for the future, largely explain why the S&P 500 went mostly nowhere during Week 3 of April 2016.

- 18 April 2016:

- U.S. economy looks good but Fed remains cautious: Dudley - continuing the Fed's new messaging discipline.

- Dollar weakens on risk appetite as Doha meeting impact fades

- Dow reclaims 18,000 as quarterly scorecards start to flow - thus also explaining why the number of dividend cuts was flat up to this point in the quarter!...

- 19 April 2016:

- U.S. housing data adds to signs of weak first-quarter GDP growth

- Oil rises as Kuwaiti strike cuts output for third day

- Wall St. inches closer to record on energy, earnings - rising oil prices should translate into fewer dividend cuts in the oil sector in the weeks ahead, as their revenues stabilize and begin to improve. Note that doesn't mean rising stock prices, which would take a positive change in expectations for future dividends per share.

- 20 April 2016:

- Oil jumps 4 percent after stockpile data; dollar gains

- Wall Street flirts with record high levels as companies report - without a positive change in expectations for dividends per share, or an outburst of speculative noise driven by other factors, we're likely within 3% of the top of the market for the year.

- 21 April 2016:

- Oil slides as dollar rebounds; glut worry grows after rally

- U.S. jobless claims hit 42-1/2-year low as labor market firms

- Wall Street snaps three-day win streak on mixed earnings

- 22 April 2016:

- Dollar rallies against yen on potential for expanded BOJ stimulus

- Wall St. lower as earnings take sheen off oil surge

- Wall Street ends flat; Alphabet and Microsoft tumble - confirming that 2016-Q1 wasn't good in a broad-based kind of way.

Labels: chaos, dividends, SP 500

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.