Since China's leaders appear to have adopted the "madman negotiation technique" to retaliate against the U.S. in the budding trade war between the two nations, we thought it might be interesting to look at the context of the U.S. total exports of soybeans to both China and to the world.

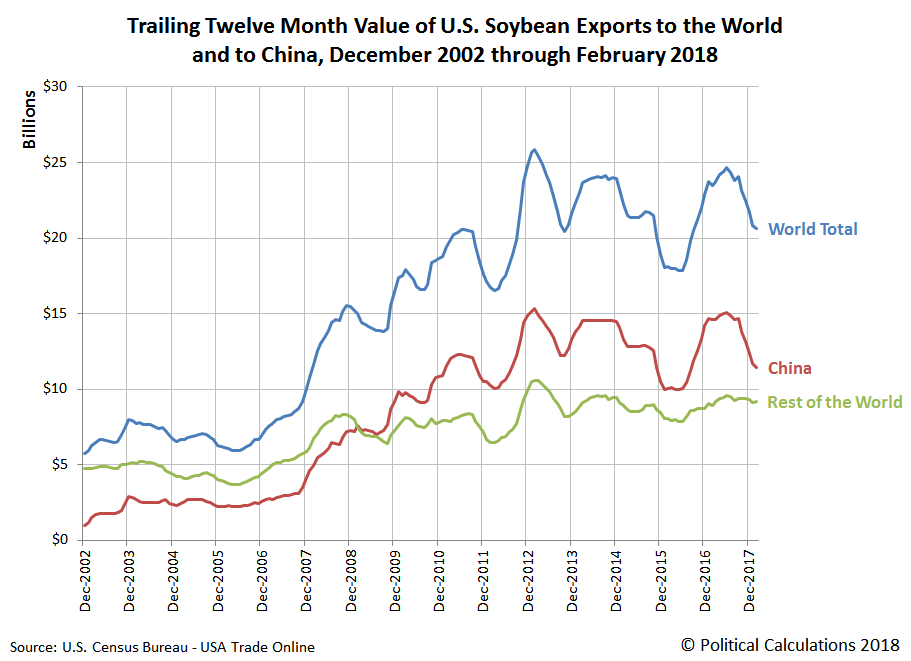

The following chart shows the trailing twelve month total values of U.S. soybean exports to the World, to China, and also to the "Rest of the World" from December 2002 through February 2018, as we calculated each from the monthly data for all U.S. soybean exports provided by the U.S. Census Bureau through its USA Trade Online database.

During the last five years, we see that the total value of U.S. exports to the world has ranged between $17.8 billion and $25.9 billion, with the amount exported to China accounting for 55.3% to 62.1% (or about three-fifths) of the total from 2012 through 2017.

That means that anywhere from 38.9% to 44.7% of U.S. soybean exports have gone somewhere else in the world. That larger global market for U.S. soybeans is important, where it can have a mitigating effect for U.S. soybean producers in the face of Chinese tariffs (taxes on imports) on U.S. soybeans.

Escalating tensions between the United States and China have triggered a flurry of U.S. soybean purchases by European buyers, in one of the first signs that trade tariff threats lobbed between the world’s top two economies are disrupting global commodity trade flows.

News of the sales, confirmed by the U.S. Department of Agriculture on Friday, helped to underpin benchmark Chicago Board of Trade soybean prices after U.S. President Donald Trump threatened to slap tariffs on an additional $100 billion of Chinese goods.

The USDA said 458,000 tonnes of U.S. soybeans were sold to undisclosed destinations, which traders and grains analysts said included EU soybean processors such as the Netherlands and Germany....

The big U.S. soybean sales come at a time when U.S. shipments are traditionally costlier than newly harvested soybeans shipped from Brazil, the world’s biggest exporter.

But accelerated buying of Brazilian beans by Chinese importers, weary of potentially paying steep tariffs on U.S. purchases, has sent Brazilian export premiums to historic highs.

Brazil is the world's top producer of soybeans, where its growing conditions are such that it produces soybeans with higher levels of protein content than those grown in the U.S., where U.S. producers have chosen to sacrifice this quality in favor of growing higher yielding crops in recent years.

The dynamics of relative quality and the threat of Chinese tariffs on U.S. soybeans exported to that country have led to some very interesting trading dynamics in the global market:

Some of the sales announced by USDA on Friday were initially booked as Brazilian shipments, but were switched to cheaper U.S. beans when Brazil’s prices spiked, traders said.

“U.S. prices got exceedingly cheap compared to Brazil,” said a U.S. trader who asked not to be named. “Some of this is outright new business. Some of it is arbitraging away from Brazil.”

Or in other words, U.S. soybean exports are very fungible, where China's threatened tariff on one of the top U.S. export products to China won't have the full negative impact that would exist if it were not.

Another interesting dynamic is that the planting season for U.S. soybean growers won't begin until later this month, which means that they still have time to make decisions on both how many seeds to plant and also of what quality level of plants to grow.

2018 could be an interesting year for U.S. soybeans.

P.S. Special thanks to one of our readers for suggesting this topic!

Labels: trade

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.