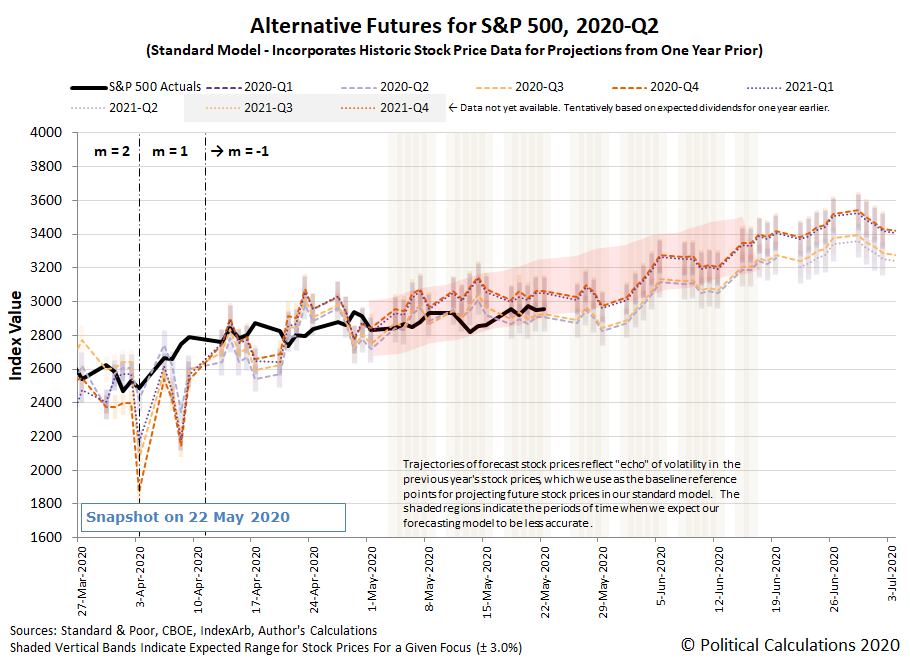

The S&P 500 (Index: SPX) is tracking along the lower end of the redzone forecast range of the alternative futures chart, which assumes investors are looking forward toward 2020-Q4 in setting today's stock prices, and which we suspect also indicates that investors are somewhat backing off the expectation the Fed may institute negative interest rates by that time.

Since the increased potential for negative rates may account for the unprecedented "upside-down" character of how stock prices have been behaving over the last several weeks, we checked in with the CME Group's FedWatch tool to see what it was indicating, where it is currently projecting the Federal Funds Rate will be held at the zero bound range (between 0% and 0.25%) for the indefinate future.

That doesn't mean investors have taken their consideration of negative interest rates in the U.S. off the table. Instead, it means that the CME Group's analysts haven't yet worked out how to adapt its FedWatch Tool to incorporate the possibility of negative rates in its projected probabilities for the future projected level of the Federal Funds Rate. With that limitation, it may be more accurate to read the 100% probabilities the FedWatch Tool is currently indicating as saying that investors are giving 100% odds the Federal Funds Rate being set at the zero bound range or less in the indefinite future.

Now, what if that limitation didn't exist and the FedWatch Tool is capturing that U.S. interest rates will be held at or just above the 0% level? How might that different expectation affect the projections for the S&P 500 provided by the dividend futures-based model?

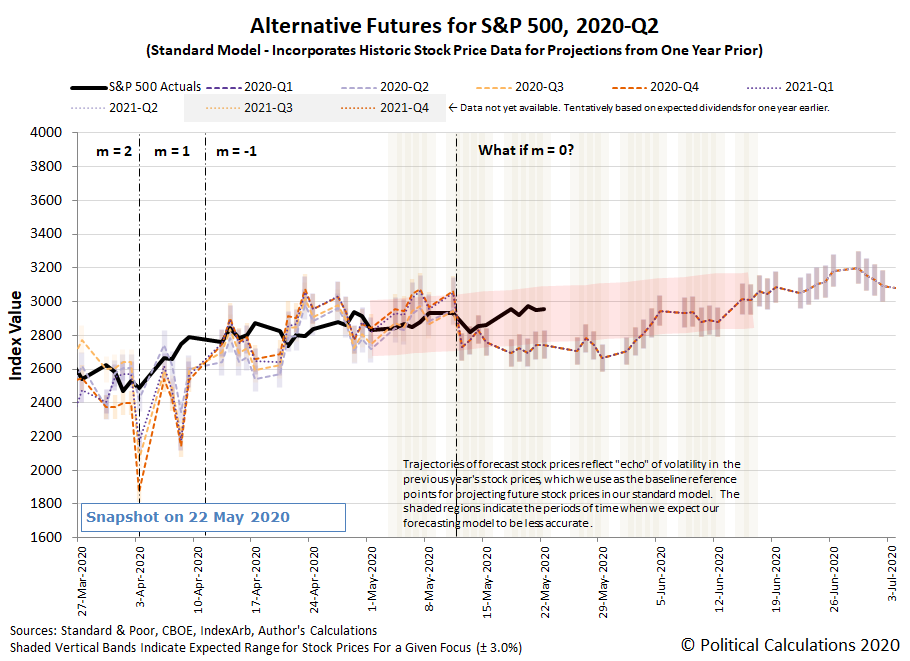

Assuming that outcome would correspond with the model's amplification factor being set so that m = 0, the following alternative futures chart shows the model's projection of the future for the S&P 500 in that scenario:

In this chart, we assume the shift of the amplification factor, m, to be zero to align with the increased expectation of zero bound interest rates in the U.S. took place beginning on 12 May 2020. We see that shift corresponds with the projected trajectory of the redzone forecast range shifting downward after that point, which corresponds to a less robust path forward for the S&P 500 than under the scenario where investors were factoring in a strong likelihood of negative interest rates prior to that point in time.

It also shifts the redzone forecast in a way that centers it closer to the actual trajectory of the S&P 500 in the period since 12 May 2020 where we've applied these assumptions, though we could also say that the value of the amplification factor m is currently falling somewhere between 0 and -1.

The stream of news from the week ending 22 May 2020 confirms that the prospects for negative interest rates continued to be very much on the mind of investors, though they are mixed in with other market-moving headlines from the week that was.

- Monday, 18 May 2020

- Daily signs and portents for the U.S. economy:

- Oil jumps to two-month high on easing lockdowns, positive vaccine results

- What did eight weeks and $3 trillion buy the U.S. in the fight against coronavirus?

- Fed's Powell: CARES Act 'critical' to support for economy

- Bigger stimulus developing in China:

- Bigger stimulus finally develops in the Eurozone:

- France, Germany propose 500 billion euro EU Recovery Fund

- Germany to shoulder 27% of Recovery Fund money: Merkel

- ECB's Lagarde cheers Franco-German EU recovery fund plan

- S&P 500 closes at 10-week high on vaccine hopes, stimulus pledge

- Tuesday, 19 May 2020

- Daily signs and portents for the U.S. economy:

- Mnuchin says seeing large second quarter unemployment, negative economic data

- U.S. crude strengthens as certain stimulus measures to continue

- Coronavirus hammers U.S. homebuilding; permits tumble

- Bigger stimulus finally coming out in Eurozone:

- Fed minions make predictions but admit they are 'flying blind':

- Fed's Rosengren says central bank would consider lowering minimum loan amount on Main Street facility

- Fed's Rosengren says U.S. unemployment rate could remain at double-digit levels by end of year

- Fed's Barkin says officials still 'riding blind' in assessing reopening: interview

- U.S. stimulus taking an old tact, and a new one:

- Mnuchin defends U.S. fiscal response to pandemic, seeks payroll loan extension

- Trump signs order directing agencies to cut federal regulations

- S&P stumbles as Moderna sinks on report questioning trial results

- Wednesday, 20 May 2020

- Daily signs and portents for the U.S. economy:

- Oil rises on lower U.S. stocks, firmer demand

- U.S. borrowers in hardship jumped in April: study

- Fed debates longer-term crisis-fighting plan, minutes show

- Bigger trouble developing in Eurozone, Canada:

- Euro zone April inflation revised down to nearly four-year low

- Outlook for European corporate profits worsens further

- Canada's annual inflation rate goes negative for first time since 2009

- Bigger stimulus under negotiation in U.S., corporate bailouts developing in Japan and Eurozone:

- U.S. Senator Rubio sees consensus for extending paycheck loan program

- Japan's LDP advocates stimulus, with funding for firms to survive COVID-19 recession

- European companies told to come clean on coronavirus pain

- Negative interest rates becoming relevant where they've never been seen before:

- Britain borrows at negative interest rate for first time

- Explainer: How do negative interest rates work?

- Wall Street climbs on stimulus hopes, as S&P, Nasdaq hit multi-month highs

- Thursday, 21 May 2020

- Daily signs and portents for the U.S. economy:

- Brent at highest since March on U.S. stock draw, recovering demand

- While U.S. economy slides, heartland auto dealers cry out for more trucks

- U.S. leveraged loan defaults at six-year high as coronavirus hits businesses

- U.S. existing home sales post largest decline in nearly 10 years

- Mnuchin sees U.S. economic bottom in second quarter, 'gigantic increase' fourth quarter

- Bigger trouble developing in Japan, United Kingdom. Plus now there are locusts:

- Japan exports fall most since 2009 as pandemic wipes out global demand

- UK factories report biggest output drop in over 40 years

- World Bank approves record $500 million to battle locust swarms

- Bailouts for businesses developing in the EU, insurers in the U.S.:

- EU mulling solvency aid for firms, commissioner tells Handelsblatt

- U.S. insurers propose taxpayer-funded business-loss coverage for future pandemics

- Fed minions try ruling out negative rates, considering a return financial repression instead:

- NY Fed's Williams says negative rates are not a tool needed now

- Yield curve control a 'natural complement' to some possible Fed tools, Clarida says

- Fed's Bostic: Banks should be preserving as much capital as possible - CNBC

- China buying American ethanol, but Americans won't be buying Chinese stocks....

- China to receive rare U.S. ethanol shipment on Friday: sources

- Senate passes bill that could block Chinese firms from U.S. securities exchanges

- Stocks slip on U.S.-China tensions; oil rises to 2-1/2-month high

- Friday, 22 May 2020

- Daily signs and portents for the U.S. economy:

- Oil falls on China-U.S. tensions, energy demand doubts

- All 50 U.S. states shed jobs in April: Labor Department

- Bigger trouble developing in Africa, China, Germany:

- S&P forecasts South Africa's economy to shrink 4.5% in 2020

- China drops mention of GDP goal as parliament opens, virus slams economy

- German tax revenues fall 25.3% due to coronavirus pandemic

- Method of bigger stimulus debated in in Eurozone, Japan fears deflation:

- ECB minutes hint at more policy easing in June

- EU 'frugals' formally oppose Merkel-Macron plan for coronavirus grants

- Japan launches its version of Fed's 'Main Street' scheme as deflation returns

- ECB minion concerned about inflation being too low in Eurozone:

- Wall Street ends mixed as China-U.S. tensions weight

The Big Picture's Barry Ritholtz has a short list of the positives and negatives that he found lurking in the week's markets and economy news.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.