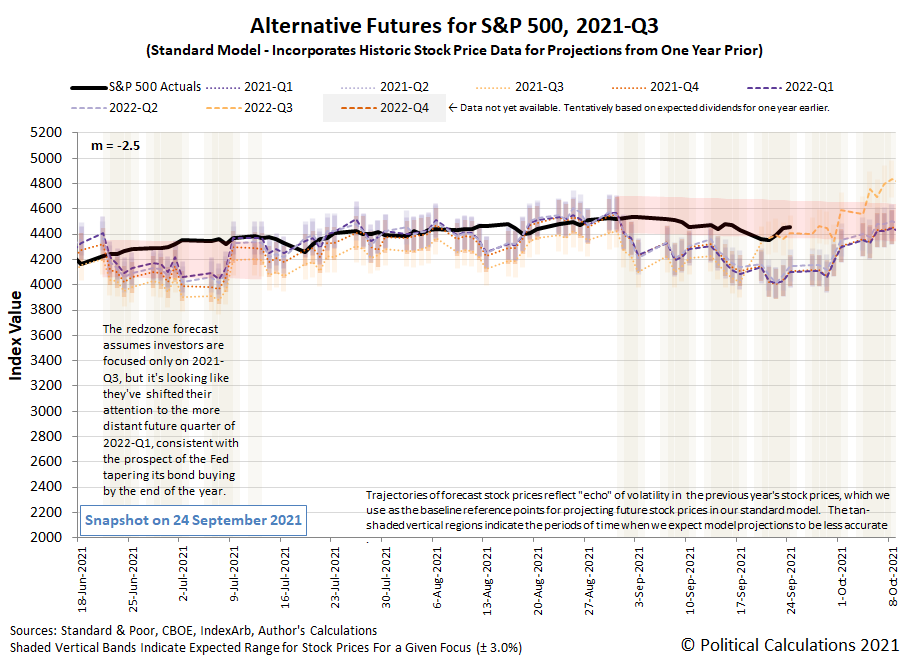

The rollercoaster ride of the S&P 500 (Index: SPX) continued last week. The index even briefly dipped below our redzone forecast range during the week, before rallying to return to its projected trajectory.

Most of the market's action during the week was driven by speculation over when the Federal Reserve would commit to begin slowing down the rate at which it has been buying U.S. government-issued securities to stimulate the economy. When all was said and done after the conclusion of the Federal Open Market Committee's two day meeting on Wednesday, 22 September 2021, the Fed indicated they would follow the plan to taper they've been signaling to investors for months, even though the specific timing has yet to be announced.

With those expectations mostly set, investors have focused on 2021-Q4, which puts the S&P 500 back into the redzone forecast's defined range. The redzone forecast range is based on our assumption investors would mostly focus on 2022-Q1 well into December 2021, which produces a forecast range that is slightly higher than a similar forecast based on investors focusing on 2021-Q4 would be. These two ranges however have considerable overlap because of the small difference in expectations for changes in the year over year growth rate of dividends between these two future quarters. For now, we'll recognize that overlap exists in the form of the actual trajectory of the S&P 500 running mostly in the lower portion of the forecast range shown on the alternative futures chart.

That's not to say investors won't shift their forward-looking attention to some other point of time in the future if prompted by new information. Nor is it to say the expectations for dividends expected at different points of time in the future won't change. As we've seen before, changes for either of these things impact the trajectory of stock prices.

Meanwhile, the market moving headlines for the week that was point to the outized role of the Fed in shaping future expections, although the developing failure of China's Evergrande group and its potential impact on the Chinese economy and what that would mean for the global economy contributed to the dip in stock prices during the week.

- Monday, 20 September 2021

- Signs and portents for the U.S. economy:

- Gas price surge, just one more headwind for world economy

- Another weak U.S. jobs report may be ahead, JPM data suggests

- Fed minions thinking about when to start tapering bond buys:

- Bigger trouble developing in China:

- ECB minions says ECB can stop buying so many bonds:

- Wall Street ends sharply lower in broad sell-off

- Tuesday, 21 September 2021

- Signs and portents for the U.S. economy:

- Bigger stimulus to keep rolling out despite created inflation:

- OECD: Still too early to ease economic support despite inflation spike

- Swiss National Bank to hold rate at record low for years: Reuters poll

- ECB policymakers acknowledge growing inflation risk

- Merkel ally sounds inflation alarm days before election

- UK inflation expectations jump in September - Citi/YouGov

- BOJ to keep stimulus as deflation risks, supply disruption cloud outlook

- Russia to spend $34 billion from rainy-day fund despite inflation worries

- Bigger trouble developing in Japan:

- Wall Street ends near flat on cautious note ahead of Fed

- Wednesday, 22 September 2021

- Signs and portents for the U.S. economy:

- Fed minions tease tapering stimulus bond buys, rate hike seen in 2022:

- Full Federal Reserve policy statement Sept 22, 2021

- Fed's Powell: Bond taper could be done by mid-2022

- Fed policymakers see upward march in interest rates starting next year

- Coronavirus continues shaping national economies:

- ECB minions thinking about making bigger bond buys a permanent feature:

- Wall St ends higher as Fed signals bond-buying taper soon

- Thursday, 23 September 2021

- Signs and portents for the U.S. economy:

- U.S. business activity grows at slowest pace in 12 months - IHS Markit survey

- U.S. weekly jobless claims unexpectedly rise; labor market recovery on track

- "Reasonably good" September jobs starts Fed taper. Is another dud coming?

- U.S. congressional Democrats report deal to pay for Biden spending plans

- Fed minions get parsed, Powell communicates willingness for tougher regulation in bid to keep job:

- How the Fed's policy statement has changed this year

- Fed's Powell opens door to tougher regulations as renomination decision looms

- Bigger trouble developing in Eurozone:

- German economic recovery loses momentum in Sept - flash PMIs

- French business activity weaker than expected in September - flash PMI

- Supply constraints squeeze euro zone business growth

- Central banks acting to clamp down on inflation:

- Investors look ahead to rate hikes with Fed tapering plan all but certain

- Norway raises interest rates, says another hike likely in December

- Brazil raises interest rates, signals third big hike next month

- ECB minions expect inflation to last:

- Indexes close up more than 1% as investors assess Fed news

- Friday, 24 September 2021

- Signs and portents for the U.S. economy:

- U.S. new home sales beat expectations; supply near 13-year high

- Oil hits highest in almost 3 years as supply tightens

- Fed minions getting on board with tapering stimulus bond buys:

- Two Fed policymakers say bar for taper met, nod to next debates

- Analysis-Fed's bond-buying program may be on the way out, but it's not going far

- Bigger trouble developing in China, Japan, Eurozone:

- Alarmed by Evergrande, China's lenders hold back on new credit for property developers

- Nomura cuts China 2021 growth forecast to 7.7% from 8.2%

- Timeline: China Evergrande's snowballing debt crisis

- Explainer-How China Evergrande's debt troubles pose a systemic risk

- Japan factory output seen down again in August on supply chain disruption: Reuters poll

- German business morale falls as 'bottleneck recession' bites

- ECB minion claims inflation is temporary:

- Dow, S&P 500 end with gains up after bumpy week, but Nike drags

Last week, we pointed to the U.S. Treasury's yield curve rates as our ongoing feature pointing to useful investing information sites, but what about other interest rates? For ones that affect personal finance (autos, credit cards, homeowners' equity, etc.), we often turn to Bankrate for its exhaustive listing of currently available loan interest rates. As a bonus, the site also features a lot of useful tools.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.