After starting 2022 on a strong footing, the U.S. stock market nearly set a new record high for number of dividend increases in February 2022.

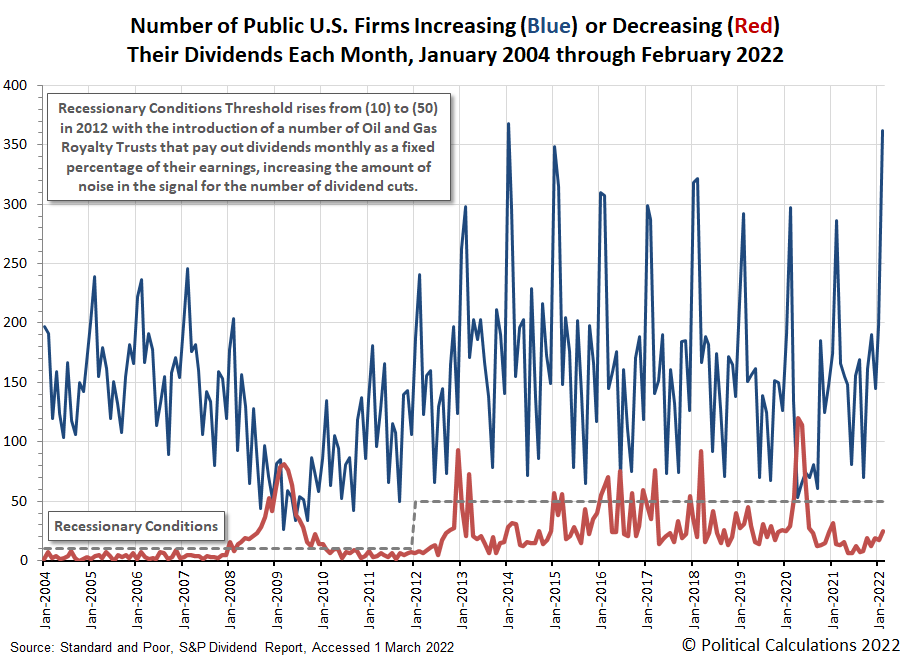

The month also saw a small increase in the number of announced dividend cuts, which still fall well below the level that would indicate recessionary conditions in the U.S. economy. The following chart shows how February 2022 compares with each month before it, going back to January 2004.

Here's what happened for the U.S. stock market's dividend metadata in February 2022:

- 4,656 firms declared dividends in February 2022, up 2,432 from January 2022's revised count of 2,224 and up 2,217 from February 2021's total of 2,439.

- Some 84 companies announced they would pay an extra, or special, dividend in February 2022. That's an increase of 25 from January 2022's number of extra dividend payers and 20 more than February 2021.

- 362 firms indicated they would increase their dividends in February 2022, the second-highest figure after January 2014's record high of 368 firms. February 2022's number of dividend rises is 164 more than hiked dividends in January 2022 and is 76 more than did one year earlier in February 2021.

- The number of firms cutting dividends in February 2022 rose to 25, up from 8 from January 2022's level and 11 more than reduced dividends in February 2021.

- Once again, zero companies announced they would suspend or omit making dividend payments in February 2022, extending the streak that began in July 2021.

As you might expect, dividend metadata like this is a slightly lagging indicator of the relative health of the U.S. economy. Should February 2022 represent a peak with its near-record number of dividend increases, the data for dividend reductions and omissions will provide some of the first signs of trouble developing in the economy. Stay tuned.

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.