With no new Lévy flight events for the S&P 500 (Index: SPX), the recent volatility for the U.S. stock market settled down during the past week. In their place, the index substituted what we consider to be garden variety noise in its day-to-day trading activities.

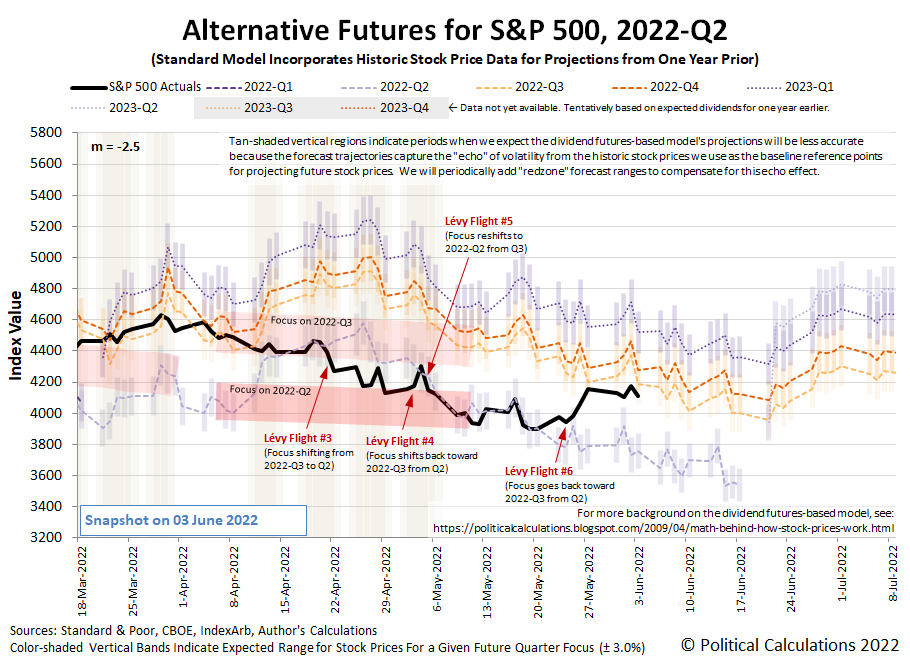

By the end of the week, the level of the S&P 500 remains consistent with the dividend futures-based model projection associated with investors focusing their forward-looking attention on 2022-Q3. The latest update to the alternative futures chart confirms that assessment.

What the Fed will do with interest rates in September 2022 remains the key concern for investors, where whether the Fed takes a break from its current plan to hike the Federal Funds Rate by a half point every six weeks was put on the table a week earlier, only to be seemingly taken back off the table in the past week. Or not. Investors ended the week with more questions than answers about what the Fed will do at that future point of time, which is why it has become their primary time horizon.

Here are the market-moving headlines for the week ending 3 June 2022, where you can get a sense of both how and when investors were exposed to the news that altered their future expectations.

- Tuesday, 31 May 2022

- Signs and portents for the U.S. economy:

- Rising cost of living hurts U.S. consumer confidence; house prices soar

- Oil pares gains as OPEC eyes exempting Russia from output deal

- Biden's June agenda: convince Americans the economy is healthy

- Fed minion really wants to hike rates, greatest economic minds in U.S. meet:

- Fed's Waller backs 50 bps rate hikes until "substantial" reduction in inflation

- Biden, Fed Chair Powell meet to discuss 40-year-high inflation

- Bigger trouble developing in China, South Korea, Japan:

- China's factory activity likely contracted more slowly in May - Reuters poll

- S.Korea's April factory output shrinks most in 2 years, service output expands

- Japan's April factory output slumps in sign of pressure on economy

- Bigger stimulus developing in China, never-ending stimulus in Japan:

- China announces detailed stimulus measures to support virus-hit economy

- BOJ's Kuroda sticks to powerful easing, sees inflation as short-lived

- ECB minions thinking about someday doing something about Eurozone inflation:

- S&P edges down after last week's rally with inflation in focus

- Wednesday, 1 June 2022

- Signs and portents for the U.S. economy:

- U.S. job openings fall; manufacturing regains speed

- Dimon says brace for U.S. economic 'hurricane' due to inflation

- U.S. firms show first hints of impact of Fed's policy tightening, survey shows

- Former top Fed minion and current Biden Treasury Secretary admits they botched policy response to developing inflation, current Fed minions wants to hike rates higher more quickly:

- Yellen says she was 'wrong' about inflation path; Biden backs Fed

- Fed's Daly: let's get U.S. interest rates to 2.5% as quickly as we can

- Fed's Bullard: high inflation 'straining' credibility

- Bigger trouble developing in Eurozone, China:

- Euro zone factories struggled in May as consumers switched to leisure activities

- German retail sales drop in April as food prices bite

- French manufacturing activity at seven-month low in May -PMI

- Global factory growth stunted by war, China's COVID curbs

- BOJ minions determined to keep stimulus going:

- ECB minions expected to go for big rate hike in September 2022:

- Wall Street ends lower as economic data fails to ease rate hike angst

- Thursday, 2 June 2022

- Signs and portents for the U.S. economy:

- U.S. labor market stays strong; unemployment rolls smallest since 1969

- U.S. productivity tumbles in first quarter; labor costs surge

- White House not expecting 'blockbuster' jobs reports every month

- U.S. factory orders rise modestly in April

- Fed minions don't want to stop hiking rates anytime soon:

- Bigger trouble developing in South Korea:

- Bigger stimulus developing in China:

- Bank of Canada minions get rate-hike happy:

- Bank of Canada hikes rates to 1.5%, says will act 'more forcefully' if needed

- Nest egg no more: Inflation eats Canadian consumer cash pile, risking growth

- BOJ minions starting to notice inflationary pressures for first time in decades:

- Wall Street ends sharply higher, led by Tesla and Nvidia

- Friday, 3 June 2022

- Signs and portents for the U.S. economy:

- U.S. job growth solid in May; unemployment rate steady at 3.6%

- U.S. service sector growth slows again in May - ISM survey

- Fed minions got a fever, the only prescription is more rate hike cowbell!

- More Fed rate hikes on tap even as job gains moderate

- Fed may need to stick to half-point rate hikes - Mester

- Strong U.S. labor market keeps Fed on aggressive rate hike path

- Bigger trouble, stimulus developing in the Eurozone:

- BOJ minions discover inflation in Japan after decades of trying to create it:

- Wall St ends down with strong jobs data keeping the pressure on for rate hikes

The CME Group's FedWatch Tool still projects half point increases in the Federal Funds Rate after the Fed meets in June (2022-Q2) and July (2022-Q3). However, the FedWatch tool is now indicating a third half point rate hike in September (2022-Q3), up from the quarter point it forecast last week. That's followed by quarter point increases in November and December (2022-Q4). For its part, the Atlanta Fed's GDPNow tool turned more pessimistic in the past week. Its forecast of real GDP growth of 1.3% for the U.S. in 2022-Q2 is down from last week's projection of 1.9% annualized growth for the current quarter.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.