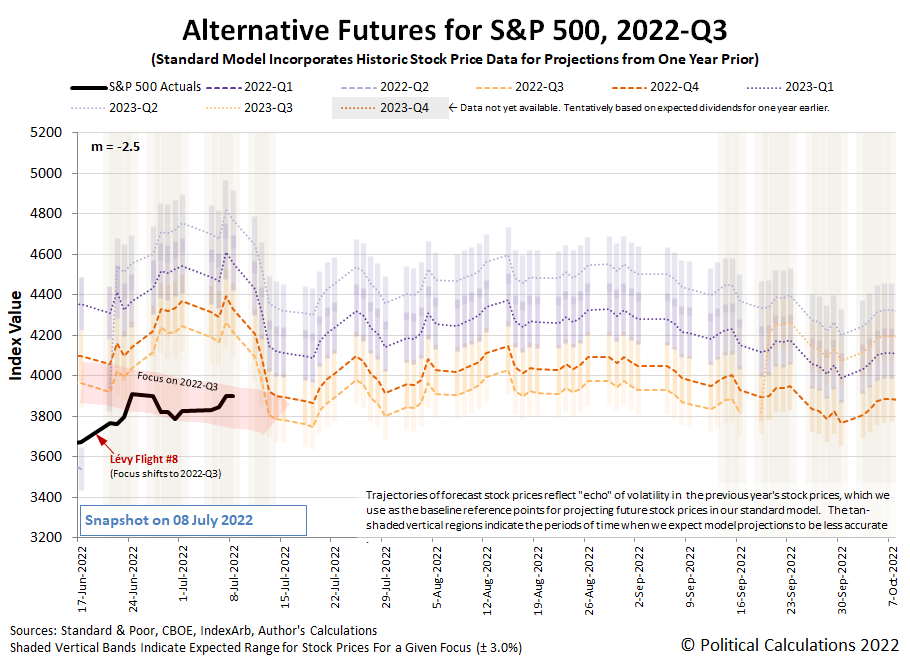

The S&P 500 (Index: SPX) tracked upward in the week ending 8 July 2022. The index closed the week at 3,899.38, putting it 18.7% below its all-time record high from 3 January 2022.

Stock price volatility was normal throughout the week, with the trajectory of the S&P 500 rising within the dividend futures-based model's projected trajectory associated with investors focusing on the current quarter of 2022-Q3:

The outlook for the index throughout 2022-Q3 has improved from what we first described several weeks ago, which still held as recently as last week. As you can see in the latest update to the alternative futures chart that now covers 2022-Q3, the level of the S&P 500 is within spitting distance of wher the model projects the trajectory of the index will go after we reach the end of the latest redzone forecast range.

Here's our summary of the market-moving news headlines from the Fourth of July holiday-shortend first trading week of the 2022-Q3 calendar quarter:

- Tuesday, 5 July 2022

- Signs and portents for the U.S. economy:

- U.S. factory orders rise more than expected in May

- Oil tumbles 9% on recession demand destruction fears

- Explainer-Is the U.S. in a recession? GDP is not the only measure

- Recovery signs following China lifting government's COVID lockdowns:

- China's June services activity expands at fastest in almost a year - Caixin PMI

- Taiwan June exports seen rising faster as supply chains woes ease - Reuters poll

- Central bank minions gearing to to launch more rate hikes to face inflation:

- Australia's central bank raises rates for third month, still more to come

- Thai June inflation beats forecast as rate hike looms

- Philippine inflation near 4-year high, cements prospect of more rate hikes

- Pakistan central bank may raise rates by 125 bps to tame 13-year high inflation

- ECB minions face inflation-harming Eurozone economy, analysts think policy response almost certain to fail:

- Inflation turns 3% growth for German retail into 2% contraction - association

- "Many Unholy Trinities" - ECB Failure Is (Almost) Guaranteed

- S&P 500, Nasdaq end higher as investors eye economic path

- Wednesday, 6 July 2022

- Signs and portents for the U.S. economy:

- Biden still weighing China tariff options as requests to keep them pile up

- U.S. job openings stay high in May, keeping labor market tight

- Oil slides 2% to 12-week low on fears of global recession

- Fed minions all on board with June's three-quarter percent rate hike:

- Bigger trouble developing everywhere?

- IMF chief says 'cannot rule out' possible global recession

- As Canada's government spends, central bank bears burden of taming inflation

- Ratio of Japan households expecting price rises hits 14-yr high - BOJ survey

- Tokyo school swaps fresh fruit for jelly as food prices soar

- Analysis-Inflation, not deflation, is now Japan's political hot potato as election looms

- Taiwan June consumer inflation hits near 14-year high

- Wall Street ends up as investors absorb Fed minutes

- Thursday, 7 July 2022

- Signs and portents for the U.S. economy:

- U.S. trade deficit narrows in May; exports hit record high

- U.S. weekly jobless claims increase; layoffs hit 16-month high in June

- Oil settles up nearly $4 as tight supply outweighs recession fears

- Fed minions say they want smaller rate hikes. Also say they won't cause recession, but willing to risk it:

- Fed hawks signal downshift in U.S. rate hikes after July

- Fed's Bullard sees continued U.S. economic growth

- Fed needs to be aggressive on rate hikes, risk economic harm - Waller

- Bigger trouble developing in France, U.K.:

- France can't tackle inflation crisis with more debt - central bank

- What next for UK economy as Boris Johnson quits?

- ECB minions thinking about the bad choices they have to make:

- S&P, Nasdaq end higher as July hot streak continues

- Friday, 8 July 2022

- Signs and portents for the U.S. economy:

- Oil rises 2% but set for weekly loss amid recession fears

- Jobs blowout cements case for another big Fed rate hike

- Fed minions starting to wonder what they'll do after big rate hikes, expect stagflation for 2022, pledge to all go down together:

- Fed's Bostic calls for 75 basis point interest rate hike in July

- Fed's Williams: After fast rate hikes this year, uncertainty over what's next

- Fed 'united' in inflation flight, 'don't know' if recession will follow -Kashkari

- BOJ minions claim they see inflation going up, but won't stop never-ending stimulus:

- BOJ to raise inflation forecast, but keep dovish bias on global slowdown risk

- Japan's household spending slips for third straight month

- Wall Street gyrates to muted close as investors weigh jobs data in rate debate

The CME Group's FedWatch Tool now projects a three-quarter point rate hike for July 2022 (2022-Q3). That's followed by half point rate hikes in September (2022-Q3) and November (2022-Q4), then a quarter point rate hike in December (2022-Q4) to wrap up the year.

The Atlanta Fed's GDPNow tool now projects real GDP will shrink by just 1.2% for the just ended quarter of 2022-Q2, improving from the much more pessimistic -2.1% it indicated last week.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.