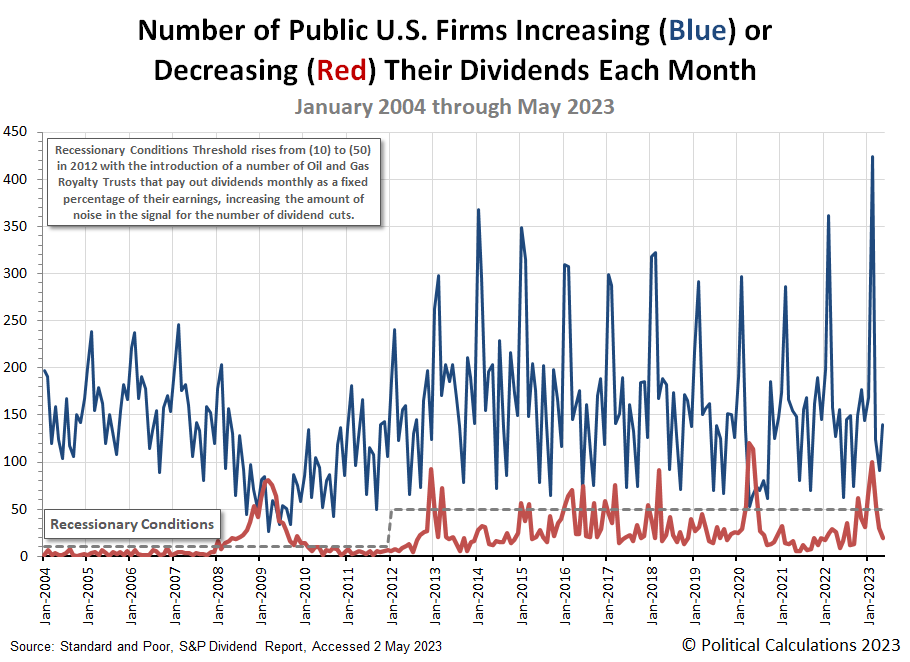

According to Standard & Poor, May 2023 showed signs of a rebound for the dividend paying companies of the U.S. stock market.

The number of firms increasing their dividends was up from last month, while the number of dividend paying firms was down. Normally, that combination represents a positive scenario for investors.

But there's a problem when we get to the numbers. We regularly sample dividend declarations each month, making a point of tracking the number of unfavorable dividend actions we find among all the month's announcements. We counted no fewer than 35 announcements of reduced, cut, or suspended dividends.

S&P only reported twenty such unfavorable changes for dividend payers in May 2023.

That makes May 2023 a very rare occurrence where our sample of dividend reductions is larger than the total reported by S&P. We'll dig more into the sampling later, but for now, here's the big picture showing where Standard & Poor's data on dividend increases and decreases for May 2023 fits as the latest data in what they've reported each month since January 2004.

The following table presents S&P's dividend metadata for May 2023, summarizing how the month's dividend data compares in both Month-over-Month (MoM) and Year-Over-Year (YoY) terms with previously reported data:

| Dividend Changes in May 2023 | |||||

|---|---|---|---|---|---|

| May-2023 | Apr-2023 | MoM | May-2022 | YoY | |

| Total Declarations | 4,093 | 3,169 | 924 ↑ | 4,041 | 52 ↑ |

| Favorable | 230 | 130 | 100 ↑ | 258 | -28 ↓ |

| - Increases | 140 | 91 | 49 ↑ | 156 | -16 ↓ |

| - Special/Extra | 87 | 39 | 48 ↑ | 85 | 2 ↑ |

| - Resumed | 3 | 0 | 3 ↑ | 17 | -14 ↓ |

| Unfavorable | 20 | 30 | -10 ↓ | 9 | 11 ↑ |

| - Decreases | 20 | 30 | -10 ↓ | 9 | 11 ↑ |

| - Omitted/Passed | 0 | 0 | 0 ↔ | 0 | 0 ↔ |

Overall, S&P's dividend data is up month-over-month, and down year-over-year.

As noted, our sampling of dividend changes tallied 35 unfavorable actions during May 2023. Fourteen of these reductions or omissions are attributable to firms that pay variable dividends in the oil and gas sector, which we'll a deeper look at later this month.

Just as significantly, we counted 6 dividend reducing firms in the financial services sector, 2 in the real estate industry, and 2 banks. Together, that's 10 firms from the sectors of the economy most sensitive to interest rate hikes that reduced their dividends.

The remaining firms whose business outlooks were distressed enough to prompt them to cut their dividends include three firms each in the consumer goods or shipping industries and two firms each in the chemical and manufacturing industries. One media company acted to cut its dividend to round out the total for the month in the sample. Here is the list - clicking the links for the firm's names will take you to our source indicating the reduced or omitted dividend for it:

- Diamondback Energy (NASDAQ: FANG)

- Viper Energy (NASDAQ: VNOM)

- CVR Partners (NYSE: UAN)

- Sturm Ruger (NYSE: RGR)

- Chord Energy (NASDAQ: CHRD)

- Sabine Royalty Trust (NYSE: SBR)

- Paramount Global (NASDAQ: PARA)

- Kimbell Royalty Partners (NYSE: KRP)

- Eagle Bulk Shipping (NASDAQ: EGLE)

- Sculptor Capital Management (NYSE: SCU)

- Artisan Partners Asset Management (NYSE: APAM)

- Genco Shipping & Trading (NYSE: GNK)

- City Office (REIT-Office) (NYSE: CIO)

- Great Ajax (REIT-Mortgage) (NYSE: AJX)

- Cheniere Energy Partners (NYSE: CQP)

- PacWest Bancorp (NASDAQ: PACW)

- Devon Energy (NYSE: DVN)

- Bridge Investment Group Holdings (NASDAQ: BRDG)

- TPG Specialty Lending (NYSE: TSLX)

- Ardmore Shipping (NYSE: ASC)

- National Bankshares (NASDAQ: NKSH)

- Crescent Energy (NYSE: CRGY)

- Crane NXT (NYSE: CXT)

- TPG Inc. (NASDAQ: TPG)

- Permianville Royalty Trust (NYSE: PVL)

- Newell Brands (NASDAQ: NWL)

- Tri-Continental (NYSE: TY)

- Hugoton Royalty Trust (OTC: HGTXU)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Marine Petroleum Trust (NASDAQ: MARPS)

- Cross Timbers Royalty Trust (NYSE: CRT)

- PermRock Royalty Trust (NYSE: PRT)

- Valhi (NYSE: VHI)

- Big Lots* (NYSE: BIG)

- Advance Auto Parts (NYSE: AAP)

The firm marked with an asterisk in this listing, Big Lots (NYSE: BIG), suspended (or omitted) its dividend during May 2023.

We've previously confirmed that S&P's dividend statistics have been missing firms that have announced they are suspending will omit paying their dividends. In fact, they haven't reported any since June 2021. We had thought they were grouping them with their count of dividend decreases, but now we're curious how they're doing their counting for both decreases and omissions. That's become an unanswered question.

Update

5 June 2023: A couple of sharp-eyed readers identified errors in our reference sources' reports of dividend decreases for the following two firms:

- Ready Capital (REIT-Mortgage) (NYSE: RC)

- FS KKR Capital (NYSE: FSK)

In both cases, there's unusual activity that was not captured in their respective reports from our linked reference sources. In the case of Ready Capital, the reported new dividend of $0.14 per share represents a payment to the firm's new "Broadmark" shareholders, while the firm's original shareholders received a $0.40 per share payment, which is in line with their previous payment.

Meanwhile, FSK announced a series of supplemental dividend payouts that will be spread out during 2023, but leaving their regular quarterly dividend unchanged. The automated system-generated report in this case didn't recognize the smaller supplemental dividends did not represent a change from the firm's regular quarterly dividend.

We've updated the numbers related to May 2023's sampling of dividend decreases accordingly, with the changed figures indicated with boldface font.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. 1 June 2023.

Image credit: Photo by Emily Morter on Unsplash.

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.