The S&P 500 (Index: SPX) didn't change much during the first full trading week of December 2023. The index closed the week at 4604.37, up 0.2% from where it closed out the previous week.

But the dividend futures-based model indicates investors pushed out their time horizon by a quarter toward the more distant future quarter of 2024-Q2. The change comes as positive economic news changed the expected timing of when the Federal Reserve will begin cutting interest rates in response to slowing economic conditions in 2024.

The CME Group's FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through next April (2024-Q2), six weeks longer than it projected a week ago. Starting from 1 May (2024-Q2), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

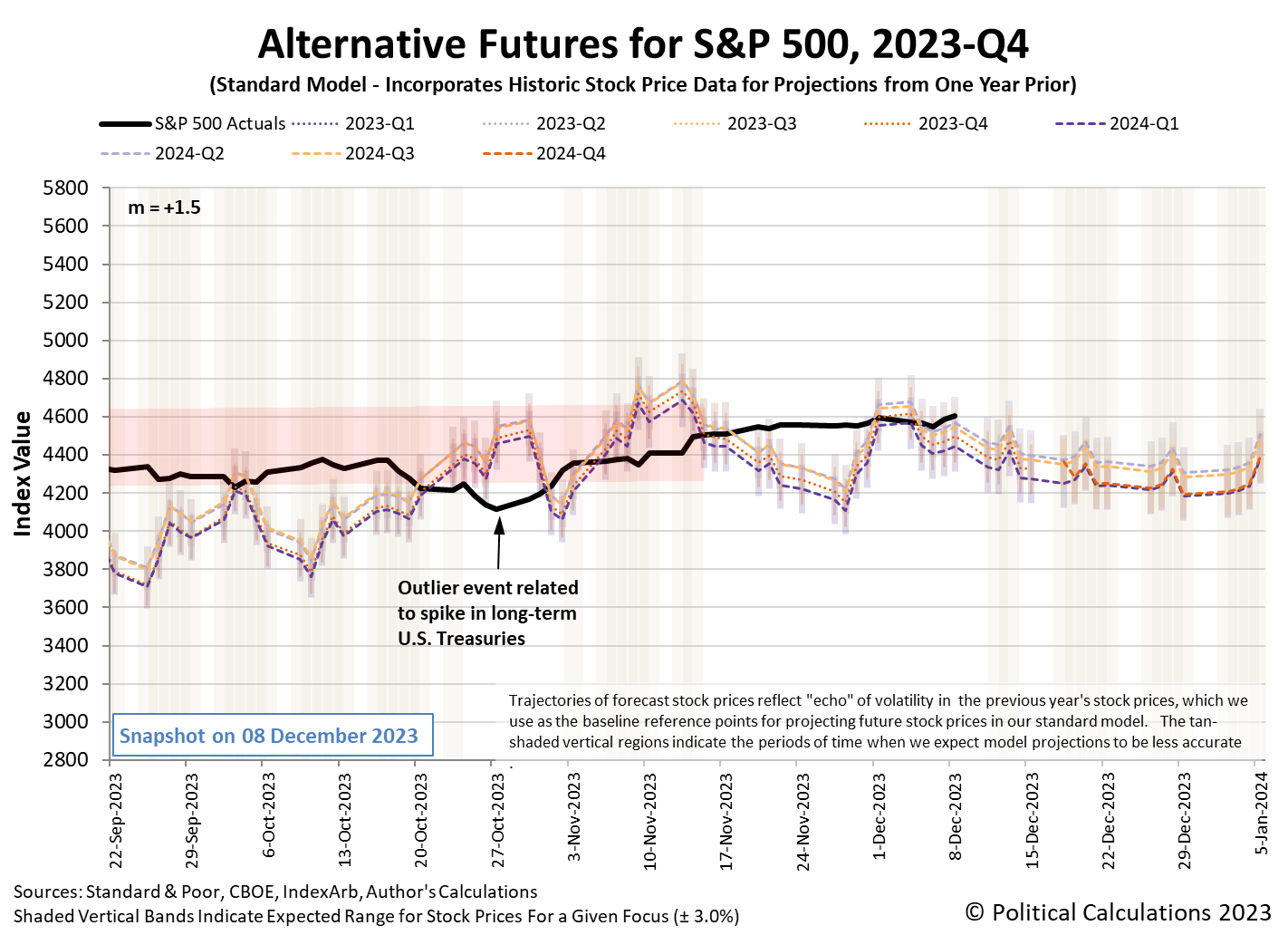

The latest update for the alternative futures chart confirms the trajectory of the S&P 500 is consistent with 2024-Q4 as the new focal point for investors.

The Federal Reserve's Open Market Committee is having their final two-day meeting of 2023 this week. The announcments that come out of the meeting and the press conference that follows it on Wednesday, 13 December 2023 may well be the last major economic event of the year with market-moving potential in the U.S. The thing to watch out for is whether the Fed's minions will say anything that alters the expectations investors have for the timing of rate cuts in 2024.

With Fed officials in communication blackout mode this past week, there was little new information from that corner to influence investor expectations. On the plus side, there were fewer market moving news headlines for investors to absorb during the week that was.

- Monday, 4 December 2023

-

- Signs and portents for the U.S. economy:

- Fed minions coming to terms that they're probably done with rate hikes:

- Bigger stimulus, bailouts, trouble developing in China:

- China has more space to cut reserve ratio instead of interest rates, says ex-official

- China edges towards a big bail-out

- China's big pig breeders dig in as losses and debts mount

- BOJ minions looking for reasons to keep never-ending stimulus alive:

- Bigger trouble developing in the Eurozone:

- Nasdaq, S&P, Dow end lower as Wall Steet takes a break after five weeks of gains

- Tuesday, 5 December 2023

-

- Signs and portents for the U.S. economy:

- Oil falls to near 5-month low on OPEC+ cut doubts, demand concerns

- US job openings hit more than 2-1/2-year low as labor market cools

- US service sector picks up in November - ISM

- Bigger trouble developing in China despite some positive news:

- Moody's cuts China credit outlook, citing lower growth, property risks

- China's state banks seen swapping and selling dollars for yuan - sources

- China's Nov services activity accelerates on boost from new orders - Caixin PMI

- BOJ minions may have a bank problem to address:

- ECB minions forced to admit they won't hike rates anytime soon as bigger trouble develops in the Eurozone:

- Exclusive: ECB hawk Schnabel takes rate hike off table

- Fall in euro zone business activity adds to recession expectations

- Wall Street ends mixed after job openings hint at cooling economy

- Wednesday, 6 December 2023

-

- Signs and portents for the U.S. economy:

- Oil falls 4% as build in gasoline stocks fuel demand concerns

- Weak US third-quarter unit labor costs point to slowing inflation

- US regulators clamp down in bid to prevent more bank failures

- Fed minions expected to start rate cuts in or by mid-2024:

- Positive signs for China's economy:

- ECB minions expected to deliver rate cuts earlier in 2024:

- Nasdaq, S&P, Dow end in the red, dragged down by energy stocks as oil falls below $70

- Thursday, 7 December 2023

-

- Signs and portents for the U.S. economy:

- Oil drops to 6-month low on weak economic outlook, high U.S. supply

- Dollar General tops quarterly results as more shoppers turn to its stores

- US mortgage rates fall to nearly 4-month low - Freddie Mac

- Positive signs for China's economy:

- BOJ minions start actively promoting plan to end never-ending stimulus:

- Nasdaq ends sharply higher as Alphabet and AMD fuel AI surge

- Friday, 8 December 2023

-

- Signs and portents for the U.S. economy:

- Oil climbs 2% but still headed for seventh weekly drop

- US November payrolls growth hurts case for early '24 Fed cuts

- Fed minions expected to start delivering rate cuts in May 2024 after jobs report:

- Positive signs for China's economy:

- S&P posts six-week win streak after favorable labor market data; Dow, Nasdaq also rise

The Atlanta Fed's GDPNow tool's estimate of real GDP growth for the current quarter of 2023-Q4 held steady at +1.2% annualized growth for a second week. This is approximately the middle of the range anticipated by the so-called "Blue Chip Consensus", whose estimates run from a low of 0.7% to a high of 1.8%.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "Time horizon, highly detailed, digital art concept".

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.