Update 10 June 2009: Welcome Calculated Risk fans! If you're interested, we can also work out how much today's skyrocketing national debt levels will take out of your pocketbook over each of the next 25 years. Or whether or not it makes financial sense for you to buy the new Kindle DX, which will start shipping tomorrow!...

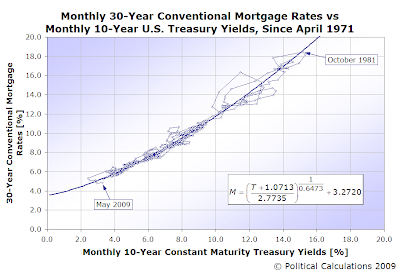

Going to the source data that CR used, we used ZunZun's 2-D function finder to identify a less complicated mathematical relationship that more closely describes the correlation between 30-year conventional mortgages and 10-year U.S. Treasuries (our version has a determination coefficient, R2, of 0.9731!) That relationship is presented in the chart to the above right, and the tool to do that math is below!

Predicting Mortgage Rates

Using the tool, we find that at yesterday's closing 10-Year U.S. Treasury yield of 3.89%, we might anticipate mortgage rates to come in at 5.73%. However, the current overnight mortgage rate is 5.45%, which would suggest that either the treasury yield will soon be falling or that the current mortgage rates will rise toward this higher level.

Predicting Treasury Yields

But wait, that's not all! Because 30-year conventional mortgage rates and 10-year Treasury yields would appear to be so highly co-dependent, we built another tool to do the math in the reverse direction! The tool below will predict the value of the 10-Year Constant Maturity U.S. Treasury Yield based on where the markets have set the level of the 30-Year Conventional Fixed Rate Mortgage:

Using the default data of 5.45% for 30-Year Conventional Fixed Rate Mortgages, which we obtained from Bankrate.com's overnight mortgage rates, we could reasonably anticipate that 10-Year U.S. Treasury Yields would be about 3.52%. In reality, the 10-Year Treasury note closed yesterday at 3.89%, which suggests that either mortgage rates will head up to support the higher level it's currently at or the Treasury yield will fall.

Given how mortgage rates have behaved in recent weeks, our money would be on mortgage rates going up.

Either way, you can now use our tool to reasonably anticipate how either treasury yields or mortgage rates will adapt to each other!

Update 15 June 2009: So what's happened nearly a week later? The yield on the 10-Year U.S. Treasury has fallen to 3.74%, while overnight 30-year conventional mortgage rates have risen to 5.67%, or in other words, both rates have converged toward where our tool would predict. How cool is that?!

Labels: forecasting, real estate, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.