As expected, the market capitalization of new homes sold in the U.S. continued rising in March 2023. Increases in the number of new homes sold and their sale prices are responsible for the development, building on the momentum from February 2023's first increase of the nation's new home market cap after 11 months of steep decline.

That decline coincides with the Federal Reserve's series of rate hikes that began in March 2022 when the Fed finally responded to inflationary pressures that began building a year earlier. The rate hikes have contributed to pushing up mortgage rates, which peaked around 7.0% in November 2022 and have come down since. A 30-year conventional fixed rate mortgage reached an average post-peak low of 6.3% in February, before bouncing up to an average of 6.5% during March 2023.

While mortgage rates averaged slightly higher in March, it wasn't enough to overcome the positive momentum for new home sales, as Reuters reports "the worst of the housing market rout is likely over". But they note there's a cloud to go with that silver lining - more on that later....

Here is the latest update to our chart tracking the trends for the market cap of new homes, which illustrates how U.S. new home builders and this sector of the U.S. economy are faring:

The chart shows the time-shifted rolling twelve month average of the U.S. new home market capitalization for March 2023 is $26.95 billion. This figure is an initial estimate, which will be subject to revision during each of the next three months.

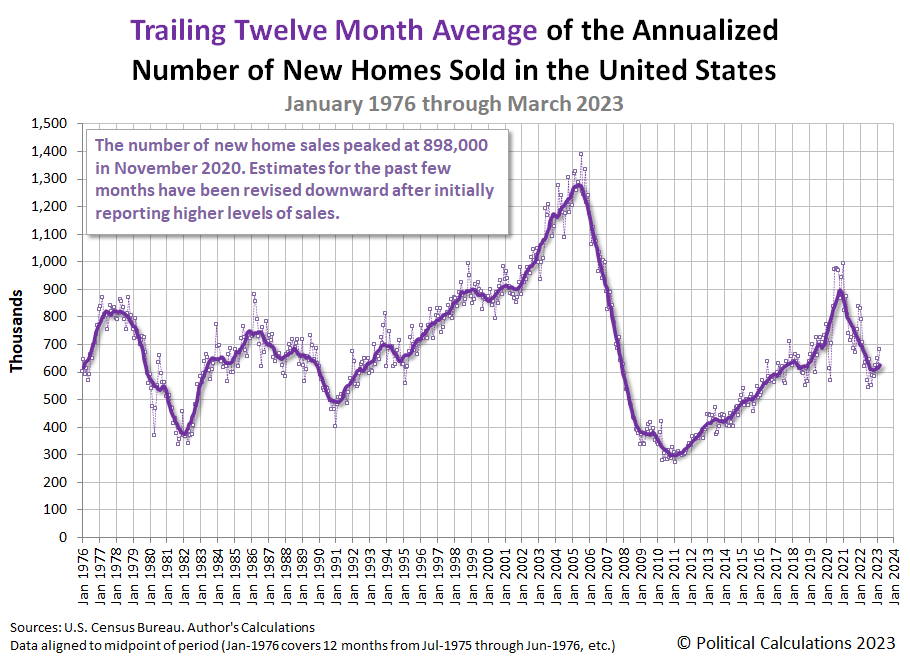

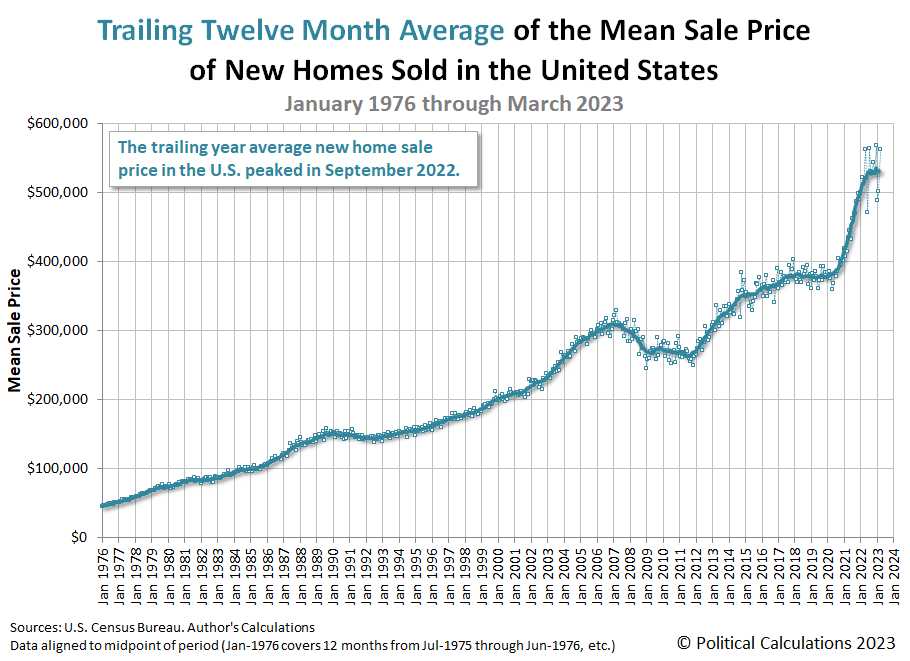

The next two charts show the latest changes in the trends for new home sales and prices:

As we mentioned, there is a cloud in the silver lining for U.S. new home builders. Reuters finds the potential for gloom after pointing to the glittery lining:

Home builder sentiment continues to creep up, though it is still depressed. Single-family housing starts have risen for two consecutive months in March and permits for future construction increased to a five-month high.

Still, challenges remain. Banks have tightened lending standards, which could make it harder for homebuilders to access funding for new projects and for prospective home buyers to secure loans to purchase houses.

The median new house price in March was $449,800, a 3.2% rise from a year ago. There were 432,000 new homes on the market at the end of last month, down from 434,000 in February. At March's sales pace it would take 7.6 months to clear the supply of houses on the market, down from 8.4 months in February.

The question for new home builders continues to be whether the positive momentum can overcome the negative conditions that are developing in the U.S. economy. Now that we're past the first quarter of 2023 and soon reaching what's expected to be the end of the Fed's series of rate hikes, the answer to that question will hinge on other developing economic factors.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 April 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 April 2023.

Image credit: WikiMedia Commons: Home Under Construction. Creative Commons Attribution-Share Alike 3.0 Unported License.

Labels: real estate

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.