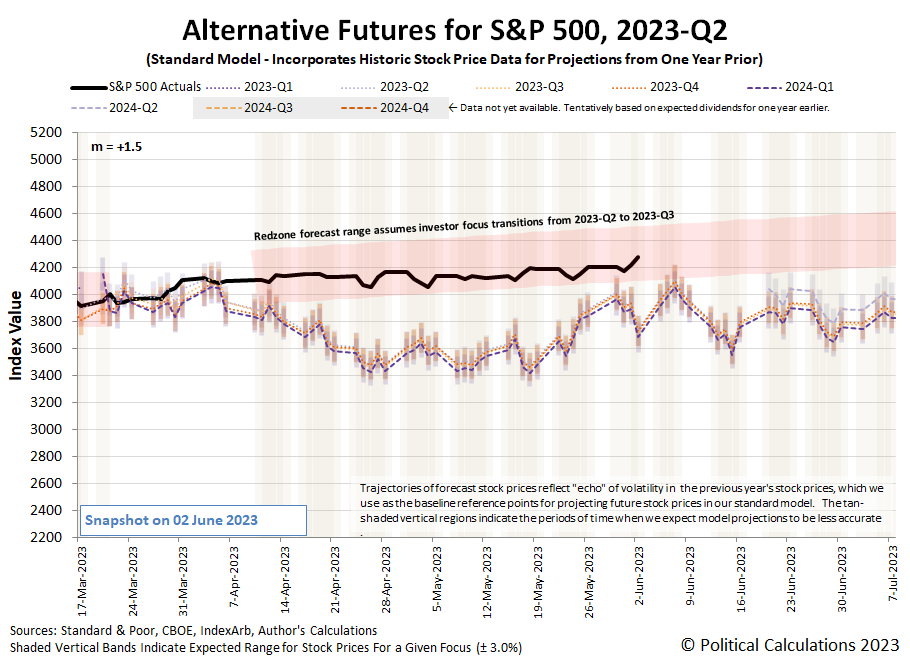

The S&P 500 (Index: SPX) had its best week as it exited May and entered June 2023, rising over 1.8% to reach 4282.37, its highest level since 18 August 2023. That also puts the level of the index some 10.7% below its record high peak of 4,796.56 that it set on 3 January 2021.

All of that positive increase was achieved after two major news events during the week. The first came on Thursday, 1 June 2023, shortly after the Federal Reserve's Patrick Harker announced the Fed "really should skip" hiking rates in June 2023.

The second news event came at 8:30 AM on Friday, 2 June 2023, when the May employment situation report was released. While reporting higher than expected employment levels, it more significantly reported slowing wage growth.

The two actions together signal slowing inflation and a more positive environment for stock prices, which rose both sharply and shortly after each of these news events. The two events boosted the redzone forecast trajectory on the latest update of the alternative futures chart.

A deal to raise the U.S. government's debt ceiling was also reached during the week, but all the news related to that development proved to have little to no impact on the trajectory of stock prices. We're basing that assessment on the lack of notable changes in the trajectory of E-Mini S&P 500 futures at the times significant news related to the debt ceiling deal occurred, but which do show significant changes in the trajectory of stock prices that correspond to the timing of the two market moving news events we've highlighted.

Speaking of the week's market moving headlines, here's our recap of what happened during the Memorial Day holiday-shortened trading week.

- Tuesday, 30 May 2023

-

- Signs and portents for the U.S. economy:

- Fed minions, biggest holders of U.S. government debt, excited by debt ceiling deal:

- Bigger trouble developing in China:

- China's factory activity likely contracts in May - Reuters poll

- China industrial profits tumble 18% in April as demand sputters

- BOJ minions looking to keep never-ending stimulus alive, worry about wage hikes:

- BOJ chief says to patiently keep ultra-easy policy

- BOJ may hike rates if sustained wage growth looks likely-government panellist

- ECB minions rate hikes producing desired result:

- Tech stocks help Nasdaq close higher; S&P ends largely unchanged while Dow slips

- Wednesday, 31 May 2023

-

- Signs and portents for the U.S. economy:

- U.S. home prices to fall less than expected despite high borrowing costs: Reuters poll

- Oil falls on weak China data, stronger U.S. dollar

- U.S. banks saw record deposit declines in Q1 as profits remained steady: FDIC

- Wells Fargo CEO says there will be losses in office loan portfolio

- Fed minions getting excited to keep hiking rates after pausing in June, upset by rebound in housing market:

- US rate futures expect Fed pause in June in sharp turnaround from earlier

- Fed's Harker: Inclined to 'skip' a rate hike in June

- Fed's Mester says no 'compelling' reason to pause rate hikes -FT

- Fed's Bowman says housing market rebound could impact inflation fight

- BlackRock's CEO expects more rate hikes as inflation persists

- Bigger trouble developing in Asia:

- China's factory activity falls faster than expected as recovery stumbles

- S.Korea April factory output falls, retail sales drop most in 5 months

- Japan April factory output unexpectedly falls on weaker machinery orders

- Thai April factory output drops 8% y/y, worse than forecast

- BOJ minions start prepping for end of never-ending stimulus, ECB minions worry that may cause global problems:

- BOJ's Ueda says era of low global interest rates may be over

- BOJ normalisation could strain global bond markets: ECB

- Bigger trouble developing in the Eurozone:

- No quick recovery for German economy after winter slump - DIW

- German inflation dips to lowest level in more than a year

- S&P 500 ekes out slight gain in May, extends monthly-win streak to three

- Thursday, 1 June 2023

-

- Signs and portents for the U.S. economy:

- Oil rises 3% on US debt ceiling progress, traders on alert for OPEC+ meeting

- U.S. manufacturing slumps further in May; employment picks up -ISM

- U.S. construction spending surges in April

- U.S. consumer outlook dims as upscale retailers, discounters slash forecasts

- Fed minions say no rate hike in June, more coming after….

- Mixed signs emerging in Asia:

- Japan's factory activity expands first time in 7 months - PMI

- South Korea factory activity slumps into longest downtrend since early 2009 - PMI

- China's factory activity swings to surprise growth in May - Caixin PMI

- India's May factory activity grows at fastest pace since Oct 2020

- Bigger trouble developing in the Eurozone:

- Euro zone factory downturn deepens in May despite price cuts

- German manufacturing shrinks at fastest in 3 years in May -PMI

- ECB minions see end of rate hikes, still excited to keep hiking rates:

- Euro zone inflation tumbles, fuelling ECB rates debate

- Euro steadies after Lagarde promises rate hike as inflation still too high

- ECB nearing end of tightening cycle but final stretch remains, De Guindos says

- ECB's Villeroy: upcoming rate hikes will be marginal

- Nasdaq ends +1%, S&P, Dow also gain on hopes for rate hike pause at June Fed meet

- Friday, 2 June 2023

-

- Signs and portents for the U.S. economy:

- Oil Brief: NY Crude Up 1.4% at Above US$71 Amid Talk of China Stimulus

- US employers boost hiring in May, but labor market losing steam

- Fed minions using other means to signal June pause for rate hikes:

- Fed rate-hike pause still likely despite strong data

- Fed's new projections may fill the void on interest rate guidance

- Much bigger stimulus developing in China:

- China plans new property-market support package to boost economy - Bloomberg News

- Analysis-China's yuan may slip further to aid economic recovery - analysts

- BOJ minions okay with taking lots of time to hit low inflation target, JapanGov minions draft their own never-ending fiscal stimulus plan:

- BOJ's Ueda: No set time frame for hitting 2% price target

- Japan's govt will vow to end deflation with bold monetary, flexible fiscal policy -draft

- Dow ends 700 points higher as stock-market rally puts S&P 500 on verge of bear-market exit

After Fed officials signaled they will pause in hiking the Federal Funds Rate in June, the CME Group's FedWatch Tool changed its projections to match that expectation. It now projects the Federal Reserve will not hike rates until the Fed's Open Market Committee meets on 26 July 2023, when a quarter point rate hike is anticipated. That would put the Federal Funds Rate at a target range of 5.25-5.50%, which the tool also anticipates will be the peak for the series of rate hikes that began in March 2022. The FedWatch Tool still anticipates the Fed will hold rates at that peak level until its 31 January (2024-Q1) meeting, at which it is will initiate a series of quarter point rate cuts at six-to-twelve-week intervals to address recessionary conditions in the U.S. economy.

The Atlanta Fed's GDPNow tool estimate of the real GDP growth rate for 2023-Q2 ticked up to +2.0% from the +1.9% growth rate it forecast a week earlier.

Image credit: Charging Bull Statue by Petr Kratochvil via PublicDomainPictures.net. Creative Commons. CCO Public Domain.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.