What is the median income earned by individual Americans in each U.S. state? And how does your income compare to it?

We can help you answer one of those questions! On 9 April 2024, the U.S. Census Bureau released its Occupational Employment and Wage Statistics data for incomes earned by individual Americans in May 2023. We extracted the data for the median (and average) incomes earned by individuals employed in all occupations for each of the fifty states and created the following interactive map to present it. If you're accessing this article on a site that republishes our RSS news feed, you may need to click through to our site to access a working version.

We'll be discussing the April 2024 estimates for median household income for the entire United States in the near future, but if you're okay with spoilers, Motio Research has already reported their estimate for April 2024 is $78,230.

Reference

U.S. Census Bureau. Occupational Employment and Wage Statistics. State (May 2023). [ZIP File (Excel Spreadsheet)]. 9 April 2024.

Labels: demographics, income

After the preceding month's better-than-expected numbers, the number of new home sales in the U.S. fell in April 2024. Worse, the estimated number of new home sales for January through March 2024 was revised downward.

Not uncoincidentally, the median and average sale prices recorded for new homes in those months was revised upward. The overall trend over the last several months however is flat.

This combination of factors mean the downward momentum for new home sales as reasserted itself. Our initial estimate of April 2024's market capitalization of the new home market is $27.24 billion, down about 4.4% since October 2023 and nearly 10% from its December 2020 pre-Biden era peak. After adjusting for inflation, the new home market's decline exceeds 23%.

The main culprit behind the continuing downward trend for the new home market is inflating mortgage rates, which have been rising and topped the 7.0% threshold in recent weeks. Mortgage rates rising faster than incomes reduce the relative affordability of new homes, putting them out of reach for a majority of U.S. households.

The following charts track the U.S. new home market capitalization, the number of new home sales, and their sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through April 2024.

Here's how the effects of the run-up in mortgage rates on home sales is being reported:

The run-up in mortgage rates has sapped momentum from the housing market. The National Association of Realtors on Wednesday reported a drop in existing home sales in April, while government data last week showed single-family housing starts and building permits fell last month. Homebuilder confidence deteriorated considerably in May.

The median new house price increased 3.9% to $433,500 in April from a year ago. Most of the new homes sold last month were in the $300,000-$499,999 price range.

We'll take a closer look at how unaffordable new houses have become for the typical American household in the next week.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 May 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 May 2024.

Image credit: New Home Construction by Paul Brennan on PublicDomainPictures.net. Creative Commons CC0 1.0 DEED CC0 1.0 Universal.

Labels: real estate

As inflation continues biting American consumers, news headlines involving their personal finances have become more dire.

Here's an example that recently grabbed our attention:

Analysts at the Federal Reserve Bank of New York report that result is heavily weighted toward younger Americans. They indicate around one out of six members of Generation Z face those financial straits, compared with one out of twenty members of the Baby Boom generation.

Regardless of generation, it might be very helpful to know how long it would take you to pay off your credit card debt. That question can be answered with the personal finance formula known as the "Credit Card Equation, which we've built the following tool to do. Just enter the details of any credit card debt scenario you want to consider and it'll tell you how long it will take to pay off that debt, assuming no additional debt is charged up on that credit card. [If you're accessing this tool on a site that republishes our RSS news feed, please click through to our site to access a working version.]

If you're wondering about the default values in the tool, they are the figures we pulled from the following sources that were available as of 24 May 2024:

- Bankrate Current Average Credit Card Interest Rate (Annual Percentage Rate)

- Credit Karma's State of Debt and Credit Report, January-March 2024. This report indicates the average credit card balance of 82.9 million Credit Karma members and the average size of their next planned payment.

Again with the assumption that no additional debt is charged to this "average" American credit card, the tool finds it will take 58 months to fully pay it down to a zero balance. Playing with the tool, we found that increasing the monthly payment by $20 can take eight months off that payoff period. Reducing the monthly payment to $180 however will extend the payoff time to 70 months.

Don't let us have all the fun! Go ahead and take it for your own test drive to work out whatever range of credit card payoff scenarios you want to consider.

Image credit: Woman with many credit cards by Petr Kratochvil on PublicDomainPictures.net. Creative Commons CC0 1.0 DEED CC0 1.0 Universal.

Labels: personal finance, tool

If anything noteworthy happened to the S&P 500 (Index: SPX), you wouldn't know it from how the index changed over the past trading week.

The S&P 500 closed at 5,304.72 on the Friday before 2024's Memorial Holiday weekend. That was an increase of 1.45 points above where the index closed the preceding week. But that 0.03% gain was enough for the S&P to "eke out" its fifth consecutive "up" week.

In between Friday, May 17 and Friday, May 24, the index set a new record high close of 5,321.41 on Tuesday, May 21, 2024. After which it retreated a full percentage point over the next two days as prospects for rate cuts in 2024 slipped. And then it recovered on Friday to "eke" out that five-week-long win streak. No real explanation for it, other than the bulls and bears on Wall Street were more than ready to go off on their holiday weekends and didn't want to make any waves before they left.

The week's action puts the trajectory of the S&P 500 well within the forecast range for investors focusing their attention on 2024-Q3, which still coincides with Wall Street's expectations for when the the Federal Reserve will execute a rate cut. The latest update of the alternative futures chart shows where things stand as Wall Street's summer begins:

Here are the week's market-moving headlines, such as they were, which describe a lot more exciting action than we just did....

- Monday, 20 May 2024

-

- Signs and portents for the U.S. economy:

- Oil steadies after death of Iran's president, Saudi king's ill health

- US regulators reconsider capital hike for big banks, WSJ reports

- Fed minions "disappointed" with inflation, want more time before they start cutting rates:

- Fed policymakers still cautious on inflation and policy

- Fed's Barr: Inflation data 'disappointing,' tight policy needs more time

- Bailout, economic recovery not as big as wanted in China:

- China's property support measures disappoint

- China's fiscal revenue shrank 2.7% in Jan-April amid shaky economic recovery

- Slump in China's home prices, sales set to worsen this year - Reuters poll

- Dow ends lower and falls back below 40,000 while S&P and Nasdaq advance

- Tuesday, 21 May 2024

-

- Signs and portents for the U.S. economy:

- Oil prices fall on fear of high US interest rates depressing demand

- U.S. auto insurance shoppers jump 6% in Q1, TransUnion says

- Fed minions say they're not just doing nothing, they're not hiking rates:

- Fed officials urge patience on timing of initial rate cut

- Fed's Waller sees some progress on inflation, no rate hike needed

- US households still feel pinched by inflation, Fed survey says

- Bigger bailout developing in China:

- "Good news, everyone!" say ECB minions:

- ECB's Lagarde 'really confident' inflation under control

- Back-to-back ECB rate cuts not a given, Nagel says

- Dow ekes out gain, Nasdaq and S&P notch record closing high a day ahead of Nvidia results

- Wednesday, 22 May 2024

-

- Signs and portents for the U.S. economy:

- Oil slips for third day on likely 'higher for longer' US rates

- US home sales post second straight monthly drop; house prices accelerate

- Fed minions becoming less sure of what they'll do next:

- Fed shifts talk to 'scenarios' as policy grows less certain

- Fed Officials Saw Longer Wait for Rate Cuts After Inflation Setbacks

- BOJ minions see interest rates rise to highest in decade:

- Stocks fall after Fed minutes; Nvidia shares climb after the bell

- Thursday, 23 May 2024

-

- Signs and portents for the U.S. economy:

- Oil creeps back up after three days of losses

- US new home sales fall in April; prices rise from year ago

- Improved business activity casts doubt over rate cuts

- Fed minions thinking they should worry about inflation more:

- Bigger stimulus developing in China:

- BOJ minions see problems for themselves among green shoots in Japan's economy:

- Japan's factory activity expands for first time in a year, PMI shows

- Japan factory output seen up, inflation complicates BOJ exit: Reuters poll

- Japan's inflation slows further, keeping BOJ cautious on rate hikes

- BOJ's Ueda sticks to economic recovery view, keeps alive rate hike chance

- Signed of improvement in Eurozone economy:

- Whipsawed on Wall Street:

- How the day started:

- How it ended:

- But there was one big winner in an otherwise down day:

- What ruined the bulls party:

- Friday, 24 May 2024

-

- Signs and portents for the U.S. economy:

- US's Yellen expresses concern over rising living costs, FT says

- Oil holds steady around three-month lows

- Fed minions starting to realize they may not have done enough to combat President Biden's inflation:

- Fed's Waller points to forces that may lift future underlying interest rates

- Central bankers should acknowledge blind spots, Fed's Mester says

- ECB minions getting excited to deliver a rate cut, won't let rising wages stop them:

- ECB's Panetta says consensus growing on need for rate cut

- Wage pick up won't jeopardize ECB's June rate cut, Nagel says

- S&P ekes out five-week win streak while Nasdaq ends at a record high; Dow gains slightly

The CME Group's FedWatch Tool continued holding steady in anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3) for the fourth week in a row. The tool anticipates the Fed will start a series of 0.25% rate cuts on that date that will proceed well into 2025 at 12-to-18 week intervals.

The Atlanta Fed's GDPNow tool's forecast of annualized real GDP growth rate during 2024-Q2 ticked down to 3.5% from the +3.6% growth it projected in a week earlier.

Image credit: Microsoft Bing Image Creator. Prompt: "An editorial cartoon of a Wall Street bull and bear relaxing on lounge chairs at the beach during the Memorial Day holiday weekend".

How does your retirement savings compare against your demographic age group peers in the United States? If you've been wanting to answer that question, Niccolo Conte and Dorothy Neufeld of Visual Capitalist created a useful chart you can use to quickly find out how you compare with members of your age group who are saving for retirement.

The chart provides two key data points for several standard age brackets: the median and average retirement savings for Americans whose age falls within each. The savings data itself was compiled by the Federal Reserve in its 2022 Survey of Consumer Finances, which is the most recent year this data is available.

Of the two data points, the median retirement savings will provide the best indication of how you compare with your age group peers. Half of Americans within the indicated age groups will have more retirement savings than this amount, while the other half will have retirement savings below this number. Here's the chart:

The numbers in the chart represent only money that Americans have saved in dedicated retirement accounts and does not include any money saved or wealth accumulated in other kinds of savings and investment accounts. The most common types of these include the Individual Retirement Account (IRA), employer-sponsored 401(k) retirement savings plans, and nonprofit employer-sponsored 403(b) retirement savings plans.

The savings in these retirement savings accounts help fund Americans' life after work, which is also supported by benefits like Social Security. And of course, whatever other kinds of financial accounts or wealth Americans have accumulated when they reach retirement age.

Labels: data visualization, personal finance

The employment situation for U.S. teenagers dipped slightly in April 2024. The seasonally adjusted number of 16-19 year olds counted as having jobs decreased from the previous month's total by 23,000 (or 0.4%) to 5,839,000. That's just under a third of the entire population of U.S. teens in this age bracket.

Although it dipped, the jobs trend for older teens (Age 18-19) remains positive. The same however cannot be said of younger teens (Age 16-17), whose numbers among the employed have been generally declining since December 2022 and more sharply since January 2024.

These changes can be seen in the following paired set of charts, which track teen employment and the teen employment-to-population data from January 2016 through April 2024.

Each of the data series presented in these charts receives its own seasonal adjustment. Because of that, the numbers of working Age 16-17 year olds and Age 18-19 year olds won't necessarily add up to the totals shown for the combined Age 16-19 population. If you're looking for employment figures that do add up, you'll want to review non-seasonally adjusted data.

References

U.S. Bureau of Labor Statistics. Labor Force Statistics (Current Population Survey - CPS). [Online Database]. Accessed: 3 May 2024.

Image Credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of teenagers applying for jobs".

Labels: demographics, jobs

Why have stock prices rallied so much during the past several months?

As it happens, there's a very fundamental answer to that question, provided you know how stock prices work, which is to recognize that changes in current-day stock prices are primarily driven by changes in the expectations about the future rate of growth of their underlying dividends per share.

If those expectations become more positive, that change can be expected to be accompanied by a rally in stock prices. If those expectations become more negative, then stock prices can be expected to fall. Either way, if you want to understand why stock prices behave as they do, you need to start with what the expectations for future dividends are doing.

That's why we pay close attention to quarterly dividend futures. Our regularly scheduled snapshot of the future for S&P 500 dividends per share for Spring 2024 comes at the end of the following animation, in which we reveal how the expectations of dividend growth through each quarter of 2024 has changed since we started tracking them at roughly monthly intervals in October 2023.

Over the past two months, there have been two major positive dividend events, both involving companies whose market capitalizations gives them a heavy weighting in the S&P 500 (Index: SPX), neither of which had previously ever paid dividends. The first was Meta Platforms (NASDAQ: META), more popularly known as Facebook, who initiated its first dividend in early February 2024. The second came in the final week of April 2024 with Alphabet's announcement that the company formerly known as Google (NASDAQ: GOOG and NASDAQ: GOOGL) would start paying dividends.

Add in the conveyance effect and other dividend increase announcements and it's been good spring for the outlook for the S&P 500 dividends per share. It shouldn't be a surprise to find the index has rallied to record highs.

Here are the dates of the individual snapshots presented in the animated chart, with links to where we originally presented the data in them:

- 13 October 2023

- 14 November 2023

- 15 December 2023

- 9 February 2024

- 19 March 2024

- 15 April 2024

- 14 May 2024

More About Dividend Futures Data

Dividend futures indicate the amount of dividends per share to be paid out over the period covered by each quarter's dividend futures contracts, which start on the day after the preceding quarter's dividend futures contracts expire and end on the third Friday of the month ending the indicated quarter. So for example, as determined by dividend futures contracts, the now "current" quarter of 2024-Q2 began on Saturday, 16 March 2024 and will end on Friday, 21 June 2024.

That makes these figures different from the quarterly dividends per share figures reported by Standard and Poor. S&P reports the amount of dividends per share paid out during regular calendar quarters after the end of each quarter. This term mismatch accounts for the differences in dividends reported by both sources, with the biggest differences between the two typically seen in the first and fourth quarters of each year.

Image Credit: Microsoft Copilot Designer. Prompt: "A crystal ball with the word 'SP 500' written inside it". And 'Dividends' written above it, which we added.

Labels: dividends, forecasting, SP 500

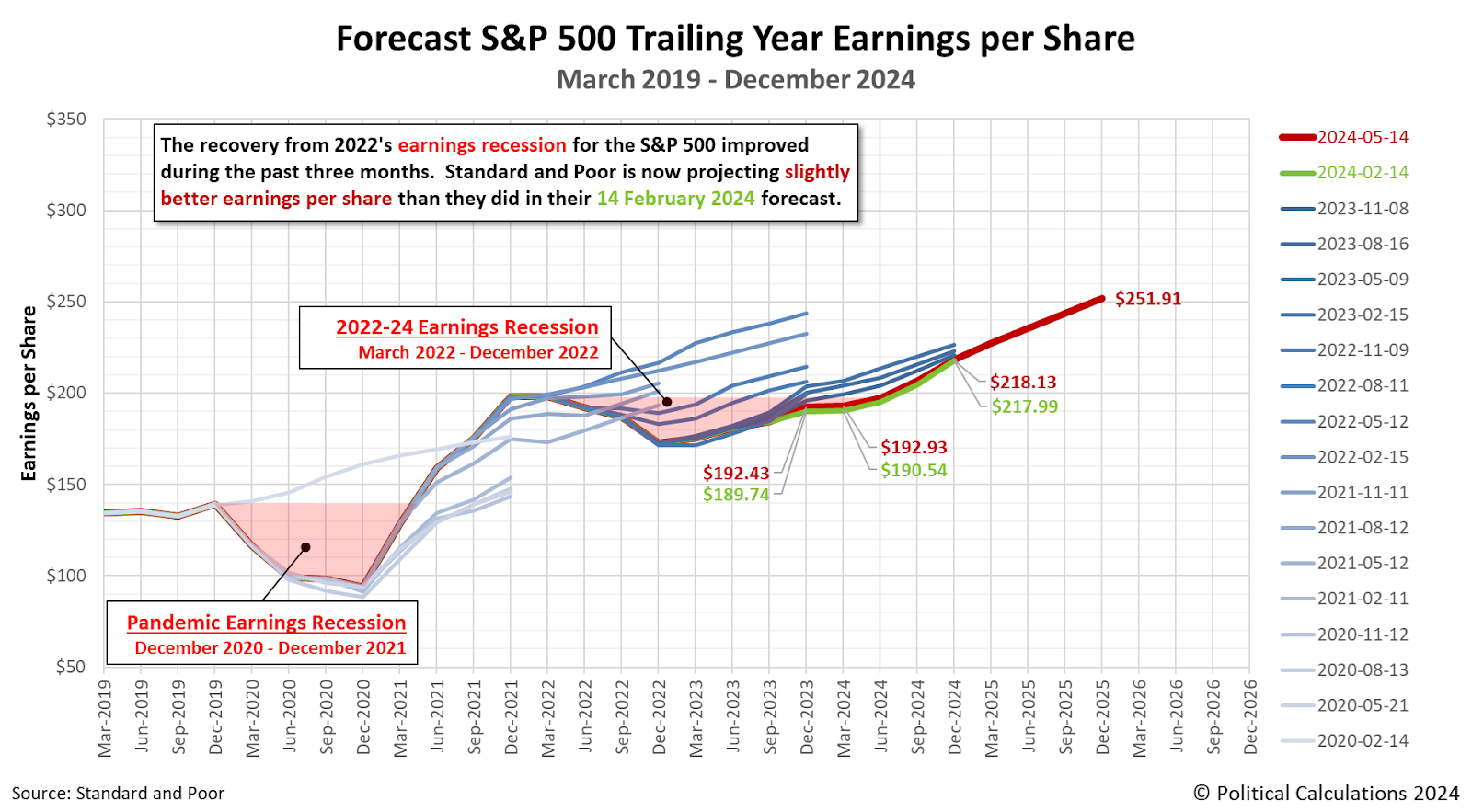

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

Since our last update three months ago, expectations for the S&P 500's earnings have improved. The S&P 500's earnings per share had been expected to return to their March 2022 peak of $197.91 after June 2024, but now looks like it will hit that mark before the end of 2024-Q2.

Here is a summary of the major observations that may be seen in the changes of Standard & Poor's earnings projections from 14 February 2024 to 14 May 2024:

- Earnings per share for 2023-Q4 increased from a projection of $189.74 to a finalized figure of $192.43.

- Projected earnings for 2024-Q1 improved from $190.54 to $192.93 per share.

- S&P projects faster earnings growth during the second half of 2024, improving from $217.99 to $218.13 per share by the end of the year.

- The first projection of where the S&P 500's earnings per share will be at the end of 2025 is $251.91.

The following chart reveals how the latest earnings outlook has changed with respect to previous snapshots:

If you look at the historic earnings expectations shown on the chart, particularly the period since 2021, you'll notice a negative pattern in which later projections for earnings are less optimistic than the projections that preceeded them. This is the 'typical' pattern we see in these earnings projections.

About Earnings Recessions

Depending on who you talk to, an earnings recession has one of two definitions. An earnings recession exists if either earnings decline over at least two consecutive quarters or if there is a year-over-year decline over at least two quarters. The chart identifies the periods in which the quarter-on-quarter decline in earnings definition for an earnings recession is confirmed for both the Pandemic Earnings Recession (December 2020-December 2021) and the new earnings recession (March 2022-December 2022) according to the first definition. The regions of the graph shaded in light-red correspond to the full period in which the S&P 500's earnings per share remained below (or are projected to remain below) its pre-earnings recession levels.

Let's define what a "double-dip" earnings recession would be in case that becomes relevant at the time of our next update. This term describes the situation where after having begun to recover, the S&P 500's earnings per share stops rising and falls without having recovered to its pre-earnings recession level.

Our next snapshot of the index' expected future earnings will be in three months. With the improvement in the earnings outlook over the past three months, we should be able to confirm the full recovery from 2022's earnings recession. Then again, at the end of 2023, we didn't expect that recovery would stretch out as it has, so there is the possibility things will turn to be more negative.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 14 May 2024. Accessed 15 May 2024.

Image Credit: Microsoft Copilot Designer. Prompt: "A crystal ball with the word 'SP 500' written inside it". And 'Earnings' written above it, which we added.

Labels: earnings, forecasting, SP 500

The S&P 500 (Index: SPX) set a new record high of 5,308.15 on Wednesday, 15 May 2024 before slipping back to close out the trading week that was at 5,303.27. The index rose a little over 1.5% about its previous week's close.

The momentum behind the move was provided by Federal Reserve Chair Jerome Powell, who assured markets the week's higher-than-expected producer price inflation report would not respond by hiking U.S. short term interest rates.

With that likelihood greatly reduced, investors sent all the major U.S. stock indices higher during the week. Most notably, the Dow Jones Industrial Average (Index: DJI) crossed above the 40,000 milestone, going on to end the week at 40,004.35.

Meanwhile, the trajectory of the S&P 500 took it to the upper end of the dividend futures-based model's projected range, which can be seen in the latest update to the alternative futures chart.

Other things happened during the trading week that ended on Friday, 17 May 2024. Here's our summary of the week's market moving headlines:

- Monday, 13 May 2024

-

- Signs and portents for the U.S. economy:

- Brent hovers above $83 as inflation data takes centre stage

- The case for forever high interest rates

- Fed minions think they have a messaging problem, are expected to deliver a rate cut in September 2024:

- Fed's Jefferson flags challenges on communications front

- Fed to cut rates in September, say nearly two-thirds of economists

- Growth signs, bigger stimulus developing in China:

- China's consumer prices rise for third month, signalling demand recovery

- China to kick off 1 trillion yuan stimulus bond issues this week

- BOJ minions see inflation from weak yen:

- Nasdaq, S&P, and Dow finish mixed as inflation data looms

- Tuesday, 14 May 2024

-

- Signs and portents for the U.S. economy:

- Oil settles lower as inflation data gives way to market jitters

- Strong services fan US producer inflation in April

- US bank failures could surge by almost 50, Nomura analyst says

- Biden hikes US tariffs on Chinese imports

- Fed minions say won't hike rates because of producer price inflation running hot, see problem with household debt:

- Fed's Powell: PPI 'mixed,' next move unlikely to be a rate hike

- NY Fed: Amid rising debt levels, some borrowers face increased stress

- Bigger trouble, stimulus developing in China:

- Utility price hikes in parts of China hand another blow to households

- China's central bank leaves key policy rate unchanged

- BOJ minions not liking the inflation they see:

- ECB minions thinking about rate cuts, but may delay them because the U.S. Fed is delaying them:

- Easing euro zone inflation creates room for rate cuts, ECB's Knot says

- Delayed Fed cuts could also slow ECB, Wunsch says

- Nasdaq notches new record closing high a day ahead of CPI; Dow, S&P also advance

- Wednesday, 15 May 2024

-

- Signs and portents for the U.S. economy:

- US consumer prices rise less than expected in April; core CPI slows

- U.S. homebuilder sentiment tumbles as rates slow buyer traffic

- Oil rebounds, gains 1% after US crude draw, lukewarm inflation data

- Fed minions say they're standing by to take action later in 2024:

- Fed hawks and doves in their own words

- Fed's Kashkari: rates should stay on hold 'for a while longer'

- Bigger stimulus developing in China:

- Bigger trouble developing in Eurozone:

- CPI gains boost S&P to close above 5,300 for the first time, propel Nasdaq, Dow to records

- Thursday, 16 May 2024

-

- Signs and portents for the U.S. economy:

- Oil up after US economic data strengthens rate cut expectations

- US labor market fairly tight, broader economy losing steam

- Fed minions say they want better data before committing to rate cuts:

- Fed remains cautious on cuts even as data improves

- Fed's Mester seeks more evidence inflation pressures are easing

- Exclusive: Fed's Williams welcomes inflation data, not ready to seek rate cuts

- Bigger stimulus developing in China:

- Bigger trouble developing in Japan:

- ECB minions say they're in "no hurry" to cut rates, see weaknesses in Eurozone economy:

- ECB not in a hurry to cut rates, should take measured steps after June, Kazaks says

- Commercial property is weak link in euro zone finance, ECB says

- Dow unable to hold onto 40,000, ends little changed; Nasdaq, S&P 500 dip slightly

- Friday, 17 May 2024

-

- Signs and portents for the U.S. economy:

- Fed minions say they'll hike rates if they have to, even though nobody believes them:

- Growth signs, "historic" bailout developing in China:

- China's factories fire up but consumer, property weakness persists

- China unveils 'historic' steps to stabilise crisis-hit property sector

- Nasdaq, S&P 500, Dow end record-breaking week near all-time highs

The Atlanta Fed's GDPNow tool is forecasting an annualized real GDP growth rate of 3.6%, down from the +4.2% growth it projected in the previous week.

Image Credit: Microsoft Copilot Designer.. Prompt: "An editorial cartoon of a Wall Street bull celebrating the Dow Jones Industrial index hitting 40,000".

The backers of wind power are running into a big problem. Their ability to generate more power by building ever-bigger wind turbines is running into both physical and economic limits. The problems of scaling up existing wind turbine technology are becoming more evident, as can be seen in this news report from 2022.

A very similar story played out earlier this year just 12 miles away from the site of the wind turbine collapse in the 2022 video.

The physics of today's most advanced wind turbine technology dictates the nature of the problem:

Larger turbines must face the inescapable effects of scaling. Turbine power increases with the square of the radius swept by its blades: A turbine with blades twice as long would, theoretically, be four times as powerful. But the expansion of the surface swept by the rotor puts a greater strain on the entire assembly, and because blade mass should (at first glance) increase as a cube of blade length, larger designs should be extraordinarily heavy. In reality, designs using lightweight synthetic materials and balsa can keep the actual exponent to as little as 2.3.

Even so, the mass (and hence the cost) adds up. Each of the three blades of Vestas’s 10-MW machine will weigh 35 metric tons, and the nacelle will come to nearly 400 tons. GE’s record-breaking design will have blades of 55 tons, a nacelle of 600 tons, and a tower of 2,550 tons. Merely transporting such long and massive blades is an unusual challenge, although it could be made easier by using a segmented design.

The growing size and mass of the components of a modern wind turbine also limit where they can be built.

Today’s longest blades have become too big to be delivered to inland wind farms. They can be taken only by ship to offshore sites, where building costs are far higher.

Beyond that, the challenge of manufacturing and operating such enormous wind turbines is far costlier than anticipated just five years ago. The designs of the biggest wind turbines are proving to not be up to the task:

Wind turbine failures are on the uptick, from Oklahoma to Sweden and Colorado to Germany, with all three of the major manufacturers admitting that the race to create bigger turbines has invited manufacturing issues, according to a report from Bloomberg.

Multiple turbines that are taller than 750 feet are collapsing across the world, with the tallest—784 feet in stature—falling in Germany in September 2021. To put it in perspective, those turbines are taller than both the Space Needle in Seattle and the Washington Monument in Washington, D.C. Even smaller turbines that recently took a tumble in Oklahoma, Wisconsin, Wales, and Colorado were about the height of the Statue of Liberty.

In April 2024, GE Vernova (NYSE: GEV) pulled the plug on building its largest ever vertical wind turbine because of the technical and economic challenges. That move that is rippling through the wind power generation industry:

The wind industry’s global race to make ever-bigger turbines stumbled to a sudden slowdown last week, jarring U.S. offshore wind projects.

When GE Vernova confirmed that it was canceling one of the largest wind turbines ever designed, it signaled a pause in an arms race that for years had led manufacturers to go higher, longer and wider when building towers, blades and other components. Now, that decision is reverberating across U.S. efforts to build wind projects in the Atlantic.

New York canceled power contracts for three offshore wind projects last week, citing GE Vernova’s decision to abandon its largest turbine model, a massive 18-megawatt machine. The timing could hardly be worse. Offshore wind is the keystone of New York’s plan to generate 70 percent of its power with renewable energy by the end of the decade.

The technical challenges of building and operating ever-larger wind turbines are clearly tied to their vertical form factor. After a certain point, building ever-taller towers to support ever-longer whirling turbine blades comes with exponentially greater costs with too little to be gained from it to make the largest designs practical.

But what if you built your wind turbine with a horizontal form factor? That's an intriguing concept being advanced by AirLoom Energy's engineers, which is described in the following video (HT: Core77):

At this point, AirLoom's horizontal wind turbine power generating concept is intriguing, but unproven. If it proves capable, it would be a game changer for the wind power industry. Since its costs are orders of magnitude lower than what it costs to bring a viable vertical wind turbine design to the market, it would still be worth building prototype units to find out how viable it could be.

That's outside the box thinking at its best. Lots of potential upside, with limited downside risks. We'll be following the technology to see how it proves out.

Labels: technology

On 31 January 2024, New York Community Bancorp (NYSE: NYCB) dropped a bombshell earnings report. Instead of reporting anything close to the $0.29 profit per share investors expected, the bank reported a $0.27 per share loss.

That the situation was bad was confirmed by the bank's surpise "massive" dividend cut, which signaled the bank's management was seeking to raise capital. NYCB's quarterly dividend slashed by 70.6% from 17 to 5 cents per share. Investors responded to the sudden, negative change in their outlook for NYCB by sending its stock price plunging by 37.7%, falling from $10.38 at the close of trading on 30 January 2024 to $6.47 per share a day later.

Flashing forward to 1 May 2024, NYCB's dividend outlook got worse as its earnings for the first quarter of 2024 fell short of expectations. As part of its announced plan to recover its profitability, NYCB further slashed its dividend to 1 cent per share. The announcement plan boosted its stock price, which had dropped as low as $2.65 per share, but which through the end of trading on 10 May 2024 was hovering around $3.45 per share.

All the same, NYCB's stock chart looks brutal.

We opted to show NYCB's daily stock price over the past five years because the period before its earnings disaster became known on 31 January 2024, the bank appeared to have weathered the major economic and banking crises of the last several years fairly well. Its stock price had recovered from both the coronavirus pandemic and the March 2023 failures of Silicon Valley Bank and Signature Bank. In fact, NYCB was considered strong enough by banking regulators that the Federal Deposit Insurance Corporation facilitated its acquisition of Signature Bank' assets less than two weeks after its failure.

In doing so, the FDIC may have set up NYCB's own earnings collapse less than a year later.

While the Signature deal strengthened NYCB's balance sheet by adding low-cost deposits and brought with it a middle-market business, the transaction also "put us over $100B in total assets, placing us firmly in the Category IV large bank class of banks between $100B and $250B in assets and subjecting us to enhanced prudential standards, including risk-based and leverage capital requirements, liquidity standards, requirements for overall risk management and stress testing," said President and CEO Thomas Cangemi.

Prior to its FDIC-facilitated acquisition of Signature Bank, New York Community Bancorp fell below the $100 billion threshold. Banks below this threshold have greater flexibility in how they manage and underwrite loans compared to larger banks that have to routinely comply with costly federal banking regulations. Regulatory requirements with which NYCB had little experience in managing, which left them exposed to risks they hadn't fully appreciated would be a consequence of the acquisition and their change in status from a small to a medium-sized bank:

“As part of management’s assessment of the company’s internal controls, management identified material weaknesses in the company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities,” the bank said in the filing.

That leads to a good question. Why did federal regulators facilitate NYCB's acquisition of Signature Bank? Weren't they aware the bank's established loan review and risk assessment practices weren't capable of meeting the requirements of the new regulatory status into which they were promoting them? And if they were not, why not?

NYCB has put forward their plan to address their identified shortfalls in their loan review processes. Where is the federal regulators plan to address where they fell short in pushing through the acquisition to NYCB? What actions could they have taken to help get NYCB up to speed with their new regulatory requirements?

These questions must be asked because of what could happen the next time banking regulators have a crisis. Maybe the next time around, other banks that might consider assisting the rescue will sit out instead because of what happened with NYCB. What do you suppose the consequences of a failed bank rescue might be? The current system in which those who come to the rescue of a failed bank with the assistance of federal regulators are punished because of it doesn't qualify as any kind of smart policy.

If you think about it, the now demonstrated risk from increased regulatory exposure could lead other small banks to deliberately restrain their growth to keep their asset level below the arbitrary threshold regulators have set. What consequences to the industry and to the economy might follow from that?

Afterword

NYCB will partially address its "size" problem by getting smaller. The bank announced on 14 May 2024 that it is reducing its commercial real estate loan portfolio by selling $5 billion in mortgage warehouse loans to JPMorgan Chase (NYSE: JPM).

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a bank building being pushed toward the edge of a cliff."

Labels: dividends, ideas, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.