Welcome to the March 30, 2007 edition of On the Moneyed Midways (OMM for short), the blogosphere's only weekly review of the best business and money-related posts from each of the week's major blog carnivals! Each week, we seek out the best posts from among the hundreds posted to the various blog carnivals posted each week and we select one post as being The Best Post of the Week, Anywhere!(TM) As an added bonus, we also cite the near contenders for the best post of the week as being Absolutely essential reading!(TM)

Welcome to the March 30, 2007 edition of On the Moneyed Midways (OMM for short), the blogosphere's only weekly review of the best business and money-related posts from each of the week's major blog carnivals! Each week, we seek out the best posts from among the hundreds posted to the various blog carnivals posted each week and we select one post as being The Best Post of the Week, Anywhere!(TM) As an added bonus, we also cite the near contenders for the best post of the week as being Absolutely essential reading!(TM)

Since we hosted the most recent edition of the Carnival of the Capitalists, you won't find any of its posts included below, so in case you missed it, click here and visit as it was a joint edition of OMM! And if you're considering hosting a blog carnival, be sure to see our report on whether or not hosting a blog carnival is worth the trouble.

But enough about what we did last week! The best posts of the week that was, from the best-hosted carnivals of the past week that was (aside from the CotC, that is!), awaits below....

| On the Moneyed Midways for March 30, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Entrepreneurs | Politeness: Respect for Others Pays | Blog Business World | What can an emphasis on politeness and good manners do for your business? Wayne Hurlbert says that in a world where politeness is a rare commodity, it can enhance and strengthen your organization. |

| Carnival of Fraud | The Farce That Is Alternative Energy (L-O-N-G) - 2007 Redux | Wisdom from Wenchypoo's Mental Wastebasket | Wenchypoo revels in revealing the irrational reasoning driving the alternative energy movement. It's simply The Best Post of the Week, Anywhere! |

| Carnival of Personal and Company Effectiveness | Make More Money Without Selling Your Soul | 360o Success | David Richeson lays out a series of goals and challenges for achieving financial and personal growth simultaneously. |

| Carnival of Real Estate | Thank You Ben, Patrick, and Keith, uber-Bubblistsas, For Helping My Clients Tremendously | 3 Oceans | It's always fun when you find a post that humorously puts you in the middle of a raging debate, and Kevin Boer's latest contribution to an ongoing real estate blogger flame war certainly fits that bill. We're calling this Absolutely essential reading just for the fun factor! |

| Cavalcade of Risk | The Delusion of Multitasking | Worker's Comp Insider | Jon Coppelman discusses the risky nature of multi-tasking and introduces the findings of recent research that suggests it's not an optimal means for humans to accomplish things! |

| Economics and Decision Making | Will Sub-Prime Lending Affect You? | Suite 101 | Michael Cook offers a primer on what sub-prime lending is, why its practices are now being viewed as a problem, and how it may affect you. Absolutely essential reading! |

| Festival of Stocks | Wheeling and Dealing | Margin of Safety | Mr. Market considers property development and holding company Wheelock Properties HK, arguing that this potential investing gateway into the Hong Kong and Singapore market is trading below its intrinsic value. |

| Festival of Under 30 Finance | Own Investment Funds and Not Individual Securities | Skilled Investor | Larry Russell thinks that owning individual securities is a big waste of time and money, and makes a good argument for the advantages of owning funds instead! |

| Festival of Under 30 Finance | How to Furnish Your House on Any Budget, Even for Free | Digerati Life | If you have a problem with too much empty space and not enough savings to convert into furniture to fill it, the Silicon Valley Blogger shows just what's possible! |

| Personal Development Carnival | Why Your Ego Loves Airline Delays | Christine Kane | Christine Kane views the emotional release of egos as frustration mounts while bad weather fouls a flight to St. Louis. Good story, and great advice! |

| Personal Development Carnival | Ways to Improve Business Decision-Making | Rowan's Future of Choice | Richard Rowan provides some really interesting insights into the nature of business decisions, including a good description of the difference between problem solving and decision making. |

| Real Estate Investing | How to Avoid Foreclosure | Wise Bread | As rising mortgage rates are stressing the housing market, Andrea Dickson provides solid advice for what to do if you're a stressed homeowner. Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Well, let's make no bones about it - the Climbing Limo method for forecasting future GDP was wide off the mark for the fourth quarter of 2006! Our chart below shows just how far off the mark it was:

The method had originally forecast that 2006-Q4 inflation-adjusted GDP would come in at 11,625.2 billion USD, and yesterday's final revision for the final quarter of 2006 put the actual value at 11,513.0 billion USD, an error of nearly 1% for a forecast created nearly 6 months earlier using data from 2005-Q3 and 2006-Q1.

The miss between the forecast and the actual Real GDP figure demonstrates the key weakness of the Climbing Limo method: its forecast values do not incorporate any information about the performance of the U.S. economy less than six months old!

The truth is that economic growth trends change over time and this is evident in looking at the most recent forecast data projected in the same chart above (the dotted line), which shows a substantial change in the growth that had originally been projected from 2006-Q4 through 2007-Q2. In fact, we could have better forecast where Real GDP for the U.S. economy would have come in at if we had simply connected the dots from the last actual Real GDP data available in 2006-Q3 to our most recently forecast data for 2007-Q2.

So, why don't we just go ahead and do that? The following chart shows our results:

Using this modified method, we substantially improve our GDP forecasting ability. We find that this technique would have predicted a Real GDP figure of 11,507.9 billion USD, where the actual Real GDP figure came in at 11,513.0 billion USD, an error of just 0.044%.

Well, since we really like really small errors between forecast and actual data, let's go ahead and use the final revision of the 2006-Q4 data to forecast the 2007-Q3 Real GDP figure using the standard Climbing Limo method, then apply our modified forecasting technique to bridge the gap:

Our original forecast, using Real GDP data from 2005-Q4 through 2006-Q2 would put the Real GDP level for the U.S. at 11,733.0 billion USD for 2007-Q1. Using our newly modified technique however predicts this figure will come in at 11,576.3 billion USD. This would represent a 2.2% annualized 1-quarter growth rate from the final quarter of 2006.

We'll find out at the end of next month if our modified method's got game!

Labels: forecasting, gdp

Is hosting a blog carnival still worth the effort?

The blogosphere has changed quite a bit since the last time we hosted the Carnival of the Capitalists, and so have blog carnivals, so our hosting duties for the CotC this week provided an excellent opportunity to compare notes from our previous effort.

The primary benefit for a blogger to host a blog carnival is the boost in traffic it provides that increases others exposure to their blog. Let's first take a look at our site traffic following the first time we hosted the CotC back in July 2005:

Here's what we observed following our original CotC hosting experience, and particularly the effect of being linked by Glenn Reynolds' InstaPundit:

Political Calculations doesn't publish on weekends, and traffic normally ranges between 30 to 70 unique visitors per day on Sunday. You can see the InstaPundit spike take off immediately on Sunday evening, peaking at 750 unique visitors on Monday, then dropping off to Political Calculations' normal daily weekday volumes between 120 and 200 unique visitors per day on Thursday and Friday.

Now, let's compare that result with our recent site traffic history. First, here's a snapshot of our previous week's site traffic, taken just before we posted the March 26, 2007 edition of the CotC:

As you can see, we've grown in traffic from two years ago and as we don't publish on weekends, these levels between 100 and 150 unique site visitors represents our low traffic volumes for the week. Since we posted shortly after midnight, we were able to capture the entire first day carnival "spike", shown below:

By our rough estimate, our blog carnival traffic from unique site visitors on the first full day after posting the CotC this time around was less than half what we saw previously. While we didn't benefit from a unique link from heavy traffic generator InstaPundit as we had previously, we did find that James Hamilton's Econbrowser was the single greatest director of traffic our way - providing well over half the traffic for our edition of the Carnival of the Capitalists.

This result confirms the importance of the role of highly popular blogs serving as gatekeepers for directing traffic to blog carnivals.

We were surprised by the number of page visits we received this time around. While we normally run about 1.7 page visits per unique site visitor, the number of clicks through to other posts here at Political Calculations jumped to a 2-to-1 ratio.

The Bottom Line

While our unique visitor traffic for this edition of the CotC decreased substantially from our previous carnival hosting experience, the increase in pages visited more than made up for the difference. This may indicate that today's blog carnival readers are fewer, but more inquisitive than the previous generation of two years ago. On the whole, we find that hosting a major blog carnival like the Carnival of the Capitalists still provides worthwhile benefits for the hosting blog.

A Challenge for InstaPundit

Here's an experiment we'd really like to run: Now that we're after the primary surge in site traffic received for hosting a blog carnival, which we presume reflects the core audience for the carnival itself, we wonder what effect that a link from InstaPundit would have our site traffic at this stage. Glenn - we'll post our numbers, if you're up for it, let's see what you got!

Labels: carnival

The blog, that is, not the book

The blog, that is, not the book....

Steve Levitt recently commented upon a Texas state senator's plan to pay expecting women $500 to visit an abortion clinic, opt out of having an abortion, then place the baby up for adoption after giving birth. While Levitt earns his economics stripes in observing that the proposed payout would involve a lot of wasted activity (as it would be a lot more efficient to give the money directly to the prospective mother to place their baby up for adoption and skip the whole side trip to an abortion clinic), we'll observe that the increased wasteful activity might be the sole point of the exercise.

One effect of the proposal would be to increase the cost of operations of the abortion provider, as they would have to tie-up resources that might be used elsewhere to serve a client who has no intent of actually purchasing their core service. Kind of like the free-riders who enjoy a vacation at a timeshare resort who ultimately decline to purchase a time share, except here, the incentive is $500 in cash rather than a free weekend at a resort.

One wonders if abortion providers will adopt the same kinds of tactics used by the timeshare marketers and salespeople to discourage the practice if it comes to pass.

And as for the question "why only $500?" How much does a weekend trip to a resort go for these days?

Leaving the abortion clinic behind, let's go to Stephen Dubner's bus stop...

Here, Dubner has observed that he can greatly increase his chances of getting a seat on a particular New York City bus if he walks some 250 yards further to a bus stop than going to one much nearer his apartment. As it happens, the bus stop near his apartment is also very near a subway station, which provides a flow of bus riders.

He wonders why substantially more people waiting for the bus don't pursue the same strategy, coming up with the following potential reasons:

- Walking 250 yards doesn’t seem like a worthwhile investment to improve a short, if miserable, experience.

- Having just gotten off the subway, the Point A passengers are already broken in spirit and can’t muster the energy to improve their commuting lot.

- Perhaps some Point A passengers simply never think about the existence of a Point B, or at least the conditions thereof.

- There is a herd at Point A; people may not like being part of a herd, but psychologically they are somehow comforted by it; they succumb to "herd mentality" and unthinkingly tag along — because if everyone else is doing it, it must be the thing to do.

While we favor Dubner's second reason, having ridden on public transit systems in the past, what we really see here is the real estate mantra of "location, location, location" at work. Bus commuters, particularly those coming from the subway, often aren't aware of much beyond the shortest, most direct path to their real destination. They're committed to paying the price of their journey in both time and money (otherwise why ride a subway to a bus stop?!) and as a result, they become price "insensitive."

We see the same thing with gas stations. If you fill up at a station near a major highway, you'll find that the price of gas is higher than if you drive a little further to another station (whether it's worth the trip is another question!)

Since walking to another stop 250 yards away won't get them to their real destination any sooner, most will opt to stay put and they will discount the value of the benefits Dubner has discovered.

That assumes however that the two bus stops are equivalent in all things other than proximity to the subway exit. Perhaps they're not, and a good question for Dubner might be "what amenities are near the two bus stops?" It could well be that one offers bus riders something other than just a place to wait for the bus.

Labels: freakonomics

Welcome to the March 26, 2007 edition of the Carnival of the Capitalists! And welcome to this week's special edition of Political Calculations' On the Moneyed Midways, which came about as we volunteered to host this week's CotC!

Welcome to the March 26, 2007 edition of the Carnival of the Capitalists! And welcome to this week's special edition of Political Calculations' On the Moneyed Midways, which came about as we volunteered to host this week's CotC!

For those new to Political Calculations, each week, usually on Friday or Saturday, we post a roundup of the best posts we found in each of the previous week's various business, economics or just generally money-related blog carnivals called "On the Moneyed Midways". What's more, we select one post as being The Best Post of the Week, Anywhere!(TM) and as an added bonus, we also cite the near contenders for the best post of the week as being Absolutely essential reading!(TM). And we're going to keep to our standards with this edition of the Carnival of the Capitalists!

This week is unique in that instead of reviewing the dozens of blog carnivals that we normally do, we're presenting the best posts (by our editorial opinion) submitted for consideration to this week's Carnival of the Capitalists! Beyond that though, we've also activated our dynamic table technology for this edition, which will allow you to sort the table below alphabetically by post, blog, category and even comments - just click a column heading! To reset the original order (the order in which the posts were added), you'll need to reload this page.

It's all below - just scroll down for the best posts we found for the Carnival of the Capitalists in the week that was....

| The Carnival of the Capitalists for March 26, 2007 |

|---|

| Post | Blog | Category | Comments |

|---|---|---|---|

| The Real Estate Market: Why "Bottom" Is a Dirty Word | Breaking the $hackles of the 9 to 5 |  business |

C Michael Dawson puts a number of notable economists, homebuilders and financiers on the stand to get to the bottom of whether the housing market is at the bottom! |

| Discriminatory Words and Investigations | The New Business World |  legal |

C H.R. professional Murad Ali discusses the changing world of words and the steps managers are obligated to take when offensive language is reported. |

| Coinstar Founder Jens Molbak | Startup Studio |  business |

C Betsy Flanagan podcasts the story of a man who found opportunity and success in the accumulation of loose change. |

| Writers: How to Make $1000 a Month from Associated Content | Getting to Graduation |  general |

C Industrious college student, and prolific blogger Matthew Paulson shares how he generates an average $1,198 per month writing articles for user-content driven network marketer Associated Content. |

| How to Sell Your Stuff via Amazon | Blogging for Business |  general |

C Ted Demopoulos talks through the process for packaging what you've already written as a blogger into book form for sale on Amazon.com. |

| So Is This a Bounce or a Bottom? | Trader's Narrative |  investing |

C Babak makes the technical case that the stock market's recent bounce may be rather short-lived. |

| Crooked Timber | Epicurean Dealmaker |  investing |

C The Epicurean Dealmaker puts a different spin on private-equity firm Blackstone's recent announcement that it may soon be going public, challenging the conventional wisdom in the business media. |

| Lowest Common Denominator Laws and the Subprime Lending Market | Real Estate Forum |  taxes |

C Alex wonders if the irresistable urge to respond to a "small but powerful number of folks who throw a wrench in the works" will lead the government to over-react and constrict opportunities for the vast majority of sub-prime loan borrowers. |

| Megatrends-Based Business Ideas | Worldwide Success |  business |

C Opportunities may be found lurking in many places - David outlines major trends that may well form the basis for successful businesses. |

| Affiliate Marketing for Bloggers | Money Online |  marketing |

C Alex Mincinopschi discusses the nuts and bolts of how to apply the A.I.D.A (Attention, Interest, Desire and Action) sales model to blogging. |

| Why Some People Almost Always Are Successful | Positivity Blog |  general |

C The choices people make plays a huge role in determining if they will become successful. Henrik Edberg looks at the lessons to be learned from the successful. |

| CEO Invincibility - Why They Turn Bad | SOX First |  managing |

C Leon Gettler reflects on the hubris on display in the trial of Conrad Black, where the qualities that made him successful may also have driven his downfall. |

| Control What Can Be Controlled | Integrative Stream |  marketing |

C Will Crawford provides a case study for how a company can distinguish itself by exceeding expectations in its portion of a three-party transaction. |

| Charting the Mindshare Market | MyMindshare Blog |  economics |

C Jim Burch defines what the mindshare market is and argues that consumers are getting a raw deal from traditional media advertising. His solution? A true market where the traditional media is bypassed as an unnecessary middleman, and consumers get compensated! |

| Sick Time Blues…. | Insureblog |  taxes |

C Henry Stern, who also organizes the Cavalcade of Risk, considers the impact of newly proposed sick-leave regulations upon U.S. businesses. |

| Entrepreneurship and 300 | Gyaan Sutra |  business |

B What can you learn about entrepreneurship from the movie 300? Sudhanshu Raheja provides some surprising insights! Absolutely essential reading! |

| 20 Typical Reasons to Sell Your Stock or Mutual Fund | Digerati Life |  investing |

C The Silicon Valley Blogger runs through the reasons why it might be time to sell off parts of your investment portfolio, providing lessons learned from experience. |

| How to Ace a Job Interview | Money $mart Life |  business |

C Are you "Google-proof?" Can you keep your skeletons in your closet? Can you make a connection? Ben offers tips for prospective employees.... |

| Solve Small Problems | Software Project Management |  managing |

C Pawel Brodzinski argues that it's wise to devote time to deal with small issues, even if there are bigger ones on the horizon. |

| Fear of Loss: Fear Strikes Out | Blog Business World |  managing |

C Wayne Hurlburt notes the effects of the "fear of loss" upon business decision makers and argues that trusting your staff and advisors can prevent it from seriously damaging your company. |

| Bubble, Bubble, Toil and Trouble | Econbrowser |  economics |

A James Hamilton has been scouring economic data to track the progress of the housing "bubble", finding that economic fundamentals, more than a "popping" bubble, are behind the recent increase in mortgage delinquencies. The Best Post the the Week, Anywhere! |

| Working and Feeling Good | Trusted Advisor |  business |

B Charles Green reviews a recent study by Gallup on what works best to engage employees in a business. Absolutely essential reading! |

| Blackstone IPO? Not So Fast | KirkWalsh.com |  investing |

C The market is certainly excited about private-equity firm Blackstone's pending IPO, but Kirk Walsh points to some serious issues that may be overlooked in all the hype. |

| Trending US-China Trade | Political Calculations |  economics |

B Did you know the U.S. has been consistently outpacing China in the growth rate of its exports to the other nation since 2004? Political Calculations has the numbers behind a story you won't find reported (yet) anywhere else! We think it's Absolutely essential reading, but since we wrote it, we would! |

| Gee, Thanks, Congressman | Tax Update Blog |  taxes |

B Joe Kristan reflects on the latest version of the statement "Hi, I'm from Washington D.C. and I'm here to help" in the rather remarkable statement made by a Representative for solving the problems of the Alternative Minimum Tax. Absolutely essential reading! |

| 5 Reasons Why the Forever Stamp Is a Lousy Idea | Personal Finance Advice |  pers-finance |

B Jeffrey Strain considers the question of whether or not the newly proposed "Forever" stamp will be a good investment and finds it's not worthy of a long-term position in your portfolio. Absolutely essential reading! |

| How Much is Your CEO Being Paid? | Boring Made Dull |  pers-finance |

C How much are CEO's being paid? As Economics and Social Policy carnival founder BoringMadeDull has found, it depends on how the numbers are being added and who's doing the math. |

| What I Wish Someone Would Have Told Me About Investing When I Was 22 | Gongol.com |  investing |

B Brian Gongol hasn't just put together a list of 26 things he wishes he was told when he was 22; he's actually put together something that looks very much like an investing action plan! Absolutely essential reading, and please note Brian's disclaimer! |

Next Week's Carnival

Next week's Carnival of the Capitalists will be hosted by Rob May at BusinessPundit. Bloggers who would like to contribute to next week's CotC may use the CotC Submission Form to submit entries. Bloggers struggling to find timely topics might consider Tom Hanna's invaluable Financial Roadmap for this next week.

About Political Calculations

Our stock in trade is to ask questions for which we don't know the answers, then answer them! Along the way, we create and publish some pretty unique tools, which means that anyone looking to answer the same questions, but maybe with different numbers, can! Today, we are the blogosphere's best source of tools for answering questions like: "Will the U.S. economy go into recession sometime in the next 12 months?", "How well has the S&P 500 performed since I was born?", "Should I call in sick today?" and "When should I play the lottery?", among hundreds of others.

Previous Editions of On the Moneyed Midways

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Acknowledgements

My special thanks to Jay Solo for the opportunity to host the Carnival of the Capitalists for this week and to all the bloggers who made contributions! Bloggers looking for information on how to implement the sorting table function in their own blogs may find very useful informtion on this function and many others at The Daily Kryogenix.

Labels: carnival

There won't be an "official" edition of On the Moneyed Midways this week! Instead, since we'll be hosting the March 26, 2007 edition of the Carnival of the Capitalists, which covers a lot of the same territory. Given the situation, we thought we'd present the CotC as our next edition!

There won't be an "official" edition of On the Moneyed Midways this week! Instead, since we'll be hosting the March 26, 2007 edition of the Carnival of the Capitalists, which covers a lot of the same territory. Given the situation, we thought we'd present the CotC as our next edition!

We do have to admit that we are enjoying having posts sent to us instead of scouring dozens of blog carnivals for the best posts of the past week. That said, we are applying our editorial standards in selecting posts, seeking the best in each category contributed.

If you're a blogger with on-topic insight into the worlds of business, careers, economics, entrepreneurship, investing, management, or other closely related matters, we look forward to your contribution - just use the official submission form for the CotC!

See you Monday!

Labels: carnival

After comparing the remarkable rate of growth of U.S. exports to China in the Bush administration from the low level that defined President Clinton's second term, we felt that this acceleration was remarkable enough to attempt to pinpoint just when that export growth began to surge.

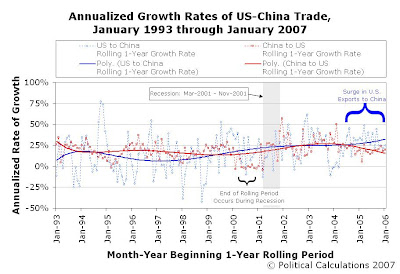

Our following chart presents the annualized growth rate of trade between the U.S. and China taken over each rolling 1-year period from January 1993 through January 2007 (Jan-1993 to Jan-1994, Feb-1993 to Feb-1994, etc.). The chart terminates at January 2006 as this data covers the period from that month through January 2007:

The trendlines largely tell the story: From February 1994 through February 1999, the rate of growth of China's exports to the U.S. (the solid red curve) strongly outperformed the rate of growth the the U.S.' exports to China (the solid blue curve.) This situation reversed from April 1999 through September 2002, although this may have more to do with the lack of growth in China's exports to the U.S. from May 2000 to January 2001, when the growth rate of exports from China to the U.S. essentially "flatlined" around 0%.

This flatlining is primarily due to the U.S. being in recession from March 2001 through November 2001. Since China did not enter into a recession at this time, this allowed the rate of growth of exports from the U.S. to China to exceed China's rate of growth in exports to the U.S. during this period. We can confirm this effect as the rate of growth of China's exports to the U.S. increased as the U.S. came out of recession.

More remarkably, the growth rate of U.S. exports to China has surged substantially since July 2004. This is important because of the effect of these growth rates upon the trade balance between the U.S. and China. In essence, the United States' higher growth rate in its exports to China (as compared to the growth rate of China's exports to the U.S.) indicates that it has begun closing it's trade deficit with China.

Other Insights

The rolling period chart also highlights the major disadvantage the U.S. had in trade with China during the majority of the Clinton administration: extreme volatility. This is consistent with the export from the U.S. of high-dollar, but low-volume goods, such as commercial aircraft. By comparison, exports under the Bush administration have benefitted from reduced volatility, suggesting that what the U.S. is now exporting to China is now more characterized by larger quantities of lower valued goods.

From our perspective, that seems to be a better business model for the United States.

Labels: trade

Given our surprising finding that U.S. exports to China have grown at such an extraordinary pace since George W. Bush became President in January 2001, we thought we might take a closer look at how that growth has developed over time.

First, we broke up the years covering the previous Clinton administration into his first and second terms. Our first chart shows the growth in the United States' exports to China from January 1993 through January 1997:

In this chart, we see that China's exports to the U.S. grew at the annualized exponential rate of 17.9% during these four years, a pace that would result in the value of China's exports doubling every 4.0 years (which, it did!) Meanwhile the value of the U.S.' exports to China grew at an annualized rate of 11.5%, which would double in value approximately every 6.3 years.

Our next chart considers former President Bill Clinton's second term, running from January 1997 through January 2001:

This chart reveals that the pace of growth in trade between the U.S. and China decelerated when compared to President Clinton's first term. Here, the annualized rate of growth of China's exports to the U.S. grew at 16.8%, a rate at which the value of China's exports would double every 4.3 years. By contrast, the rate of growth of the U.S.' exports to China was less than half this value over these four years, coming in at 7.4%, equivalent to doubling in value every 9.7 years.

Now, let's reconsider these growth rates through the six years of the Bush administration:

Over the six years covered in this chart, we find that the rate of growth in China's exports to the U.S. has increased to 22.0%, the equivalent of doubling in value every 3.3 years. What's absolutely remarkable, and to our knowledge, not reported in any meaningful way anywhere, is the growth rate of the U.S.' exports to China, which has clocked in over these past six years at 21.4%, a rate at which the value of U.S. exports to China will double every 3.4 years. That's just shy of triple the rate at which U.S. export growth occurred during President Clinton's second term!

We'll take a better, closer look at these trends tomorrow....

Labels: trade

Has it been six weeks already? Well, that means we've got another FOMC rate announcement to consider!

Using our tool for reckoning the odds of recession, we find that the 1-quarter rolling averages for the ongoing Federal Funds Rate (5.25%) and the spread between the 3-month and 10-year Constant Maturity Treasuries gives the probability of recession beginning sometime in the next twelve months at 49.7%, having increased from 48.9% when we last considered it on March 1.

Meanwhile, using the daily discounted Treasury yield curve data (used to create the line on the chart below), which the tool points to as a fairly good, if somewhat volatile proxy for the 1-quarter averaged data, we find the probability has declined from it's March 1 level of 50.1% to today's 44.9%. This sharp move follows the bond market's positive reaction to the Federal Reserve's statement in which they indicated they were no longer inclined to consider further tightening of interest rates.

What does all this mean? If we accept the discounted daily Treasury yield data as the best snapshot of the bond market's take on recession risks today, we can expect that there will be no recession in the next 12 months.

By contrast, the rolling one-quarter average for the daily values of the Constant Maturity U.S. Treasuries is likely to continue increasing for a time, and will exceed the 50% probability level in the very near future. At present, trends suggest that the probability of recession using the method developed by Jonathan Wright will continue to move upward to float somewhere in the 50-52% range.

As always, time will tell, but at this point, we're not prepared to predict that a recession will begin in the U.S. sometime in the next twelve months. (For more on what we would need to see to make that call, see our thoughts here!)

Labels: recession forecast

In light of our recent experiment, in which we determined that there is still some benefit to posting to some blog carnivals (although not as great as in the past), we're looking forward to seeing how our blog traffic might change from officially hosting a carnival. Is it still worth the effort to host a carnival? We'll show you!

In the meantime, this week's edition is up at Dispatches from Blogblivion!

And now, on to the randomness of it all....

How long will it take Instapundit's Glenn Reynolds, well known enthusiast of futuristic technology *and* the second amendment, to notice this fun convergence....

Maybe it's 1984 all over again!

Speaking of technology, we've had more than our fair share of fun lately with Google's Patent Search. Some of our favorites include Patent #1,183,492, which provides the figure featured in the upper right corner at the top of this post, Patent #325,316 (aka, "the beer faucet") and if you've never noticed how the lids to every coffee travel mug ever produced have unique patent numbers stamped on them, see them all!

Labels: carnival, random thoughts

Just for fun, we thought we'd revisit the issue of U.S.-China trade and compare the relative performance of Bill Clinton and George W. Bush over the course of their presidencies. First up, here's a chart showing the history of U.S. exports to China and U.S. imports from China from January 1993 through January 2001, corresponding with President Clinton's terms in office (all data taken from the U.S. Census):

In this chart, we see that during the Clinton era, the volume of China's imports to the U.S. grew at twice the rate of the United States' exports to China. At an annualized growth rate of 16.3%, the volume of China's imports nearly quadrupled during the course of Clinton's presidency, while U.S. exports to China only doubled.

Now, let's look at the relative trade performance of the Bush administration, going from January 2001 through the most recent data available as of January 2007:

In this chart, we see than in just seven years, the growth rate of U.S. exports to China (21.4%) has surged to very nearly match the growth rate of U.S. imports from China (22.0%), all while the overall growth rate of trade between the two nations has grown beyond the average level of growth during the Clinton years. The volume of exports from the U.S. to China and imports to the U.S. from China now doubles roughly every 3.3-3.4 years!

Just out of curiosity - which President's administration would you say is better at managing the United States' international trade?

Labels: trade

Welcome to the March 16, 2007 newly improved and streamlined edition of On the Moneyed Midways, the only weekly review of the best business and money-related posts from each of the week's major blog carnivals! Each week, we seek out the best posts from among the hundreds posted to the various blog carnivals posted each week and we select one post as being The Best Post of the Week, Anywhere!(TM) As an added bonus, we also cite the near contenders for the best post of the week as being Absolutely essential reading!(TM)

Welcome to the March 16, 2007 newly improved and streamlined edition of On the Moneyed Midways, the only weekly review of the best business and money-related posts from each of the week's major blog carnivals! Each week, we seek out the best posts from among the hundreds posted to the various blog carnivals posted each week and we select one post as being The Best Post of the Week, Anywhere!(TM) As an added bonus, we also cite the near contenders for the best post of the week as being Absolutely essential reading!(TM)

This is also the first week in which we've scrubbed the blog carnivals running on autopilot from our consideration. We were actually rather surprised at how many blog carnivals that was this week. How can a carnival host get back in our good graces? Three things:

- Read the contributed posts.

- Edit out the ones that don't fit into the general topic of the carnival you're hosting.

- Describe the posts that make the cut accurately and why someone might choose to read them.

In other words, be an editor. Our recent experiment confirmed that carnival hosts that do these three things deliver more traffic to the contributor blogs. Learn the lesson.

But enough about the state of blog carnivals! The best posts of the week that was, from the best-hosted carnivals of the past week that was, begins below....

| On the Moneyed Midways for March 16, 2007 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Career Intensity | The WHY of Clutter | It's Not About Your Stuff | Jessica Duquette observes that when most people get around to focus on the clutter around them, they never ask why. |

| Carnival of Career Intensity | Why the Non-Resume Strategy Beats Out a Traditional resume Every Time! | OhCash.com | John1212 presents a strategy for doing an end-run around many companies' HR departments. Well worth reading! |

| Carnival of Entrepreneurs | Failure and the Measure of Success | Verve Coaching | Erek Ostrowski cuts right to the point in teaching one of life's great lessons: "Keep doing what works. Stop doing what doesn't work." |

| Carnival of Fraud | Tax Fraud Might Mean Tax Preparer, Too | Tick Marks | Can you be on the hook if an unscrupulous tax preparer does a number on your return? Dan Meyer reviews a recent tax court ruling that says yes. Absolutely essential reading! |

| Carnival of Investing | Gold as Investment: When One Pound of Gold Is Not Equal to One Pound of Gold | Money, Matter, and More Musings | Golbguru is new to investing in gold and offers up a wealth of what he's learned so far. If you've ever considered buying the bright shiny yellow metal for your portfolio, read this first! |

| Carnival of Investing | The China Syndrome | SOX First | Leon Gettler sees the shape of things to come in the world's capital markets following last week's worldwide stock market drops. |

| Carnival of Real Estate | The Implied Accusation in Real Estate: How to Win the War on Your Attitude | Bloodhoundblog | "Your cockiness and arrogance is only matched by your incompetence" was the message Greg Swann received in the comments for one of his blog posts. Greg takes the comment and provides invaluable advice in how to deal with hostility and personal attacks in The Best Post of the Week, Anywhere! |

| Carnival of Real Estate Investing | Real Estate Investment Theories that Can Actually Help You Make Money | Bloodhoundblog | Michael Cook confronts his pet peeve about too many theories that don't work in practice with a handful of theories that do work in practice for real estate investing. Absolutely essential reading! |

| Carnival of the Capitalists | There Aren't Many Ways to Reach a Suspect | James S. Logan | Jim Logan targets how to deliver the message about your product or service to the right person in an organization. |

| Economics and Social Policy | Ethical and Socially Responsible Investing: Why It Can't Be Done | Getting Green | Matthew Paulson on the impossibility of being able to truly focus one's investment portfolio on those companies you perceive to be socially responsible. |

| Personal Development Carnival | Boxing and The Law of Attraction | Martial Development | What does the Boxer Rebellion tell us about The Secret |

Previous Editions

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Although they might perhaps now regret it, the city of Seattle, perhaps unintentionally, conducted a bold experiment in multi-voting (providing voters multiple options for expressing their true preferences) in an election held on Tuesday, March 13.

Although they might perhaps now regret it, the city of Seattle, perhaps unintentionally, conducted a bold experiment in multi-voting (providing voters multiple options for expressing their true preferences) in an election held on Tuesday, March 13.

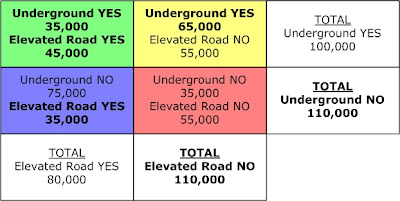

Among other local ballot issues, voters were presented with two separate options regarding the potential replacement of the Alaskan Way Viaduct, a major thoroughfare running along the city's waterfront in downtown Seattle. The two choices for the advisory ballot: an underground tunnel (preferred by many elected officials in the city government and the big developers who fund their campaigns) and an elevated roadway structure (similar to the existing Viaduct).

In presenting these two separate ballot issues directly related to the same issue, the city of Seattle in essence conducted a 22 Designed Experiment. The following diagram illustrates how individual voters could have marked their ballots:

Aside from the pure YES or NO votes for each measure, we see that the ballots also allow us to truly determine voter intent on the issue of whether or not voters want the Alaskan Way Viaduct to be replaced at all. Here's how that works - the total votes cast in FAVOR of either measure may be combined together as one "super" vote in support of replacing the Viaduct. Meanwhile, all the votes cast against each measures would count as a vote against replacing the Viaduct.

By taking this approach, public officials in Seattle may be able to accurately determine which of these two options are preferred by the city's voters, even if both measures passed or failed. Here's an example of how that might work, first showing some hypothetical 200,000 voters might cast their ballots, with both measures failing (the actual tally is still underway at this writing):

Now, let's look at the combination of groupings where voters were in favor of at least one Viaduct replacement option:

As you can see in the figure above, even though voters were not in favor of either specific ballot measure in the hypothetical example's vote totals, they were overwhelmingly in favor of replacing the Viaduct structure. While our example came out in favor of replacing the structure, it is very possible that in addition to voting against each ballot measure that voters also voted against replacing the structure.

What Seattle city officials must do now is examine the official vote totals for the recent election to determine if voters do in fact favor replacing the Viaduct or if they want to pursue an option where the current structure would be maintained. If the majority of cast ballots come out in favor of replacing the structure, they will need to propose new options for the voters to consider should they present this choice to the voters in a future election. Or depending upon the relative vote totals, they might place just the more popular of the previous options on a new ballot, on the theory that the presence of the less popular option on the ballot prevented the more popular option from gaining clear majority support.

Stefan Sharkansky of Sound Politics has been tracking the vote tallies - be sure to read down into the comments for the latest vote totals.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.